USDA loans offer a unique benefit: in some situations, you can roll your closing costs into your loan.

Add that to the program’s zero down payment requirement, below-market rates, and lenient credit score standards, and there’s hardly a better program out there.

After helping many people become homeowners using a USDA mortgage, here’s a trick I learned that could help you become a homeowner, too.

Check your USDA loan eligibility. Start here.

Key points

- Can closing costs be included in a USDA loan?

- But, the house might not appraise high enough

- Negotiate seller paid closing costs instead

- Who pays closing costs on a USDA loan?

- The funding fee can always be financed

- Other ways to pay for closing costs

- How much are USDA closing costs?

- Conquer USDA closing costs

Can closing costs be included in a USDA loan?

Yes. USDA allows you to finance closing costs by rolling them into your total loan amount.

No other major loan program permits this.

However, there’s only one way this can happen: the appraised value needs to be higher than the purchase price.

For example, if you have a signed purchase contract at $225,000 and the appraisal comes in at $230,000, you can get a loan amount for the full $230,000. You can use the extra $5,000 toward closing costs.

Start your USDA loan pre-approval.

But, the house might not appraise high enough

The toughest part about rolling closing costs into the loan is that you don’t have any control over how the appraiser values the property.

Often, appraisers will simply issue a value that matches the purchase price, even if the true value of the home is arguably higher. The appraiser has no incentive to juice the value.

One strategy is to find an undervalued home. Perhaps the seller needs to move right away, or they are about to enter into foreclosure. Maybe the house is just a little run down and has been sitting for a while.

In cases where you have the power, offer a lower-than-market price.

From there, all you can do is hope that the appraiser issues a value that’s higher than the purchase price.

Strict laws prohibit the buyer, seller, lender, or anyone involved in the transaction from trying to manipulate the appraiser’s final value.

But, on occasion, appraisers do determine that the value is higher than the purchase price.

Best practice, though, is not to count on it. Let it be icing on the cake. Here’s a better way to cover USDA loan closing costs.

See if you can buy a home with a zero-down USDA loan.

Negotiate seller paid closing costs instead

USDA loans allow the seller to pay for up to 6% of the home price in closing costs. Six percent!

That means the seller of a $200,000 home can kick in $12,000 in closing costs.

In reality, you probably won’t get that much. But you might get $5,000 or so.

Again, find a house that’s been sitting and doesn’t have any offers. Instead of negotiating a lower price, work with your real estate agent to go in at asking price and request closing cost help.

The seller is happy because they don’t have to lower the price. You get guaranteed closing cost help. You don’t have to merely hope that the appraisal comes in higher. It’s a win-win.

And if the home does appraise higher, you have the choice of financing any costs not covered by the seller, or keep your lower loan amount.

For other ways to cover closing costs, read about how I bought a $250,000 home with just $1,100 out of pocket.

Who pays closing costs on a USDA loan?

The homebuyer is responsible for most closing costs on a USDA loan. As discussed, you can finance these costs into the loan under certain circumstances.

The seller may pay some title depending on customary practices in your area. But you are responsible for the majority of loan closing costs.

The funding fee can always be financed

There is some confusion with USDA loans, because they require a “guarantee fee.” This is a 1% fee that goes to USDA to support the program.

The guarantee fee can always be financed into the loan amount. You do not need a higher appraised value.

With all USDA loans, you’ll end up with an approximate 101% loan because you’re financing this fee. So a $250,000 home is eligible for a $252,500 loan, even if it only appraises for $250,000.

So you never have to worry about not being able to finance this specific USDA fee.

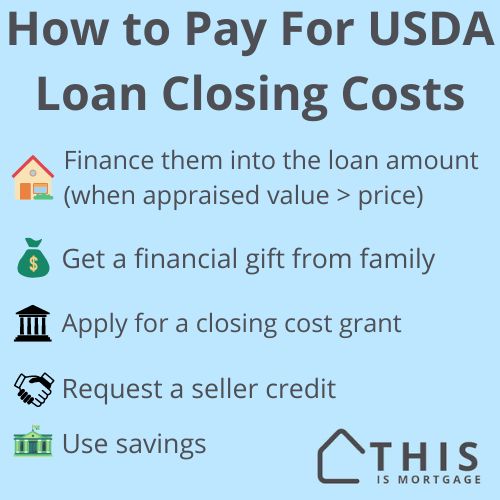

Other ways to pay for closing costs

There other ways to pay for closing costs if you don’t have the cash yourself.

