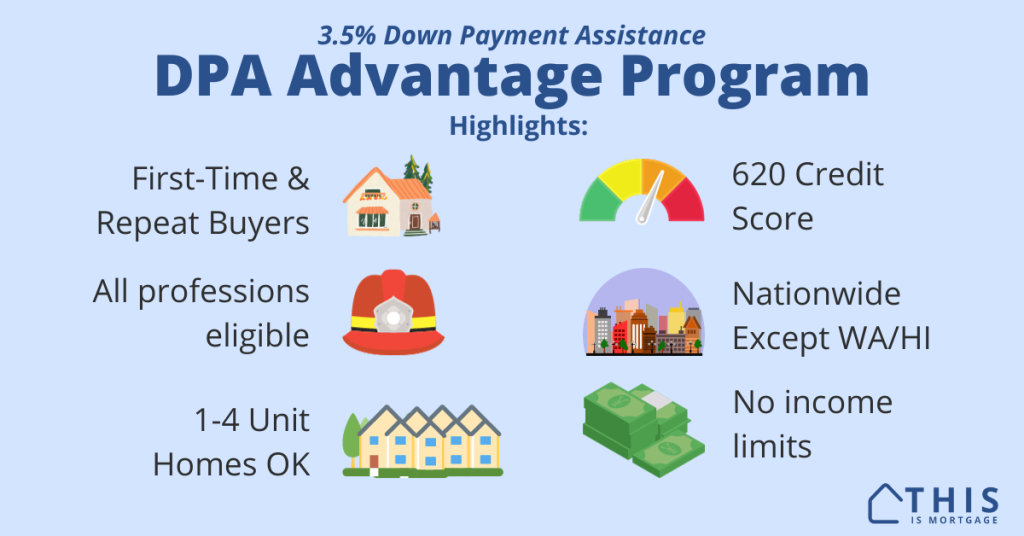

A down payment assistance (DPA) program has hit the market and it offers the widest eligibility criteria of just about any DPA program out there.

It’s called DPA Advantage and it gives a 3.5% down payment grant for eligible homebuyers. Saving up for a down payment is now optional.

Check your DPA Advantage Program eligibility.

What does the DPA Advantage Program do?

The DPA Advantage Program issues a down payment grant of either 2% or 3.5% of the purchase price. FHA loans only require 3.5% down, so this program can cover your entire down payment.

For instance, a $350,000 home would require a down payment of $12,250. The DPA Advantage lender sends $12,250 to the escrow company as the administrator of the DPA. The lender considers these funds as your down payment.

The assistance comes in the form of a grant that is forgiven immediately. There is no restriction on how long you have to keep the loan or home.

Nor does the assistance come in the form of a loan or lien placed on the house that eventually has to be repaid, as is common with many DPAs.

Who qualifies for the DPA Advantage loan?

In short, anyone who qualifies for an FHA loan, has a 620 credit score, and is not buying a property in Washington State or Hawaii is likely eligible for DPA Advantage.

This eligibility standard is probably the most lenient of any DPA in the country. Even the Empowered DPA, a similar program, requires you to meet certain criteria (although it is a very lenient program as well.)

DPA Advantage simply removes traditional down payment assistance requirements.

While the program lists ways you might be eligible — be a first-responder, first-time buyer, educator, medical personnel, and more — it follows up by saying that anyone who qualifies for FHA is eligible, provided they meet program lending criteria. So even if you aren’t in one of those eligible groups, you are likely still eligible if you qualify for an FHA loan.

Get started on the DPA Advantage Program.

Requirements for the program

First and foremost, this is down payment assistance and a loan program wrapped into one. You can’t get the assistance without using the mortgage program. You must use a DPA Advantage lender to access both (more below). Here are additional guidelines.

Credit: 620 credit score minimum. If your score is lower, the lender may be able to advise you on how to raise your score.

Loan purpose: Purchase of a primary residence only.

Debt-to-income ratio: Can be as high as can be approved by FHA. The program does not set its own maximum DTI. In some cases, you can be approved with a DTI of up to 56.9% with an otherwise strong loan scenario.

Loan Limits: The loan must be at or below standard FHA loan limits, currently $472,030 in 2023.

Property type: Single-family home, duplex, 3-4 unit, manufactured homes, FHA-approved condos, PUDs.

Homeownership education: Borrowers must take HUD-approved homeownership course which may require a small fee.

FHA loan: Can be used in combination with the standard FHA program, FHA 203k rehab loan, or FHA Repair Escrow. The program can even be used with the FHA 2-4 unit multifamily program where you live in one unit and rent out remaining units.

Seller concessions allowed: The seller is allowed to pay up to 6% of the home’s price toward closing costs.

DPA Advantage lenders and how to get access

DPA Advantage is offered by mortgage brokers who are approved to originate loans for AFR, a wholesale lender. AFR does not lend to the public directly but issues all loans through loan brokers.

To get access to DPA Advantage, apply with a mortgage broker that is approved with AFR. The good news is that you can connect with an AFR-approved broker here and start your application in minutes.

Connect with a DPA Advantage Program mortgage broker.

Is there a catch?

You might be wondering at this point whether there’s a catch. What’s the fine print?

The “catch,” so to speak, is that the program comes with higher rates and fees than a standard FHA loan.

For example purposes only, if a standard FHA loan rate were 7.25% with one point, DPA Advantage might be 7.75% with three or more points charged.

You can opt for a 2% grant instead of 3.5% to get a lower rate and fee structure.

Most buyers get a large seller concession, preferably 6% of the sales price, to help pay for these extra costs.

The program will work best, then, where the seller accepts an FHA loan offer and agrees to a seller closing cost credit of up to 6% of the purchase price.

DPA Advantage loan FAQ

You may need additional cash to close due to closing costs. This is true even with a seller closing cost credit. DPA Advantage fees can be high, so the seller credit may not cover the closing cost total.

The program lists educators, first-responders, medical personnel, civil servants, military, first-time buyers, those who make less than 140% of their area median income, and homebuyers in underserved census tracts. However, rules state that if none of these apply, the borrower must only be able to qualify for an FHA loan to be eligible.

There is no time requirement. You could literally sell or refinance the day after closing without having to pay back the DPA funds.

No. It’s an entirely forgivable grant with no strings attached. It’s completely and 100% forgiven the day of closing. You sign an agreement at closing that the funds are not repayable.

You must get the loan from a DPA Advantage lender. If your current lender has access to the program, it may be able to change your loan approval. You can’t apply this program to a non-DPA Advantage loan.

You can choose either 2% or 3.5% down payment assistance. The 2% program comes with better rates and lower fees, but the 3.5% program can cover your entire FHA down payment.

No, you must use an FHA loan to access the program.

If you have some savings, it might be better to access lower rates by choosing a standard FHA loan instead of DPA Advantage. This program comes with higher rates and fees than does the typical FHA loan.

The program comes with rates that are 0.50-1.0% higher than the standard FHA program and about 2-3 additional mortgage points. Each “point” equals 1% of the loan amount payable to the lender. This is why it’s important to get a seller concession of the full 6% of the purchase price if possible when using this program. If no seller concession is available, it might be better to use a standard FHA loan to eliminate the extra mortgage points.

How do I apply for DPA Advantage?

Applying for DPA Advantage is just like applying for any mortgage loan. Contact the lender, who will ask a few questions via phone, or you can complete your application online.

If you need help finding a DPA Advantage lender, we can connect you with one here.

Get started on your DPA Advantage Program eligibility check now.