If you’re a first-time homebuyer, you have access to some amazing programs to get you into a home. Government agencies and lenders have made it easier to buy a home with low down payment, lenient credit requirements, and favorable mortgage rates.

Start Here

12 Best First-Time Homebuyer Programs For 2024

Here are 12 strategies and programs that could make you a homeowner in 2024.

More About First-Time Homebuyer Programs

How I Bought a House With Almost No Money Out Of Pocket

Buying a house with no money out of pocket is once again possible in today's market. Here's what worked for me.....

Freddie Mac Home Possible® 2024: A Flexible, 3% Down Mortgage

The Freddie Mac Home Possible program offers 3% down, reduced mortgage insurance and rates, and flexible income sou....

Freddie Mac HomeOne® 2024: 3% Down, No Income Limits

The 3%-down Freddie Mac HomeOne program comes with no income limits, expanding opportunities for first-time buyers.....

Freddie Mac BorrowSmart Income Limits & Eligibility

Homebuyers can receive up to $3,000 in down payment assistance with Freddie Mac BorrowSmart or BorrowSmart Access.....

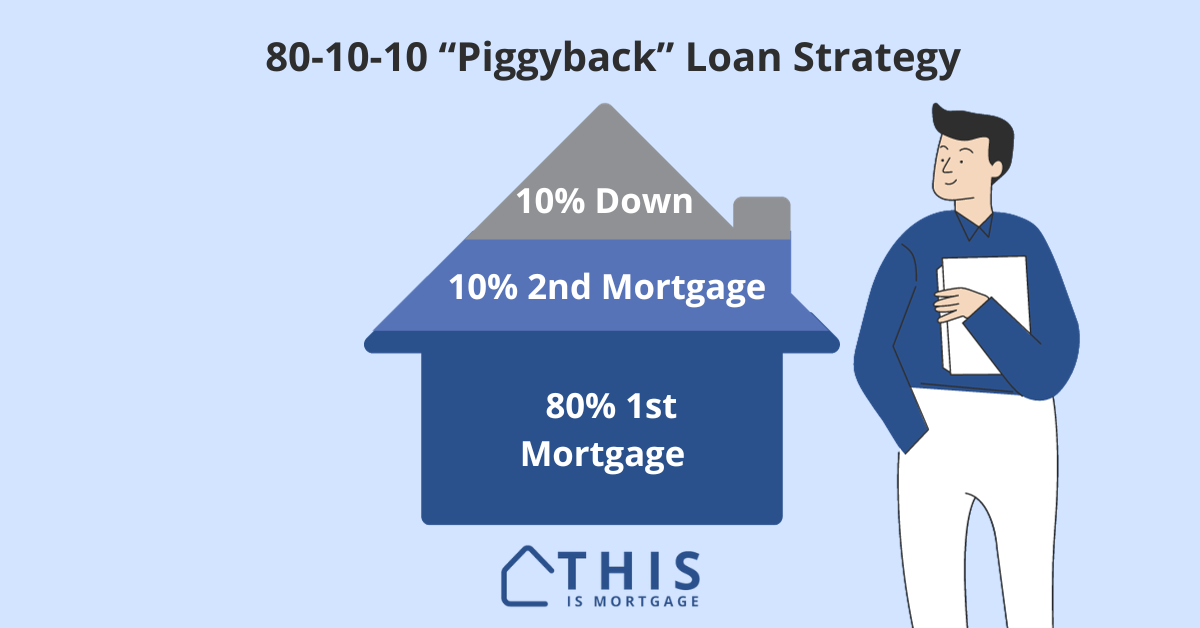

3 Killer 80/10/10 Piggyback Mortgage Strategies

A combination 1st and 2nd mortgage can help you avoid PMI, get conventional financing, and set you up for lower pay....

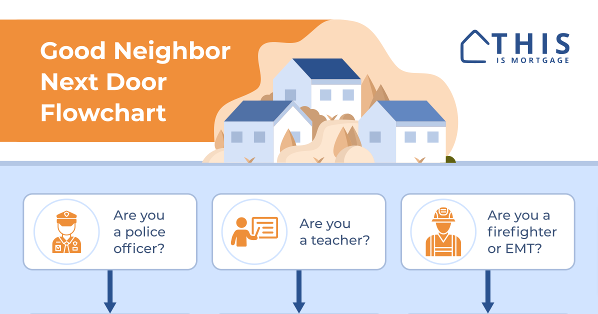

Good Neighbor Next Door Program + Calculator

The Good Neighbor Next Door is a homebuying program that gives select public service employees a 50% discount. GNND....

