I purchased a home in June 2006, not only at the top of the real estate market, but also right before a recession.

And I don’t regret it.

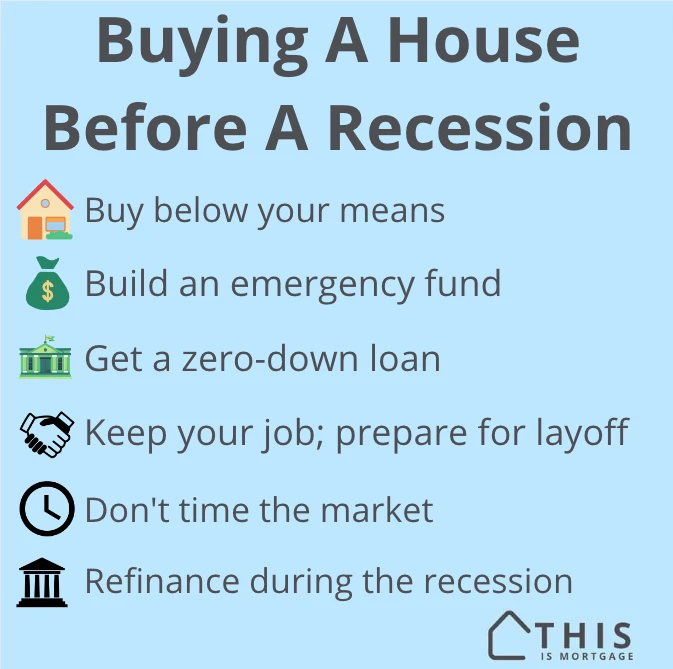

Buying a house before a recession can be a very good idea. Here’s what I learned from my experience that you can apply to your situation if you’re planning to buy.

Speak to a lender to see if you’re eligible to buy a home.

- Is a recession coming?

- What I learned from buying a house before a recession

- Keep your job, but prepare to lose it

- Crashing home prices isn’t the worst-case scenario; losing your income is

- Buy below your means

- Build a war chest

- Mentally prepare to sell assets

- Get a zero-down mortgage

- Refinance during the recession

- Timing the market is futile

- Bottom line: Should you buy a house before a recession?

Is a recession coming?

There is strong evidence that a recession is on its way. But that doesn’t mean we’ll actually see one.

One indicator — the inverted yield curve — has been correct about recessions all but once. The yield curve has been inverted since July 2022. We usually see a recession between 6 and 24 months after the yield curve inverts, pointing to a spring or summer 2024 recession.

That being said, we had the first pandemic since yield curves were a thing, and the mind-boggling stimulus that went with it. Did that stimulus cause a false yield curve somehow? No one knows.

The point is that we could genuinely see a “soft landing” as the Fed would prefer. This is when inflation falls without a major job-loss recession. This would be a good outcome.

However, you should plan for the worst while hoping for the best. Since we don’t know the future, we need to ask whether it’s a good idea to buy a home in the face of potential recession.

What I learned from buying a house before a recession

It’s certainly okay to buy a house, even when you know a recession is on the way. But, be smart about it.

Here’s what I wish I had known before I bought my house before the Great Recession.

Keep your job, but prepare to lose it

My timing is awesome.

After buying a very expensive house in 2006, I quit my job and started my own company processing mortgages in 2007. Then I tried my hand at being a full-time loan officer amidst the worst housing meltdown in history.

We were coming out of a time when just about anyone could be approved for a mortgage. Suddenly, loan programs were drying up and almost no one could get approved for a mortgage. My income dried up with it.

I wouldn’t advise this strategy. If you plan to buy a home, keep your full-time job as long as you can.

That being said, there’s a good chance you could get laid off during a recession, so you better have a backup plan.

It’s a good exercise to think about what you would do if you were laid off tomorrow. In fact, assume your entire industry imposes a hiring freeze.

Create a budget including your proposed mortgage payment. Assume some or all of your income ceased for 3-6 months. How long could you last?

Here’s where you get creative. Could you go work at Starbucks to get a small paycheck and benefits for a while? Could you flip merchandise on eBay?

For a time, I cleaned an event venue after weddings for $250. I became an assistant for a well-established loan officer. I used whatever skills I had to generate some income. It takes humility to come down off a solid career just to make ends meet. But it’s worth it to keep the home, and you’d have to do it anyway, even if you were renting.

Speak to a lender to get pre-qualified to buy a home.

Crashing home prices isn’t the worst-case scenario; losing your income is

Despite what you hear on YouTube, a falling home value isn’t the worst thing that could happen after you buy a home.

I purchased my home for $540,000 in 2006 and at one point it probably dipped below $375,000.

But that was all on paper. Home value doesn’t matter unless you sell.

