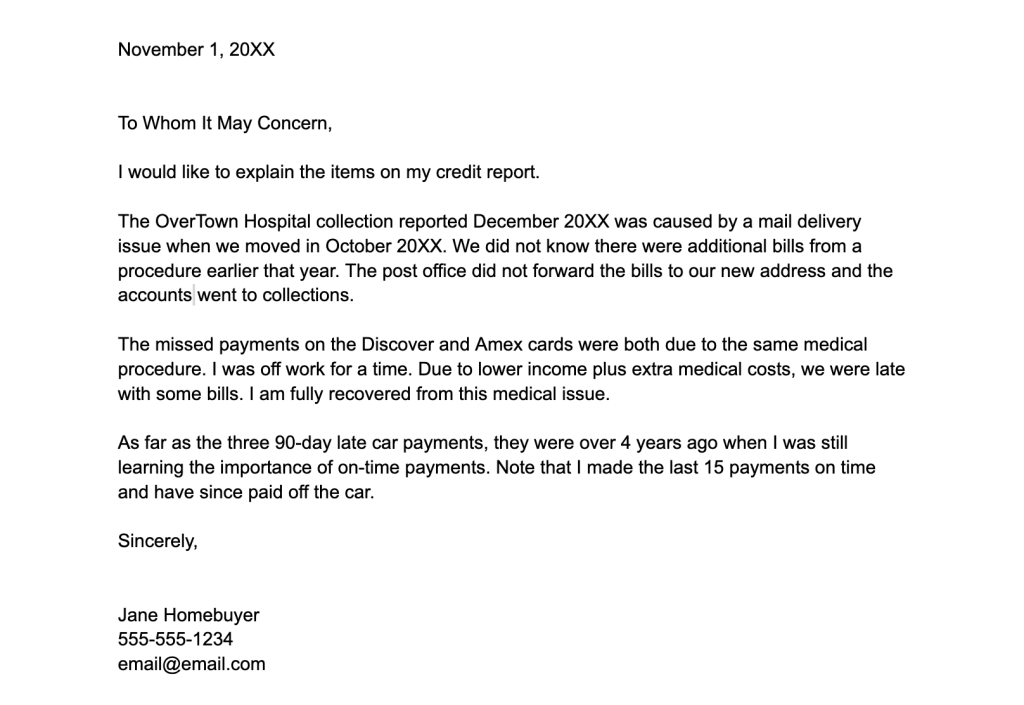

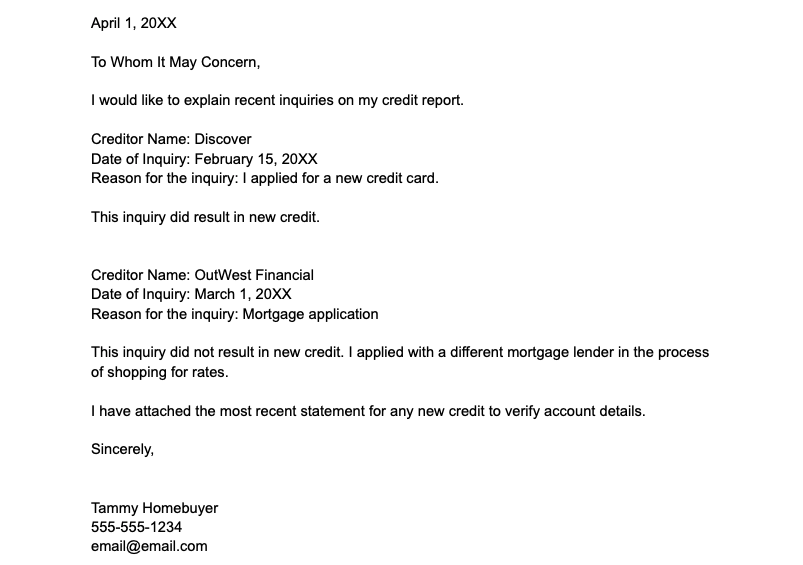

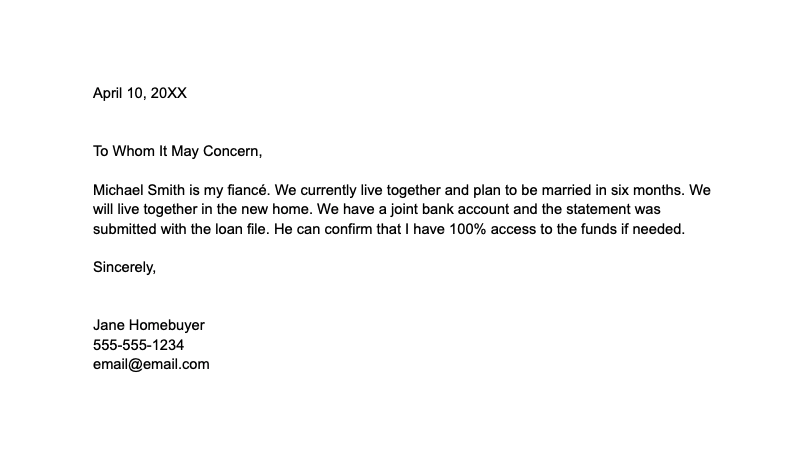

Sample Letter of Explanation For Derogatory Credit For A Mortgage

When your mortgage lender asks for a letter of explanation for derogatory credit, they want to prove that your credit troubles are behind you and are not likely to happen again. Knowing that, here are templates to write the perfect LOE for past derogatory items on your credit report. See if you can be approved […]

Sample Letter of Explanation For Derogatory Credit For A Mortgage Read More »