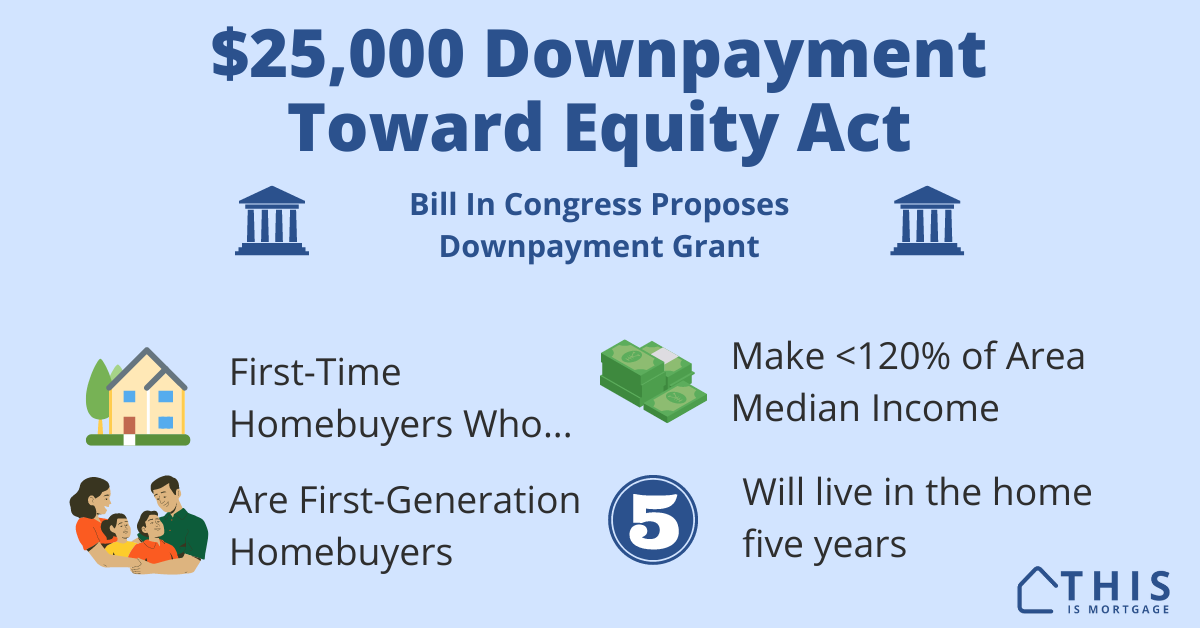

Downpayment Toward Equity Act: $25,000 Homebuyer Assistance

A proposed bill in Congress would give first-time, first-generation homebuyers $25,000 in downpayment assistance.....

