Donald Trump beat Nikki Haley in the South Carolina Republican primary. Haley is his last serious Republican rival – and it was her home state.

This all but guarantees the GOP nomination will go to Trump, landing him on the ballot with Joe Biden in November.

One topic – among many – that mortgage shoppers wonder is how each President might affect mortgage rates.

Looking at how markets could react to each candidate’s victory, we can make some educated guesses on what might happen.

Will mortgage rates fall under Biden or Trump?

Check today’s mortgage rates with a lender.

Short answer:

A Biden victory would likely not affect mortgage rates much. Markets would assume the status quo and continue to analyze economic data like inflation and Fed policy.

A Trump win could mean higher mortgage rates. Markets may predict an inflationary economic environment. But for reasons discussed below, rates have a chance to fall, too.

Biden vs Trump: How their policies might affect rates

Each candidate has a drastically different agenda. Their proposed policies will have a different effect on mortgage rate markets.

Joe Biden: not much change in mortgage rates

Joe Biden plans to continue his 2020 agenda, says the Associated Press. In fact, his campaign slogan is “Finish the Job.”

Status Quo Joe wouldn’t bring many surprises to markets.

Biden’s policies were never market movers, even when they were new in 2020. His agenda has a predominantly social bent: covering the cost of pre-school, tax incentives to fight climate change, and reducing healthcare costs.

Mortgage rate markets fear big, inflationary spending plans that could flood the economy with employment opportunities in an already tight labor market. And, mortgage rates don’t like government borrowing, either.

While Biden’s initiatives have large price tags, markets are realistic: they know that Congress would water down the most ambitious goals if not completely gridlock them.

Even if passed, more taxes on corporations and the wealthy would fund them, not government borrowing, at least according to the Build Back Better Framework published by the White House.

In short, you may not notice any change to mortgage rates if Biden wins a second term except what would have happened anyway.

Get a mortgage rates quote from a lender.

Donald Trump: inflationary policies could drive rates higher

Compared to “Status Quo Joe,” Donald Trump is real wild card.

Mortgage rates would have a lot more potential to move in November 2024.

Markets would need to decipher between campaign-trail rhetoric and possible future policy, leading to a turbulent ride for rates.

For example, Trump has touted a 10% tax on all non-U.S. goods and penalties on companies that outsource labor, says NBC news. This would be an inflationary move, as it would drive up costs for just about everything. Inflation pushes up mortgage rates.

In 2018, he imposed a 25% tariff on steel and 10% on aluminum. And, he’s not afraid to use executive orders to move things along. During his presidency, he used 220 executive orders to Biden’s 132 to date, although many of Trump’s were related to COVID-19.

Markets could also consider Trump the more pro-growth option, as he might keep corporate tax rates low and remove environmental hurdles for companies. Markets could assume a stronger GDP, higher employment and wages, and skyrocketing inflation, all of which are murder on mortgage rates.

Contact a lender to see how much mortgage you qualify for.

On the other hand, Trump could cause market disruption and lower rates

The above may be too simplistic a guess. There’s a chance mortgage rates could go down with a Trump victory.

Markets may fear Trump is a messenger of uncertainty. The S&P 500 is up 34% since Biden took office. The markets like status quo at the moment.

But remember that good economic markets are bad for mortgage rates. Growth could become uncertain with a Trump win, sending rates downward.

Remember, it’s not reality but the prediction of it that drives mortgage rates.

And let’s not forget that Trump was first a real estate investor. He knows all about interest rates and their effect on consumers and investors. Trump could even use his new-found political power to push for lower rates.

In 2019, Trump went so far as to call out Fed Chief Jerome Powell and the rest of the members for not cutting rates. On X, then Twitter, Trump said, “The Federal Reserve should get our interest rates down to ZERO, or less…A once in a lifetime opportunity that we are missing because of ‘Boneheads.’”

The president doesn’t control the Fed, but political pressure to cut rates would almost certainly be greater under Trump.

How did rates change on election day for each candidate the last time?

