If you’re one of the nearly seven million owners of manufactured homes in the U.S., you might be wondering if you can partake in a cash-out refinance just like site-built owners do.

The answer is yes. Manufactured homes are eligible for cash-out refinances and you can use the funds for any purpose.

As you may have guessed, there are additional requirements for manufactured home cash-out refinances. Here’s what to expect for each major loan type.

Request a call from a lender to check your cash-out refinance eligibility.

- Conventional cash-out refinance

- FHA cash-out refinance on a manufactured home

- VA cash-out refinance for manufactured housing

- USDA cash-out manufactured home refinance

- Finding a manufactured home cash-out refinance lender

- Items that apply to all manufactured home loans

- Cash-out refinance on a manufactured home: possible

Conventional cash-out refinance

Conventional loans allow cash-out refinancing for manufactured housing.

Fannie Mae and Freddie Mac set the following guidelines specifically for manufactured home cash-out loans. Rules are different for a home purchase or no-cash-out refi.

- Must be your primary residence. No second homes or investment properties

- Can’t be a single-wide

- Maximum loan-to-value of 65% based on current appraised value

- You must have owned the home and land for a minimum of 12 months

- HUD Certification Label and Data Plate are in/on the home and appear on the appraisal

- The home was built after June 15, 1976

- The home is built to HUD Manufactured Home Construction and Safety Standards (MHCSS)

- Never installed in a different location

- Classified as real estate (vehicle title eliminated)

- Can’t include an accessory dwelling unit (ADU)

- Tow hitch, wheels, and axles must be removed. Attached to permanent foundation meeting HUD and local codes

- Land must be owned by the homeowner, co-op, or condo association. No leased land

- Minimum 12 feet wide and 400 square feet

- Located on a publicly or privately maintained street

Beyond these requirements, you have to qualify for standard conventional loan guidelines, i.e. have about a 43% debt-to-income ratio, a 620 credit score, and steady employment.

Connect with a conventional manufactured home loan lender.

FHA cash-out refinance on a manufactured home

FHA is a bit more generous than a conventional loan when it comes to maximum loan amount. Whereas conventional limits you to 65% of the home’s current value, FHA will allow 80% on a cash-out refinance.

Following are other guidelines.

- Must be your primary residence. No second homes or investment properties

- Engineer’s foundation inspection required ($700+ cost). The inspection may not be required if you have an FHA loan currently

- Crawl space is fully enclosed with adequate skirting

- Maximum loan-to-value of 80% based on current appraised value

- State and local requirements for termite protection must be followed

- HUD Certification Label and Data Plate are in/on the home and appear on the appraisal

- The home was built after June 15, 1976

- The home is built to HUD Manufactured Home Construction and Safety Standards (MHCSS)

- Classified as real estate (vehicle title eliminated)

- Home must be at least 400 square feet

Other rules will likely apply depending on the lender.

Check your eligibility with an FHA cash-out refinance lender.

VA cash-out refinance for manufactured housing

VA is one of the most lenient of all loan types, and its cash-out manufactured home loans are no exception. However, you must be an eligible veteran. Typically you need to be currently serving or have two years of service in one of the branches of the U.S. Armed Forces with an honorable discharge.

Typically, you need a credit score of at least 620, a debt-to-income ratio of no more than 43%, and meet other standard VA home loan guidelines.

- Must be your primary residence. No second homes or investment properties

- The home was built after June 15, 1976

- Classified as real estate (vehicle title eliminated)

- Home must be at least 400 square feet if single-wide or 700 square feet if a double-wide

- The home is on a permanent foundation that meets state and local requirements

- The home is built to HUD Manufactured Home Construction and Safety Standards (MHCSS)

- The new loan can be up to 100% of the home’s current value, if the lender allows it. Many lenders only allow 90%

- Veteran must have adequate entitlement. If there is a VA loan on the home currently, the entitlement will be restored for the refinance

Check with a lender to see if you qualify for a VA cash-out manufactured loan.

USDA cash-out manufactured home refinance

This one is simple because USDA does not allow cash-out refinancing at all, no matter what type of home you have.

It does allow a USDA-to-USDA refinance called a Streamlined Assist where no income documentation is required. However, you can’t take cash out and your payment must drop by $50. They are only available for manufactured homes if you have a USDA loan on the home already.

