One of the most powerful features of FHA multifamily homebuying is that you have access to higher loan limits than are available for 1-unit, or single-family, homes

Loan limits, believe it or not, can exceed $2 million.

Here’s how to leverage increased FHA multifamily loan limits.

Get an FHA multifamily rate quote from a lender. Start here.

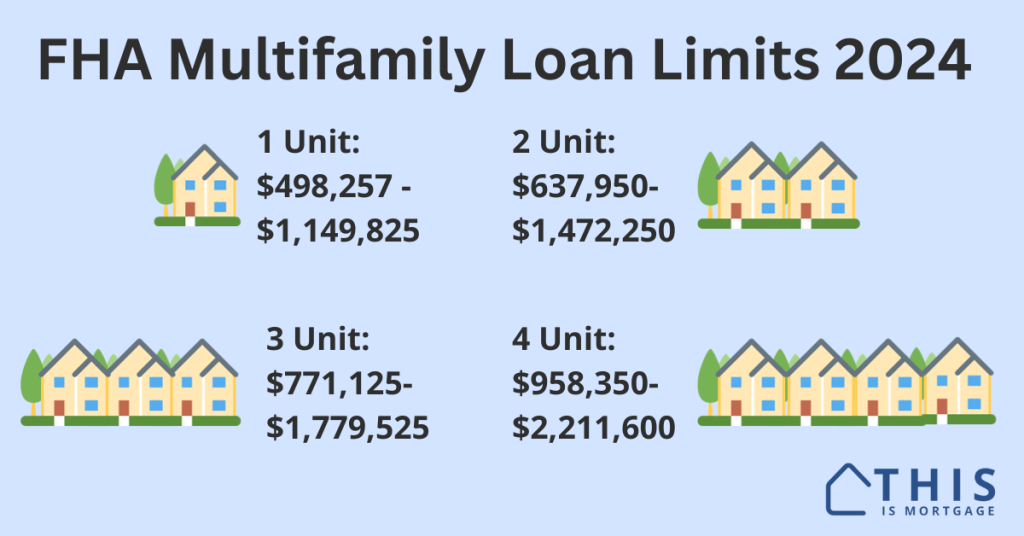

FHA loan limits for a duplex, triplex, and fourplex 2024

Your maximum eligible FHA loan amount depends on the property’s unit count and location. For comparison, the tables below also include 1-unit limits.

| Units | Standard areas | High-cost area max |

| 1-unit | $498,257 | $1,149,825 |

| 2-unit | $637,950 | $1,472,250 |

| 3-unit | $771,125 | $1,779,525 |

| 4-unit | $958,350 | $2,211,600 |

FHA multifamily Special Exception area loan limits 2024

FHA allows even higher loan limits for very high cost areas.

| Units | AK, HI, Guam, USVI |

| 1-unit | $1,724,725 |

| 2-unit | $2,208,375 |

| 3-unit | $2,669,275 |

| 4-unit | $3,317,400 |

FHA multifamily “in-between” loan limits

Many areas have loan limits somewhere between low and high-cost limits.

| Units | Mid-range limits |

| 1-unit | $498,258- $1,149,824 |

| 2-unit | $637,951- $1,472,249 |

| 3-unit | $771,126- $1,779,524 |

| 4-unit | $958,351- $2,211,599 |

Some examples are:

- Seattle 2-unit: $1,251,400

- Atlanta 2-unit: $831,800

- Santa Fe, New Mexico 3-unit: $838,150

- Wenatchee, Washington 3-unit: $783,000

- Salt Lake City, Utah 4-unit: $1,192,050

- San Antonio, Texas 4-unit: $1,072,600

When you find a property, it’s best to look up your specific limit based on location and unit count at HUD.gov. Use “CY2024” in the Limit Year field.

Speak to a lender to check your FHA multifamily buying eligibility.

Your personal maximum loan limit

Keep in mind that your “real” limit is what you can qualify for. It can never exceed area limits, but it can be much less. For instance, you would need to make enough money to support a $2 million loan limit in California, which would come with a payment of around $15,000 per month.

Your employment income and future rent would have to support that large payment.

You can enter a scenario and check your debt-to-income levels with this FHA multifamily calculator.

FHA loan limits are on the loan, not on home price

Loan limits are on the loan amount, not on the home price. You always have the option to put more down to get the loan amount within limits.

For example, you could put $100,000 down on a $600,000 triplex to meet a local limit of $500,000.

How are FHA loan limits established?

FHA limits use Fannie Mae and Freddie Mac conforming limits as a baseline. Conforming limits come from the Federal Housing Finance Agency House Price Index. In 2024, home prices from the 3rd quarter of 2023 were compared with prices in the third quarter of 2022. The index increased about 5.56%. In turn, 2024 conventional loan limits were raised by 5.56%.

Then, HUD establishes FHA loan limits based on the conforming loan limits.

- Low-cost areas = 65% of 1-unit conforming loan limits

- High-cost areas = 150% of 1-unit conforming loan limits

Currently, the national conforming loan limit is $766,550.

- $766,550 X 0.65 = $498,257 (FHA 1-unit low-cost limit)

- $766,550 x 1.50 = $1,149,825 (FHA 1-unit high-cost limit)

Conforming multifamily loan limits are established via a complex methodology based on the 1-unit limit (which you can read about here.). As you might guess, FHA then bases its multifamily limits on 65% of the 2-, 3-, and 4-unit conforming limits.

| Units | Conforming limit | Multiplier | FHA low-cost limit |

| 1 | $766,550 | 65% | $498,257 |

| 2 | $981,500 | 65% | $637,950 |

| 3 | $1,186,350 | 65% | $771,125 |

| 4 | $1,474,400 | 65% | $958,350 |

In short, all FHA loan limits are based on conforming loan limits, although there’s no single formula for all areas of the country. Your best bet is to look up FHA-specific limits for your area.

Connect with a lender to check your FHA multifamily buying eligibility.

How to qualify for maximum FHA multifamily loan limits

Most buyers will naturally be well within FHA loan limits since they are quite high for most areas.

However, you might find the perfect property that is outside local limits.

For example, you’re looking for a duplex in Dallas, Texas where the local 2-unit loan limit is $721,400. The duplex is $800,000. Here are some options.

Make a larger down payment: The minimum down payment for FHA is 3.5%. However, you can always put more down. Put enough down to bring your loan amount within range.

Try a conventional loan: Fannie Mae and Freddie Mac conforming loans offer higher limits (FHA limits are typically 65% of conforming limits). The standard loan amount for a duplex is $981,500 versus $637,950 for FHA. You’ll need to put down at least 5% for a conventional multifamily.

Use future rental income: Sometimes you can’t qualify for the local FHA limit. Fortunately, FHA allows you to use future market rent to qualify. Use all available rents to reduce your debt-to-income ratio. Here’s how.

Apply for down payment assistance: There are down payment assistance programs in just about every corner of the U.S. Look for local government-sponsored grants and loans to help you increase your down payment and bring the loan within limits.

Start your multifamily home purchase

Buying a multi-family home with FHA can be a rewarding experience, as you experience property management and have tenants help pay the mortgage.

You might even pay less each month owning a multifamily versus a single-family.

And generous FHA loan limits help you do it.

Speak to a lender to see if you qualify for an FHA multifamily loan.