FHA jumbo loans are available well over $1 million. And the require just 3.5% down.

According to HUD data, about 4,000 FHA loans over $500,000 are originated each month. Nearly 100 of these per month are over $1 million.

So how do you get an FHA jumbo loan, and what is the loan limit?

FHA jumbo loan method 1: Expanded loan limits in high-cost areas

The standard FHA loan limit for 2024 is $498,257. You can get an FHA loan of this size anywhere in the U.S. assuming you qualify.

But HUD allows expanded FHA limits up to $1,149,825 in high-cost areas. The limit varies based on local home prices. Most major metros enjoy higher limits.

Here are examples of local expanded limits in 2024:

- Phoenix: $530,150

- Miami: $621,000

- Atlanta: $649,750

- Denver: $816,500

- Seattle: $977,500

- San Fransisco: $1,149,825

Loan limits vary by city and county. Check with a lender for your local limit.

Check your eligibility for an FHA jumbo loan.

FHA jumbo loan method 2: Buy a multifamily property

If you’re not in a high-cost area, you can still get a jumbo FHA loan for 2-4 unit properties.

For example, FHA allows loan amounts up to $637,950 for duplexes and even higher limits in high-cost areas. In fact, FHA loans over $2 million are available for 4-unit properties.

| Units | Standard areas | High-cost area max |

| 1-unit | $498,257 | $1,149,825 |

| 2-unit | $637,950 | $1,472,250 |

| 3-unit | $771,125 | $1,779,525 |

| 4-unit | $958,350 | $2,211,600 |

Some example multifamily loan limits are:

- Atlanta 2-unit: $831,800

- Seattle 2-unit: $1,251,400

- Wenatchee, Washington 3-unit: $783,000

- Santa Fe, New Mexico 3-unit: $838,150

- Salt Lake City, Utah 4-unit: $1,192,050

- Washington, D.C 4-unit: $2,211,600

Keep in mind that 3-4 unit properties must pass FHA’s tough self-sufficiency test. In most cases, you’re better off looking for duplexes if you’re interested in multifamily.

Related: Buying a Multifamily Home with FHA

FHA loans in ultra-high-cost areas

Surprisingly, you can get an FHA loan for more than $3 million in Alaska, Hawaii, Guam, and the U.S. Virgin Islands.

These are the ultimate FHA jumbo loans for those who can qualify.

| Units | AK, HI, Guam, USVI |

| 1-unit | $1,724,725 |

| 2-unit | $2,208,375 |

| 3-unit | $2,669,275 |

| 4-unit | $3,317,400 |

Loan limits are for the loan, not the purchase price

FHA loans do not limit the home price. In other words, you could buy a $2 million duplex in an area with a $1.4 million FHA loan limit by putting $600,000 down.

However, if you are making a large down payment, you may want a conventional loan. Standard loan limits are higher and you avoid upfront and monthly mortgage insurance with 20% down.

Standard conventional loan limits are:

- 1 unit: $766,550

- 2 unit: $981,500

- 3 unit: $1,186,350

- 4 unit: $1,474,400

Like FHA, higher conventional loan limits are available in many areas of the U.S.

See if FHA is the right program for you.

How to qualify for an FHA jumbo loan

Large FHA loans are approved by the same rules as standard FHA loan amounts.

- 3.5% down

- Debt-to-income ratio under 56.9%

- 580 FICO or 500 with 10% down

- Upfront and monthly mortgage insurance required

- Primary residence only

Learn more about FHA loan guidelines here.

Of all the rules, debt-to-income ratio, or DTI, might be the hardest to meet.

