A zero-closing-cost refinance is one where the lender pays all your closing costs.

Sounds great, but with refinance costs running $5,000 or more, how can this be a real program?

Here’s what to know about these loans.

Get your zero-closing cost refinance rate. Start here.

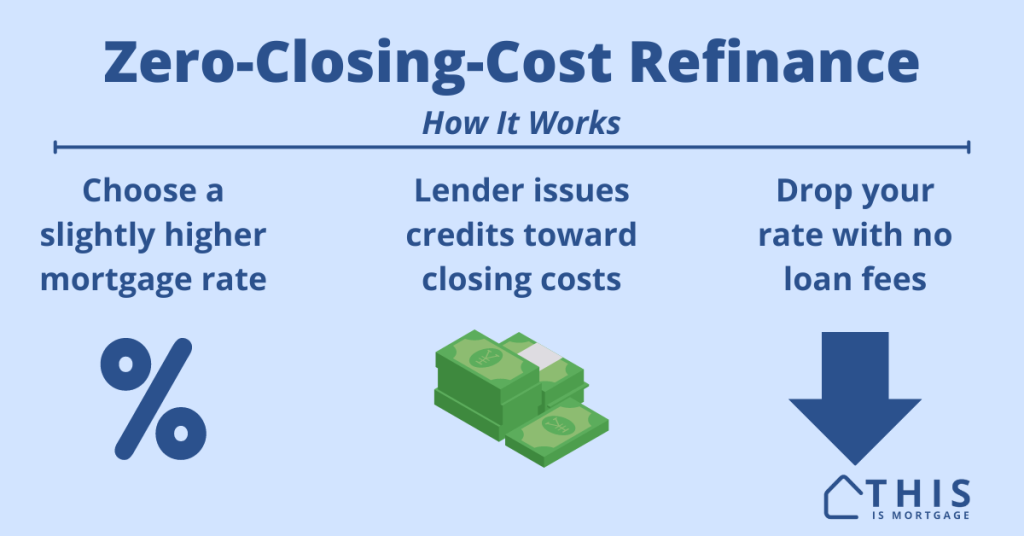

Zero-closing-cost refinance: How they work

The name is a bit misleading. Refinances always have costs. But instead of rolling costs into the new loan or paying them out of pocket, you take a higher mortgage rate.

You can think of a no-cost refi as paying points in reverse. Instead of paying points to lower your rate, the lender pays you to take a higher rate.

A higher rate generates more profit. The lender then issues you the excess profit as a lender credit. Here’s how it might work comparing a full-cost refinance side-by-side with the “no-cost” one.

| Full-cost refi | No-cost refi | |

| Refinance loan amount | $300,000 | $300,000 |

| Current rate | 7.5% | 7.5% |

| Refinance rate | 5.5% | 6% |

| Current payment | $2,100 | $2,100 |

| New payment | $1,700 | $1,800 |

| Savings | $400/mo | $300/mo |

| Due at closing | $5,000 | $0* |

*The lender typically does not cover prepaid taxes and insurance in a zero-cost refi, so you may need to pay cash at closing or roll these costs into the new loan.

If rates are low enough, a no-cost refi drops your rate without the out-of-pocket loan costs.

You should decide what’s more important to you: to pay no cash at closing (or avoid rolling costs into the new loan), or to receive the lowest rate.

How high are no-cost refi rates?

The rate on a zero-cost loan depends on the mortgage market at the time and the lender’s rate sheet that day. Sometimes no-cost refi rates are just 0.25% higher, sometimes they are 1.5% higher.

The best way to see if a no-cost refinance is a good value is to get two quotes from the same lender on the same day. Compare upfront and lifetime costs of both options. One or the other should stand out as the better choice for your situation.

Is a zero-closing-cost refinance a good idea?

A zero-closing-cost refinance works well for someone who doesn’t mind a slightly higher rate to avoid loan fees.

Keep in mind that you can still drop your rate significantly if rates are lower than when you purchased your home.

Zero-closing-cost pros

- Little-to-no out-of-pocket costs at closing

- Avoid rolling closing costs into the new loan, increasing your debt load

- Lowers your interest rate and lifetime interest costs versus your current mortgage

- Breakeven point is day 1 of the mortgage

Zero-closing-cost cons

- Higher-than-market mortgage rate (though still lower than your current rate)

- Higher payment than a standard refi

- Could be difficult to cover all costs

- Harder to qualify for due to larger payment

A no-cost refinance can make the decision easy

One of the biggest questions a homeowner asks is when they will break even on the refinance.

For example, if a refinance costs $4,000 and I save $100 per month, it takes 40 months for me to break even.

With a zero-cost refinance, though, you break even at month one (and day one). There’s no breakeven point. If the refinance saves $100 per month, you are $100 ahead starting with the first payment.

If you can drop your rate with no cost, the refinance becomes a very easy decision.

See how much you can drop your rate.

What about lifetime interest?

Is a no-cost refinance more expensive in the long run? Let’s find out.

Because most people don’t keep a mortgage for the full term, let’s assume you have a 30-year fixed loan for 10 years. We’ll also assume the no-cost refi rate is 0.50% higher than the full-cost option.

| Full-cost refi | Full-cost refi (roll in closing costs) | No-cost refi | |

| Refinance loan amount | $300,000 | $305,000 | $300,000 |

| Refinance rate | 5.5% | 5.5% | 6.0% |

| Payment | $1,700 | $1,730 | $1,800 |

| Cash to close | $5,000* | $0* | $0* |

| Interest cost (10 yrs) | $153,000 | $158,000 | $168,000 |

*Additional funds needed due to prepaid taxes/insurance. This amount includes true loan costs only.

Over 10 years, paying closing costs out-of-pocket is the cheapest option. You avoid paying interest on closing costs.

However, many refinancing homeowners would rather save money now and have their costs spread over coming years. It’s a personal decision and either one is okay.

Best times to use a zero-cost loan

- Refinance with almost no money in the bank

- Eliminate closing costs when you can’t roll them into the new loan, such as with the FHA Streamline refinance.

- Avoid paying points and fees for a loan you’ll have only a few years

- When buying a house, reduce closing costs and cash to close

- When you want to free up cash for other purposes

Don’t roll in prepaid taxes and insurance

One piece of advice: don’t roll taxes and insurance into a zero-cost refinance.

At closing, you must pay about 15 months of homeowner’s insurance and 3-9 months of property taxes. This can add up to thousands of dollars.

The best strategy is to pay these out of a savings account. You will receive a check for a similar amount a few weeks after closing. It’s a refund of the taxes and insurance you prepaid when you last purchased or refinanced the home.

However, if you want to raise as much cash as possible, you might choose to finance prepaid taxes and insurance.

Get a zero-closing-cost refinance rate quote

As rates drop, it could be a great time to capture a low rate while paying no closing costs out of pocket.

Speak to a lender to see how much you can save.