Freddie Mac Home Possible® 2024: A Flexible, 3% Down Mortgage

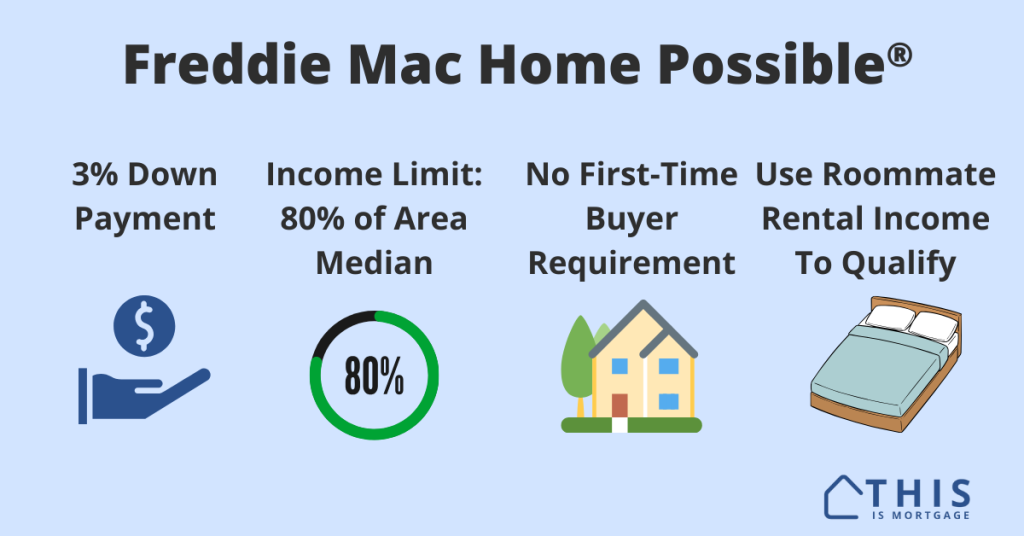

The Freddie Mac Home Possible mortgage is the agency’s all-out effort to turn moderate-income renters into homeowners. Benefits include: Here’s what you need to do to get a Home Possible loan. Check your Home Possible eligibility. In this article: Home Possible income limits To qualify for Home Possible, you must make 80% or less of […]

Freddie Mac Home Possible® 2024: A Flexible, 3% Down Mortgage Read More »