This Is Mortgage

Homeownership Through Creative Financing

Achieve Homeownership. Start Now.

Hi, I’m Tim Lucas. (NMLS 118763) There’s nothing quite like homeownership to give you a feeling of security and accomplishment. That’s why I focus on mortgage finance strategies that help you break into the housing market and start building wealth. I’ve helped hundreds of people buy homes IRL, plus run mortgage websites for millions. Want to know if you can be a homeowner? Start here.

Recent Content

Can You Rent Out A Room With an FHA Loan? What To Consider

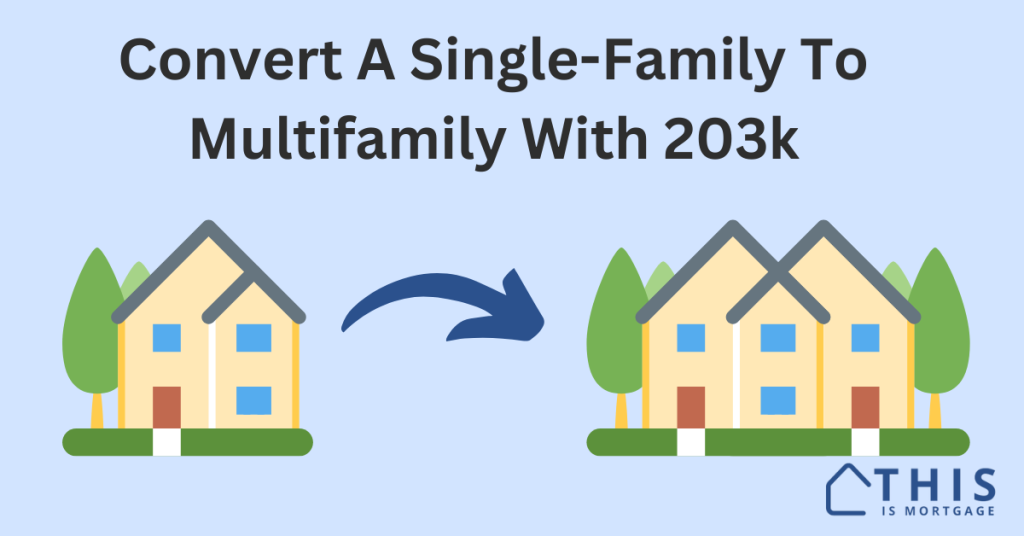

Can You Convert A Single-Family To Multifamily Using FHA 203k? Yes

Does FHA Make Your Offer Look Bad?

