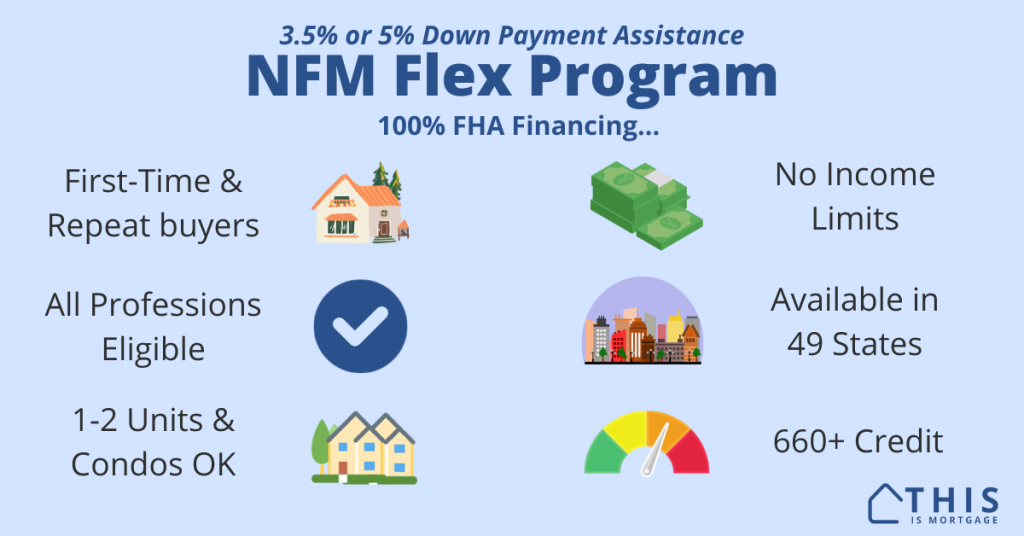

The NFM Flex Program turns FHA into a zero-down loan option.

FHA loans normally require just 3.5% down.

But on a $300,000 loan, your down payment and closing costs could run upwards of $18,000.

That’s where the NFM Flex Program comes in. NFM is a nationwide lender (all states except NY) that is offering down payment assistance of 3.5% or more to cover the entire FHA down payment.

Talk to a lender about down payment assistance.

What is the NFM Flex Program?

NFM Flex is a down payment assistance (DPA) program that reduces the amount of savings you need to buy a home.

The program allows you to finance your FHA down payment with a second mortgage. So instead of coming up with $10,500 on a $300,000 FHA loan, for instance, you can finance it with a low monthly payment.

NFM Flex example

| Standard FHA | NFM Flex | |

| Home price | $300,000 | $300,000 |

| Down payment | $10,500 | $10,500 |

| Closing costs* | $7,500 | $9,500 |

| 2nd loan | n/a | -$10,500 |

| Cash to close | $18,000 | $9,500 |

*For example only. Your costs will vary.

This program opens up doors for buyers who meet FHA guidelines and have some savings, but don’t have the entire amount for a standard FHA loan.

Contact a lending professional to get started with down payment assistance.

@this_is_mortgage Zero down FHA homebuyer program NFM Flex 😍 #firsttimehomebuyer #mortgagetips #thisismortgage #mortgageadvice #firsttimehomebuyertips #fhaloans

♬ Vibes – ZHRMusic

NFM Flex requirements: Who qualifies?