Finding a manufactured home cash-out refinance lender

It’s harder to find a lender for any manufactured home loan. Most lenders only offer services on traditional site-built homes.

However, many lenders specialize in this financing and know how to do them. Your best source could be a mortgage broker, which can shop your loan scenario to many banks and mortgage companies.

Don’t get discouraged; keep looking and you could eventually find a lender who can finance your home.

Items that apply to all manufactured home loans

Following are common issues with manufactured home financing that you should know before applying for a cash-out refinance.

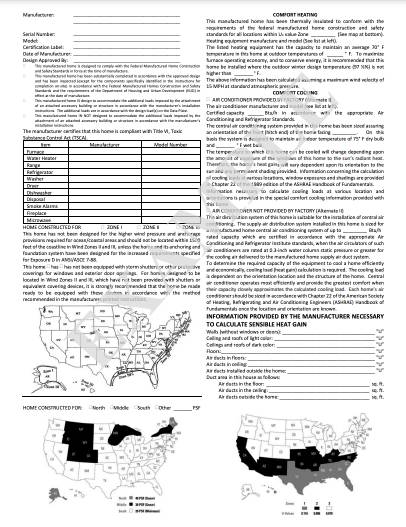

HUD Data Plate and Certification Label

One of the most important steps to financing a manufactured home is making sure the home’s HUD Data Plate and Certification Label are accessible, not painted over, and not destroyed.

Nearly all loan types require images of the Data Plate and Certification Label on the appraisal. If the appraiser can’t find it, you will have spent hundreds of dollars for an incomplete appraisal.

Certification Label: The metal plate on the outside of the home measuring about 2 x 4 inches. It resembles a small license plate. Double-wide and triple-wide homes may have more than one label.

Data Plate: Paper label inside the home with manufacturing data. It’s on an 8½ X 11 inch sheet of paper and should be in a kitchen cabinet, electrical panel or bedroom closet.

These tags show that the home was built to national HUD standards and is eligible for financing. If you can’t locate the Certification Label or Data Plate, contact the Institute for Building Technology and Safety (IBTS). This organization may be able to provide a letter with the same information.

What’s the deal with June 15, 1976?

If you’re a huge housing geek like I am, you’ll find this article interesting.

In the early 1900s and especially after World War II, manufacturers built moveable homes to satisfy housing demand, especially housing that you could move to your new job if you had to. But all this was done with little oversight. Construction was likely shoddy.

On June 15, 1976, though, the Department of Housing and Urban Development (HUD) set federal standards for manufactured home construction, called the Manufactured Home Construction and Safety Standards (MHCSS).

All non-site-built homes constructed on or after this date had to adhere to these standards. There’s no way to guarantee quality or safety for any manufactured home built before this date.

All major loan programs follow HUD guidelines, so naturally, no major loan program will finance a home that may not be safe for its residents.

Request a call from a lender to check your cash-out refinance eligibility.

What is a manufactured home versus a mobile home?

Anything built today is called a manufactured home because it adheres to the MHCSS code required after June 15, 1976.

Shortly after passage of the MHCSS mentioned above, the federal government mandated that all references to “mobile homes” in laws and codes be changed to “manufactured homes.”

A “mobile home”, then, is a structure built before June 15, 1976 and might even be transportable.

That being said, many people use “mobile home” and “manufactured home” interchangeably, even though they are probably referencing homes built after 1976.

About manufactured home alterations

Most additions or alterations to the original manufactured home will make it ineligible for financing. This is because it’s nearly impossible for an appraiser or other professional to certify that the addition did not compromise original construction. (Remember the all-important MHCSS code of 1976.)

If you have a manufactured home, do not alter it from its original manufactured state, at least nothing that penetrates a wall or the exterior. Even attaching an exterior deck or awning to the home itself – even putting a single nail in the exterior – can make it ineligible for financing.

Cash-out refinance on a manufactured home: possible

Not only is it possible to get a cash-out refinance on a manufactured home, it can also help you get ahead financially.

Consolidate high-interest credit card debt, pay college tuition, or accomplish other goals with the money. It’s your choice.

Have questions about any home financing need? Leave it in the comment section below and I’ll try to answer.

Speak to a lender now to check your eligibility for a manufactured home refinance.