You can think of The Good Neighbor Next Door program as a bargain outlet store for homes.

Buyers in public-service professions can buy a home at a 50% discount, sometimes with just $100 down.

These homes are foreclosures owned by the U.S. Department of Housing and Urban Development, or HUD. The agency offloads homes while granting easy homeownership to those that need it most.

So, in one motion, HUD revitalizes an area by increasing homeownership and populating it with skilled community builders. Genius move on all counts.

Do you qualify? Let’s find out.

Check your GNND eligibility with a lender.

Table of Contents

- Good Neighbor Next Door calculator

- Who qualifies for Good Neighbor Next Door?

- How to find GNND homes

- Make an offer

- More GNND requirements

- Get the loan

- Buying a GNND fixer-upper

- FAQ

- Apply for Good Neighbor Next Door

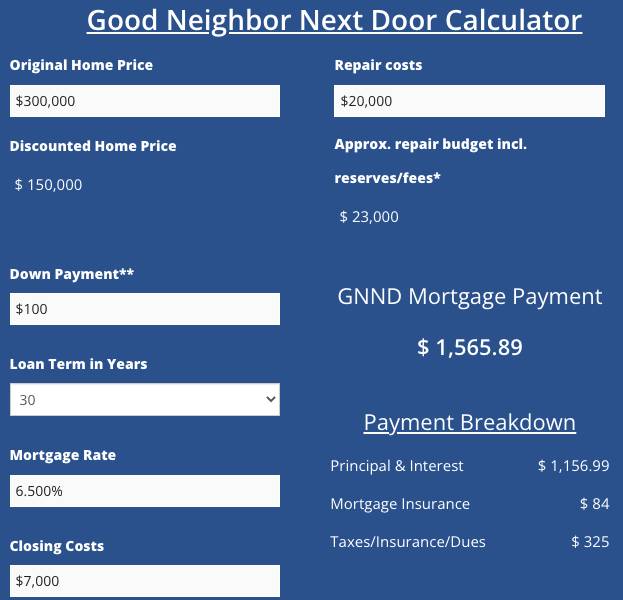

Good Neighbor Next Door calculator

This calculator estimates your GNND cost breakdown.

Good Neighbor Next Door Calculator

Payments, interest rates, and other details are for example purposes only and do not constitute a quote or commitment to lend.

*10-15% reserve account required for repairs after closing, plus fees

**Down payment is $ 100 if using FHA. Standard down payment for other programs

***GNND allows you to finance closing costs into the loan when using FHA

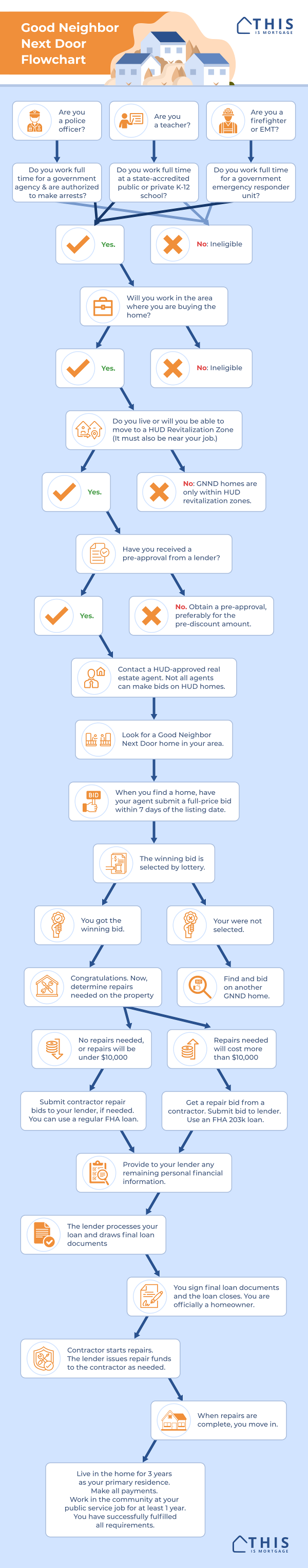

Good Neighbor Next Door Flowchart

[↓Click the chart to download a high resolution PDF↓]

Who qualifies for the Good Neighbor Next Door program?

