When you put less than 20% down on a home, you’ll most likely pay mortgage insurance.

Mortgage insurance is just another tool in your homebuying kit. It’s no worse than paying interest on a mortgage. Just like the mortgage itself, PMI helps you buy a home when you lack savings.

Still, many people avoid PMI like the plague. This is unnecessary. PMI helps you break into the housing market years earlier than you would otherwise.

Here’s how much you can expect to pay for this very useful tool.

Get started on your homebuying goals.

A Quick Note

Conventional loans: 0.25% to 2%+ of the loan amount per year (the “PMI factor”). PMI, or “private mortgage insurance” is issued by private companies and attached to conventional loans. The cost is driven by your down payment and credit score.

FHA: 0.55% of the loan amount per year for most loans. FHA “MIP” is provided by the government. As such, it is not as sensitive to credit score or down payment.

USDA: 0.35% of the loan amount per year. This government-issued “Guarantee Fee” is essentially mortgage insurance. It costs the same for all credit scores and down payments.

VA loans: No monthly mortgage insurance. Veterans pay an upfront funding fee but no ongoing mortgage insurance.

PMI cost: 3% down (Conventional, FHA, USDA)

All of the following are estimated PMI costs as published by MGIC. Your costs could be different, but this gives you an idea of potential costs.

| Loan | Credit | PMI Factor | Conv. PMI | FHA 3.5% down | USDA 0 down |

|---|---|---|---|---|---|

| $350,000 | 760+ | 0.58 | $169 | $160 | $102 |

| $350,000 | 740-759 | 0.7 | $204 | $160 | $102 |

| $350,000 | 720-739 | 0.87 | $254 | $160 | $102 |

| $350,000 | 700-719 | 0.99 | $289 | $160 | $102 |

| $350,000 | 680-699 | 1.21 | $353 | $160 | $102 |

| $350,000 | 660-679 | 1.54 | $449 | $160 | $102 |

| $350,000 | 640-659 | 1.65 | $481 | $160 | $102 |

| $350,000 | 620-639 | 1.86 | $543 | $160 | $102 |

| $350,000 | <620 | Ineligible | Ineligible | $160 | $102 |

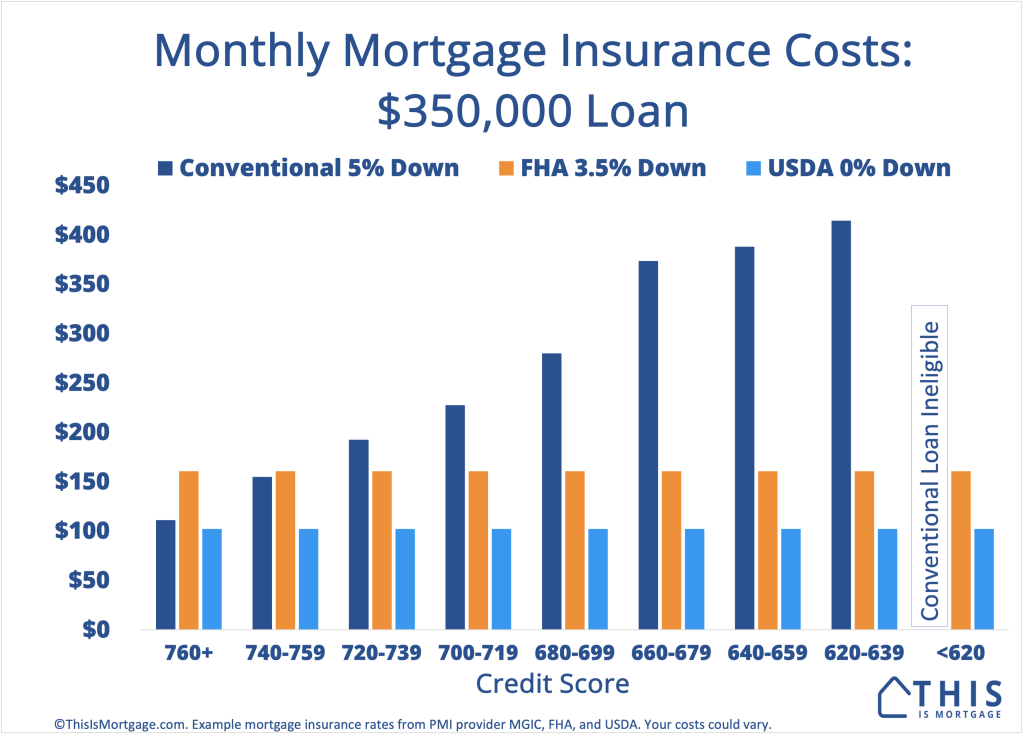

PMI cost: 5% down (Conventional, FHA, USDA)