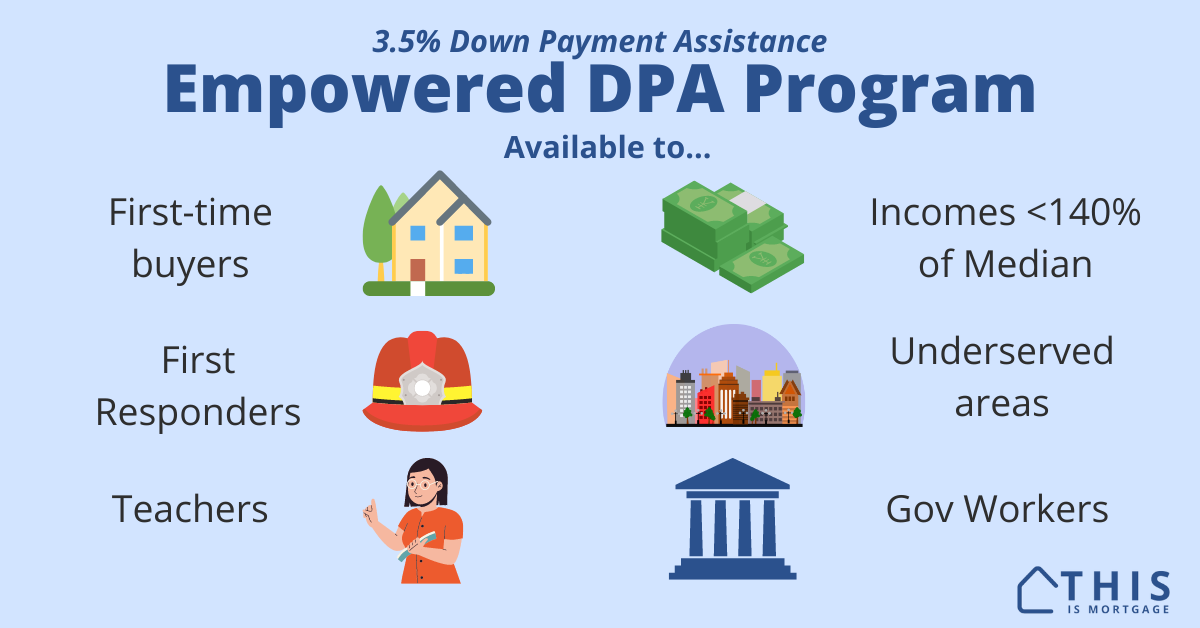

Empowered DPA Program: 3.5% Down Payment Assistance Grant

The Empowered DPA Program offers 3.5% down payment assistance, to first-time buyers, first responders, teachers, go....

FHA Fast 100 Down Payment Assistance Program: Zero-Down Loan

The FHA Fast 100 offers 3.5% down payment assistance to nearly anyone who qualifies for a standard FHA loan.....

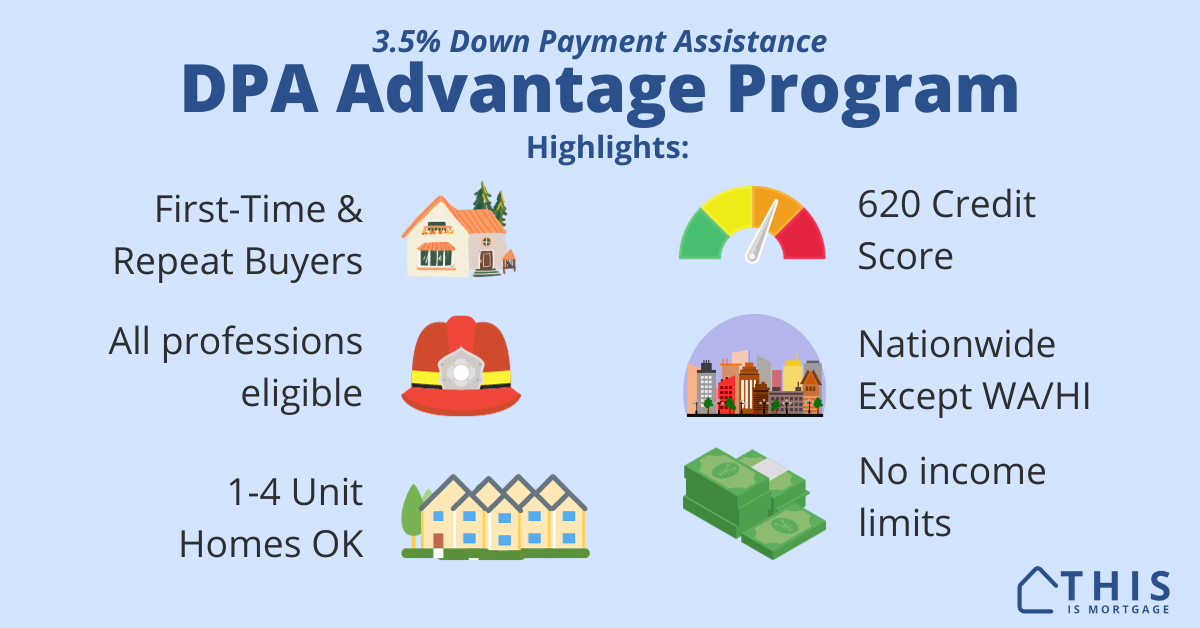

DPA Advantage: 3.5% Down Payment Assistance Grant

The DPA Advantage Program offers 3.5% down payment assistance to nearly anyone who qualifies for a standard FHA loa....

