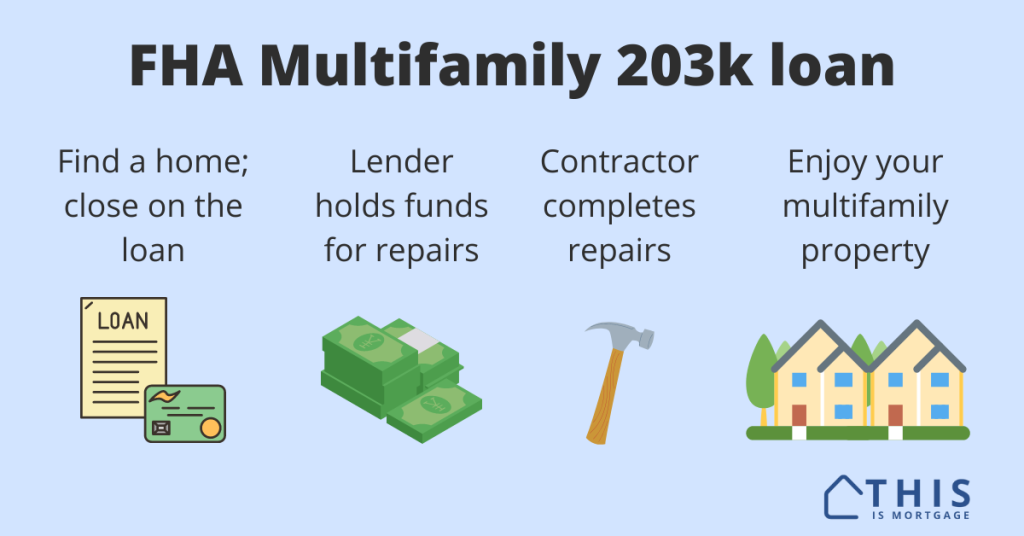

Can You Convert A Single-Family To Multifamily Using FHA 203k? Yes

FHA buyers who have looked for a duplex, triplex, or fourplex lately have probably found out that competition is fierce for these homes. If you do find one for sale, you’ll probably have to go head-to-head with cash buyers and investors using conventional loans. But what if you could buy a single-family home and convert […]

Can You Convert A Single-Family To Multifamily Using FHA 203k? Yes Read More »