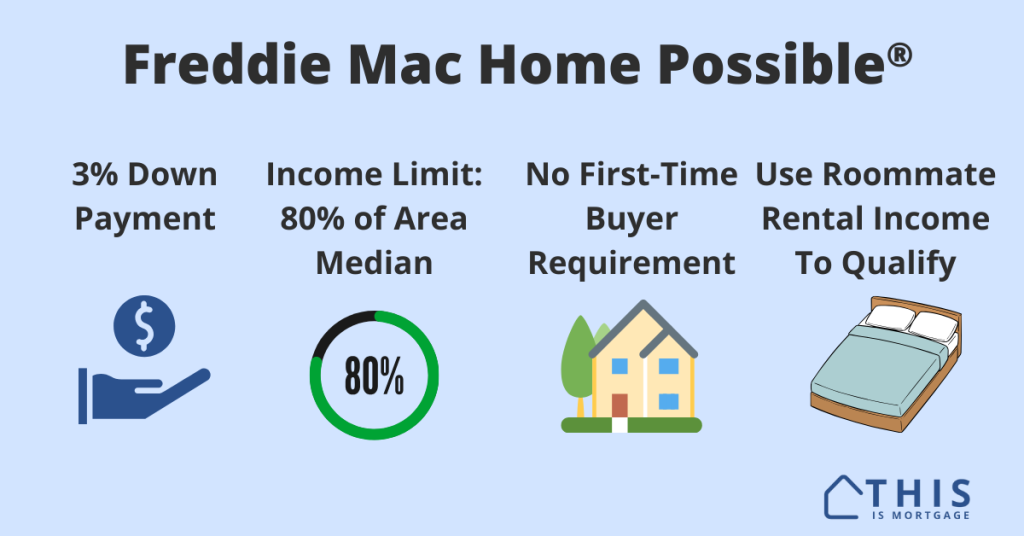

The Freddie Mac Home Possible mortgage is the agency’s all-out effort to turn moderate-income renters into homeowners.

Benefits include:

- Reduced mortgage rates

- Reduced mortgage insurance

- Alternative down payment sources

- Ability to use sweat equity

- Qualifying with roommate income

- And more

Here’s what you need to do to get a Home Possible loan.

Check your Home Possible eligibility.

In this article:

- Home Possible income limits

- Freddie Mac Home Possible quick guidelines

- Benefits of this program

- Using sweat equity

- Home Possible vs HomeOne

- Home Possible vs HomeReady

- Home Possible vs Fannie Mae 97

- Home Possible vs FHA vs USDA

- Get started

Home Possible income limits

To qualify for Home Possible, you must make 80% or less of your area median income. Freddie Mac has created an income eligibility map tool. Enter an address or area where you are looking to buy a home to learn the Home Possible income limit.

Keep in mind that the lender will use your qualifying income on the loan application. So if you make a high self-employed income, but write off a lot of expenses, you may still be eligible. The best way to discover your eligibility income is to get a full pre-approval from a lender. Those who make too much may qualify for Freddie Mac’s 3% down loan with no income limits, HomeOne®

Request an income check from a lender.

Freddie Mac Home Possible income limit tool

Freddie Mac Home Possible quick guidelines

You must earn a moderate income

This program is open to those who make 80% or less of their area’s median income. See the

“Income Limits” section above.

3% down

Your down payment can come from personal savings, checking, or investment accounts. But it can also come from alternative sources such as gift funds, down payment assistance, cash saved at home, and even sweat equity. More on sweat equity below.

You don’t have to be a first-time homebuyer

You can own one other property and still be eligible for Home Possible.

Homebuyer education required

If everyone on the loan is a first-time buyer, one applicant must take a 4-8 hour homebuyer education course. Many courses are available for free or a small fee, and can be done online.

You must plan to live in the property

The program can be used for a home you plan to live in full-time. No second homes or investment properties.

Single-family, 2-4 unit, condos, and manufactured homes are eligible

It will be easiest to purchase a 1-unit (single-family) home with the program. However, you can buy a duplex, triplex, or fouplex, condo, or manufactured home with some additional requirements.

Contact a lender to see if you’re eligible for Home Possible.

Benefits of Home Possible

Use rental income from a roommate to qualify

You can use rental income from a roommate for up to 30% of qualifying income. For example, if your employment income is $5,000 per month, you could use up to $1,500 in monthly roommate rent payments, or the actual amount if lower.

The roommate must have been living with you for a year and plans to continue to live with you in the new property. This person can’t be your spouse or domestic partner.