Good Neighbor Next Door (GNND) is open to buyers in law enforcement, education, and emergency response.

Law enforcement employment requirements

- Employed full time

- You work for an agency of the federal, state, municipal, or Tribal government

- You are sworn to uphold and make arrests for violations of municipal, state, tribal, or federal laws

- You serve or will serve the area where the home is located

Teachers

- Employed full-time at a state-accredited public or private K-12 school

- Serve or will serve students in the area where the home is located

Firefighters and EMTs

- Employed full-time by a fire department or federal, state, municipal, or Tribal government emergency responder unit

- You serve or will serve the area where the home is located

Think you’re eligible? Great. The next step is to find a home that qualifies for the program.

How to find GNND homes

Finding a home that is eligible for GNND can be tricky.

Currently, there aren’t many foreclosure homes on HUD’s books, especially ones in revitalization areas. Still, it’s worth checking if there is a home in your area.

The home must:

- Be a HUD foreclosure home in a revitalization area

- Have been listed within the last 7 days

Let’s walk through an example of how to find a home.

Start your Good Neighbor Next Door pre-approval.

Find a HUD foreclosure home in a revitalization area

HUD makes it easy to look for GNND-eligible homes. Simply go to HUDHometore.gov.

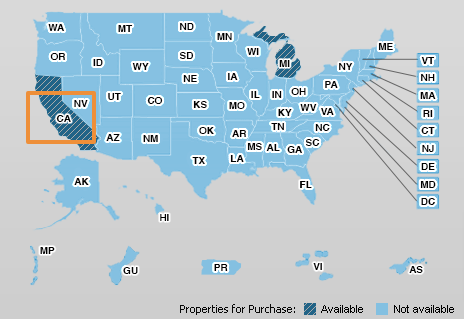

At the time of this writing, there were only two GNND-eligible homes in the country. More about this later.

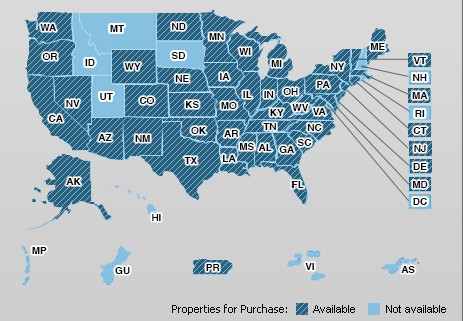

Click on a state that has at least one home, indicated by the dark blue stripes. It doesn’t matter if it’s your state; you’re just getting the hang of how to find homes.

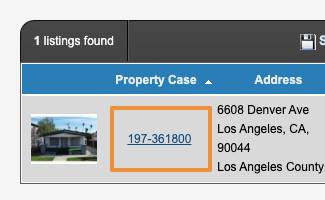

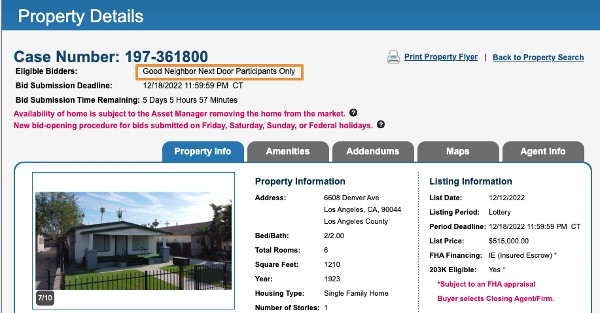

Click on the “Property Case” number listed.

Looking at the home, you can see that only GNND-eligible buyers may make an offer. You can also see the time remaining to make a bid. Bidding stays open for seven days. This “lockout” period keeps real estate investors from snatching up the property before regular buyers have a chance.

