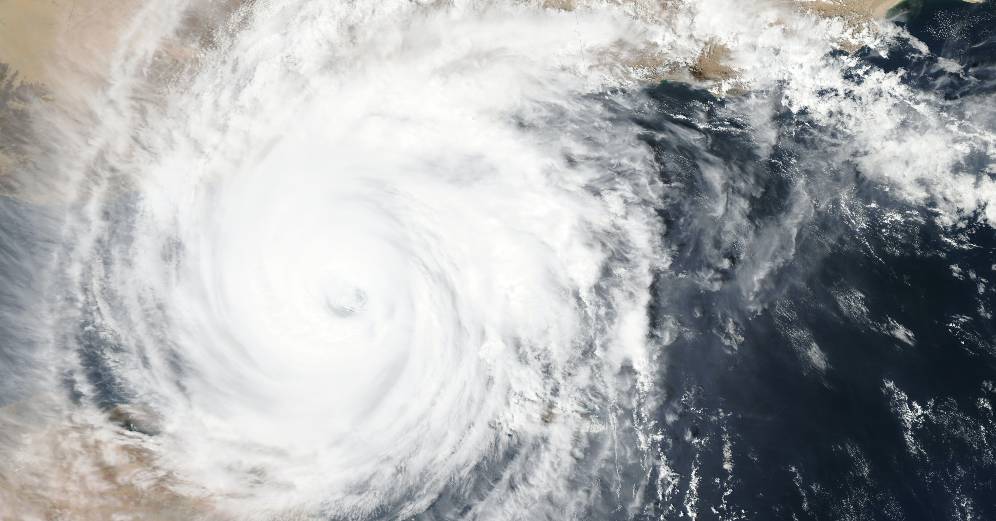

Those who experience a natural disaster know that housing is one of the top concerns after the event.

That’s why the U.S. Department of Housing and Urban Development (HUD) created the FHA 203(h) program.

This zero-down loan can help disaster victims rebuild or buy a home at favorable terms.

Check your eligibility with a 203h lender.

FHA 203(h) loan requirements

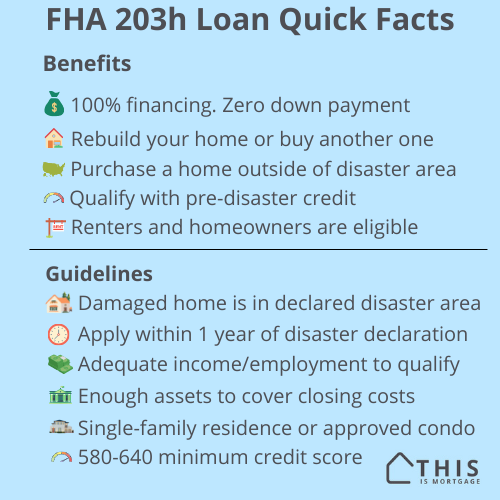

To qualify for the FHA 203(h) loan, your primary residence must have been

- Destroyed or damaged to an extent that reconstruction or replacement is necessary

- Within a Presidentially Declared Major Disaster Area (PDMDA).

You do not have to own the home that was destroyed. You may be eligible even if you rented the home as your primary residence.

This program, then, could help first-time homebuyers whose house or apartment building was destroyed by wildfire, flooding, hurricane, or another natural disaster within a PDMDA. To see if your area qualifies, check FEMA’s Declared Disaster search tool.

Additional qualifications include

- 580-640 minimum credit score, depending on lender

- Adequate income and employment history to qualify for the new loan

- Enough liquid assets to cover closing costs and prepaid taxes, insurance, and other items

- Be able to prove the previous home was destroyed or damaged

- Zero late mortgage payments prior to the disaster

- The new home is a single-family residence or a condo in an FHA-approved condo complex. No manufactured homes

- Must apply with a lender within one year of the disaster declaration

- Standard FHA mortgage insurance rates apply (typically 1.75% of the loan amount upfront and 0.85% of the loan amount annually)

Check your eligibility for 203h.

FHA 203(h) advantages

Why use this program instead of a regular FHA loan? It comes with big advantages that could help you re-establish your residence faster.

