You can close your FHA Streamline 210 days after closing your existing FHA loan.

You can apply 30-60 days earlier and close on the 210th day.

Within that 210 days, all of the following must happen:

- Six months have passed since your first payment due date.

- You have made six payments

- You have no more than one payment that was 30 days late in the last six payments

- The payment has been made for the month prior to the refinance closing date

Example:

- Home purchase closing: June 15, 2023

- First payment: July 1, 2023

- Eligible to close the FHA Streamline: January 11, 2024 (210 days since closing and six months since first payment)

- On-time payments made (max 1 30-day late payment): July, August, September, October, November, December

- January payment made for February refinance closing

Although there are caveats, a good rule of thumb is this: You are eligible to close an FHA streamline 7 months after the existing mortgage closing date.

This “seasoning” rule is in place for your protection. Before the 210-day rule existed, lenders would give homebuyers high rates then call them a month later to try to get them to refinance.

See how much you can save with an FHA Streamline refinance.

Is the FHA Streamline program too good to be true?

It’s just a matter of time before mortgage rates drop. When they do, countless homeowners will be asking, “How soon can I refinance an FHA loan?”

Within 7 months of closing an FHA loan, you can close a new FHA Streamline refinance to drop your rate with almost no documentation required whatsoever.

At first, this program seems too good to be true:

- No appraisal

- No current home value check (you don’t need any equity)

- No credit report

- No minimum credit score

- No employment or income verification

- Partial refund of FHA upfront MIP applied to new loan

- Non-mortgage accounts can be late

Why would FHA offer this? FHA’s mission is affordable homeownership. If you are making on-time payments, that’s proof enough that you can keep making lower payments.

The FHA Streamline refinance saves borrowers time and money by removing most of the traditional refinance requirements.

FHA Streamline documentation requirements

The FHA Streamline program is light on the documentation, but you will need certain items.

- If the lender pulls no credit report, proof of on-time mortgage payments for six months

- A utility bill or pay stub showing that your current address matches the property address. The lender may be able to pull third-party verification.

- Two months’ bank statements showing adequate funds to cover closing costs

- Current mortgage statement

- Final HUD (final settlement statement) and Note from your existing loan to prove your interest rate and loan type (fixed versus adjustable)

- Homeowner’s insurance agent/company contact information

These documents will help the lender satisfy all the conditions of the FHA streamline, including Net Tangible Benefit.

Net Tangible Benefit

The lender must prove the refinance offers value.

The general rule for most loans is that you must drop your combined interest rate plus FHA Mortgage Insurance Premium (MIP) by at least 0.5%.

For example:

| Existing Loan | Refinance Loan | |

| Interest rate | 7.50% | 6.50% |

| FHA MIP | 0.55% | 0.55% |

| Combined rate | 8.05% | 7.05% |

| Result | 1% reduction (eligible) |

You can also pass the Net Tangible Benefit test with the help of an MIP reduction. If you purchased a home before February 2023, you may have an MIP rate of 0.85%. Refinancing into today’s MIP rate of 0.55% gets you a 0.30% savings automatically. Your interest rate simply needs to drop by 0.2%

| Existing Loan | Refinance Loan | |

| Interest rate | 6.50% | 6.30% |

| FHA MIP | 0.85% | 0.55% |

| Combined rate | 7.35% | 6.85% |

| Result | 0.50% reduction (eligible) |

In this example, the refinance drops the rate by 0.20% and the MIP reduction by 0.30%. The full 0.50% reduction requirement was met.

Above are rules for fixed-rate to fixed-rate 30-year loans. If you are refinancing to or from an adjustable rate loan, your rate must drop 1-2%. Check with your lender to see if you’re eligible.

If you refinance into a 15-year, your rate must drop and the new payment may not rise by more than $50.

Check your FHA Streamline eligibility.

Don’t forget your FHA MIP refund

Most loan types don’t offer a refund on mortgage insurance, but FHA Streamlines do.

When you purchased your home, you paid an upfront fee of 1.75%. This is called FHA Upfront MIP.