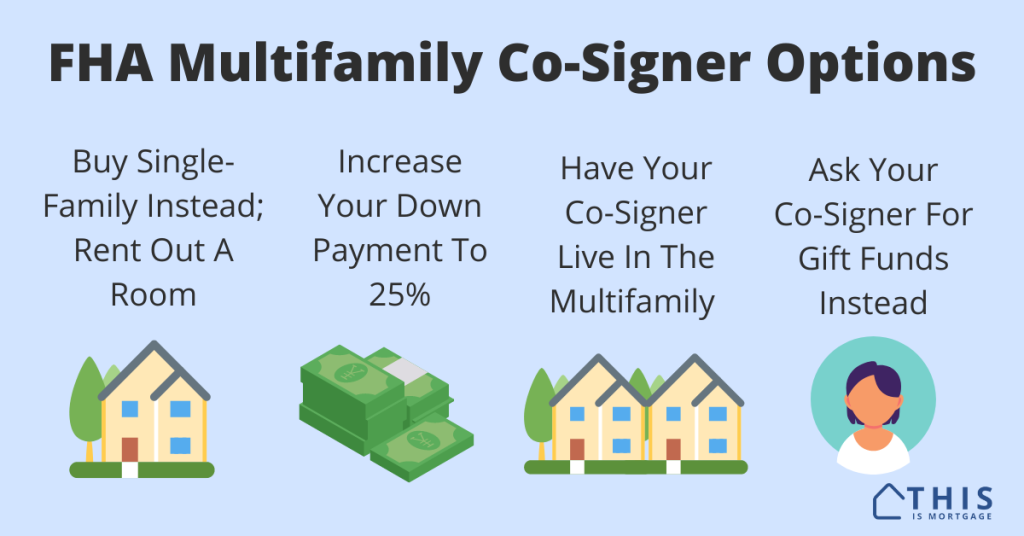

You Can’t Use A Co-Signer On An FHA Multifamily Loan. What To Do Instead

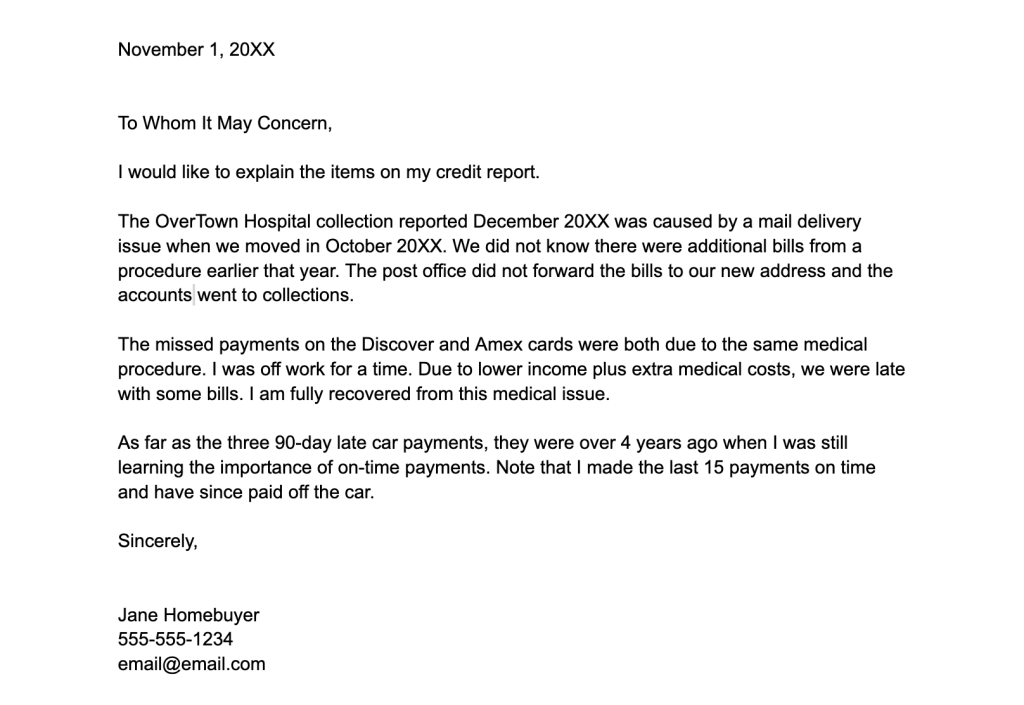

Sample Letter of Explanation For Derogatory Credit For A Mortgage

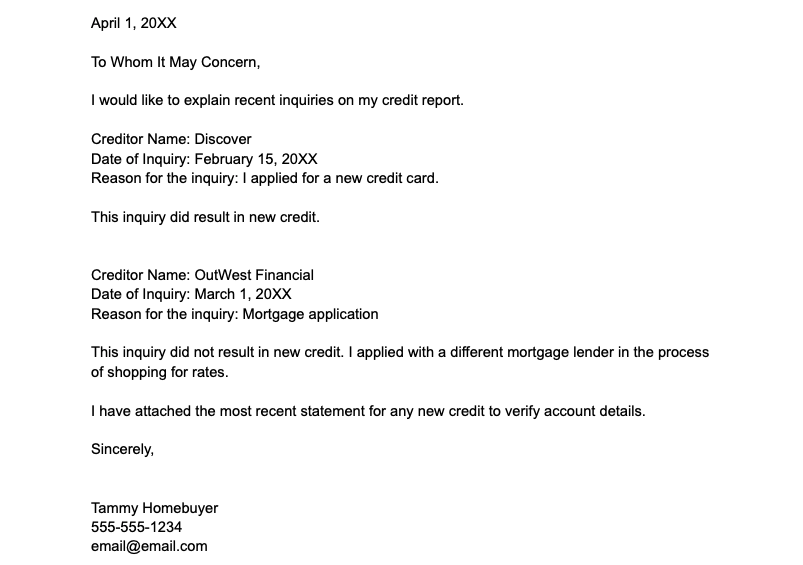

Sample Letter of Explanation For Credit Inquiries for a Mortgage [Template]

