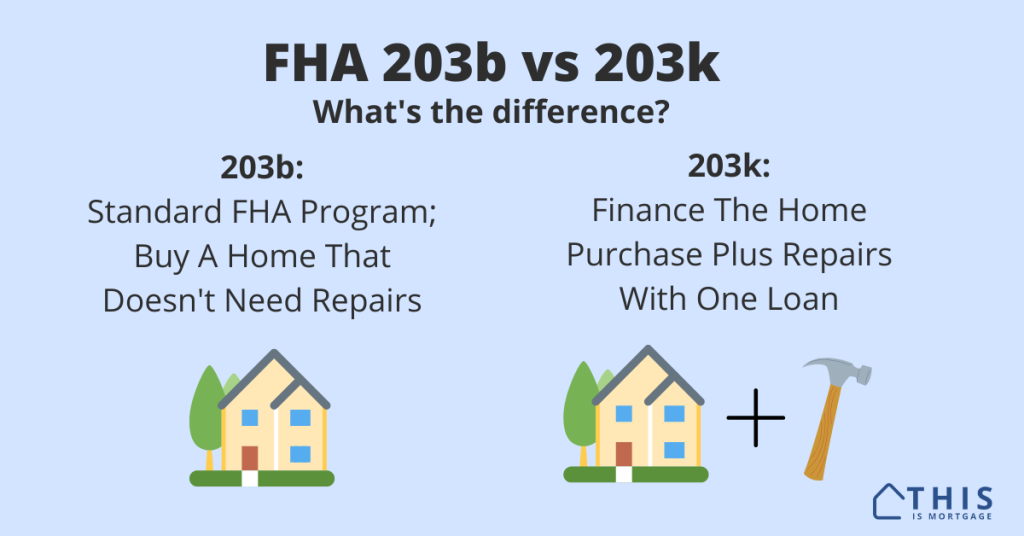

FHA 203b vs 203k

FHA 203b is simply another name for the standard FHA home loan program, while 203k is a home rehab program that allows buyers to finance the home purchase plus repairs with one loan.

See if you can buy a home with FHA.

Where do these numbers come from?

The numbers 203b and 203k are sections of the National Housing Act, created in 1934 in response to the Great Depression. The Act created the Federal Housing Administration (FHA) which encouraged homeownership by protecting lenders against borrower defaults, allowing them to lend at more lenient standards than they would otherwise.

So, the “FHA 203b” loan came out of this section of the National Housing Act and 203k rehab loans were born from that section.

Section 203b of the National Housing Act

Section 203k of the National Housing Act

When to use FHA 203b

As mentioned, 203b is the standard FHA program. With it, first-time and repeat home buyers can put just 3.5% down with a credit score as low as 580, or 10% down with a credit score of 500.

Lenders can be lenient on debt-to-income ratios, or the portion of income going toward housing payments plus other debt. Some applicants can be approved even though 50-60% of their gross income is going toward debt payments.

It’s the most popular first-time buyer program by far, since it’s available nationwide and most lenders offer it.

It’s meant for “turn-key” single-family and 2-4 unit homes that are immediately livable and that meet FHA quality standards. The home doesn’t have to be perfect; cosmetic issues and small deficiencies are usually fine. However, certain items like a bad roof, exposed wiring, or inadequate heat will make the home ineligible for FHA financing.

That’s where 203k comes in.

See what you can afford with an FHA 203b loan.

When to use FHA 203k

When you find a home that’s a good value, but won’t meet FHA quality standards, you can use a 203k loan. But you can also use 203k to remodel the home for cosmetic reasons.

Rehabbing a home can be quite expensive, and new homebuyers often don’t have the money to complete repairs.

203k lets you finance up to 96.5% of the home purchase and repair costs in one loan. Repairs are completed after closing. This opens your homebuying options immensely. Imagine zeroing in on run-down homes in your search instead of skipping over them.

With 203k, you can finance nearly any home because it allows you to bring it up to FHA’s property standards.

The extent of the repairs needed will determine which type of 203k to use.

Limited 203k: For minor home repairs up to $35,000 to address small safety issues and cosmetic fixes. You can remodel the kitchen and bathroom, put in a new furnace, address electrical deficiencies and more. No structural work can be done, like moving a wall.

Standard 203k: For major repairs over $35,000, including structural fixes and major rehab. You can even add a bedroom or even a second story onto a one-story home. You have the power to completely transform a home with this loan.

Start here to purchase and fix up a home with 203k.

For either 203k program, repairs need to cost more than $5,000. For repairs needed under $5,000, read on.

Other FHA programs

There are other FHA programs, though 203b and 203k are the most popular.

FHA repair escrow: For small fixes costing $5,000 or less. The lender can hold funds for small repairs to be done after closing to bring the home up to FHA standards.

FHA 203h: Another section of the National Housing Act (you guessed it, section 203h) says a homebuyer can get a zero-down FHA loan if their home was destroyed by natural disaster, even if they didn’t own the destroyed home.

FHA 248: Mortgages for homes on Indian Reservations and other restricted lands

FHA Energy-Efficient Mortgage (EEM): Include the cost of energy-efficient improvements into the FHA loan.

Good Neighbor Next Door: Law enforcement, Teachers, Firefighters, and EMTs can buy a HUD foreclosed home for 50% off and pay just $100 down when using an FHA loan.

FHA 203b alternatives

FHA isn’t the only program offering a low down payment and lenient guidelines. Conventional loans like Freddie Mac Home Possible offer 3% down at reduced rates and lower mortgage insurance than standard conventional loans. Likewise, HomeOne is a 3%-down program, and, like FHA, has no income limits.

Another conventional loan agency, Fannie Mae, offers a 3%-down loan called HomeReady, which allows you to use roommate income to qualify among other interesting guidelines.

FHA 203k alternatives

Fannie Mae and Freddie Mac offer their own renovation loans such as HomeStyle Renovation and CHOICERenovation that can be had for just 3% down.

Conventional loans offer some advantages over FHA, such as the ability to cancel mortgage insurance a few years into the loan and no upfront mortgage insurance costs. But for buyers without high credit and income, FHA 203k is probably the better option.

FHA 203b vs 203k : Which one is right for you?

FHA offers many programs for new buyers and those who have owned before. Which type you use depends on the condition of the home you’re buying, and whether you want to tackle a home remodel.

Whether you want a move-in ready home or one that you can fix up and make your own, FHA has you covered.