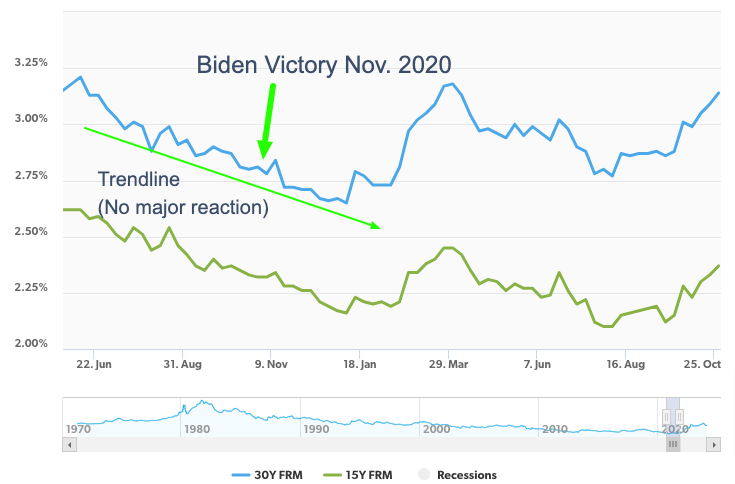

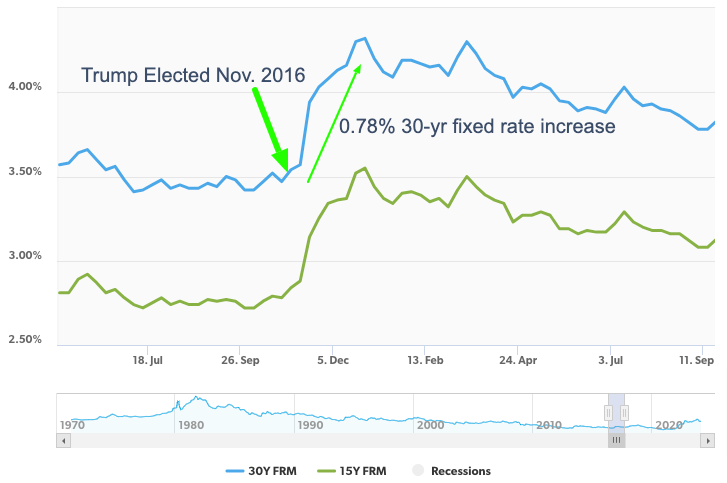

As you might expect, rates barely moved when a Biden victory was declared in November 2020, but swung wildly when Trump won in 2016.

The Biden win over Trump in 2020 caused a one-week jump, but then rates continued their downward trajectory until February 2021.

Four years earlier, no one expected Trump to win. He was running against Hillary Clinton, who would have likely continued Obama’s policies. She was the “Status Quo Joe” of 2016.

But when Trump won, markets spiraled into turmoil. Overnight, stock market futures plummeted 900 points as investors digested the news. Shortly thereafter, though, markets turned around and applauded Trump as the pro-growth candidate.

One of the fastest-ever mortgage rate run-ups ensued. The 30-year fixed went from 3.54% on November 3, 2016 to 4.32% on December 29. This increased the monthly payment on a $300,000 mortgage by $130 within a few weeks.

It’s hard to say which way mortgage rates will go when election results are final in November, but it’s safe to say that there will be more volatility with a Trump victory.

Request a call from a lender for your rate quote.

How did mortgage rates perform under each President?

Each President oversees a specific segment of history – and no two segments are the same. It’s not all that useful to predict rates by each President’s previous tenure.

But why not look at the data?

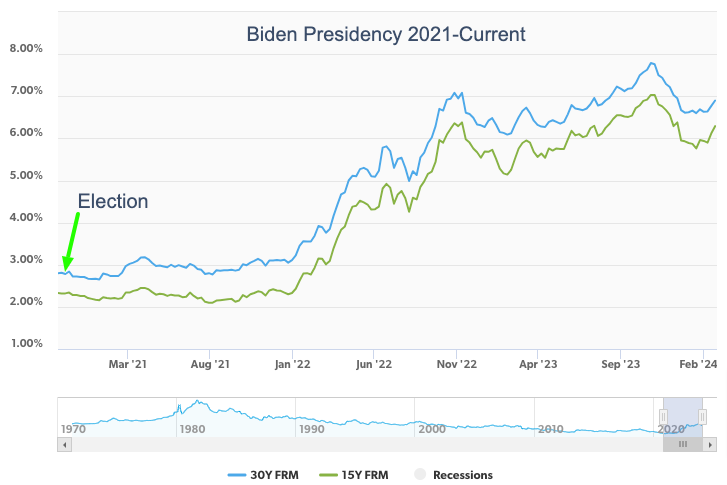

Mortgage rates under Biden 2021-2024

While mortgage rates rose during the Biden Administration, it was not due to policy. Rather, it was the effect of record stimulus during COVID that ramped up inflation and therefore mortgage rates.

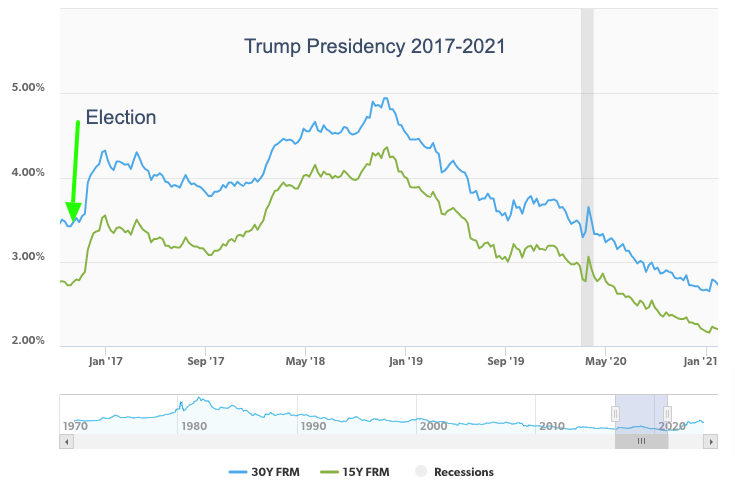

Mortgage rates under Trump 2017-2021

Mortgage rates rose for the first two years of Trump’s tenure, then started falling in 2019, even before COVID hit in March 2020, when they plummeted even further.

The only potential takeaway is that Trump was viewed and even implemented policy (i.e. tariffs) that increased inflation and therefore mortgage rates. There’s a possible higher-rate replay brewing if Trump is elected.

Should mortgage rate shoppers wait until after the election?

It could be unwise to postpone your plans to buy or refinance property until the election.

Not only is the winner impossible to predict, but market reaction is, too.

If you’re ready to buy or refinance, go ahead with your plans. The mortgage rate environment could be worse after November 5. But if it’s better, you always have the opportunity to refinance into lower rates.

Start your home purchase or refinance by checking today’s rates with a lender.