Use the 80-10-10 piggyback mortgage strategy to accomplish one or more goals.

- Avoid PMI

- Avoid jumbo financing

- Lower your mortgage payment later without a refinance

See if an 80-10-10 is right for you.

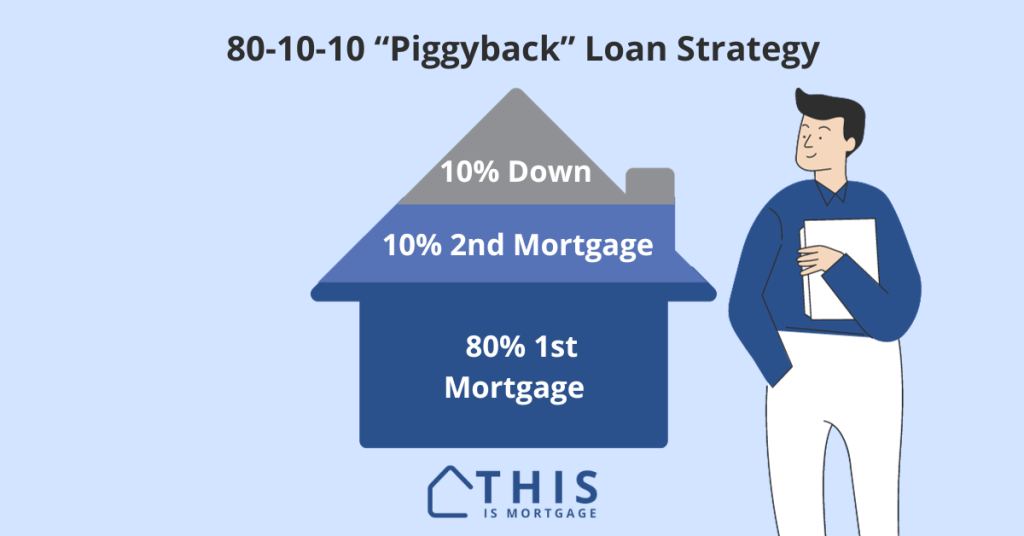

How an 80-10-10 Piggyback works

First, it’s worth knowing how piggyback loans work.

- 80%: The primary “first” mortgage is 80% of the purchase price

- 10%: The second mortgage covers 10% of the purchase

- 10%: You put 10% down

One loan “piggybacks” on top of the other, covering 90% of the purchase price in total.

@this_is_mortgage 80/10/10 piggyback homebuyer program. No PMI. #firsttimehomebuyer #mortgagetips #2024realestate #thisismortgage #mortgagetok #mortgageadvice

♬ Good With Me – Jaylon Ashaun

1. Avoid PMI

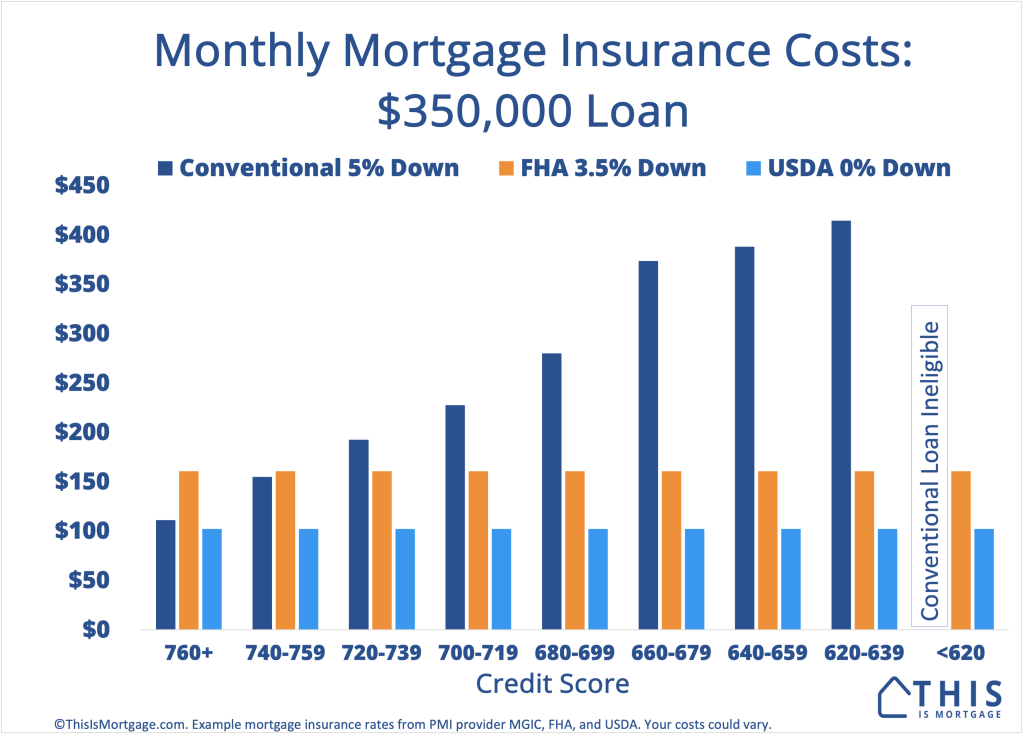

Most loan types require private mortgage insurance, or PMI, when you put less than 20% down.