Reduced mortgage rates

Freddie Mac waives risk-based rate increases that normally apply to conventional loans. For instance, someone with a 660 credit score and 3% down could receive a rate reduction of about 1%, lowering the monthly payment by about $200 on a $300,000 mortgage.

Reduced mortgage insurance

Freddie Mac also lowers the mortgage insurance burden for Home Possible buyers. The savings pencil out to about $57 per month on a $300,000 mortgage for a buyer with a 680 credit score.

Alternative down payment sources

Down payments can come from gifts from a relative, or even wedding and graduation gifts from non-relatives. You can also finance your down payment with an unsecured personal loan or down payment assistance second mortgage. You can also make improvements to the home prior to closing and count the value of the improvements toward the down payment, otherwise known as “sweat equity.” More on this below.

Non-occupant co-borrowers allowed

A parent, sibling, or another individual who does not plan to live with you can be on the loan to help you qualify. This works well if you don’t have enough income to be approved on your own.

Using sweat equity for your down payment

Sweat equity is the value of renovations you do yourself. Home Possible allows you to use the actual value of materials purchased or labor completed before closing toward your down payment.

For example, you are buying a home worth $200,000 as-is. But you remodel the bathroom prior to closing, an improvement that would have cost $6,000 had you not done it yourself. The lender can apply the improvement value toward your down payment.

In this example, the bathroom remodel covers your entire 3% down payment.

However, sweat equity can be difficult to use. Here are some things to be aware of.

The seller might not agree: Most sellers don’t want the buyer working on their home prior to closing. Injuries, bad workmanship, delays, and major damage are just some of the risks to the seller. You’ll have to convince them that you can do the job safely and effectively.

You’ll need a legal agreement: There’s always a risk of the seller backing out of the sale after you complete improvements and sell the home to someone else for more. A legal agreement drafted by a lawyer can reduce this risk.

Know the value of the repairs: The appraiser must estimate the value of improvements in the appraisal. Know how much the appraiser thinks the renovation is worth before committing to it.

Start your Home Possible loan by connecting with a lender.

Home Possible vs HomeOne

Freddie Mac offers another 3% down program, HomeOne. Here are the differences between these two loans.

| Loan criteria | Home Possible | HomeOne |

| Income limits | 80% of area median income | None |

| Previous homeownership | At least 1 borrower: No ownership in last 3 years | At least 1 borrower: No ownership in last 3 years |

| Homebuyer education | Required if all applicants are first-time buyers | Required if all applicants are first-time buyers |

| Mortgage rates | Reduced | Standard for incomes >100% of area median |

| Down payment | 3% | 3% |

| Loan type | Fixed and ARMs | Fixed rate only |

| Property type | 1-unit house or condo; 2-4 unit house with 5% down; manufactured homes with 5% down | 1-unit house, condo or PUD |

| Occupancy | At least one borrower must reside in the home; non-occupant co-borrowers allowed if 5% down | All borrowers must reside in the home |

| Roommate income | Can use to qualify | Not allowed |

| Maximum loan amount | $766,550 for 3% down; local “conforming jumbo” / High Balance limits with 5% down. | $766,550 (no “conforming jumbo”) |

| Credit score | 660; borrowers with no credit are eligible with 5% down | 620; at least 1 borrower must have usable credit score |

| Max debt-to-income ratio | 45% | 45% |

| Mortgage insurance | Reduced | Standard, or reduced with higher rate/fee |

Home Possible vs HomeReady

| Loan criteria | Home Possible | HomeReady |

| Income limits | 80% of area median income | 80% of area median income |

| First-time buyer | At least 1 borrower: No ownership in last 3 years | First-time and repeat buyers are eligible |

| Homebuyer education | Required if all applicants are first-time buyers | Required if all applicants are first-time buyers |

| Mortgage rates | Reduced | Reduced |

| Down payment | 3% | 3% |

| Loan type | Fixed and ARMs | Fixed rate and ARMs |

| Property type | 1-unit house or condo; 2-4 unit house with 5% down; manufactured homes with 5% down | 1-unit homes; 2-units with 15% down; 3-4 units with 25% down; 1-unit condos & manufactured homes |

| Occupancy | At least one borrower must reside in the home; non-occupant co-borrowers allowed if 5% down | Non-occupant co-borrowers allowed with 5% down |

| Roommate income | Can use to qualify | Can use to qualify |

| Maximum loan amount | $766,550 for 3% down; local “conforming jumbo” / High Balance limits with 5% down. | $766,550 for 3% down; local “conforming jumbo” / High Balance limits with 5% down. |

