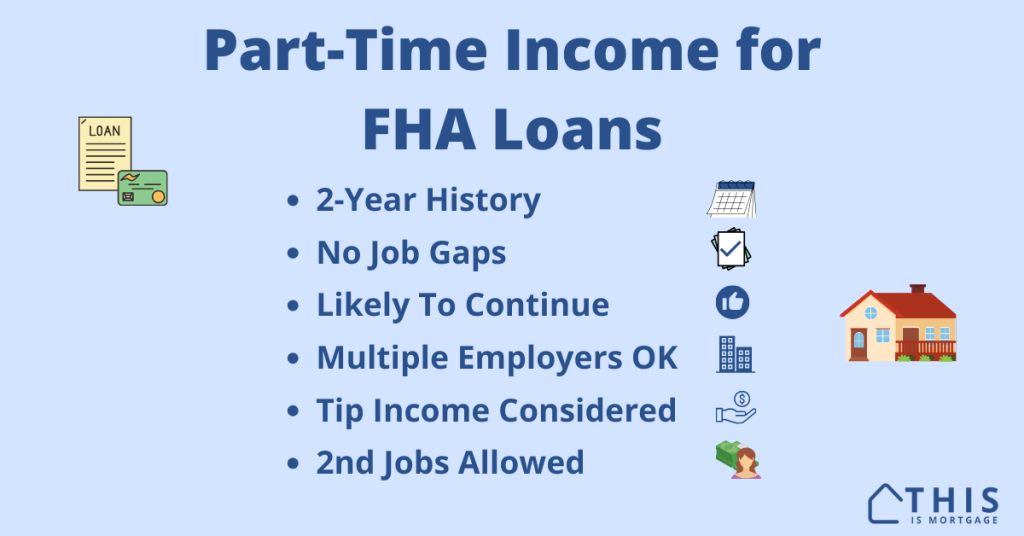

FHA allows you to use part-time income to qualify for a mortgage. Whether you’re a restaurant server, retail worker, or have other part-time work, your income could help you become a homeowner.

Here are FHA’s rules about using part-time income for your mortgage.

How does FHA define part-time work?

FHA defines part-time as work that is “generally performed for less than 40 hours per week.”

Basically, any job that is not salaried or full-time hourly will be considered part-time.

For these positions, you have some additional requirements.

2-year history required

FHA lenders need a longer history of part-time work to determine income compared to full-time employment.

Full-time salaried job: Can use current income to qualify

Part-time income: Two-year history required

FHA is stricter about part-time income because it is considered variable, and any variable income requires two-year average earnings.

| Part-time income example | Income |

| Year 1 | $42,000 |

| Year 2 | $47,500 |

| Total | $89,500 |

| 2-year average (divide by 24) | $3,729/mo |

With a full-time salaried job, lenders assume you will have stable monthly income going forward, but part-time income is less predictable.

If you don’t have a two-year history of part-time employment, it’s possible to start a full-time job now and use that income to qualify. The lender may need to verify two years of history before the job, including any part-time work, prior education or training, or military service.

See if you can use your part-time income to qualify.

No job gaps

Unlike with a full-time job, you can’t have any gaps in part-time employment for the past two years. You can have some job changes, but any gaps may disqualify you from using the income.

Taking time to find another job is common, but unfortunately, FHA won’t accept gaps in part-time work.

If you had a job gap and are now starting full-time work, you need to be at the new full-time job for six months before applying for the FHA loan.

Part-time employment likely to continue

The FHA underwriter will examine the type of work and determine whether it’s likely to continue.

For example, you work at a large retail store. You can likely work there for years to come.

But if your current job is at an outdoor ice cream shop on the beach – and it’s summer – expect questions from the underwriter on the stability of the position.

Part-time income from multiple employers

Lenders will consider part-time income from multiple employers as long as there have been no gaps between jobs.

The lender will attempt to get an employment verification for start and end dates for each position. It will try to piece together a solid two-year history.

The lender will then use the average two-year income for qualifying purposes.

If you’ve had more than three job changes in the past 12 months, you may need to verify that each new position came with better pay or benefits. Lenders may suspect you can’t hold a job if you continually change employers for no apparent gain.

See if you qualify for FHA using part-time income.

Recent raises can help

If you recently got an hourly pay rate increase, you can use the new rate of pay.

The lender will use current pay rate times average hours over the past 12 months.

For example, you were getting paid $19 per hour and averaged 120 hours per month over the past year. You just got a raise to $20 per hour. The lender can use $2,400 per month (120 hours X $20/hr) as your qualifying income.

Hourly pay

You do not need two years of income history for a full-time, hourly position. (Though you may need two years of work history to be eligible for FHA. We’re mainly talking about income levels here.)

For example, you are paid $30 per hour and work 40 hours per week or more. The lender can assume you’ll continue the 40-hour-per-week schedule.

But if you work 30 hours some weeks and 40 hours others, for instance, the lender will consider your income variable and you’ll need two years of history.

Tip income

Restaurant servers and others may receive tip income. This is considered qualifying income for FHA.

You need at least one year of tip income history, but preferably two. Your current role must receive tips and this income should be likely to continue.

Keep in mind that to use tip income to qualify, you must claim it as income on your federal tax returns.

See more FHA loan strategies here.

Second (simultaneous) jobs

You must show that you’ve worked your primary job and second job simultaneously two years to use the second job income.

| Secondary employment examples | Scenario 1 | Scenario 2 |

| Primary job | Have had the job for 2 years with no gaps | Have had the job for two years with no gaps |

| Second job | Have held the second job simultaneously for 2 years with no gaps | Started a simultaneous second job 1 year ago |

| Result | Lender may use income from both jobs | Lender will use primary job income only |

Do you make enough to qualify?

One common issue with part-time applicants is making enough to qualify.

At today’s mortgage rates and home prices, it’s often hard for two full-time incomes to be approved for a mortgage. So one part-time income can be challenging.

Luckily, FHA is lenient about debt-to-income ratios. With a decent credit score, you might be approved to spend about 56% of your gross (before-tax) income on your mortgage plus other debts.

To qualify, keep your debts low. Sell a car with a high payment. Do everything you can to eliminate other debt like credit cards.

It’s worth applying with a lender to see what you might qualify for now, and what to work on if you can’t be approved yet.

See if you qualify for FHA

FHA is the easiest loan to qualify for in most situations. It is very forgiving about income and employment history.

Check your FHA eligibility and see if you qualify to become a homeowner.