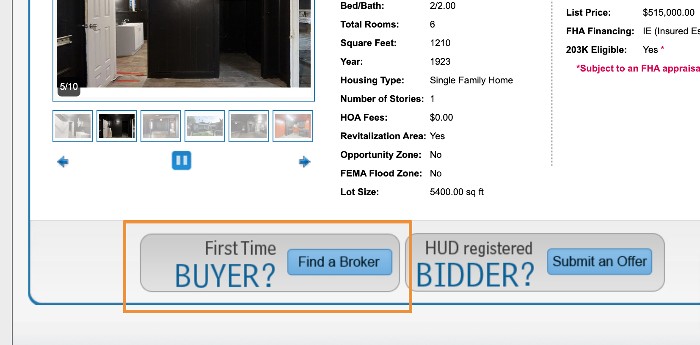

If this were a home you would like to bid on, you would contact your HUD-approved agent. If you don’t have one, you can find one by hitting the button below the listing (or go to this link).

Don’t be discouraged because there are so few homes. Keep checking, because new listings appear all the time.

What about other HUD homes?

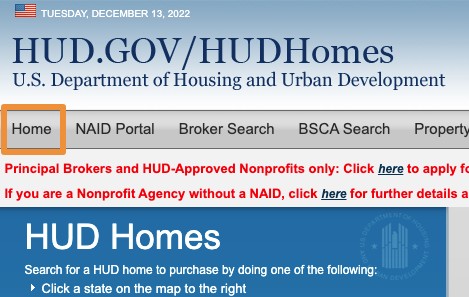

While you’re looking at GNND homes, be sure to check out other HUD-owned homes on this same site. Simply hit Home on the upper left.

Now you’ll see that most states have at least one HUD foreclosure for sale. The only difference between these homes and GNND homes is that these are not in revitalization areas. Each home allows bids from only owner-occupants for seven days.

These homes are not 50% off, but there could still be great deals to be had.

How to bid/make an offer on Good Neighbor Next Door homes

Making an offer on a HUD-owned home is different than on a regular home on the open market.

You must:

- Choose a HUD-approved real estate agent (find one here)

- Have the agent bid on the property at full list price (eligible GNND discounts will be applied later)

- Wait to see if your offer is accepted (the winning bidder is selected by random lottery)

- If you are the winning bidder, work with your agent to submit your earnest money deposit and all required sales contract paperwork.

Your earnest money will be required within two days of an accepted offer and is equal to 1% of the purchase price. The amount must be at least $500 for properties below $50,000 and a maximum of $2,000, even if the home is more than $200,000. Make sure your earnest money is in a checking or savings account before submitting your bid.

Keep in mind that you may already be working with an agent if you’ve started looking for open-market homes. You may have even signed an exclusivity agreement, which could keep you from working with a HUD-approved agent. In this case, go to your current agent and request that, if you find a GNND or other HUD-owned home, you can be released to work with a different agent.

Get pre-approved for your GNND loan.

Where are Good Neighbor Next Door revitalization areas?

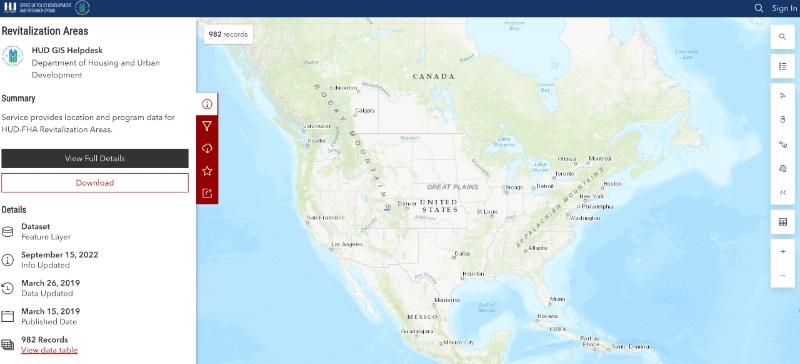

GNND homes must be in a revitalization zone. While there may be no GNND homes in your area currently, it pays to know if there are approved areas in your city.