| Loan | Credit | PMI Factor | Conv. PMI | FHA | USDA |

|---|---|---|---|---|---|

| $350,000 | 760+ | 0.38 | $111 | $146 | $102 |

| $350,000 | 740-759 | 0.53 | $155 | $146 | $102 |

| $350,000 | 720-739 | 0.66 | $193 | $146 | $102 |

| $350,000 | 700-719 | 0.78 | $228 | $146 | $102 |

| $350,000 | 680-699 | 0.96 | $280 | $146 | $102 |

| $350,000 | 660-679 | 1.28 | $373 | $146 | $102 |

| $350,000 | 640-659 | 1.33 | $388 | $146 | $102 |

| $350,000 | 620-639 | 1.42 | $414 | $146 | $102 |

| $350,000 | <620 | Ineligible | Ineligible | $146 | $102 |

PMI cost: 10% down (Conventional, FHA, USDA)

| Loan Amount | Credit | PMI Factor | Conv. PMI | FHA | USDA |

|---|---|---|---|---|---|

| $350,000 | 760+ | 0.28 | $82 | $146 | $102 |

| $350,000 | 740-759 | 0.38 | $111 | $146 | $102 |

| $350,000 | 720-739 | 0.46 | $134 | $146 | $102 |

| $350,000 | 700-719 | 0.55 | $160 | $146 | $102 |

| $350,000 | 680-699 | 0.65 | $190 | $146 | $102 |

| $350,000 | 660-679 | 0.9 | $263 | $146 | $102 |

| $350,000 | 640-659 | 0.91 | $265 | $146 | $102 |

| $350,000 | 620-639 | 0.94 | $274 | $146 | $102 |

| $350,000 | <620 | Ineligible | Ineligible | $146 | $102 |

Conventional loan PMI is best for those with great credit

PMI is highly sensitive to credit score. Just like car insurance companies, private mortgage insurers determine premiums based on risk.

For example, a 5% down homebuyer with a 760 score will pay $300 less per month for PMI than someone with a 620.

This is why most people choose FHA or USDA if they have lower credit. FHA and USDA are government-insured loans. Their purpose is to get people into homes, not turn a profit. As such, a 620-credit buyer with 3.5% down will pay almost $400 per month less for mortgage insurance using FHA and $450 less per month using USDA.

See which loan type you qualify for.

Should you use PMI or save 20%?

Many homebuyers don’t like the idea of PMI. It seems like a waste of money. However, it could be a bigger waste of money to try to save 20% for a down payment.

Even with modest annual home appreciation of 3%, a $400,000 home increases by $12,000 per year. That means you need to save an extra $2,400 per year (20% of $12,000) to be in the same position as the year before.

That $2,400 per year is $200 per month. But PMI on a 3% down conventional loan with a 740 credit score is just $204 per month.

In short, you’re spending almost as much by waiting to buy a home as you would on PMI, so it could be worth buying a home now.

Capture today’s home prices by buying now before they rise.

Other loan attributes that affect PMI cost

Credit score and down payment are the major influencers of PMI cost. But there are things you can do to lower PMI.

2+ borrowers: Mortgage insurance companies often give a discount if there are more than one borrower on the loan.

Buy a single-family home or duplex: PMI on 3-4 unit homes costs more.

Find a special mortgage program: Conventional loans like HomeReady and Home Possible offer discounted PMI premiums.

Lower your debt-to-income: A debt-to-income above 45% can require higher PMI costs.

PMI is often worth it

PMI can cut years off of your homebuying goals. Instead of spending years or decades trying to save for ever-rising home prices, lock in a home price now with PMI.