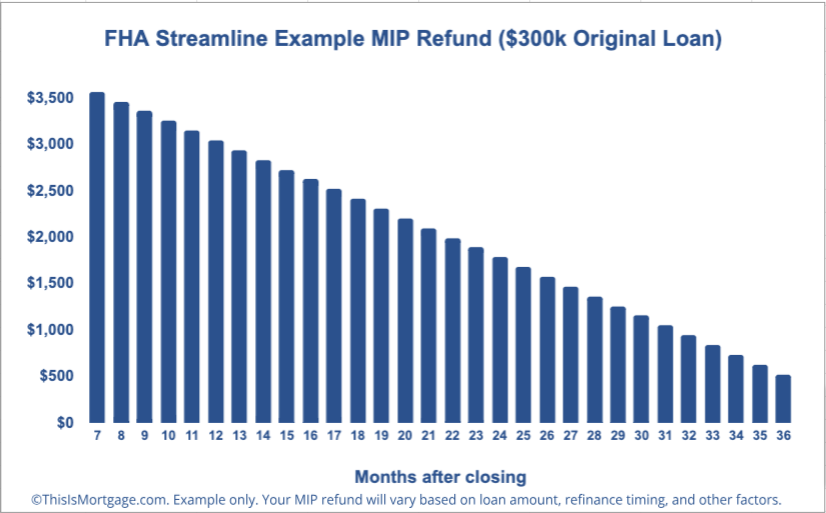

You are entitled to a partial refund of upfront MIP. You will receive it in the form of a credit toward the new MIP. You must close your FHA Streamline within three years of your last closing to recoup upfront MIP charges.

For example, if you closed your $300,000 FHA loan 10 months ago, the FHA Streamline MIP on the refinance would be reduced by $3,255.

Here’s what FHA MIP refund you could expect if your existing loan started at $300,000.

MIP refunds only apply to FHA-to-FHA refinances. You do not receive a refund by refinancing into a conventional loan, VA loan, or other loan type.

Should you wait to refinance with a conventional loan?

While an FHA Streamline comes with many advantages, estimate your equity before deciding on it.

Most FHA loans require monthly mortgage insurance as long as you have the loan. If you have 20% equity or close to it, you may be able to refinance into a conventional loan and eliminate mortgage insurance. This could save you hundreds per month.

An FHA-to-conventional refinance will require an appraisal, income verification, asset documentation, a 620 minimum credit score and more. But since you don’t have to pay upfront MIP or monthly mortgage insurance, it’s likely worth it.

Most homeowners won’t gain 20% equity for 3-5 years, so if you just purchased a home in the last few years, FHA Streamline is likely your best bet.

Other things to know about FHA Streamline

No cash back: FHA streamline loans do not allow cash back to the borrower of more than $500 at closing.

Out-of-pocket closing costs: You will likely need to pay closing costs out-of-pocket. FHA Streamline rules do not allow you to wrap closing costs into the new loan.

Escrow account: You will prepay 3-9 months of taxes and 12-15 months of homeowner’s insurance at closing. You will receive a check back from your current mortgage servicer for a similar amount a few weeks later. The best plan is to take these funds out of savings to close the refinance, then replace the funds a few weeks later.

Second homes and investment properties: Some lenders allow these as long as the home started as an owner-occupied residence and has since been converted to another use.

Removing a borrower: Generally, all borrowers on the original loan must stay on the loan. You can remove a borrower by ordering an appraisal and re-qualifying for the loan on your own.

Divorce, legal separation, or death: You may remove a borrower in the case of divorce, legal separation, or death of a borrower. Provide a divorce decree or legal separation agreement awarding the home to the remaining spouse. In cases of divorce, separation, and death, provide proof of six months of mortgage payments paid solely by the remaining borrower.

Adding a borrower: You may add someone to title and/or the new mortgage refinance without supplying their income and credit documents.

Appraisals: If your home has gone up in value, you may choose to get an appraisal to be able to wrap closing costs into the new loan.

Home value: You are still eligible if your home value has dropped since you purchased the home.

Homes in need of repair: Because there is no appraisal, FHA will not require work to be done on the home prior to closing the FHA Streamline refi.

Is an FHA Streamline refinance right for you?

It could be worth investigating an FHA Streamline refinance if current rates are at least 0.50% lower than your current rate.

If there’s no benefit to you, the lender can’t move forward with the refinance. Homeowners can feel at ease when applying knowing that this protection is in place.