Fannie Mae announced a 5% down conventional loan with no self-sufficiency test in late 2023. Interested buyers should apply now. Read more here.

Buying a multi-unit house with an FHA loan is a fantastic idea.

With one motion, you become a homeowner and a real estate investor.

What’s more, your bottom-line monthly payment might be less than if you purchase a single-family home, thanks to rental income.

But before making an offer on a 3- or 4-unit home, make sure it passes the FHA self-sufficiency test.

Speak to a lender to see if you can buy a 3-4 unit home.

In this article:

- FHA self-sufficiency test worksheet/calculator

- What is the FHA self-sufficiency test?

- Calculating FHA self-sufficiency rental income

- Calculating FHA self-sufficiency house payment

- The self-sufficiency formula

- FHA self-sufficiency test example

- What if the home doesn’t pass the test?

- Self-sufficiency test is now harder to pass

- How to get rent estimates

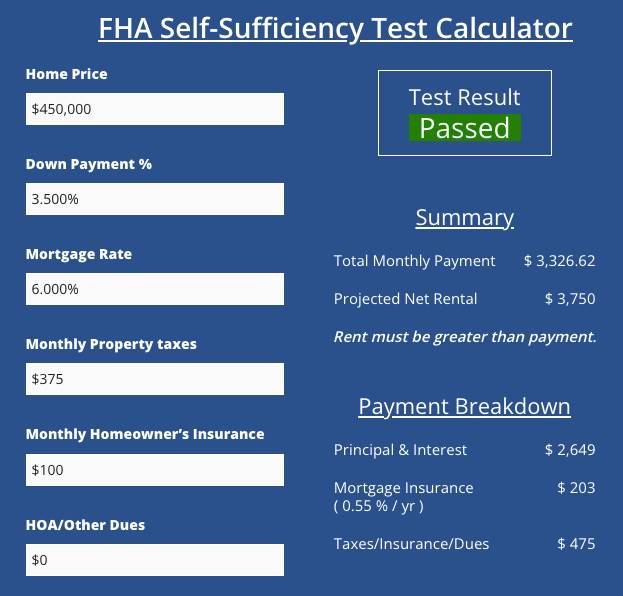

FHA Self-Sufficiency Test Calculator

This calculator is better than an FHA self-sufficiency test worksheet because it calculates all FHA fees and payments to give you a pass/fail result.

FHA Self-Sufficiency Test Calculator

Test Result

Summary

Total Monthly Payment

$

Projected Net Rental

$

Rent must be greater than payment.

Payment Breakdown

Principal & Interest

$

Mortgage Insurance

( % / yr )

$

Taxes/Insurance/Dues

$

Loan Details

Base Loan Amount

$

Upfront Mortgage Insurance

$

Final Loan Amount

$

Down Payment

$

Loan term

30 years

Rent Details

Gross rent

$

Vacancy Factor Used

(Greater of Appraiser’s factor

or 25%)

%

*If Failed, try reducing the rate or loan amount until the net rental is higher than the payment.

This test is for 3-4 unit FHA eligibility. You still must meet other qualifications; Payments, interest rates, and other details are for example purposes only and do not constitute a quote or commitment to lend.

What is the FHA self-sufficiency test?

The FHA self-sufficiency test is a newer guideline that determines whether a property’s rental income can cover its full payment.

A triplex or four-plex is not eligible for FHA financing unless its rental income potential exceeds the payment. The rule does not apply to duplexes.

For example, you can use an FHA loan on a 4-unit home with $4,000 in eligible rental income (after the vacancy factor is applied) only if the payment is less than or equal to $4,000.

That being said, there are some “gotchas” and the formula isn’t as simple as stated above, so let’s dive into details.

Connect with a loan professional to check your eligibility for a 3-4 unit FHA loan.

Calculating FHA self-sufficiency rental income

To FHA, the full rental income potential on a property isn’t the eligible rental income for the self-sufficiency test.

Related: FHA Duplex vs Single Family Calculator

You must use an FHA-approved appraiser’s rent estimate minus a vacancy factor.

The vacancy factor is the greater of:

- The appraiser’s vacancy factor on the appraisal

- 25%

If the appraiser says the area’s typical vacancy is 20%, use the standard 25% factor since that is higher.

Calculating the PITI payment

Once you have the eligible rental income, it must be equal to or greater than the full PITIA payment.

