An FHA “Single-Unit Approval”, formerly known as a “spot approval” can help you buy a condo in a non-FHA-approved complex.

FHA maintains a list of approved condo projects. The problem is, not many projects nationwide are on it. Many HOAs simply skip the hassle of FHA approval.

As a buyer, your choices are to:

- Use a conventional loan to buy the condo

- Find a condo unit within an approved project

- Get a Single-Unit Approval

Let’s find out how to get a Single-Unit Approval, or SUA, from FHA.

Check your eligibility for FHA condo financing.

Single-Unit Approval requirements

Meet the following conditions to be approved for an SUA.

- The condo project is not on the HUD approved list. It can’t be within an unapproved phase of an approved project. Also, check with the HOA. They may be in the process of approving the complex

- You are approved for an FHA loan. You received an approval letter from a lender. You may need 10% down if the lender did not use FHA’s computerized underwriting system to approve you (they did a “manual underwrite” which is rare)

- The condo and condo complex are complete, not under construction

- The condo unit itself was completed one year ago or has been occupied (no recently completed condos that are new on the market)

- The condo complex has at least five units

- No more than 10% of units have FHA financing. For projects under 20 units, no more than two can be financed with FHA

- Form HUD-9991 must be completed by the lender and HOA

- At least 50% of units must be owner-occupied

- The association must meet certain financial standards such as a reserve fund of 10% of annual unit assessments. Also, no more than 15% of units can be late on HOA dues

- HOA not in litigation or bankruptcy: The HOA must be in good standing

- No single owner can own more than 10% of units

- The complex must have adequate insurance including structure, liability, and flood if in a flood zone

See if you can be approved for FHA.

The condo association must provide:

- The completed HUD-9991 form

- Master insurance policy

- Current budget, balance sheet, and profit and loss

- Recorded legal documentation

- Explanation of special assessments and pending litigation

There may be more requirements. Luckily, it’s not up to the buyer to verify the condo meets all of them. The lender will work with the HOA to do that. However, keep in mind that the unit may not be SUA-eligible.

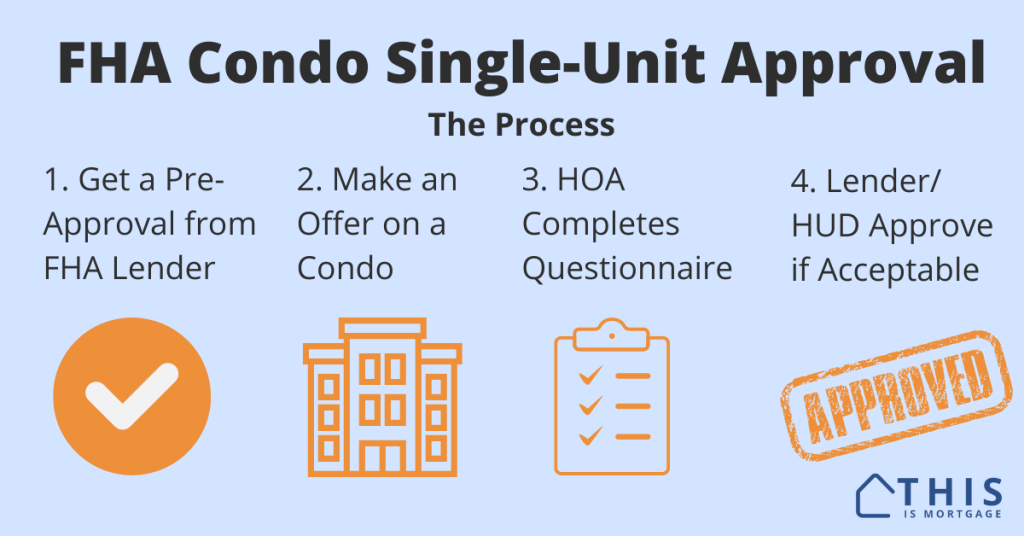

The SUA process

Because the lender does most of the heavy lifting for SUAs, your job as a buyer is pretty simple.

1. Get approved for an FHA loan

One of the main ingredients of SUA approval is that the buyer has an FHA approval.

2. Get under contract

Before making an offer, have your real estate agent talk to the HOA. There’s always a risk that the lender or HUD won’t approve the SUA. But by the time you know, you’re already under contract. Include a contingency in the offer that lets you back out without losing your earnest money.

3. The lender sends SUA form to the HOA

Getting the SUA form (HUD-9991) back from the HOA could take time. The HOA may not act quickly. Make sure the lender is checking on the SUA form every one or two days.

4. The lender evaluates the condo, issues final approval

The lender checks the SUA questionnaire against FHA guidelines. If it appears acceptable, it sends the form to FHA for a final approval. The lender finalizes your loan if there are no issues.

What if the SUA is denied after I’m under contract?

There’s a chance that HUD will reject your SUA after you have an accepted offer.

It’s important to leave an “out” on the contract so you don’t lose your earnest money: a financing contingency. Your agent will state a financing date on the contract. Make sure it gives your lender enough time to approve the SUA.

If it’s rejected, you can:

- Try conventional financing: Some conventional programs allow you to put just 3% down. Generally, you have to be a first-time buyer with good credit.

- Find a condo in a different project: Look for units in approved condo complexes. Or, try an SUA in a non-approved project again.

- Look for affordable single-family homes: In some markets this is impossible. However, you may find that a single-family home is nearly as affordable as a condo since they don’t come with high HOA dues.

- Consider run-down single-family homes: Buy a less expensive fixer home and repair it with a rehab loan.

- Look for townhomes: Many townhomes are considered single-family homes and not subject to condo approval. They may come with a lower price tag than a true free-standing home.

Most of the time, you’ll have to move on to a different property. Hopefully your agent built in strong contingencies so you can cancel the purchase without penalty.

Check all your options. Start here.

How long does a Single-Unit Approval take?

You should add a week or two to your closing date when attempting to get an SUA.

How long it takes to get an SUA depends on your lender and the condo association. The lender should start working with the association as soon as you’re under contract.

Completing the form may not be a top priority for the HOA. It also may complete the form incorrectly. The lender should proactively work with association reps to get this done.

Apply for condo financing

The first step to buying a condo is to get pre-approved. Then you’re ready to make an offer on a condo, whether it’s in an approved condo complex or not.