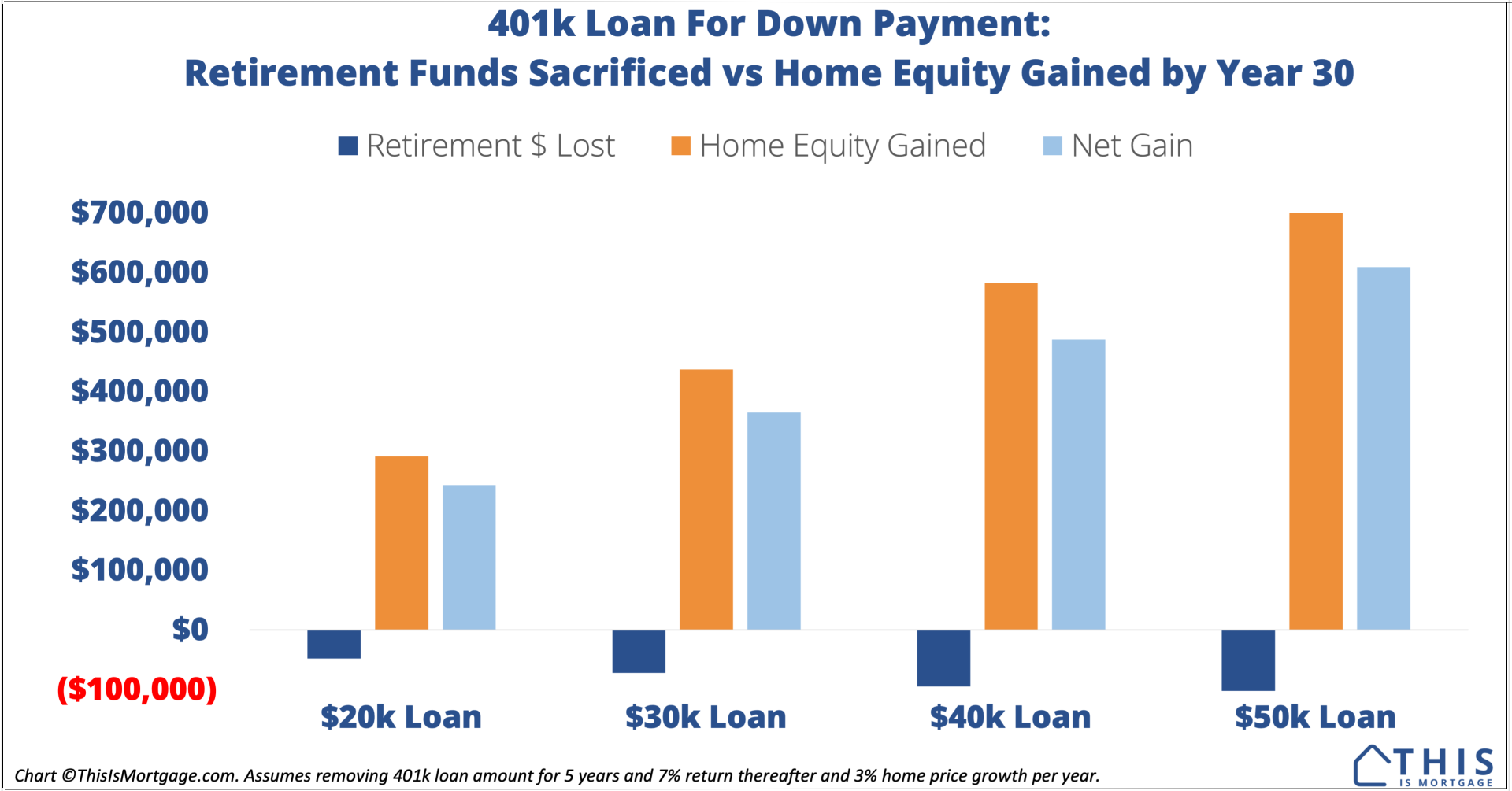

No, a Down Payment 401k Loan Doesn’t Tank Your Retirement. Here’s Proof

There are plenty of critics who will call you "dumb" for taking a 401k loan to buy a home. They completely miss the....

How To Buy a Duplex, Triplex, or Fourplex With an FHA Loan

You can use an FHA loan to buy a duplex, triplex or fourplex at 3.5% down. Live in one unit and qualify with rental....

Limited 203k Loan: Buy and Remodel A Home In 2024

A Limited 203k Loan opens up your homebuying options. Make offers on homes that need remodeling or are not financea....

Can You Rent Out A Room With an FHA Loan? What To Consider

Can you rent out a room if you buy a home with an FHA loan? Find out the surprising answer, and what to consider.....

Don’t Dispute Items on Your Credit Report Before Getting a Mortgage. Here’s Why

Disputing items on your credit report can derail your mortgage approval, even if the account is inaccurate. What to....