You may be scrolling through property listings and come across something strange: a detached condominium.

It looks like a house, feels like a house, and acts like a house. Why is it a detached condo and is it something to avoid?

Connect with a lender to see how much home you can buy.

What is a detached condominium?

A detached condominium is a free-standing condominium unit within a condo development. Instead of looking like an apartment like most condos, it is “detached” from other units.

The “condominium” designation describes its legal status and how it functions.

With a typical house, you own and have total control over the land the house sits on. With a condo, you don’t own the exact plot of land under the house. Rather, every owner in the complex owns a portion of the entire land plot.

This is a fine point but an important one. It affects how you can use the land, the value of the home, and how difficult it will be to sell someday.

See if you qualify to buy a detached condo or house.

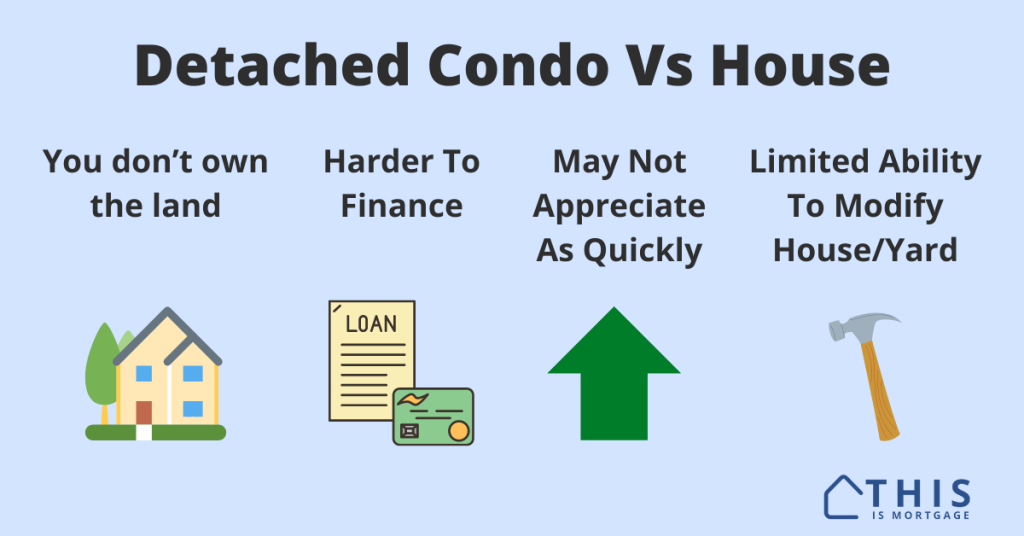

What are the dangers of buying a detached condo vs a single family home?

While detached condos have upsides, there are things to be aware of.

Perhaps the biggest deal-breaker for homebuyers is the inability to modify the home or yard.

If you ever wanted to add a bedroom, mother-in-law unit, short-term rental tiny home, or an income-producing ADU, that’s a no-go with a detached condo.

Even simple things like a garden or deck could be an issue. Remember that the land is not yours. You are subject to current and future HOA rules.

There could be financial drawbacks as well. While lawn and home maintenance costs are lower, you’ll pay monthly HOA dues. Many homeowners would rather buy a $50 lawnmower on Craigslist and have their brother help them re-roof the house when the time comes. Instead, you’ll pay hundreds per month to the HOA to take care of those things for you.

And if the HOA ever runs out of money, you could be charged a five or even six-figure “special assessment” for needed repairs to the entire condo complex, not just your unit.

Independent souls are just not cut out for HOA living.

For those who want complete control over their hard-earned home, a detached condo poses serious problems.

Detached condominiums and appreciation

Detached condos may not appreciate as quickly as regular homes.

You don’t own the land. In many markets, and individually-owned piece of land becomes more valuable than the structure over time.

Additionally, as discussed below, condos of all kinds can be hard to finance. You could buy a detached condo today with an FHA loan, then the HOA could be removed from the FHA-approved condo list. This shrinks your future buyer pool. You could have a harder time selling and may have to unload the property at a low price.

Regular homes can be approved for every loan type – FHA, VA, USDA, and conventional – and therefore nearly always enjoy buyer demand.

Yes, a detached condo still appreciates as demand for homes increases. But there is a lot more risk of lower appreciation with these homes.

Run your scenario by a lender.

Detached condominium pros and cons

Should you buy a detached condo? It certainly may come with a lower price tag than a regular house, while affording you certain advantages of a free-standing home.

Here’s what to think about.

Detached condo pros

- HOA may maintain the landscaping

- HOA maintains the exterior of the building like siding, paint, and roofing

- May come with a lower purchase price than a single-family home

- Access to condo amenities like pool, gym, etc.

Detached condo cons

- You’re subject to HOA rules

- Higher HOA dues

- Limited use of yard (no garden, deck or shed)

- You can’t build an addition or accessory dwelling unit (ADU)

- May be harder to finance. The condo project must be approved with FHA or Fannie Mae

- Lower appreciation. Could be harder to sell in the future

- You’ll have a higher mortgage rate if you use a conventional loan

Financing a detached condo

One often-overlooked aspect of condo buying is that they are harder and more expensive to finance.

First, the condo complex as a whole has to be on the approved FHA list if you’re using one of these popular 3.5%-down loans. It’s difficult for a condo association to get FHA-approved. So if you need an FHA loan, a detached condo may not even be an option.

Conventional loans can be difficult to use on a condo as well. The condo complex must meet a laundry list of requirements if it’s not on Fannie Mae’s approved list already.

In addition, conventional loans require a fee of 0.75% of the loan amount for condos. This translates to about 0.125% to 0.375% higher rate.

In any case, check with your lender upfront to make sure the condominium complex is approved for financing, and what your rate would be compared to a regular home. It may not be as cheap as you think to buy a detached condo.

Speak with a lender about the condo you’re considering.

Detached condo vs PUD

You may see home listings labeled “detached condo” and also “PUD” or planned unit development. They look exactly the same, but there’s a key difference.

With a PUD, you own the land. Not so with a detached condo. This makes a detached condo worth a little less than a PUD home. That’s not necessarily a bad thing if you’re looking for the lowest possible purchase price.

Both home types often allow access to shared amenities like pools, parks, and gyms. Common areas are maintained by the HOA.

Homes in a PUD come with some of the same drawbacks as a detached condo. What you can do with your yard, house, and property are subject to HOA rules. You’ll pay HOA dues, but probably less than for a detached condo.

Overall, a PUD is better than a detached condo for the simple reason that you own the land under the home.

Detached condominium FAQ

The biggest downside of a detached condo is that you do not own the land under the home. Therefore, it may not appreciate as fast as a regular home and you may have a harder time selling in the future. You are also limited on how you can use the property. A garden, deck, shed, or other modification to the grounds probably won’t be allowed.

Those who want low-maintenance living and just want a place of their own might opt for a detached condo. Those who want to modify their home, build a shed in the yard, or have free reign to do as they wish with the property should buy a house.

You feel like you are in a regular home, but maintenance is much easier and you have access to community amenities.

Should I buy a detached condo?

There’s no blanket right answer for everyone. Many people enjoy the benefits of living in a free-standing condo. Otherwise, builders wouldn’t build them.

Examine your present and future goals using the points brought up in this article. Can you see yourself enjoying a detached condo for years to come? If the answer is yes, go ahead and make the next step to buy one.

See if you qualify to buy a detached condo or another type of home.