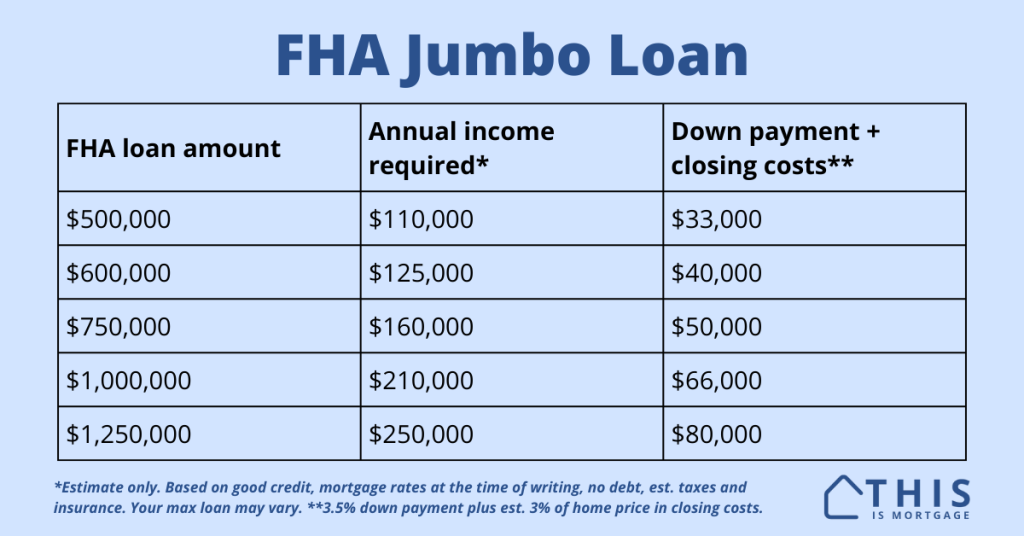

How much can you qualify for?

To qualify for a large FHA loan, you have to make enough money to meet DTI requirements. Luckily, FHA does not have income limits.

You also must have personal funds for the down payment and closing costs in most cases since down payment assistance can’t be used for higher home prices.

| FHA loan amount | Annual income required* | Down payment + closing costs** |

| $500,000 | $110,000 | $33,000 |

| $600,000 | $125,000 | $40,000 |

| $750,000 | $160,000 | $50,000 |

| $1,000,000 | $210,000 | $66,000 |

| $1,250,000 | $250,000 | $80,000 |

*Estimate only. Based on good credit, mortgage rates at the time of writing, no debt, est. taxes and insurance. Your max loan may vary. **3.5% Down payment plus an estimated 3% of the home price in closing costs.

As you can see, you have to be a high earner and have substantial liquid assets to qualify for large FHA loans. These types of buyers most often choose conventional. So why do large FHA loans exist?

Start here to see how much you qualify for.

Why use an FHA loan instead of conventional for large loans?

High income does not always mean high credit.

Plenty of homebuyers make a lot of money but don’t have great credit. Perhaps they are focused on their careers or businesses instead of paying a credit card bill on time. This is a common situation.

FHA loans allow high-net-worth and high-income borrowers purchase homes with very little down even with lower credit scores.

Additionally, FHA lets you stretch your qualification further. While FHA maxes out at about 56.9% DTI, conventional would likely go up to 45% or 50% at these loan amounts, even with great credit.

Borrowers with lower credit scores and want to buy as much home as possible might choose FHA.

Mortgage insurance for FHA jumbo

One drawback to FHA jumbo loans is that they come with higher monthly mortgage insurance for loan amounts over $726,200.

You’ll pay $46 per month per $100,000 in loan amount (0.55% per year) for loans under $726,200.

You’ll pay $62.50 per month per $100,000 in loan amount (0.75% per year) for loans over $726,200. Both figures assume a 3.5% down payment.

To put it in real dollars, here’s what you would pay in monthly mortgage insurance for various FHA loan amounts.

| FHA loan amount | Monthly mortgage insurance |

| $500,000 | $225 |

| $600,000 | $270 |

| $750,000 | $460 |

| $1,000,000 | $614 |

| $1,250,000 | $767 |

The mortgage insurance fees are high for higher loan amounts, but still worth it considering you can buy a $1 million home or more for 3.5% down with a 580 credit score.

Should you get a large FHA loan?

Expanded FHA loan limits help buyers purchase high-value homes even with lower credit. Most people assume conventional loans are the only option for large loan amounts.

Check your eligibility for a large FHA loan to see how much house you can afford.