Getting a jumbo cash-out refinance is a lot like getting a normal refinance, with two exceptions.

First, you’re above standard Fannie Mae and Freddie Mac conforming limits, which are between $766,550 and $1.15 million in 2024, depending on your area.

Second, you’re getting a bigger loan than what you owe, yielding cash to you at closing.

These loans are very available in today’s market. Let’s look at how you qualify.

Check your eligibility for a jumbo cash-out refinance.

See if you’re in a “Conforming High Balance” area

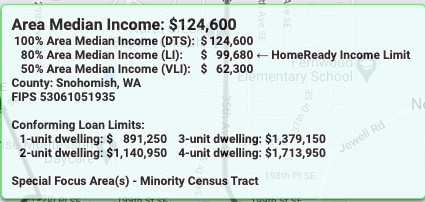

First, check whether your area is eligible for a Conforming High Balance loan.

Conforming High Balance sounds like an oxymoron – is it conforming or jumbo? Well, it’s both.

Fannie Mae and Freddie Mac offer increased loan limits in more expensive areas of the country. These agencies also allow cash out on a Conforming High Balance loan.

Here are a few examples of areas with higher-than-standard limits.

| City | 1-unit home loan limit |

| Boulder, Colorado | $856,750 |

| Nashville, Tennessee | $943,000 |

| Seattle, Washington | $977,500 |

| Washington, DC | $1,149,825 |

Conforming high-balance loans are as high as $1,149,825 in the most expensive areas in 2024. The easiest way to check limits for a specific address is to go to Fannie Mae’s interactive map. Look at “Conforming Loan Limits”. If you are looking to finance a single-family home, look at “1-unit dwelling.”

If your expected loan amount is at or below your area’s limit, here are general guidelines:

- Minimum credit score: 620

- Loan-to-value: 80% for 1-unit homes, 75% for 2-4 unit (owner-occupied). 75% for second homes (1-unit only). Investment properties: 75% for 1-unit and 70% for 2-4 units.

- Maximum debt-to-income ratio: 43-45%

- Maximum cash-out: No max

True jumbo loans

You are in true jumbo territory if your desired loan amount is above Conforming High Balance limits, or there’s something about your scenario that doesn’t match Fannie Mae guidelines.

That’s okay too. There are plenty of lenders that create jumbo loan programs for various situations.

Each lender will set its own rules for these programs. Whereas one might offer a 90% LTV jumbo cash-out refinance, another might limit the LTV to only 70%.

Here are some places to check:

- Credit unions

- Local banks

- National lenders

- Independent mortgage companies

- Mortgage brokers

If you need help, you can get connected with a jumbo lender here.

Max LTV

As mentioned, each lender will create its own guidelines around these loans. That’s why it’s important to shop around for a loan that will work for you.

The maximum LTV on a cash-out jumbo loan is likely to be in the 70-80% range, although a few lenders might allow 85-90% for top-tier borrowers.

Expect to need a very high credit score, reserves in the bank after closing (not including cash-out funds), a highly desirable property, and other positive loan attributes.

Jumbo cash-out guidelines 2024

Below are general guidelines you can expect. There are no hard-and-fast rules, though, because each lender might be more lenient or strict on any one of these factors.

| Loan attribute | Guideline |

|---|---|

| Credit score | 660+ |

| LTV | 70-80% |

| Property type | Single-family, warrantable condos, townhomes |

| Loan amount | $650,000 – $3 million+ |

| Liquid assets | 6-12 months of proposed principal, interest, tax, insurance and HOA dues (not including cash-out funds) |

| Debt-to-income | 40-45%; some lenders may allow 50% |

Jumbo cash-out mortgage rates

Some banks and credit unions offer lower rates for jumbo loans than for conventional.

How can this be?

First, many banks want to attract high-net-worth individuals – the same demographic that is looking for jumbo loans. So they will take a loss on the mortgage rate to attract the client to other financial services.

Second, jumbo loans aren’t subject to Fannie Mae and Freddie Mac “loan-level price adjustments” or LLPAs. LLPAs are a laundry list of fees that drive up conventional loan rates. For instance, a Conforming High Balance, cash-out loan with a 720 score will require 3.625 in mortgage points (3.625% of the loan amount). This would drive up the rate by 1-2%.

Jumbo loans, however, are not subject to these fees.

This is why it’s a good idea to compare Conforming High Balance rates with a bank’s jumbo rates. You might find that the non-conventional loan is cheaper.

Check today’s jumbo cash-out refinance rates.

FAQ

It will vary by lender, but a common maximum LTV for a jumbo cash-out refinance is 70-80%. Some lenders may go up to 90%. Call around to local and national lenders, mortgage brokers, and other companies for an LTV that will work for you.

Yes. There are plenty of lenders and programs that allow cash-out on a jumbo loan refinance. Lenders are more difficult to find than for conforming or no-cash-out loans, but they do exist.

Some lenders limit your cash out and some don’t. For certain credit scores, some lenders will allow you to take $1 million or more as cash at closing if you have enough equity and meet loan guidelines.

While your credit doesn’t have to be perfect, most lenders will require a higher credit score for a jumbo cash-out refinance. Expect lenders to require 660-680. The higher your score, the better your chances of approval.

Jumbo cash-out refinance loans: plenty of lenders and options

Taking cash out of your home for large purchases can make a lot of sense. From home improvement to consolidating debt, or just getting a better rate while taking cash out, these loans can pay off.

Plus, there are numerous lenders and options at each lender to meet your needs.

Connect with a lender to see today’s jumbo cash-out refinance rates.