To find out, simply go to HUD’s interactive map.

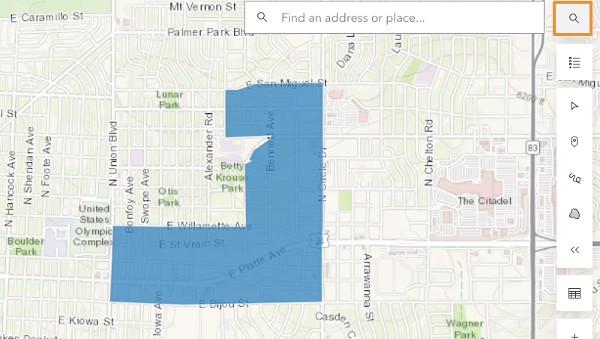

As an example, zooming in on Denver reveals many revitalization neighborhoods.

All it takes in a HUD foreclosure in one of these areas, and you have a GNND-eligible home.

Find a specific address by hitting the magnifying glass on the top right.

Other Good Neighbor Next Door requirements

If you’re lucky enough to find a GNND home, there are some other requirements you should know.

You must live in the home for three years

For the first three years, HUD will send a certification to the home by mail. You must sign and return the form certifying that you still live there. If HUD receives no response after two tries, it will send an investigator to the home to verify occupancy.

The investigator can report non-occupancy to HUD. Those found not living in the home will have to repay a prorated amount of the discount.

However, certain provisions are made for those who must vacate the property due to military service.

You must take on a three-year “silent second” mortgage

The 50% discount comes in the form of a “silent second” mortgage.

This means HUD creates a second mortgage for the discounted amount. For example,

| List price/value | $300,000 |

| Discount – Silent second, forgiven after 3 years living in the home | $150,000 |

| Your sale price | $150,000 |

No payments or interest is owed on this loan. At the end of three years, HUD forgives the mortgage and clears the lien with your county, leaving you with your primary mortgage only.

You may be obligated to pay off the second mortgage with your own funds if you don’t live in the home for three years.

You have not owned a home in the past 12 months

Only first-time homebuyers are allowed, defined as someone who has not owned a home in the past year and has not used GNND before.

How do I get a loan on a GNND home?

Getting a loan on one of these homes is similar to financing any property.

First, get a pre-approval from a lender that offers FHA mortgages. Your HUD-approved real estate agent will likely require a pre-approval before making a bid.

It’s a good idea to get pre-approved at the pre-discount price. That will allow you to bid on other HUD-owned and open-market homes if a GNND home is not available.

Once you have a winning GNND bid, give the property details and purchase contract to your lender. Supply any personal financial documents the lender requests at that time.

The lender will order the appraisal and move the file through processing. Typically within 45-60 days, your loan will be fully approved. You sign final paperwork, get the keys, and move in.

The GNND loan amount

Your loan amount will be based on the reduced price, less the down payment. Here’s how the loan would work.

| Home Price | $300,000 |

| Discount | -$150,000 |

| Final price | $150,000 |

| Down payment (when FHA loan used) | -$100 |

| Financed closing costs | $5,000 |

| Financed repairs | $4,000 |

| Financed upfront mortgage insurance | $2,710 |

| Final loan amount | $161,600 |

Even though your final loan amount is higher than the purchase price, it’s still only slightly above a 50% loan-to-value, giving you plenty of equity assuming you stay in the home for three years.

GNND-compatible loan programs

You can use almost any loan type to buy a Good Neighbor Next Door home. However, your best bet is an FHA loan.

FHA

An FHA loan is best for Good Neighbor Next Door homes because FHA is sponsored by HUD. This agency has already examined the home to see if it meets its own standards. You may run into issues using other loan types because the home may not meet those standards. Plus, you are eligible for other benefits, such as $100 down, and financing repair costs and closing costs when you use FHA.

Conventional

You can use low-down-payment conventional loans like HomeReady and Home Possible for GNND homes. These loans require just 3% down. Keep in mind that, if the home is in need of repairs, you’ll have to use a conventional rehab loan such as Fannie Mae HomeStyle.