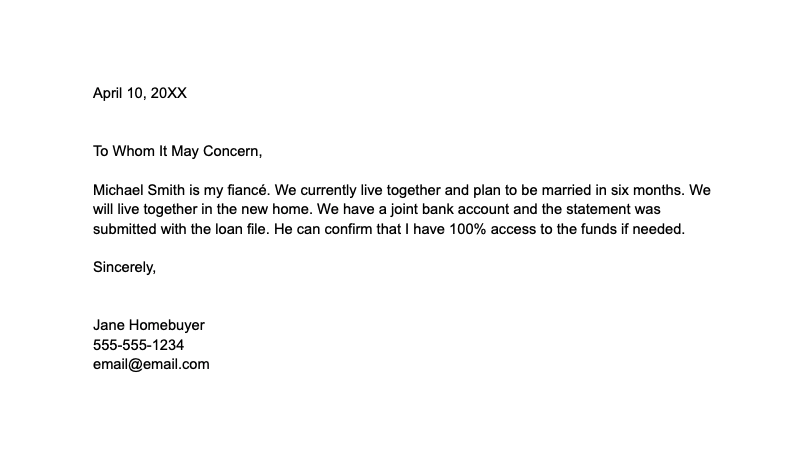

Sample Letter of Explanation of Relationship For A Mortgage – Word, PDF, Google Sheets Template

