If you’ve ever looked into down payment assistance (DPA) programs, you may have been frustrated about the stringent requirements to qualify.

Some require very low income, while others only work in specific geographic locations.

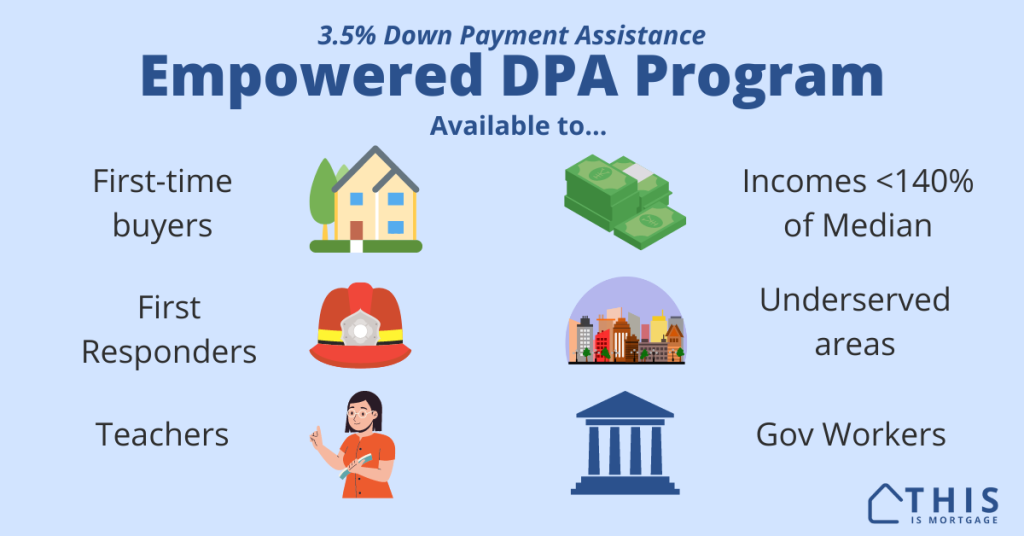

The new EPM Empowered DPA program, though, is available to most home buyers nationwide, thanks to its wide acceptance criteria.

Better yet, it offers up to 3.5% down payment assistance, enough to cover the entire down payment on an FHA loan.

Speak to a lender about down payment assistance programs.

What does the EPM Empowered DPA Program do?

@this_is_mortgage New down payment assistance program for firat time homebuyers covers your entire down payment requirement for an FHA LOAN #fhaloans #firattimehomebuyingprograms #firattimehomebuyers #mortgagetips

♬ Beach Day – Plastic Ruby

Empowered DPA gives you up to 3.5% of the home’s price toward the down payment on a house.

Because FHA loans require just 3.5% down, the program would cover your entire down payment.

For instance, a $300,000 home would require a down payment of $10,500. The Empowered DPA issues $10,500 to the closing agent at time of closing on your behalf. The lender counts that as your down payment.

The assistance comes in the form of a grant that is forgiven as long as you have the loan for six months.

The assistance is not a loan or lien placed on the house that eventually has to be repaid, as is common with many DPAs.

Request your down payment assistance approval from a lender.

Here’s who qualifies for Empowered DPA

The difference-maker about this program is how widely available it is.

Geographically, it’s available to home buyers nationwide, except for Washington State. That’s very rare for a DPA program.

Next, you only have to meet one of the following criteria:

You’re a first-time homebuyer: You haven’t owned a home in the past three years and will reside in the home as your primary residence

or…

You are currently or formerly one of the following (employee or volunteer): military, first responder, educator, medical professional, local or federal government worker

or…

Income: You make 140% or less of the median income where the property is located

or…

Underserved area: You are buying a home in an underserved census tract.

If you meet just one of the above, you are eligible.

Connect with a loan professional about down payment assistance.

Requirements for the program

To qualify for the DPA and loan, you must meet the following guidelines.

Credit: 620 credit score minimum. If your score is lower, the lender may be able to advise you on how to raise your score.

Loan purpose: Purchase of a primary residence only

Debt-to-income ratio: Maximum 48.99%, meaning less than 49% of your gross income may go toward the future housing payment plus all other debts such as credit cards, auto loans, and student loans. This is lower than the standard FHA DTI maximum of 56.9%, making this program slightly harder to qualify for. Still, 48.99% DTI maximum is still higher than for most conventional loans.

Property type: single-family home, duplex, single- and multi-wide manufactured homes, FHA-approved condos, PUDs.

Homeownership education: Borrowers must take an approved homeownership course offered by Framework Homeownership or from a HUD-approved counselor.

