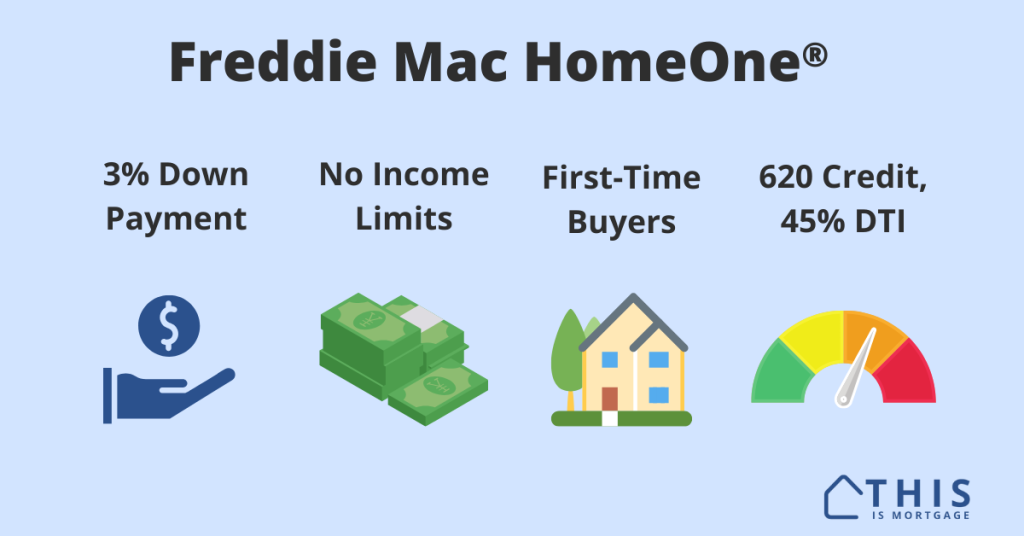

Freddie Mac HomeOne® allows first-time buyers to access a 3% down conventional loan without income or geographic restrictions.

This program is a game changer for any first-time buyer who can’t access other programs because they make too much or aren’t buying in eligible neighborhoods.

Here’s your guide to HomeOne.

Check your HomeOne eligibility with a lender.

- Freddie Mac HomeOne Guidelines

- No income limits

- No geographic restrictions

- How to get a HomeOne loan

- Down payment and closing costs

- Homebuyer education

- Mortgage insurance

- HomeOne vs Home Possible

- HomeOne vs HomeReady

- HomeOne vs Conventional 97

- Alternatives to HomeOne

- Become a homeowner with HomeOne

Freddie Mac HomeOne guidelines

Down payment is the biggest barrier to homeownership for first-time buyers. Yet many low-down-payment programs aren’t available to those who make more than 80% of the area’s median income.

In many areas, you can’t even qualify for a home with that income.

HomeOne makes a 3% down loan available to buyers of any income level. Following are the guidelines.

- You are buying a primary residence

- You have not owned a home in the past three years

- 1-unit property, condo, or PUD only

- 620 credit score

- 45% debt-to-income

- Homeownership education required

- 3% down plus closing costs from personal savings, gift, or down payment assistance

- Loan amount up to $766,550

Welcome to the new world of homebuying.

Say goodbye to income limits

Freddie Mac HomeOne has no income limits, unlike other programs such as:

- USDA home loans (115% of area median income [AMI])

- Freddie Mac Home Possible (80% of AMI)

- Fannie Mae HomeReady (80% of AMI)

If you’re buying in an expensive area, income limits are, well, very limiting.

Someone buying in Denver, Colorado, could only afford a home of around $325,000 (math below) if they make 80% AMI. But Denver’s median home price is $550,000 according to Redfin.

HomeOne allows you to buy the average home in places like Denver if you have a higher income.

Say goodbye to geographic restrictions

Many low-down-payment programs come with geographic restrictions.

USDA loans are only available in areas outside major metros, for example. Conventional loans like HomeReady and Home Possible are available everywhere, but the neighborhood determines income limits, adding a lot of guesswork to the home search.

HomeOne removes any geographic question marks so you can search for a home with confidence.

How do you get a HomeOne loan?

Getting a HomeOne loan is like applying for any mortgage, with one key difference.

The lender you apply with must be approved to offer Freddie Mac loans. Freddie Mac is one of the two government agencies (the other is Fannie Mae) that creates rules for conventional/conforming loans.

When you apply, specifically ask if the lender is approved with Freddie and if they have experience with HomeOne.

If so, get a HomeOne pre-approval so you can start looking at homes. A pre-approval is a fully approved loan minus the appraisal. In other words, when you find a home, you’re nearly done.