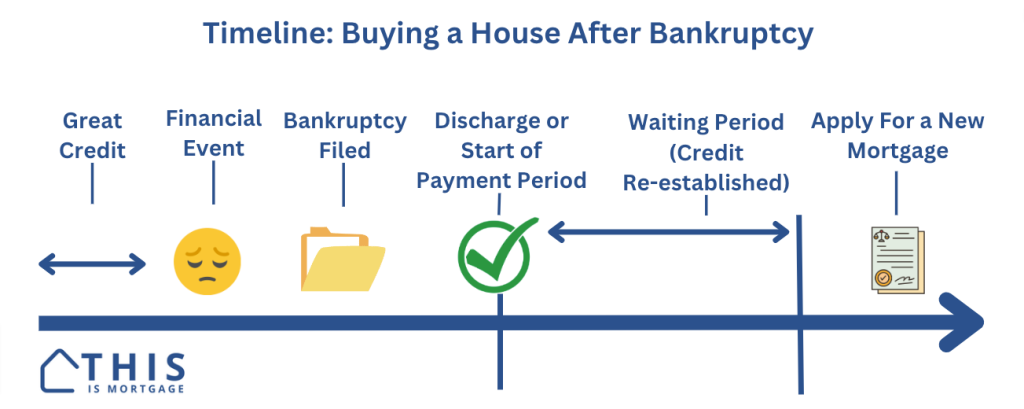

Buying A House After Bankruptcy 2024: FHA, Conventional, VA, USDA, Non-QM

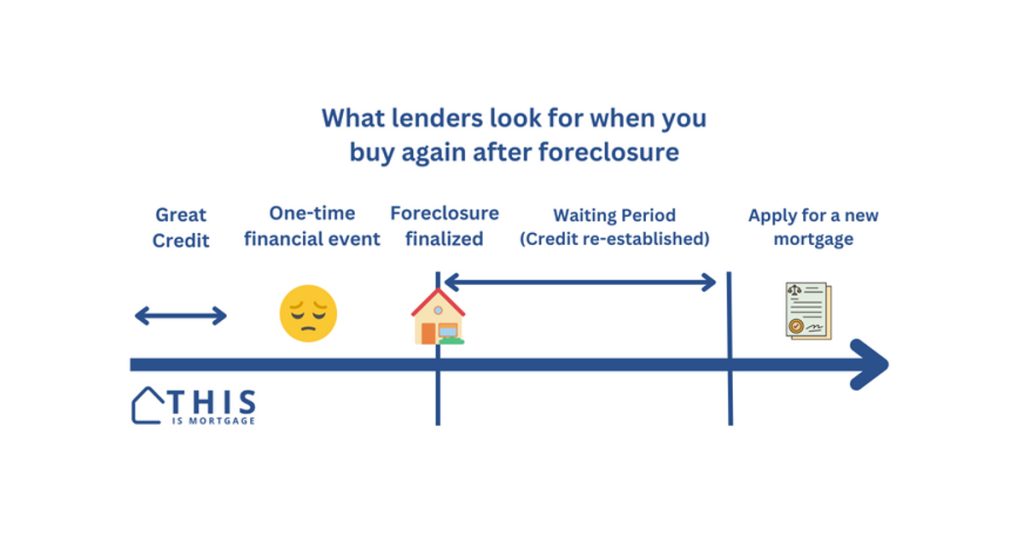

Buying a House After Foreclosure 2024 – FHA, Conventional, VA, USDA, Non-QM

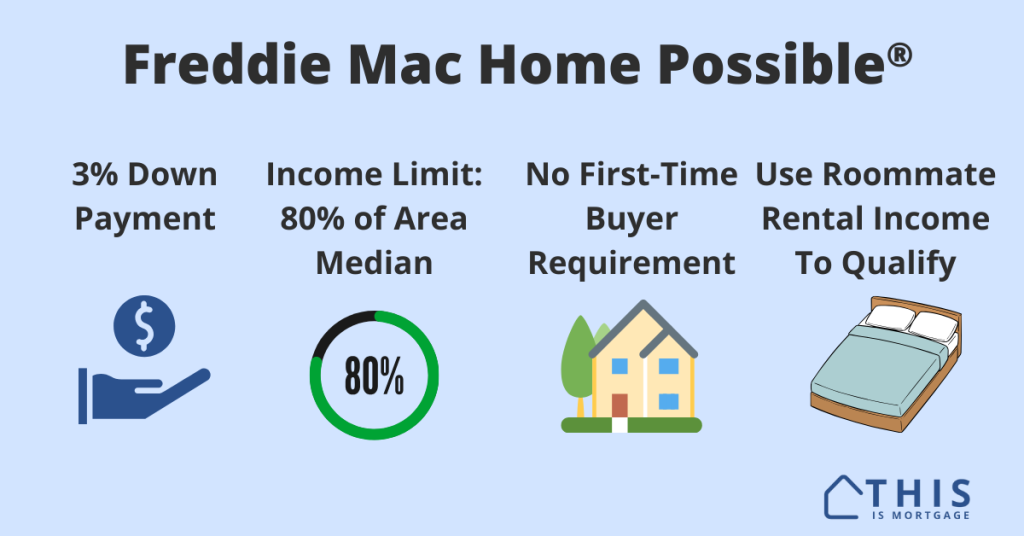

Freddie Mac Home Possible® 2024: A Flexible, 3% Down Mortgage

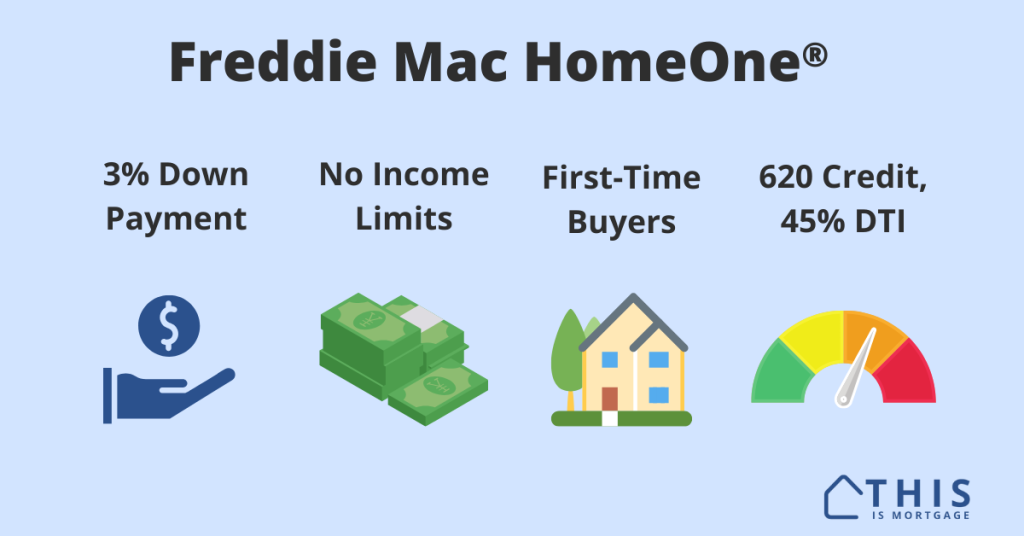

Freddie Mac HomeOne® 2024: 3% Down, No Income Limits

Good Neighbor Next Door Program + Calculator

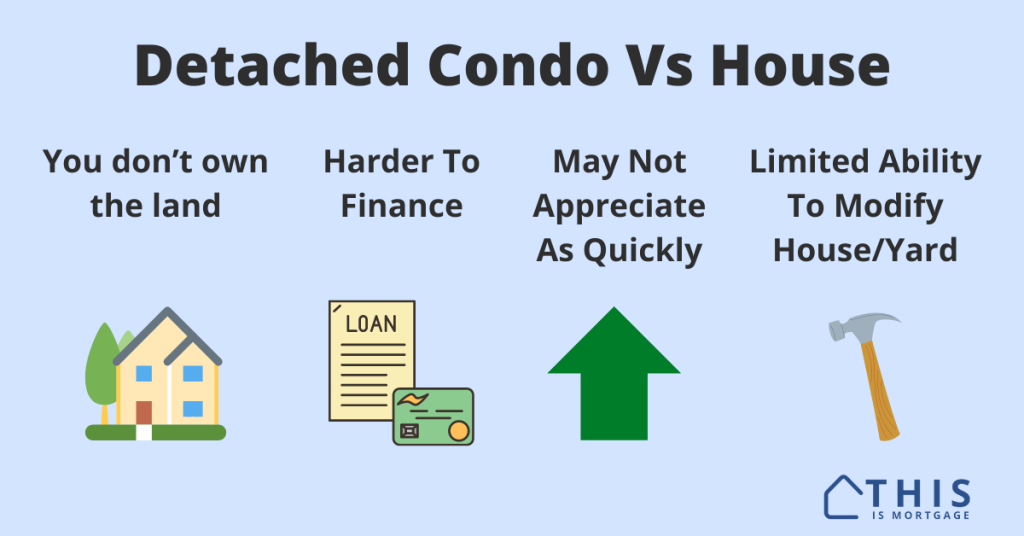

Is Buying A Detached Condominium a Terrible Mistake? Let’s Find Out

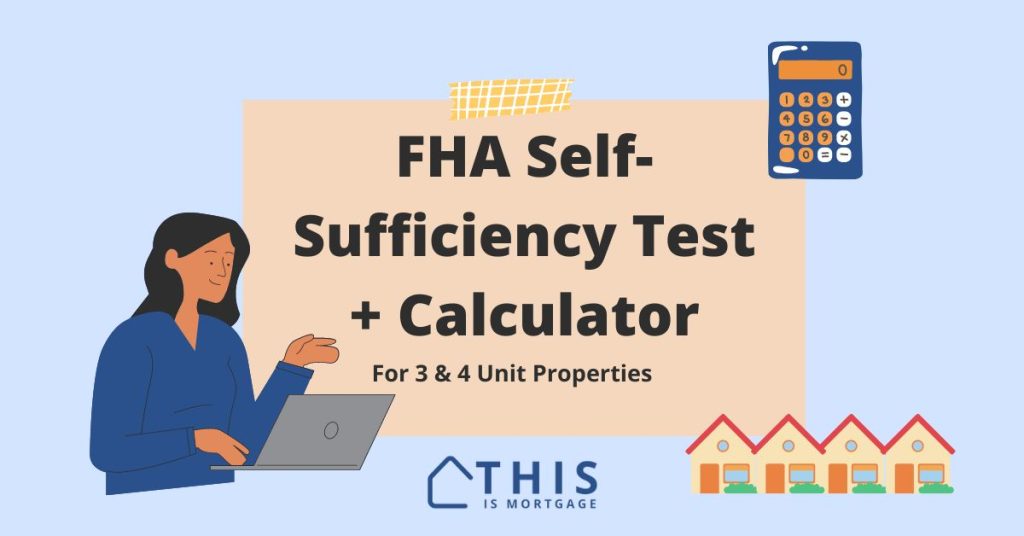

FHA Self-Sufficiency Test Calculator For 3- and 4-Unit Properties 2024

How To Buy a Duplex, Triplex, or Fourplex With an FHA Loan

Not sure where to start? Here’s a checklist:

- Create a budget. Know how much you can spend on a mortgage payment each month after other expenses.

- Examine your life situation: Only buy a home if you plan to stay put for 3-5 years.

- Get a pre-approval: Work with a lender to see how much you can qualify for. Start this process here.

- Hire a real estate agent: The home seller pays the agent’s commission. No need to go it alone.

- Shop for homes. Find a home in your price range based on your payment comfort level.

- Make offers: Chances are you’ll need to make many offers before yours is accepted.

- Negotiate: Ask your agent if you can request closing cost credits from the seller. The seller might agree if it’s not an in-demand home.

- Submit remaining documentation: Quickly supply the lender any further documents they need. The lender will also order an appraisal at this point. Don’t make any large purchases, change jobs, or apply for credit at this point.

- Get a final approval: The lender will issue a “clear to close” status and send legal loan documents to the escrow company.

- Wire closing funds to escrow: The escrow company will let you know how much you need to close. Wire it from your bank (work with escrow to avoid scams. at this point).

- Close: Sign final paperwork. A few days later, you’re a homeowner

Hopefully, this demystifies the process enough to make your first step. Why not start today?

See if you can be approved to buy a home.

What are today’s rates?

Mortgage rates change daily. You can check today’s rates here and even get started with one of the listed lenders.