Freddie Mac BorrowSmart(SM) & BorrowSmart Access income limits

There are two BorrowSmart programs in the market currently, and your income and geographic location determine which one you qualify for.

BorrowSmart: $2,500 in assistance for homebuyers earning 50% or less of the area median income. It is available anywhere in the U.S.

BorrowSmart Access: $3,000 in assistance for homebuyers earning up to 140% of area median income. It is available in 10 select metropolitan areas.

Connect with a lender to check your BorrowSmart eligibility.

How to determine your BorrowSmart eligibility for $2,500 in assistance

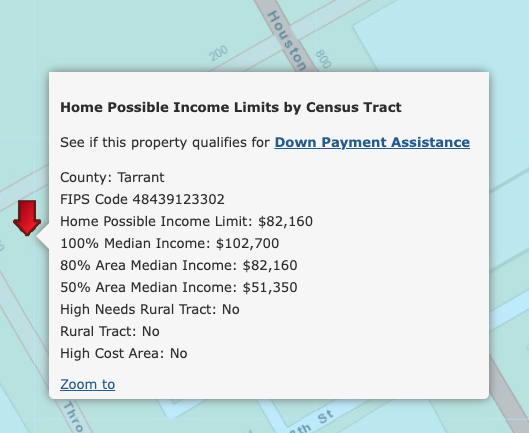

BorrowSmart is a down payment assistance program for lower-income homebuyers. To check your area’s median income and whether you’re eligible, use Freddie Mac’s Income Limits Tool.

For best results, use a specific address. You can also pinpoint a neighborhood or region, but if you end up buying elsewhere, your eligibility could change.

Using the tool in this area near Fort Worth, Texas reveals that someone making up to $51,350 per year may be eligible for $2,500.

Speak with a BorrowSmart lender to check your eligibility.

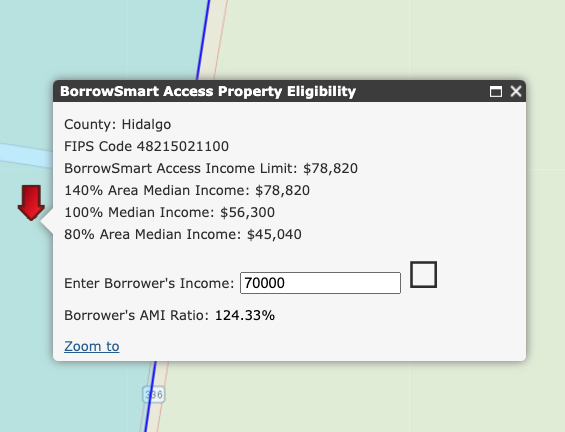

How to determine your BorrowSmart Access eligibility for $3,000 in assistance

BorrowSmart Access is a down payment assistance program targeting traditionally underserved areas. Homebuyers purchasing a home in the area may qualify even though they make up to 140% of the area median income.

The 10 metros currently eligible for BorrowSmart Access are:

- Atlanta

- Chicago

- Detroit

- El Paso

- Houston

- Mcallen-Edinburg-Mission, Texas

- Memphis

- Miami

- Philadelphia

- St. Louis

To see if a specific address is eligible, use Freddie Mac’s income tool. You can input your income to see if you are within 140% of the area median. In the example below, someone buying near McAllen, Texas with a $70,000 annual income is eligible because they make less than 140% of the area median income.

Freddie Mac BorrowSmart Guidelines

Here’s a summary of how to qualify for BorrowSmart.

- Earn 50% or less of the area median income where the property is located for BorrowSmart

- Earn 140% or less than the area median income and be buying in an eligible county

- 620 credit score

- 3% down

- Adequate income and employment to qualify for the loan

- Adequate assets or additional assistance to pay for the portion of the down payment and closing costs not covered by BorrowSmart funds

- Primary residences only

- First-time and repeat buyers are eligible

- Complete a homeownership counseling course

While there are some hoops to jump through, the right applicant can get all or part of their down payment paid for with BorrowSmart funds, which is a rare benefit. Typically, a lender or other interested party in the transaction may not contribute toward the borrower’s down payment.

Compatible loan programs

You can’t use BorrowSmart with just any loan program. It is not compatible with FHA, VA or USDA loans.

You can think of BorrowSmart not as its own loan program, but an add-on feature to some of Freddie Mac’s other loan offerings.

You can use BorrowSmart in conjunction with some of Freddie Mac’s 3% down programs to ease the burden of coming up with a large down payment.

Many banks and mortgage companies are approved to offer Freddie Mac loans; Freddie Mac does not offer its loans directly.

FAQ

The funds will come from the lender at closing. It will go toward reducing your down payment and closing costs.

50% of area median income (AMI) to receive $2,500 anywhere in the U.S.; 140% of AMI to receive $3,000 in 10 select metropolitan areas including El Paso, Atlanta, Chicago, and others.

Standard down payment assistance (up to $2,500) is available in all 50 states. $3,000 in assistance is available in 10 select metropolitan areas.

Get a head start with Freddie Mac BorrowSmart

This program is a rare opportunity to get down payment assistance from your lender.

For low- and moderate-income households, this assistance program could offer homeownership that is finally attainable.