Unlike most DPAs, NFM Flex, like its name suggests, is flexible. Nearly anyone who qualifies for FHA is eligible:

- No income limits

- No first-time buyer requirement

- Not reserved for certain professions

- No geographic restrictions except NY

Lending criteria are also lenient:

Credit score: 660 (however, other NFM programs allow scores down to 600 so it’s worth seeing if you qualify)

Debt-to-income ratio: Somewhere between 50-56.9% max depending on borrower profile

Employment: Use full pre-tax W2 income or 2+ years self-employment income average after write-offs

Loan-to-value: 100% combined LTV (CLTV) i.e. zero down; 101.5% CLTV option available

Property: Single-family homes, townhomes, condos, PUDs, duplexes

Home use: Owner-occupied only; no 2nd homes or rentals

Maximum loan: $498,257 in most areas; up to $1,149,825 in high-cost areas

Gift funds: allowed following FHA guidelines

Mortgage insurance: Standard FHA mortgage insurance: 1.75% of the loan upfront and typically 0.55% annually

Geography: All states except NY and U.S. outlying territories

U.S. Residency: Citizen, Green Card, non-perm resident aliens, DACA etc. per standard FHA guidelines

Closing costs: Most borrowers will pay for closing costs unless they have gift funds or seller credits to cover them

3.5% or 5% DPA

You can select a down payment assistance loan of 3.5% or 5%. While the 5% option comes with higher rates, it gives you an additional 1.5% of the home’s price toward closing costs.

For example, if closing costs were $8,000 on a $200,000 home, the 5% DPA would let you finance $3,000 of that, leaving you with only $5,000 out of pocket.

House payment example

This program can help you get into a home for less money upfront, but is the payment sky-high?

Your payment will be somewhat higher than for a standard FHA loan. This is because you take on a second mortgage instead of paying the down payment in cash.

But for buyers with decent incomes but little cash, this program could work well.

| Standard FHA | NFM Flex | |

| Home price | $300,000 | $300,000 |

| 1st mortgage payment | $1,955 | $2,100 |

| 2nd mortgage payment | n/a | $95 |

| Tax/Insurance/ mortgage ins. | $485 | $485 |

| Monthly Payment | $2,440 | $2,680 |

*$250/mo taxes, $100/mo insurance, 0.55% FHA MIP, standard FHA rate 6.75%; NFM Flex rate 7.75%. All costs are for example purposes only.

NFM Flex comes with a higher rate on the first mortgage plus a 2nd mortgage payment. In this example, it costs about $240 more per month than standard FHA, a small price to pay to eliminate your down payment.

Connect with a lender for your rate and payment estimate.

The 2nd mortgage

The second mortgage is a 10-year loan with an interest rate about 2% higher than the first mortgage.

To keep the payment low, choose a 30-year amortization.

You won’t pay off the full amount in 10 years, so you’ll have a lump sum payment due at that time. However, most people sell or refinance before the 10-year mark, making this an insignificant risk.

Drawbacks

The program isn’t without its downsides.

Higher rate and fees: Because this is a zero-down loan, you’ll pay higher rates and loan fees compared to standard FHA.

Hard to refinance: If rates drop, you can’t use an FHA Streamline refinance to drop your FHA rate unless you pay off the 2nd mortgage. Few new buyers will have the funds to do so.

Getting an accepted offer: Home sellers are more likely to accept a conventional offer over FHA whether you are using DPA or not.

Two mortgage payments: You’ll pay two separate companies each month. The second mortgage payment will be under $100 in many cases, but you still have to remember to pay it.

FAQ

You probably need some savings to purchase a home with NFM Flex. Though your down payment is covered, you will still pay closing costs.

The program allows you to receive gift funds and seller concessions for closing costs. So if you have enough funds from those sources, it is possible to get into a home with little or nothing out of pocket.

Unlike most DPA programs, there are no income restrictions.

No. You must pay back the down payment assistance. You finance the down payment with an additional loan.

FHA guidelines state you must live in the home at least 12 months. You can sell before that, but you must pay off the first and second mortgages if you do so. You would probably not have enough home equity to sell without paying money into the transaction unless you keep the home for at least three years.

NFM is a mortgage banker that lends in 49 states. It has created this program to give more homebuyers access to affordable housing.

How do I apply for the NFM Flex Program?

You can apply directly with an NFM Flex Program lender through this site. After answering a few questions, you’ll be connected with an expert at NFM to guide you through the process.

Request a call from a lender to see if you’re eligible to buy a home.