Loan Amount: Up to the standard nationwide FHA limit, currently $498,257. No high balance FHA loans.

Related: FHA Loan Calculator With Down Payment Assistance

Empowered DPA lenders and how to get access

Empowered DPA is offered by mortgage brokers who are approved to originate loans for EPM. EPM is a wholesale lender that doesn’t directly offer loans to the public. Rather, mortgage brokers take the applications.

Mortgage brokers don’t issue money themselves. Instead, they work with many banks and lenders to offer a variety of programs.

To get access to Empowered DPA, find a mortgage broker that works with EPM. That broker can then take the application and work through the approval process with you.

Connect with a loan professional to discuss down payment assistance programs.

Wondering if you’re eligible? Here’s more about who can qualify

As mentioned, this DPA offers one of the widest eligibility criteria of any DPA program. Many buyers are eligible even if they can’t meet requirements for other down payment assistance.

And, buyers only have to meet ONE of the following criteria, not all four or even two. Just one.

First-time home buyers are eligible

Anyone who hasn’t owned a home in the past three years is eligible. But this DPA program takes it one step further: a single parent who owned a home with a former spouse in the past three years is also eligible.

Only one first-time buyer on the application is required, so the co-applicant may have had ownership in a home recently. For instance, a buyer recently got a divorce and owned a home with her ex-spouse two years ago. She is marrying again and buying a home with her new spouse, who is a homeowner. They are eligible even if they are both on the loan application.

Speak to a lender to check your down payment assistance eligibility.

First Responders are eligible

Some examples of eligible professions are police officers, firefighters, EMTs, and paramedics. Even if you’re a volunteer firefighter, you are eligible. In this way, the program is similar to Good Neighbor Next Door.

Current and former military

Those who are serving or have served in the U.S. military are eligible, as are those who are in the Reserves.

Teachers are eligible

Volunteers and those employed in education can get the Empowered DPA. This includes teachers, daycare workers, music teachers, tutors, Sunday school teachers, and educators of all kinds.

Medical personnel

Doctors, nurses, and others employed or volunteering at a hospital or other medical facility are eligible.

Government workers

Civil servants working at any city, state, county, federal, tribal, or other government agency are eligible for the program.

Low, medium, and medium-high earners

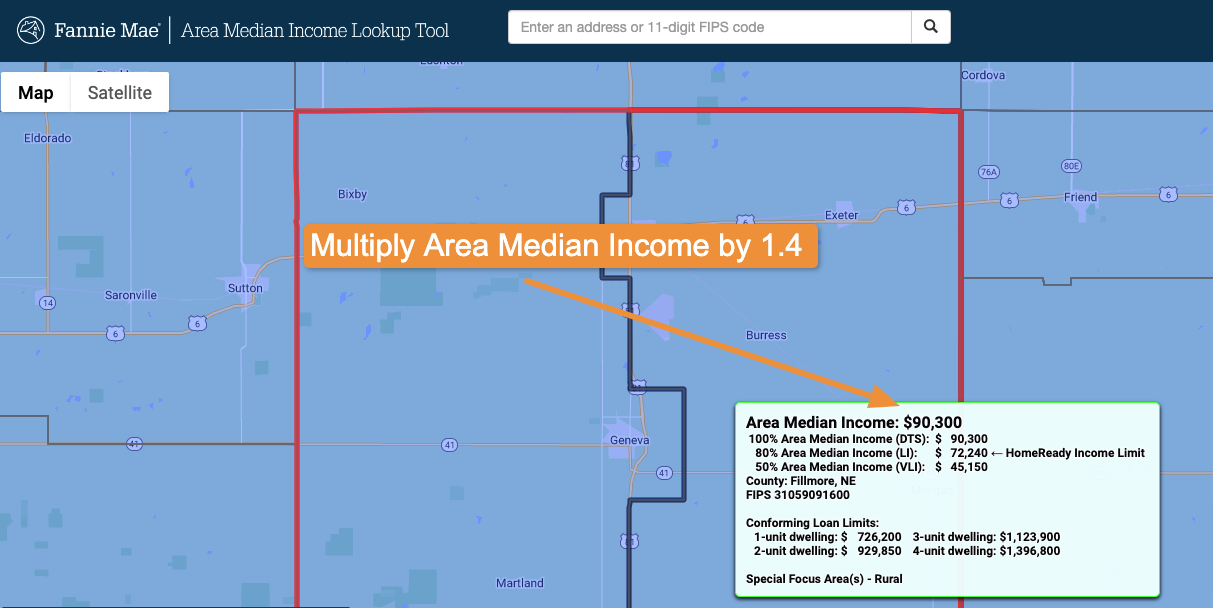

This program is not just for low-income individuals like most DPA programs, although it works well for lower-income homebuyers. Those making up to 140% of their area’s median income are eligible. To check eligibility, enter the property address into Fannie Mae’s median income lookup tool and multiply your area’s median income by 1.4 (140%).

