When I was 26, I purchased this house for $250,000 with $1,100 out-of-pocket.

Yes, I got into a house for less than it costs to rent an apartment.

And I could have done it with none of my own money if I knew what I was doing.

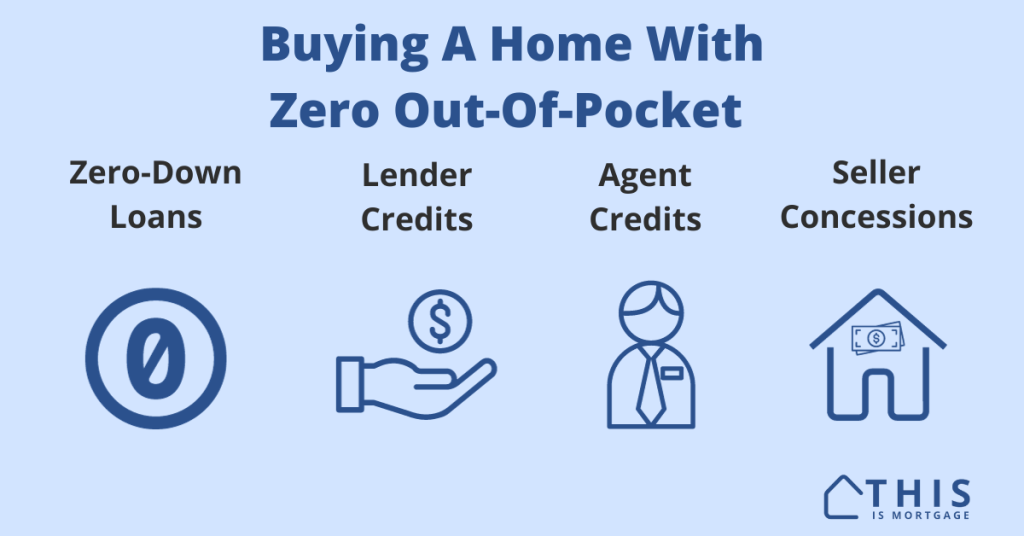

Here’s how I bought a house with almost no money, and tactics to help you do the same.

Check your eligibility for a low out-of-pocket home loan.

@this_is_mortgage You don’t need $10k+ in the bank to buy a home. 💡Use zero down loans, down payment assistance, and credits to pay your down payment and closing costs. 😍💵#firsttimehomebuyers #firsttimehomebuyerhacks #usdaloans #mortgagedownpayment

♬ Summer – Croquet Club

1. Get a zero-down loan

The most important piece of the puzzle is to get a zero-down loan. Your down payment isn’t the only upfront homebuying cost, but it’s the biggest one.

Even 5% down on a $250,000 home is $12,500. Not exactly pocket change.

You might assume there is no such thing as a zero-down loan. But many programs are alive and well.

100% USDA loan: This is the least-known but perhaps most powerful mortgage in today’s market. If you buy in a USDA-designated area, you may be eligible for zero down. These loans are meant for rural locations, but many eligible areas are solidly suburban. It might even be worth buying farther out than you planned, just to qualify for this no-money-down loan.

Zero-down VA loan: This loan is for those with qualifying military experience. That’s usually defined as having 2 years of service if you are now separated, or 90 days if on active duty. VA loans require no down payment, no monthly mortgage insurance, and come with lower rates than FHA or conventional loans.

FHA loan with down payment assistance or gift funds: FHA loans require 3.5% down, but this program is liberal about where that money can come from. You can get a financial gift from a family member or down payment assistance program such as the NFM Flex Program.

Check your FHA down payment assistance eligibility.

Freddie Mac Home Possible & Fannie Mae HomeReady: These are conventional loans that require 3% down. However, like FHA, they allow gift funds to cover the down payment. If you’re buying a regular one-unit home, gift funds can cover the entire down payment and closing cost requirement.

Good Neighbor Next Door $100 down program: While this program is limited, it’s still worth checking into. Select homes are available at a 50% discount to law enforcement officers, teachers, firefighters, and EMTs. Additionally, if you use FHA financing, you may qualify for just $100 down. Learn more about GNND here.

Check your zero-down loan eligibility.