| Credit score | 660; borrowers with no credit are eligible with 5% down | 620 |

| Max debt-to-income ratio | 45% | 45% |

| Mortgage insurance | Reduced | Reduced |

Home Possible vs Fannie Mae Conventional 97

| Loan criteria | Home Possible | Fannie Mae 97 |

| Income limits | 80% of area median income | None |

| First-time buyer | At least 1 borrower: No ownership in last 3 years | At least 1 borrower must have had no ownership in last 3 years |

| Homebuyer education | Required if all applicants are first-time buyers | Required if all applicants are first-time buyers |

| Mortgage rates | Reduced | Standard for incomes >100% of area median |

| Down payment | 3% | 3% |

| Loan type | Fixed and ARMS | 3% down Fixed rate; 5% down adjustable rate |

| Property type | 1-unit house or condo; 2-4 unit house with 5% down; manufactured homes with 5% down | 1-unit house, condo, or PUD. Manufactured home allowed with 5% down. |

| Occupancy | At least one borrower must reside in the home; non-occupant co-borrowers allowed with 5% down | Primary residence. Non-occupant co-borrowers allowed with 5% down. |

| Maximum loan amount | $766,550 for 3% down; local “conforming jumbo” / High Balance limits with 5% down. | $766,550 for 3% down; local “conforming jumbo” / High Balance limits with 5% down. |

| Credit score | 660; borrowers with no credit are eligible with 5% down | 620 |

| Max debt-to-income ratio | 45% | 45% |

| Mortgage insurance | Reduced | Standard, or reduced with higher rate/fee |

Home Possible vs FHA vs USDA

| Loan criteria | Home Possible | FHA | USDA |

| Income limits | 80% of area median income | None | 115% of area median income |

| First-time buyer | No ownership in last 3 years | Not required | Not required |

| Homebuyer education | Required if all applicants are first-time buyers | Not required | Not required |

| Mortgage rates | Reduced conventional rates | Comparable to Home Possible | Comparable to Home Possible |

| Down payment | 3% | 3.5% | 0% |

| Loan type | Fixed and ARMs | Fixed and ARMs | Fixed only |

| Property type | 1-unit house or condo; 2-4 unit house with 5% down; manufactured homes with 5% down | 1-4 unit homes and manufactured homes | 1-unit homes only |

| Occupancy | Owner-occupied | Owner-occupied | Owner-occupied |

| Roommate income | Allowed | Not allowed | Not allowed |

| Maximum loan amount | $766,550 in most areas | $498,257 in most areas | No stated limits |

| Credit score | 660; borrowers with no credit are eligible with 5% down | 580 | 580-640 |

| Max debt-to-income ratio | 45% | 56.9% | Determined by |

| Mortgage insurance | About 0.75-1.25% of loan per year | 0.55% of loan per year | 0.35% of loan per year |

The Home Possible process

Here’s how to buy a home with this program, start to finish.

- Examine your budget and make sure you’re ready to buy a home

- Ensure you have funds or alternative sources for 3% down, plus 2-5% in closing costs

- Request a pre-approval from a lender

- Hire a real estate agent

- Shop for a home based on your pre-approved amount

- Make an offer on a home

- Work with the seller to agree on a sweat equity arrangement, if applicable

- Submit your purchase agreement to your lender

- Complete sweat equity work, if applicable. Get a final inspection from the appraiser

- Sign final loan documents

- Move into your home

FAQ

Yes. You can cancel mortgage insurance on all Freddie Mac and Fannie Mae loans when you reach 20% to 22% equity, depending on your servicer.

Yes. Freddie Mac eliminated risk-based rate hikes for certain borrowers as of December 1, 2022. Home Possible buyers with incomes less than 80% of their area’s median, or any first-time buyer who makes less than 100% of their area’s median (<120% in high-cost areas), will receive better rates than other buyers.

Use Home Possible if you need extra flexibility such as using roommate rent to qualify and want discounted rates and mortgage insurance. If your income is over 80% of the area’s median, though, you’ll have to use a standard 3% down conventional loan.

Lower-credit applicants should consider FHA, since mortgage insurance will probably be less expensive. FHA has no income limits and requires 3.5% down versus Home Possible’s 3%. Ask your lender to run both scenarios to see which one better suits your situation.

No. Find a lender that is approved to offer Freddie Mac programs. Freddie Mac is a government-sponsored mortgage agency that creates lending guidelines. Private mortgage companies and banks use these guidelines to approve loans.

Start your Home Possible loan

If you’re ready to buy a home, this program could be the tool you need to complete this goal.

Contact a lender, get pre-approved, and start looking for a home.