Go home shopping at your approved purchase price. Find the home and submit additional documents. Take homeownership education. Then, close the loan. You’re a homeowner.

Sounds simple right? It can be, but let’s dive into some more details so you know everything about this program.

Apply for HomeOne. Start here.

Down payment

HomeOne requires just 3% down. An easy way to think about it is $3,000 for every $100,000 borrowed.

The down payment can come from obvious sources like a checking or savings account, or even liquidated cryptocurrency, investment or 401k funds.

But few people know that the down payment does not need to be your own money. You can use the following to cover it.

- Gift funds from a family member

- Gift funds from non-family you received for a wedding or graduation

- Down payment assistance (DPA) from federal, state, or local housing agency

- DPA from a non-profit organization or employer

For instance, you’re buying a home for $500,000 with HomeOne. The down payment would be $15,000. But your city offers down payment assistance that can cover the whole thing. In this case, you may be eligible to have 100% of the purchase price covered by loans and grants.

Keep in mind that HomeOne doesn’t come with income limits, but many DPAs do.

Closing costs

Even if you have assistance for the down payment, you still have to come up with closing costs.

Luckily, HomeOne lets you borrow money for the down payment and closing costs up to 105% of the home’s price through its Affordable Seconds program.

This program lets you use down payment assistance from government or non-profits to cover down payment and closing costs, even if the assistance is a loan that you must pay back. An additional loan is called a “second mortgage,” hence the name.

Closing costs are typically around 2-5% of the home’s price and pay for things like title and escrow services, credit reports, appraisal, and pre-paid property taxes.

These items can run $7,000-$10,000 or more. Here’s an example.

| Home price | $500,000 |

| Down payment (3%) | $15,000 |

| Closing costs | $10,000 |

| Down payment assistance loan | $25,000 |

| Cash out-of-pocket | $0 |

| Total loans | $510,000 |

| Total home loan-to-value (LTV) ratio | 102% |

HomeOne would allow the above scenario because it is below 105% total LTV.

Homebuyer education

Homebuyer education is required prior to drawing final loan documents.

Education providers are easy to find, but it must be:

- A HUD-approved national or local counseling agency

- A mortgage insurance company

- A state housing agency

- A CDFI (community development financial institution)

Realtors, builders, and most other organizations involved in the transaction are not an eligible source of education.

There are free and low-cost courses available, and many can be done online. Expect to spend 4-8 hours completing your education.

Mortgage insurance

Private mortgage insurance (PMI) is required for HomeOne or any conventional loan with less than 20% down.

Mortgage insurance cost is based on

- Credit score

- Down payment

So, if you can put 5% down instead of 3%, for instance, mortgage insurance will be less expensive.

Following are approximate monthly PMI costs per MGIC based on a 3% down payment and various credit scores and loan amounts.

| Loan Amount | Monthly PMI: 740 Score | Monthly PMI: 700 Score | Monthly PMI: 660 Score |

|---|---|---|---|

| $200,000 | $116 | $165 | $256 |

| $300,000 | $175 | $247 | $385 |

| $400,000 | $233 | $330 | $513 |

| $550,000 | $320 | $453 | $705 |

| $700,000 | $408 | $577 | $898 |

Conventional PMI gets expensive with a lower credit score. Consider a 3.5%-down FHA loan if your credit score is below about 700.

You also have the option to reduce your mortgage insurance costs by taking a higher rate or paying more upfront in fees. For example, A buyer with a 740 credit score could pay an extra $4,000 upfront to lower their PMI by about $50 per month on a $400,000 mortgage.

Have your lender run both “standard” and “custom” mortgage insurance options to see which is better for you.

You can cancel mortgage insurance when you reach 20% to 22% equity in the home.

Difference between Freddie Mac HomeOne and Home Possible – Matrix

| Loan criteria | HomeOne | Home Possible |

| Income limits | None | 80% of area median income |

| Previous homeownership | At least 1 borrower: No ownership in last 3 years | At least 1 borrower: No ownership in last 3 years |

| Homebuyer education | Required if all applicants are first-time buyers | Required if all applicants are first-time buyers |

| Mortgage rates | Standard | Risk-based pricing is capped to keep rates lower |

| Down payment | 3% | 3% |

| Loan type | Fixed rate only | Fixed and ARMs |

| Property type | 1-unit house, condo or PUD | 1-unit house or condo; 2-4 unit house with 5% down; manufactured homes with 5% down |

| Occupancy | All borrowers must reside in the home | At least one borrower must reside in the home; non-occupant co-borrowers allowed if 5% down |

| Maximum loan amount | $766,550 (no “conforming jumbo”) | $766,550 for 3% down; local “conforming jumbo” / High Balance limits with 5% down. |