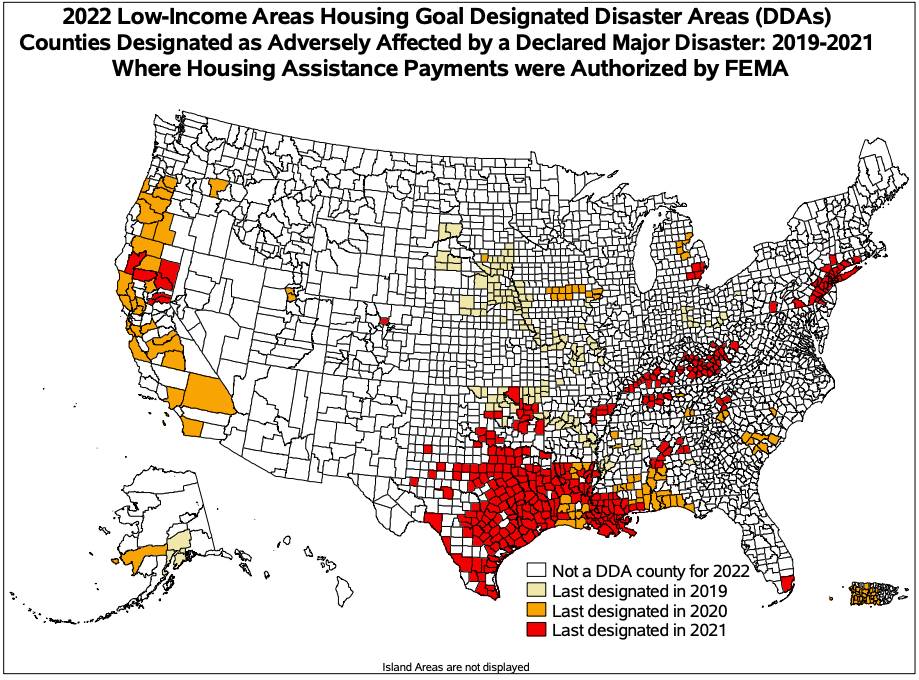

Homebuyers in an Underserved Area

Anyone buying in an Underserved Area as defined by the Federal Housing Finance Agency is eligible for the program. There are many counties across the U.S. that are eligible.

Is there a catch?

When a program this good comes along, homebuyers naturally wonder if there’s a catch.

The program is legitimate and its primary purpose is to get people into homes who can afford it, but don’t have down payment funds.

However, here are two things to be aware of:

- Higher mortgage rates: The program will likely come with a higher rate than standard FHA loans due to the greater risk when the borrower does not put their own funds into the transaction. But the buyer can refinance using the FHA streamline program after 6 months. An FHA streamline requires no appraisal and no income documentation. However, you’ll have to pay closing costs again.

- Larger fees: Fees will be larger due to less profit being produced in the loan transaction due to the DPA funds. The lender will work with your real estate agent to try to get some of these costs paid for by the seller.

In all, the program is a great way to get into the home.

@this_is_mortgage Down paymenr assistance versus standard FHA. Which one is right for you? #homebuyertips #thisismortgage #firsttimehomebuyertips #mortgagedownpayment #mortgagetok #downpaymentassistance

♬ Friday Night Lights – ROKKA

FAQ

Even though there’s no down payment, you still must pay closing costs, which typically equal 3-5% of the home’s price. However, you can work with your lender and real estate agent to request seller concessions up to 6% of the home’s price to help pay for closing costs like title, escrow, prepaid property taxes, and more.

No. You are exempted from income limits if you are employed or volunteering as a first responder, teacher, medical professional, civil servant, or another eligible group.

The DPA is a grant that is forgivable after six months. As long as you hold the loan and home for six months, nothing is owed.

Grant funds are generated from loan proceeds that would normally go to the lender. Because this program comes with higher-than-market rates, that extra loan origination profit is issued to the buyer in the form of down payment assistance.

How do I apply for Empowered DPA?

If you’ve considered buying a home but don’t know where to get the down payment, this program is for you.

The program was created for those who make enough money to make the mortgage payment but don’t have the upfront savings.

You can apply with an approved mortgage broker. If you don’t know one, we can connect you with one now.