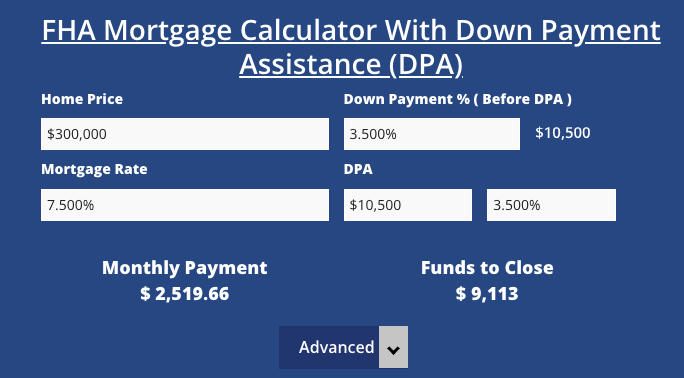

This FHA loan calculator estimates your funds needed to close after applying any down payment assistance and seller concessions. Get an idea of how much you’ll need in savings or other sources to buy a home in 2024.

FHA Mortgage Calculator With Down Payment Assistance (DPA)

Advanced

Payments, interest rates, closing costs, and other details are for example purposes only and do not constitute a quote or commitment to lend. *Seller-paid closing costs and other interested party contribution may not exceed actual closing cost amount.

FHA loan primer

FHA loans are a favorite of first-time buyers. In fact, over 80% of all FHA purchase loans are used to help people buy their first home.

Why? Its sole purpose is to support homeownership, so it’s more accepting of imperfect scenarios.

You can have a credit score down to 580. And those with lower income may qualify, too. In some cases, you can use up to 46.9% of your gross monthly income toward your housing payment.

Plus, personal savings, checking, and investment accounts aren’t your only options for the 3.5% down payment. You can use down payment assistance (DPA) and/or gift funds to cover the entire down payment and closing cost total.

You can also use seller concessions, also known as seller-paid closing costs, to cover all your fees and costs associated with the loan. FHA allows sellers to contribute up to 6% of the home’s price toward closing costs.

See if you can buy a home with an FHA loan.

How to use this FHA loan calculator

Using this FHA calculator with down payment assistance is similar to using any FHA calculator, with some added features. Here’s how to find out your monthly payment and funds to close.

Home price: Enter a specific property’s home price or your general price range. If you don’t know your pre-approved amount, you can get the process started here.

Down payment: FHA loans require 3.5% down but you may put more down if you’d like.

Mortgage rate: Rates change daily so it’s okay to estimate.

DPA: The amount of down payment assistance you expect to receive. You can enter either a dollar amount or a percentage of the home price. If you don’t know how much DPA is available, complete a short contact form and we’ll help.

Monthly payment: Your estimated monthly payment based on your inputs.

Funds to close: The amount you’ll need to pay at closing to complete the purchase. This includes the down payment and closing costs, less any DPA and seller concessions.

Advanced: Hit “Advanced” to see more details.

Loan breakdown: You can see all parts of your housing payment including principal, interest, and mortgage insurance. You can edit property taxes, homeowner’s insurance, and HOA dues.

Closing funds breakdown: Here you can see your down payment, estimated closing costs, and the total funds you need to close without DPA.

Seller-paid closing costs: The amount the seller is willing to give you to help with closing costs. You may also hear the terms “seller concessions” and “seller contributions.” Entering an amount in this field will reduce your funds to close.

Funds to close: The final amount needed from a savings, checking, gift, or other source of funds after applying DPA and seller concessions.

About down payment assistance

Down payment assistance, or DPA, is a well-known term, but how it works is a mystery to most new buyers.

At the simplest level, down payment assistance programs pay all or part of the loan’s required down payment amount. This reduces the amount you need out-of-pocket, helping you buy a home without years of saving.

Down payment assistance can come from government sources, non-profits, and local housing agencies. Some DPA programs are offered by the lender itself, through an affiliation with another entity.

Because DPA programs are often localized, there’s no single rulebook for all of them. Finding them is a lot like finding a scholarship for college: you have to meet requirements, apply, and hope for the best. Some require you to be in a certain income bracket, others say you have to work in a certain profession.

That’s why this resource, ThisIsMortgage.com, focuses on education about widely-available DPA programs such as:

All three have very loose income limits, if any at all, and allow you to have a lower credit score. They are available nearly nationwide. To learn more quickly, check out my TikTok on Empowered DPA and my deep dive on how these programs work.

You can also get gift funds from family members to cover all your down payment and closing costs.

See if you’re eligible for a down payment assistance program.

About seller concessions

This is a shocker to most first-time buyers: The seller will often give you money to help you buy their home. And it’s legal.

Seller concessions, or seller-paid closing costs, are meant to attract buyers and make it easier to sell the home.

You can apply seller concessions toward your closing costs only. These funds may not be used to cover any part of your down payment.

And, there are limits to how much you can get. FHA loans allow up to 6% of the home price, but conventional loans allow just 3% when you put down less than 10%.

Other parties are allowed to contribute to closing costs as well: the lender, real estate agent, and builder are a few examples. Total contributions from all parties who have an interest in the transaction may not exceed limits for the loan type.

Under the “Advanced” section of the calculator, you can enter the amount of seller concessions plus contributions from other parties to the transaction like the lender or agent.

See if FHA and DPA can make you a homeowner in ’24

While down payment, closing costs, and DPA can be overwhelming and mysterious, this calculator will increase your understanding of these homebuying terms.

With this knowledge, there’s a good chance you can become a homeowner in 2024.

Submit your scenario to see if you can buy a home.

FHA loan calculator with DPA image