Best Times to Use a Zero-Closing-Cost Refinance

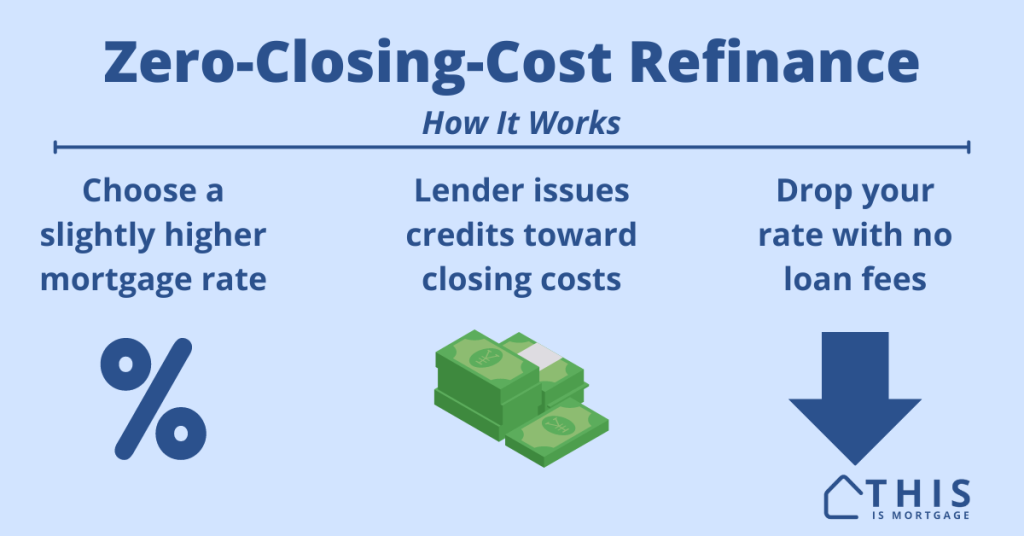

A zero-closing-cost refinance is one where the lender pays all your closing costs. Sounds great, but with refinance costs running $5,000 or more, how can this be a real program? Here’s what to know about these loans. Get your zero-closing cost refinance rate. Start here. Zero-closing-cost refinance: How they work The name is a bit […]

Best Times to Use a Zero-Closing-Cost Refinance Read More »