Two powerful features of FHA loans are 1) buying a multifamily home, and 2) rehabbing a property. But can you combine these features to get an FHA 203k rehab loan on a multifamily?

Yes, you can. FHA allows its 203k loan to be used on 1-4 unit homes as long as you plan to live in one of the units.

But how you go about getting the loan depends on your planned improvements.

Speak to a lender to check your FHA multifamily 203k eligibility.

Cosmetic, livability, and safety issues: Limited 203k

Getting any kind of construction loan can be a tedious process. That’s why FHA breaks up its program into two options. The first, the Limited 203k, can make your duplex, triplex, or fourplex more livable, safer, and cosmetically modern without as much hassle as a full-blown rehab loan.

Here’s what the Limited 203k allows you to do:

- Make improvements up to about $30,000 (technically, $35,000, but fees and contingencies eat up some of that budget)

- Complete cosmetic repairs like kitchen and bath remodels

- Resolve safety issues that disqualify the property from FHA financing

- Repair/replace plumbing, HVAC, and electrical

- New roof

- Adding energy-efficient systems

- New appliances

- Fix decks and patios

- Lead paint remediation

- Most other small and less-involved improvements

Ineligible Limited 203k repairs:

- Improvements costing more than about $30,000

- Structural work (moving walls, creating bedrooms etc.)

- Luxury repairs like new swimming pools and outdoor amenities

- Rehabs requiring more than two payments to the contractor

- Repairs that prevent you from occupying the property more than 15 days.

If you’ve got your eye on more substantial improvements, consider the Standard 203k.

Request a call to discuss your FHA multifamily 203k loan.

Structural and major repairs: Standard 203k

The FHA Standard 203k can tackle major renovations up to and including rebuilding the whole house or performing major interior changes.

Eligible Standard 203k improvements:

- Converting a single-family home into a 2-4 unit multifamily home

- Converting a multifamily home to a single-family

- Rebuilding a home that is or will be demolished, provided the original foundation footprint doesn’t change

- Foundation repairs

- Building additions

- Finishing attics and basements

- Building a garage

- Handling cosmetic and safety issues that are eligible under the Limited 203k

- Landscaping

- Repairing/removing an existing swimming in-ground pool

Ineligible Standard 203k improvements:

- Adding luxury amenities like swimming pools, hot tubs, outdoor kitchen areas, etc.

- Additions that support commercial use

- Projects costing less than $5,000

When to use a 203k loan

Perhaps the best use for a 203k multifamily loan is to pick up a property that no one else wants because it won’t qualify for financing.

Turn-key multifamily properties are highly sought after. As an FHA buyer, you’ll face competition from all-cash and conventional buyers.

Armed with a 203k, you can finance the home purchase and repair costs with one loan, all for just 3.5% down. FHA allows you to close the loan prior to completing repairs since that’s how these loans were designed. Many buyers won’t know this, or won’t be interested in the extra work.

And once the repairs are complete, you’re sitting on a property that will be the envy of investors and house hackers everywhere.

Speak to a lender to see your 203k eligibility.

Can you convert a single-family to multifamily with 203k?

Because multifamily properties are sought-after, another use case is purchasing a single family and converting it into a 2-4 unit.

HUD guidelines state that a 203k loan may be used for “converting a one-family structure to a two-, three- or four-family structure.”

At the same time, you can fix cosmetic and safety issues to make it the best possible rental for future tenants.

Just make sure that, if you plan to convert a home into a 3 or 4 unit, it will pass the self-sufficiency test.