2. Cover closing costs

Unfortunately, solving for the down payment isn’t your only hurdle. There are also closing costs to consider, a significant expense that most first-time buyers overlook.

On a $300,000 home, closing costs could be anywhere from $5,000-$8,000 or more. There are quite a few services to pay for during the process, like title, escrow, appraisal, and lender fees.

You also have to pay items in advance, like 6-9 months’ taxes and 12 months of homeowners insurance. If taxes are $300 per month and insurance is $75 per month, that’s $3,600 right there.

Luckily, there are strategies to pay for closing costs and prepaid items with other people’s money. (Yes, you can get others to prepay your property taxes for you!)

The following sources of funds can’t be used for your down payment, but they can help pay all or part of your closing costs.

Lender credits

I was fortunate to get a closing cost credit from the mortgage broker.

How this works is the lender gives you a slightly higher rate and issues excess profit toward closing costs.

Raising your rate by just 0.125% or 0.25% could be enough to generate thousands of “extra” dollars in lender profit, which you can use toward closing costs.

When you apply, ask your mortgage lender or broker that you’re interested in seeing interest rate options with and without lender credits.

Connect with a lender to learn more.

Realtor closing cost credit

Your Realtor can rebate some of their commission toward your closing costs.

When I bought my first home, I got about $2,000 from my agent. This helped bring down required upfront funds.

The traditional commission for a realtor who helps a buyer is 3% of the home’s price.

That’s high – $9,000 on a $300,000 home. You can negotiate with your agent to issue some of their commission to you. In today’s tougher market, they might just do it.

A small portion of their commission could lower your costs by $1,000 or more.

Seller credit

Perhaps the most well-known option for closing cost help is a seller credit, also called a seller concession.

This is a credit I didn’t know to ask for when I purchased my home. If I did, I may have been able to eliminate out-of-pocket costs altogether.

Why would the home seller pay your closing costs? Well, they probably won’t in a hot market or if they have more than one offer. But they might if they don’t have much interest.

It’s a nice incentive to draw a buyer’s attention and offload the home sooner.

Right now, in 2024, it’s a great time to request a seller credit. In many markets, sellers are panicky. Selling a home is harder than it was a couple years ago.

Fall and winter are great times to request a credit. Sellers fear that they will need to wait until spring if they don’t find a buyer soon.

If you’re buying new construction, the builder often contributes toward closing costs or even buying down your rate.

Your real estate agent is the one who negotiates with the seller for a credit. Ask them about the best strategies in your market. Even $500 will help.

How much can you get in closing cost credits?

Closing cost credits from parties to the transaction are known as “interested party contributions” or IPCs. Interested parties are the Realtor, seller, or builder. Lender credits are not considered IPCs.

These limits are pretty generous. Imagine getting $18,000 (6%) from interested parties on a $300,000 home. In most cases, you won’t get the maximum, but it’s nice to know you can.

One thing to keep in mind is that IPCs are “use it or lose it.” You can only use as much as your closing costs and prepaid items. For instance, if you have $5,000 in closing costs and $7,000 in agreed-upon credits, you can’t pocket the extra $2,000 or apply it to your down payment.

In that case, you could use the extra funds to buy down the interest rate, making monthly payments more affordable.

Start your no-money-down loan.

No money homebuying FAQ

Technically, yes. You could get a zero-down loan, then cover all your closing costs with seller, lender, and agent contributions. However, it’s smart to have money in the bank after closing for emergencies. Your goal should be to save a few thousand dollars, but then not need it for your down payment or closing costs.

No. There are programs in today’s market that don’t require a down payment. Other programs let you use down payment assistance. It’s often not worth spending years saving up for a down payment while home prices march upward.

No. You will need to either pay closing costs out-of-pocket or get contributions from the seller, builder, your agent, your lender, or any combination of them. Closing costs can be $5,000 to $8,000 or more on a $300,000 home, so you need to plan ahead to cover these.

You can buy a house with no money out of pocket

If I got into a home with just $1,100 out-of-pocket without information like this, you might do it with zero out-of-pocket using this knowledge.

The market is turning, and lenders, sellers, and agents are now more willing to negotiate to get your business than they have been in years.

The first step is to apply for a zero-down loan. If you’re approved, start negotiating closing cost help. Soon, you’ll have a homebuying story just like mine.