VA loans

VA loans are zero-down home loans that is eligible for GNND. You must have military experience, typically two years in the service, to qualify.

USDA loans

USDA loans require no down payment. It may be difficult to use a USDA loan, however, since these are available only in certain rural and suburban areas. Many HUD revitalization areas are in downtown cores, which are ineligible for USDA financing.

Good Neighbor Next Door $100 down program

If you buy a GNND home using FHA financing, you are eligible to make a down payment of just $100 instead of the typical 3.5% down.

Additionally, you can finance repairs, closing costs, and most other expenses into the loan so that your true out-of-pocket expense is just $100. You will be refunded any earnest money not applied to the down payment.

On a $150,000 final purchase price after the discount, this saves you at least $5,150 in down payment costs compared to the standard FHA down payment amount.

Buying a fixer-upper with GNND

One situation you may encounter is that HUD-owned homes are in rough shape. Most foreclosures are. In fact, they might have issues that make them unlendable.

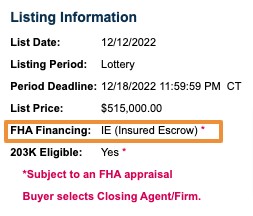

To find out what repairs are needed on the property, look at the listing for

- IN – Insurable by FHA (meaning you can get an FHA loan on it). No repairs needed

- IE – Insured with Escrow. Minor repairs needed which can be financed with the standard FHA program

- UI – Uninsurable. This means you need an FHA 203k loan to finance more substantial repairs

For “IN” and “IE” properties, you can use a regular FHA loan. “IE” properties mean that the appraiser estimates repairs under $10,000. You can finance the repair costs under the standard FHA loan. You will hire a contractor who will submit a bid to the lender before closing. The contractor has 30 days to repair the items after closing.

“UI” properties require repairs over $10,000. You need an FHA 203k loan, which is FHA’s rehab loan. Repairs up to about $31,000 can be financed into the purchase with an FHA 203k Streamline (technically $35,000 but you have to keep about 10% in reserve for cost overruns). No structural work allowed. You can do more extensive repairs with an FHA 203k Standard loan, including structural work. You can finance up to 110% of the total pre-discount value of the home.

For instance, the home needs a new deck and roof, and upgraded wiring. You also have to repair a load-bearing wall, all at a cost of $40,000. No worries. The FHA 203k loan can finance those repairs and the home purchase with one loan. You could even do cosmetic updates like a new kitchen or bathroom while you’re at it.

Be sure to find a lender that is experienced with 203k loans.

Prepare for longer closing times and a longer timeframe to move in. Under GNND rules, you must move into the home within:

- 30 days for repairs under $10,000

- 90 days for repairs between $10,000 and $20,000

- 180 days for repairs over $20,000

Good Neighbor Next Door FAQ

Yes. If you’ve met all GNND requirements, HUD releases the silent second mortgage after three years of occupancy. You can then sell the home for a very nice profit, since your loan amount was based on half the market value of the home when you bought it.

You may be able to refinance a GNND home if it’s to lower the rate, change the term, to get an FHA 203k renovation loan, or to prevent defaulting on the mortgage. HUD will have to provide a subordination agreement for the silent second mortgage in order for it to be placed behind the new first mortgage.

Yes, you may add your closing costs to the loan amount and pay little or nothing out of pocket, assuming you use an FHA loan.

No, only those within revitalization areas, and only for the first 7 days they are listed.

How to apply for Good Neighbor Next Door

If you’re a teacher, police officer, firefighter, or EMT, it’s worth at least seeing available homes. With some luck, you could get a home at 50% off.

And, after three years, you could sell or do a cash-out refinance to buy a rental property or a move-up property.

Good Neighbor Next Door could be the once-in-a-lifetime homeownership opportunity you’ve been looking for.

Start your Good Neighbor Next Door home search here.

Good Neighbor Next Door Calculator Image