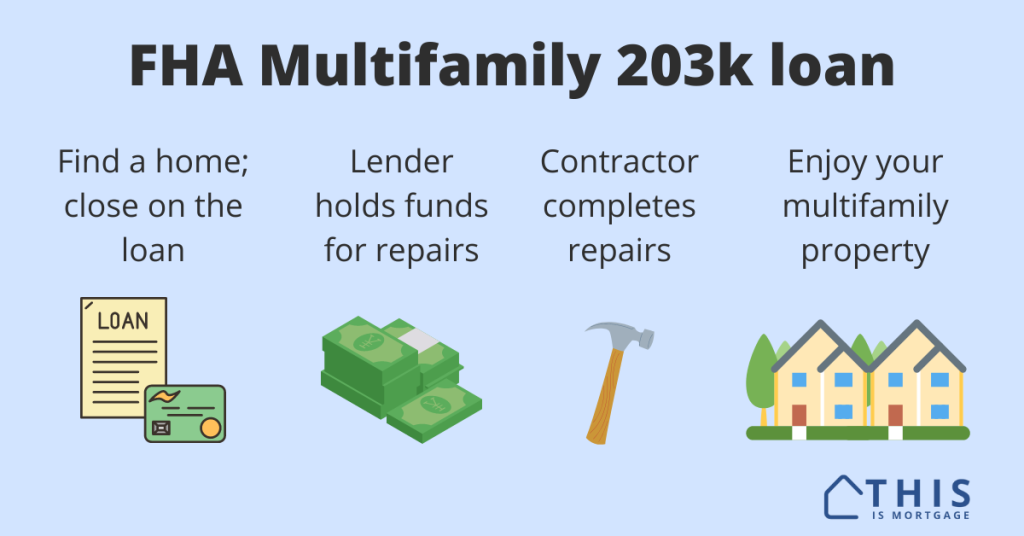

The 203k process

Now that you know the 203k is one of the best loan products on the market, how exactly do you get one? Is it hard?

The process is definitely more involved than getting a standard FHA loan. But you can make it easier on yourself by avoiding some pitfalls and knowing the process, which is:

- Get a 203k-specific pre-approval from an experienced lender.

- Find a 2-4 unit home. Make sure it pencils out after repair costs.

- Make an offer. Negotiate a lower purchase price and/or closing cost assistance if possible

- After an accepted offer, hire a HUD 203k Consultant. One is optional for a Limited 203k but .mandatory for a Standard 203k. The Consultant ensures all HUD property standards are met and work is done correctly.

- Find an experienced contractor, preferably one that has worked on a 203k project before.

- Have the contractor do a 100% set-in-stone bid for all repairs. It’s imperative the bid is accurate. A bid that is revised later will trigger appraisal changes, resulting in lost time and money.

- The lender orders the appraisal. The appraiser works up the as-is and as-completed values. The maximum loan amount is based on the as-completed value. The bid is an important piece of this step.

- The lender submits the appraisal and all borrower documentation to underwriting.

- When final approval is obtained, the buyer signs final loan documents.

- The lender closes the loan and repair funds are put into an escrow account.

- Repair funds are issued to the contractor in intervals as work is completed.

- When all repairs are complete, the escrow account is closed. The buyer has a fixed-up home financed with an FHA loan.

Start your 203k multifamily loan. Contact a lender here.

Maximum loan

Your maximum FHA 203k multifamily loan may never exceed any of the following:

- The area FHA multifamily loan limit

- The purchase price plus repair costs, minus the 3.5% down payment

- 110% of the as-completed value, minus 3.5%

Down payment

The 203k down payment matches FHA’s standard of 3.5%. The 3.5% is calculated based on the purchase price plus repairs. So, essentially, you are financing your repairs with just 3.5% down, which in itself is a fantastic deal.

Example:

- Home price: $300,000

- Repairs: $50,000

- Total: $350,000

- Down payment: $12,250

You certainly won’t find many other construction loans that offer 3.5% down. That’s why the 203k is one of the most underrated yet powerful programs in today’s market.

Doing the work yourself

The lender may allow you to do some of the 203k work yourself. You must prove that you can complete the project to HUD’s standards in a timely manner. You must sign a self-help agreement.

Don’t be surprised, though, if many lenders don’t allow this. To keep the project moving swiftly and with less risk, many lenders will require all work be done by a professional contractor.

Refinancing an existing multifamily with 203k

The 203k program allows you to refinance an owner-occupied multifamily home and make repairs with a refinance loan.

The process will look similar to a purchase transaction, except a bit easier, since you don’t have to find a property.

You could even convert your current single-family home into a multifamily, assuming local zoning allows it.

As you can see, you can get really creative with this program.

203k multifamily FAQ

Yes. If you live in one of the units, you can buy or refinance and repair a 2-4 unit home with an FHA 203k loan.

No. You end up with one FHA loan for both the purchase price and the repair costs. The lender will hold back repair funds after closing, then pay contractors as they complete the work.

Any FHA lender can do a 203k loan, but it’s best to find one experienced in the 203k process. It is more involved, and an inexperienced lender can cause costly delays.

See if the 203k loan will work for you

If you’re the kind of person who likes to think differently, a 203k multifamily loan could help you maximize two unique features of FHA loans simultaneously, getting value from both.

See if you qualify, and get started on your multifamily rehab loan.

Speak to a lender to check your FHA multifamily 203k eligibility.