My bigger concern was making my mortgage payment without a solid income.

You shouldn’t fear buying a house before a recession because the home value might drop. Your entire decision should be based on whether you can keep making payments through the recession.

Buy below your means

Having a foreclosure on your record will destroy your credit and keep you from buying a home for years.

That’s why it’s important to have plans in case you lose your income during a recession. This applies whether recession is near or not.

I made the mistake of buying a home at the top of my pre-recession income. Everything is fine and dandy until you lose your job. Then, your payment seems a lot bigger.

I have mixed feelings about this, though, because, looking back, I’m glad I stretched my budget. I’ve been in my house for 18 years and have not had to move. Had I bought a smaller home, I may have had to sell and buy again, losing a ton of home equity in the process.

It worked out in my case, but the safer scenario is to buy a home that leaves room in your budget. You have a longer runway in case you lose some or all of your income.

Start your mortgage pre-approval by connecting with a lender.

Build a war chest

Another mistake I made was having no emergency fund to fall back on.

I put most of the money from my previous home sale into the 2006 home. I had no emergency fund – what I call a war chest – to help me ride out a recession.

If you’re making a lot of money now, earmark funds each month for your war chest. Don’t touch it even for a down payment on the house. You’ll thank yourself if you hit hard times.

Mentally prepare to sell assets

Recessions are a great time to reassess what’s important and to get off your high horse.

I ended up selling my dream vehicle, a 2000 Ford Excursion 4×4 diesel (the biggest SUV ever made). Diesel had hit $5 per gallon, so that didn’t help my situation.

I sold it for $14,000 and purchased a 1997 Subaru Outback for $2,000, funding my war chest with the $12,000 difference. I was able to continue making payments on the house – which was my top priority.

I really liked the Subaru, though, perhaps even more than the Excursion. It symbolized getting back to basics. It showed I could be nimble and not too proud to focus on what’s really important.

Get a zero-down mortgage

Zero-down mortgage loans are powerful tools if you’re buying ahead of a recession. Why? Because you don’t burn all your emergency funds on a down payment.

Getting a zero-down loan, and also buying the house with little or no money out-of-pocket, pushes risk onto the lender, not you.

It’s much better to have a 10-20% of the home price in your bank account, not sunk into the home.

A $400,000 home would likely use up about $50,000 in cash for a 10% down payment and closing costs. Now, imagine if you put just 3.5% down with an FHA loan, or zero down with a USDA loan. You would have up to $40,000 in the bank with which to make payments if you lost your income.

The media will tell you to put 10-20% down on a home because that’s “safer.” But it’s only safer for the bank.

Refinance during the recession

Recessions do have silver linings, such as falling mortgage rates.

According to Freddie Mac, the average 30-year mortgage rate dropped from 6.73% in July 2007 to 3.31% in November 2012.

Mortgage rates were sliced in half in five years.

I refinanced my 6.5% adjustable-rate mortgage into a 30-year fixed in the 4% range in 2009.

Rates are likely to drop again if we enter a recession. Assuming you can qualify, you could refinance later and drop your payment by hundreds per month.

A $350,000 mortgage at the current average of around 7% would cost over $2,300 per month. What happens if you can refinance later?

| Rate* | $350k Loan Payment* |

|---|---|

| 7% | $2,329 |

| 5% | $1,879 |

| 4% | $1,671 |

Rates shown for example purposes only. Payments do not include taxes, insurance, HOA.

Imagine saving over $650 per month going from 7% to 4% during a recession.

There’s no guarantee that rates will drop, or that you’ll qualify for a refinance at the time. But many people can and do refinance during a recession and make out quite nicely.

Speak to a lender to see how much you can afford.

Timing the market is futile

You hear stories about people who bought at the bottom of the last housing crash in 2011 and now their home is worth five times what they paid. They brag because they think they are geniuses.

They got lucky.

The reality is that trying to buy at the very bottom is futile. Very few people do it. Most people buy in the middle somewhere.

Not buying now because you think home prices will drop has a name – timing the market – and true investment geniuses can’t even do it.

If you’re ready to buy a house, you shouldn’t try to wait until prices decline. Home prices don’t always drop during recessions. I bought a house at the very top, yet still did very well over time.

Bottom line: Should you buy a house before a recession?

There’s no single correct answer for everyone. Anyone who says there is, is probably trying to sell you something.

There is always a chance that you could buy a home, lose your job during a recession, and lose the home. There is no way of knowing exactly which industries and professions a recession will hit hardest.

But, if you follow the suggestions above, you’ll be much better prepared for a loss of income post-homebuying.

Consider your income security and your overall financial health. Those who are financially sound and aren’t afraid to get creative can do well as a homeowner if the bottom drops out of the economy.