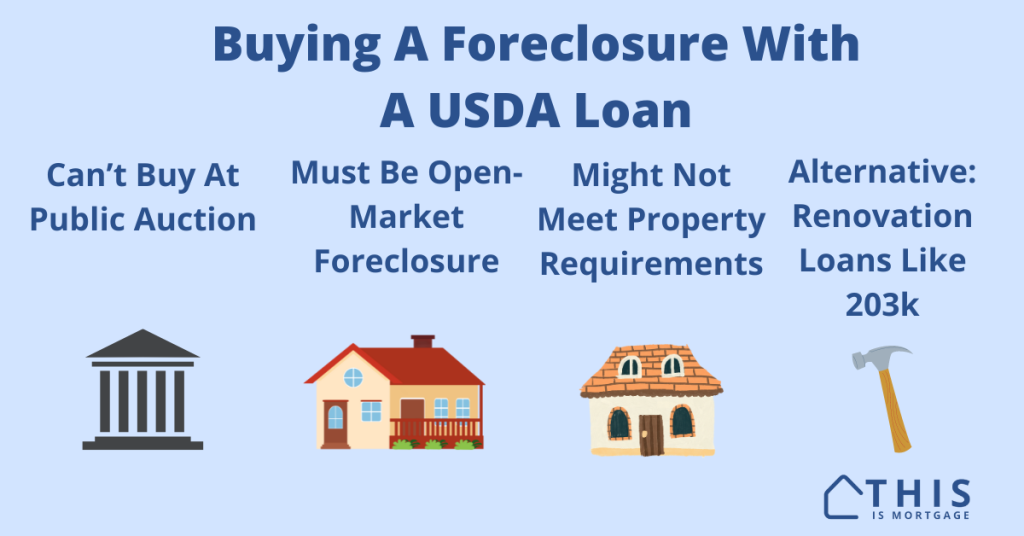

Can You Buy A Foreclosure With A USDA Loan?

Buying a foreclosed home sounds great. They are offered at bargain-basement prices and you can achieve fast equity by fixing it up. And buying a foreclosure with a USDA loan would be even sweeter: get a zero-down loan AND a low home price? Yes, please. So, can you buy a foreclosure with a USDA loan? […]

Can You Buy A Foreclosure With A USDA Loan? Read More »