| Credit score | 620; at least 1 borrower must have usable credit score | 620; borrowers with no credit are eligible with 5% down |

| Max debt-to-income ratio | 45% | 45% |

| Mortgage insurance | Standard, or reduced with higher rate/fee | Reduced |

Difference between HomeOne and Fannie Mae HomeReady – Matrix

| Loan criteria | HomeOne | HomeReady |

| Income limits | None | 80% of area median income |

| First-time buyer | At least 1 borrower must have had no ownership in last 3 years | First-time and repeat buyers are eligible |

| Homebuyer education | Required if all applicants are first-time buyers | Required if all applicants are first-time buyers |

| Mortgage rates | Standard | Risk-based pricing is waived or reduced, lowering rates |

| Down payment | 3% | 3% |

| Loan type | Fixed rate only | Fixed rate and ARMs |

| Property type | 1-unit house, condo or PUD | 1-unit homes; 2-units with 15% down; 3-4 units with 25% down; 1-unit condos & manufactured homes |

| Occupancy | All borrowers must reside in the home | Non-occupant co-borrowers allowed with 5% down |

| Maximum loan amount | $766,550 (no “conforming jumbo”) | $766,550 for 3% down; local “conforming jumbo” / High Balance limits with 5% down. |

| Credit score | 620; at least 1 borrower must have usable credit score | 620 |

| Max debt-to-income ratio | 45% | 45% |

| Mortgage insurance | Standard, or reduced with higher rate/fee | Reduced |

Difference between HomeOne and Fannie Mae 97 – Matrix

| Loan criteria | HomeOne | Fannie Mae 97 |

| Income limits | None | None |

| First-time buyer | At least 1 borrower must have had no ownership in last 3 years | At least 1 borrower must have had no ownership in last 3 years |

| Homebuyer education | Required if all applicants are first-time buyers | Required if all applicants are first-time buyers |

| Mortgage rates | Standard risk-based pricing applies | Standard risk-based pricing applies |

| Down payment | 3% | 3% |

| Loan type | Fixed rate only | 3% down Fixed rate; 5% down adjustable rate |

| Property type | 1-unit house, condo, or PUD | 1-unit house, condo, or PUD. Manufactured home allowed with 5% down. |

| Occupancy | All borrowers must reside in the home | Primary residence. Non-occupant co-borrowers allowed with 5% down. |

| Maximum loan amount | $766,550 (no “conforming jumbo” a.k.a. High Balance) | $766,550 for 3% down; local “conforming jumbo” / High Balance limits with 5% down. |

| Credit score | 620 | 620 |

| Max debt-to-income ratio | 45% | 45% |

| Mortgage insurance | Standard, or reduced with higher rate/fee | Standard, or reduced with higher rate/fee |

HomeOne alternatives

Freddie Mac Home Possible: This is similar to HomeOne, but it is only available to those who make 80% or less of the area median income. It requires 3% down.

Fannie Mae HomeReady: HomeReady can be thought of as Fannie Mae’s version of Home Possible. You must make 80% of your area’s median income or less. It comes with income limits. One unique aspect of this loan is that you can use income a roommate pays you if they have been living with you for the last 12 months and plan to live with you in the new home. This is a 3% down loan.

Fannie Mae Conventional 97: The Conventional 97 is Fannie Mae’s version of HomeOne. It has no income limits, yet has many of the flexibilities that first-time buyers need. As the name suggests, it requires 3% down.

FHA loan: FHA allows for lower credit scores. Mortgage insurance is often less expensive for those with lower credit. It also offers flexibility around debt-to-income ratios and employment history. There are no income limits and 3.5% down is required.

VA loan: Available only to those with past or present military service, the VA loan is a zero-down program with no monthly mortgage insurance. There are no income limits.

USDA loan: This loan comes with geographic restrictions, since it’s meant to encourage homeownership is less densely populated areas. It has income limits of 115% of area median income. It requires 0% down.

HomeOne FAQ

No. Only one applicant must have not had ownership in a home for the past three years.

No. High-income applicants are eligible.

No. You can only purchase a primary residence.

HomeOne requires 3% down. You can finance the down payment and closing costs with a government- or non-profit-sponsored down payment assistance program, with total loans up to 105% of the purchase price.

No. You can buy anywhere in the U.S. using HomeOne.

Is HomeOne right for you?

Fortunately for homebuyers, there are plenty of 3% down loan options for any income level.

HomeOne can help you buy a home even if you thought you weren’t eligible for a loan with less than 10-20% down.

Contact a lender today and see if you can use HomeOne to become a homeowner.