PMI is not very expensive, but some would rather avoid it.

Surprisingly, the 10% second mortgage counts as part of your 20% down, eliminating the first mortgage lender’s PMI requirement.

So does an 80-10-10 save you money? Let’s find out.

| Piggyback | 90% loan w/PMI | |

| Home price | $500,000 | $500,000 |

| 1st loan | $400,000 | $450,000 |

| 2nd loan | $50,000 | n/a |

| 1st mtg pymnt* | $2,730 | $3,150 |

| 2nd mtg pymnt* | $440 | n/a |

| PMI | n/a | $140 |

| Total payment | $3,170 | $3,290 |

*Piggyback 1st mortgage at 7.5%; 90% first mortgage 7.25%. 2nd mortgage at 10%. PMI 0.38%/yr based on 740 credit per MGIC. All rates are for example purposes only and may not be available. Payments do not include taxes, insurance, HOA.

In this scenario, the piggyback loan saves $120 per month. But everyone’s situation could be different so get a quote for both scenarios.

See if you can save money with an 80-10-10 loan.

2. Avoid jumbo financing

The conventional loan limit for 2024 is $766,550. While this is a generous amount, many homebuyers must take out a larger amount, requiring jumbo financing.

Jumbo loans are great, but they often require excelleng credit and a large down payment. Conventional piggyback loans need just 10% down and may be more lenient about credit scores.

Lowering your first mortgage amount to $766,550 using a second mortgage can help you qualify.

| Piggyback | Jumbo | |

| First mortgage | $766,550 | $900,000 |

| Second mortgage | $133,450 | n/a |

| Total loan | $900,000 | $900,000 |

3. Pay off your second mortgage at any time to reduce your payment

It’s often difficult to lower your payment on a single 90% loan without an expensive refinance.

To cancel PMI, you have to pay down your balance to 80% of the original value, then make a formal request to your mortgage servicer. There’s no guarantee they will remove mortgage insurance.

And, you can’t lower your principal and interest payment by paying down the loan.

But you can pay off a second mortgage at any time, reducing your monthly housing costs with no hassle whatsoever.

Piggyback loans are great for those who will receive a large sum within the first few years of their mortgage with which to pay off the 2nd loan:

- You are selling your current home but it won’t close until after the new home purchase

- You expect a large bonus or exercisable stock options from work

- You will receive an inheritance in the next few years

- You plan to sell your business

If you expect a very large sum, you could structure your piggyback loan as 70-20-10, 60-30-10, or any other combination. Your second mortgage should be the approximate amount you would like to pay off in the future.

80-10-10 requirements

Most lenders today offer 80-10-10 mortgages.

The 80% first mortgage is typically a conventional loan. Then, your lender will find a second mortgage lender for the 10% portion.

Some lenders offer both loans as a single package.

Either way, getting approved for both loans can be harder than for a single loan.

Here are general requirements, which vary by lender.

- 10% down payment

- 680-700 minimum credit score

- 45% debt-to-income ratio including both loan payments

- 2+ months of mortgage payments in reserve after closing

- Solid income and employment history

You have to be a fairly strong applicant to be approved for a piggyback loan, but not perfect. It’s worth applying to see what you qualify for.

Check your 80-10-10 eligibility.

Are 80-10-10 rates high?

Piggyback loan rates are about 0.25% to 0.50% higher than standard conventional rates.

Fannie Mae and Freddie Mac require an extra loan fee of 1.125% of the loan amount. Most people accept a slightly higher rate in lieu of paying the extra fee.

80-10-10 pros

- No PMI

- Potentially lower payment

- Lower your housing payment by paying off the second mortgage

- Avoid jumbo financing

80-10-10 cons

- Two separate payments each month

- More difficult to refinance the first mortgage

- High second mortgage rate

- Second mortgage rate may be variable

- Higher first mortgage rate

- Need great credit

Second mortgage options

You have many options for the secondary financing.

- Fixed or variable rate

- 10, 15, or 20-year terms

- Interest-only

- Home equity line; pay down and borrow again as needed

Piggyback loan alternatives

FHA loan: You may be approved for FHA with a 580 credit score and 3.5% down.

90% loan: You can put just 10% down with a 90% first mortgage with PMI. Some 10% down jumbo loans do not require PMI.

95-97% loan: Conventional loans allow down payments as low as 3%.

VA loan: Current and former members of the military may qualify for a zero-down mortgage with no monthly PMI.

USDA loan: Buyers in rural and suburban areas are eligible for a zero-down home loan sponsored by the US Department of Agriculture.

Can you refinance a piggyback loan?

You can refinance a piggyback loan in one of two ways:

First mortgage only: You can typically refinance the first mortgage without touching the second loan. You will need a “subordination agreement” from the second mortgage lender. This document places the second mortgage lower in priority than the new first mortgage. The document can take some time to get.

First and second mortgage: Conventional lending allows you to refinance the first and second mortgage with a new first mortgage provided the entire second mortgage was used to acquire the property and no additional funds have been accessed.

Is an 80-10-10 right for you?

Some applicants will see significant savings with this loan option. For some, it may be better to choose one loan with PMI or another loan type.

Contact a lender to see multiple scenarios and decide which one is best for you.