- 0 down payment (100% financing)

- Renters and homeowners are eligible

- Closing costs can be paid by the seller or lender, up to 6% of the purchase price

- Rebuild the destroyed home or buy a new or existing home elsewhere

- The home you purchase can be located outside the disaster area – even in another state

- Roll 6 months of mortgage payments into the new loan to help during the transition, depending on the lender

- The lender can use pre-disaster credit history (late payments as a result of the disaster won’t necessarily disqualify you)

Perhaps the biggest advantage to the 203(h) loan is that it waives the typical FHA down payment requirement.

On a $300,000 home, a standard FHA loan requires $10,500 down. The 203(h) program allows you to finance the full $300,000 home price.

What about the mortgage on the destroyed home?

You might wonder whether you need to qualify for the new loan and the old loan at the same time.

The answer is no in certain cases. Some lenders will disregard the mortgage and payment on the destroyed home. This will help you more easily qualify for the new loan.

Hopefully, you have enough insurance coverage to pay off your mortgage. If not (or until insurance pays it off) you are still responsible to pay the mortgage on the destroyed or damaged home.

It’s important to call the company to which you make mortgage payments right away after a disaster. Ask for a forbearance plan. These plans can pause payments without late fees or penalties for up to 12 months.

FHA 203(h) lenders

Not every FHA lender offers 203(h) loans. In fact, very few do.

This list isn’t an endorsement of any company. Do your due diligence to make sure the company is reputable and is offering you a good value. Also check that they are licensed in the state where you plan to buy a new home or rebuild the damaged home. You can check a company’s license status on the NMLS Consumer Access website.

- GMFS Mortgage

- Gateway Mortgage

- BrightPath Mortgage Solutions

- Open Mortgage

- Fairway Independent Mortgage

Wholesale lenders. Note: these companies do not lend to consumers directly, but through mortgage brokers. Find a reputable broker in your area.

- REMN Wholesale

- AFR

- Flagstar Wholesale

- Carrington Wholesale

Connect with one of our lenders to check your 203h eligibility.

More 203(h) features

- Non-occupant co-borrowers permitted, meaning someone who does not plan to live in the house can co-sign for the loan.

- U.S. Citizens and certain permanent and non-permanent residents are eligible

- Those who are delinquent on a federal debt are not eligible

- Available to applicants in every state, assuming a presidentially-declared natural disaster occurred and there is a licensed lender that offers the loan type

- 10, 15, 20, 25, and 30-year loans available

- Adjustable-rate mortgages available

- Loan amounts up to $420,680 and higher in high-cost-of-living areas

Other assistance for homeowners after a natural disaster

Federal and state governments offer other types of assistance to disaster victims.

SBA loans

The U.S. Small Business Administration (SBA) offers loans up to $200,000 to replace or repair a homeowner’s primary residence. You may receive up to 20% more than repair costs if you are making improvements that minimize risk of future natural disaster damage.

The SBA can also refinance a previous mortgage if the homeowner is not able to obtain traditional mortgage credit due to damage to the home.

Renters and homeowners may receive a loan of up to $40,000 to repair or replace personal property like cars, appliances, and furniture since these expenses can’t be included in mortgage financing.

Loan interest rates won’t exceed 4% if credit is not available elsewhere, and terms are up to 30 years.

You can check if you’re in an eligible disaster area here and, if so, apply online for SBA assistance.

FEMA grants

The Federal Emergency Management Agency (FEMA) offers home repair and replacement assistance if the home is deemed uninhabitable after a declared disaster.

The agency can also provide temporary housing, rental assistance, emergency food and water services, and more.

Check your state’s FEMA page to ensure the disaster you experienced is eligible for assistance.

DisasterAssistance.gov

If you’re not sure what type of assistance you may be eligible for, check DisasterAssistance.gov’s Assistance Finder, for more resources for disaster survivors and ways to apply.

FHA 203(h) FAQ

The home being rebuilt or purchased must be a 1-unit single-family residence, PUD, or condo in an FHA-approved condo project. Manufactured homes are not allowed.

FHA 203(h) loan limits for 2022 are between $420,680 and $970,800 depending on the area. The 203(h) limits match those for a standard FHA loan.

Disaster survivor? There’s help available

A destroyed home is one of the hardest circumstances someone can go through, both emotionally and financially.

While assistance programs will never take away the sorrow of losing a home, they can help you rebuild and move on.

And thanks to the FHA 203(h) program, homeowners and renters will have a little easier time financing their new home and moving on with their lives.