FHA regards the full payment as:

- Principal: Loan principal due each month

- Interest: Interest due each month

- FHA mortgage insurance: Typically 0.55% of the loan balance divided by 12

- Property taxes

- Homeowner’s insurance

- HOA dues

Related: FHA MIP Reduction To Make It Easier To Pass Self-Sufficiency Test

Self-sufficiency test formula

Rent from all units X 75%

Must be greater or equal to:

The Full Housing Payment Including Principal, Interest, Mortgage Insurance, Taxes, Homeowners Insurance and HOA Dues

FHA self-sufficiency test example

Following is an example. Imagine you’re buying a 4-unit home with FHA and you want to see if the home passes the test.

| Total units including owner-occupied unit | 4 |

| Market rent estimate for all units | $4,000 |

| Appraiser’s vacancy factor | 20% |

| Standard vacancy factor | 25% |

| Self-sufficiency rent ($4,000 minus 25%) | $3,000 |

| Principal, interest, mortgage insurance, taxes, homeowner’s insurance, and HOA dues | $2,900 |

Result: $3,000 ≥ $2,900 so the home is eligible for FHA financing.

What if the home doesn’t pass the test?

If the home doesn’t pass, you still have options.

Make a bigger down payment: This could lower the payment to the point where it does pass.

Lower your rate: This could also reduce the payment enough to reach eligibility

Conventional loan: Fannie Mae introduced a 5% down multifamily loan in November 2023. The former down payment level was 15%-25%. The loan does not require a self-sufficiency test. Learn more.

VA loan: If you have military experience, try a VA loan. You can buy a home up to 4 units with zero down payment.

Check your FHA multi-unit eligibility with a lender now.

Do the test before making an offer

Before you make an offer on 3- or 4-unit home, consult your lender. The loan officer can run the test with decent accuracy before you commit to a home.

Avoid the situation where you lose your earnest money because the property can’t pass the test.

Self-sufficiency test is now harder to pass

Rates have risen dramatically since mid-2022, making it more difficult to pass the test.

For example, a full payment might be $2,000 at a 3% interest rate, but $3,500 at a 7.5% interest rate.

If market rents are $3,000, the property would pass at the lower rate, but not at 7.5%.

This is why it’s more important than ever to make sure a property “pencils out” according to FHA guidelines.

Why does FHA require the self-sufficiency test?

It’s hard to speak for HUD, but it’s likely the agency saw a pattern of inexperienced landlords buying triplexes and quadplexes at any price, then getting behind on payments.

So HUD put a fairly conservative guideline in place to safeguard itself and the buyer. With the rule in place, a buyer could lose a renter for a time and still potentially make the payment.

And, the idea of buying a duplex, triplex, or four-plex with an FHA loan has become so popular in recent years that perhaps HUD wanted to make sure buyers weren’t “house hacking” too aggressively.

Whatever the reason, it appears the rule is here to stay. In a way, it’s a good thing. The test can tell you whether the home is likely to cash flow or drain you each month.

How to get acceptable rent estimates

Part of the self-sufficiency test requires a market rent estimate from an FHA-approved appraiser.

This is not something you order.

The lender will request an additional report from the appraiser along with the standard appraisal report. Keep in mind that the rent estimate will require an additional fee.

This begs the question, what if you estimate a certain market rent, then the appraiser low-balls the rent estimates?

It’s possible. Do your own research. Your lender may have resources that can estimate market rent fairly accurately, such as a Realtor, automated software, or by looking at comparable rental properties in the area.

If your estimate is cutting it close, you might consider not making an offer. Just a slight reduction in rent or a high vacancy factor from the appraiser, and the property may fail the self-sufficiency test.

Speak to a lender to see if you can buy a 3-4 unit home.

Will a multifamily fixer-upper pass the test?

FHA allows you to fix up a 2-4 unit residence with its multifamily 203k renovation program. However, it’s best used on a duplex. For 3-4 units, you must use the existing lower rents for the self-sufficiency test, not the higher future rents after the renovation.

There are few if any properties that will be self-sufficient at the lower current rent level.

The FHA triplex and quadplex test: the new reality

Buying a multifamily property is still a great idea and can launch your real estate investing goals. But now, it’s a bit harder with FHA.

If you find the right property, though, your plan can still work.

Request a call from a lender to see if you can buy a 3-4 unit home with FHA.

Self Sufficiency Test Calculator Image: