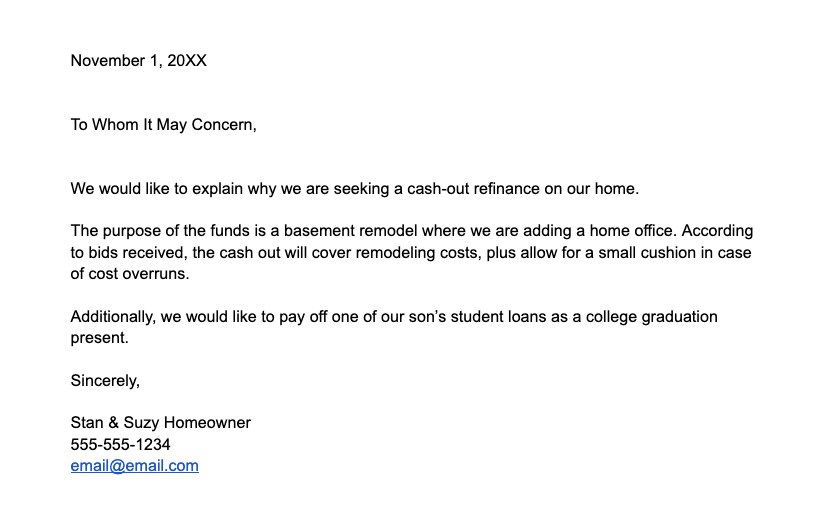

Sample Letter of Explanation for Cash-Out Refinance – Free Download: Word, PDF, Google Doc

Free downloadable letter of explanation for cash-out refinance example Sometimes, the lender’s underwriter will request a letter of explanation (LOE or LOX) for why you are seeking a cash-out refinance and what the funds are for. Connect with a lender to check today’s refinance rates. Here is a template to use. >>Download the Word document […]