A closing cost grant: Many states, counties, and cities promote homeownership by offering closing cost grants and loans.

Gift: USDA permits you to cover closing costs with a financial gift from a relative.

Savings: Start saving for closing costs now, if you plan to buy in the next 6-12 months. If you end up using other funds for closing costs, you’ll have a nice emergency cushion as you become a homeowner.

How much are USDA closing costs?

USDA closing costs are similar to those of other loan programs. The only unique cost is the 1% guarantee fee mentioned above. Here’s a list of potential fees you may encounter on a USDA loan. All in, you’re probably looking at around 2-4% of the loan amount in closing costs and prepaid items for a USDA loan.

USDA fees

Guarantee Fee – 1% of the loan amount

This fee goes to USDA itself to support the program

Annual Fee – 0.35% of the existing loan balance per year

You pay this monthly in 1/12 equal installments. On a $250,000 loan balance, you would pay $875 per year, broken up into monthly payments of $73 which you pay along with your mortgage payment each month

Lender fees

Loan origination or broker fee – 0-1% of the loan amount

This is not always charged, but the lender or broker may charge this fee to pay for their services and produce profit from the loan to stay in business.

Discount points – 0-2% of the loan amount

This cost goes directly toward lowering your mortgage rate. The more discount points you pay, the lower your rate can be.

Processing fee – $300-$700+

Costs of paying staff to process your loan file through the system, ordering third-party reports, and preparing your file for underwriting

Underwriting fee – $300-$750+

Costs of paying staff to review your financial profile and coming to an approval decision.

Get a personalized USDA closing cost estimate.

Third-party fees

Many reports and services are required to close a home loan. These fees go to pay these providers. Costs vary greatly depending on the size and type of home and company.

Appraisal – $400-$800+

As discussed above, an appraiser reviews the property to determine fair market value.

Title report/title insurance – $400-$1,500+

A company verifies there are no claims to ownership that aren’t already known, and also insures against future unforeseen claims of ownership to the home.

Escrow/Remote signing – $400-$750+

The escrow company ensures all monies involved in the transaction come in and go out to the appropriate parties. It also ensures all parties sign necessary documents to close the loan.

Recording fee – $100

The fee the county or municipality charges to record the home’s new ownership in public records.

Credit report – $100

The lender pulls credit through a third-party service to determine your creditworthiness for the loan. Typically the lender has to eat this cost and can’t pass it on to the borrower.

Flood certification – $40

A search for whether the home is in a flood zone.

Attorney fees – $500+

Some states require the use of attorneys to facilitate loan document signing and sales contract negotiation.

Get a personalized USDA closing cost quote.

Prepaid items

These are costs associated with owning the home, whether or not you get a mortgage. However, since you’re getting a mortgage, lenders require you to pay them in advance, since not paying them puts the loan at risk.

You can cover prepaid items with seller contributions. You can also finance them into the loan amount if the appraised value is higher than the purchase price.

Property taxes – 6-9 months

This fee can vary greatly depending on taxes for the particular property. For instance, a home with a $2,400 yearly tax bill would require just $1,200-$1,800 collected at loan closing. But a property with $5,000 in annual taxes would require $2,500-$3,700 upfront. This is likely your biggest prepaid item and perhaps your biggest closing cost, too.

Homeowners insurance – 12-15 months

Lenders require you to pay at least one full year of your homeowners insurance in advance. This ensures that the house can be rebuilt if destroyed. In addition, a few additional months are collected. So a property that costs $60 per month to insure will require about $900 upfront.

Flood insurance – 12 months

The majority of properties do not require flood insurance. However, you will be required to purchase it if your flood certification indicates that the property is in a flood zone. The lender will collect at least one year’s worth of premiums at closing.

You can roll closing costs into a USDA loan when the appraised value comes in higher than the purchase price. Because you never know when the value will come in higher, it’s better to ask for a closing cost credit from the seller.

USDA closing costs are somewhere between 2-4% of the loan amount depending on the home price and local customary fees.

No. USDA is the only major loan type that allows you to finance closing costs. Conventional, FHA, and VA loans do not offer this benefit.

USDA does not cover your closing costs when you buy a home. You must pay these out-of-pocket, get a seller credit to cover them, or finance them into the loan under some circumstances.

Conquer USDA closing costs

Because USDA loans do not require a down payment, paying for closing costs is the only major upfront cost. And if you use one of the strategies above, you’ve conquered that barrier.

Move ahead with your goal to be a homeowner. Become an email subscriber to This Is Mortgage for even more insights and homebuying wizardry.