If you choose to take a 401k loan, you’re in good company. About 20% of all 401k holders have an outstanding loan on the account, said the Employee Benefits Research Institute in a recent study.

Additionally, the National Association of Realtors states that 5% of all homebuyers tap a 401k for their down payment. That number is likely much higher for first-time buyers.

This is a popular idea, but is it a good idea?

Contrary to what you might hear from “experts”, you can come out way ahead by tapping into a 401k for a down payment. Here’s what to consider.

See if you qualify to buy a home.

- Should you tap retirement accounts to buy a home?

- But aren’t I tanking my retirement? No. Here's proof

- How to borrow from your 401k for a down payment

- What about ROTH IRA withdrawals?

- How much can I borrow from a 401k?

- How much should I borrow to put down on a house?

- How a 401k loan affects your mortgage application (DTI, reserves)

- 401k Loan FAQ

- Is a 401k loan for you?

Should you tap retirement accounts to buy a home?

If you’ve perused Reddit on the topic, you’ll discover lovers and haters of this idea. Here’s what I noticed, though:

- Redditors who have used the strategy have no regrets and recommend it

- Critics of this approach have no real-world experience with it and speak in theoretical abstractions

Granted, I’m pro-homeownership whereas many others emphasize retirement savings.

My problem with the retirement-only approach is this: what good is a healthy retirement if you’ll be spending $7,500 per month in rent by then?

While compound interest is a powerful tool, so is locking in housing costs.

If I didn’t buy my current home in 2006, I would be spending $3,700 per month in rent for a similar home. I pay $2,700 per month for the mortgage, taxes, and insurance. The gap will widen when I pay off the home in about 10 years.

I wouldn’t trade my low housing expense for a larger retirement account. The cost of not owning will one day outstrip extra retirement income.

| My housing expense starting today | Cost of owning* | Cost of renting** | Difference |

| Years 1-5 | $178,000 | $222,000 | +$44,000 |

| Years 5-10 | $190,000 | $244,000 | +$54,000 |

| Years 10-15*** | $64,000 | $268,000 | +$204,000 |

| Years 15-20*** | $70,000 | $294,000 | +$224,000 |

*Added 10% to monthly payments to account for maintenance and upkeep. **Assumes rent increase of 10% every 5 years. ***Taxes, insurance, and upkeep costs only, increasing 10% every 5 years.

Eventually, renting will cost an additional $200,000 every five years versus owning.

I realize I’m 15 years into this journey and you’re just starting. That’s okay. Owning is always more expensive at first but won’t be in 10 years. And when you reach retirement, you don’t want to still be renting.

You will need a retirement account in the millions to compensate for rental prices over a 20- or 30-year retirement.

I didn’t pull from retirement to buy my home. But I contributed less over the years to make homeownership possible. So I am in a similar position to someone who pulls money out of a 401k.

I can say from experience that it is usually worthwhile to pull from your 401k to buy a home.

The sooner you lock in your housing costs, the lower your overall costs will be in retirement.

But that doesn’t mean the strategy is without risk and other considerations, which I’ll discuss below.

Start your home purchase with 401k loan funds.

But aren’t I tanking my retirement? No. Here’s proof

Certain Redditors say that withdrawing $10,000 in 401k money now costs you $300,000 in 30 years. Don’t take such claims at face value. The numbers don’t back that up.

As mentioned, your retirement account balance will suffer, but not your retirement itself. That’s an important distinction.

Think of a 401k loan as transferring money from one retirement asset to another.

While your retirement account balance is lower, the eventual equity in your home skyrockets. You also lock in housing costs, helping you spend less on rent in the future. This can accelerate future retirement contributions.

There are too many variables to make an exact prediction, but let’s see if you might come out ahead taking a 401k loan.

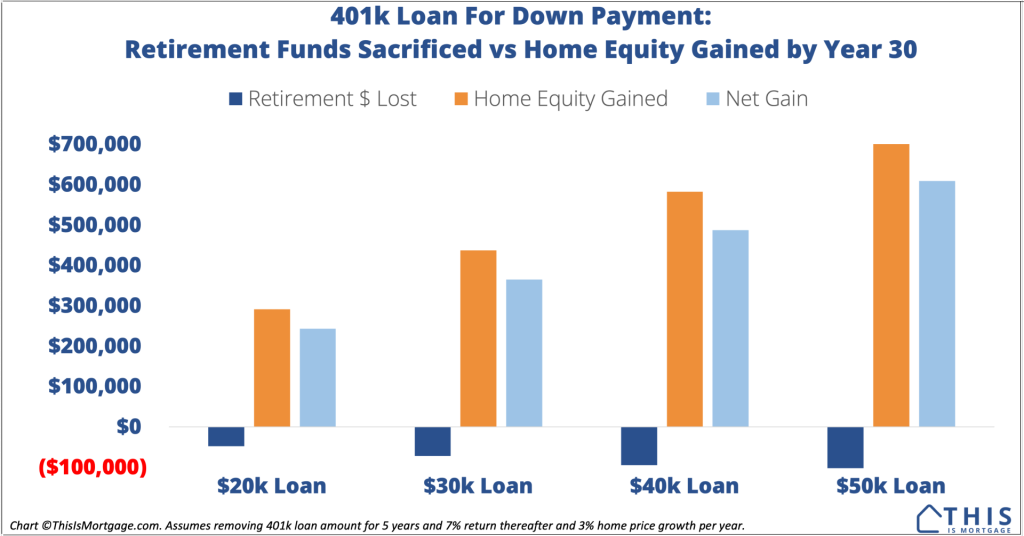

| Time horizon | 401k loan amount | Current home price | Retirement earnings lost by year 30* | Home equity gained by year 30** (Future value minus today’s value) |

| 30 years | $20,000 | $200,000 | $48,000 | $291,000 |

| 30 years | $30,000 | $300,000 | $72,000 | $437,000 |

| 30 years | $40,000 | $400,000 | $95,000 | $582,000 |

| 30 years | $50,000 | $500,000 | $119,000 | $728,000 |

*Assumes removing 401k loan amount for 5 years and compound interest difference at 7% return. **Assumes 3% home price growth per year.

By borrowing, say, $40,000 from your 401k, you could gain $582,000 in home equity in 30 years versus $95,000 by keeping those funds invested the full 30 years instead of 25 (you must pay back a 401k loan within five years).

Remember, $582k isn’t the home price after 30 years, it’s equity gained. The home price is $982,000.

You come out almost $500,000 richer by using a 401k loan to purchase a home.

And this is using a very generous growth of 7% for the 401k versus a conservative 3% home appreciation.

Plus, you end up with a home you can live in virtually free throughout retirement.

Any way you slice it, it doesn’t make much sense to avoid a 401k loan because you’ll “tank your retirement.”

See how much down payment you need.

How to borrow from your 401k for a down payment

There are two ways you can tap your 401k:

- A 401k loan

- A 401k withdrawal

Both methods are allowed when using funds for a home down payment.

401k loan

With a 401k loan, you pull money out for a down payment then pay yourself back with interest.

This really isn’t a loan because you’re borrowing from yourself. You receive the interest, not a bank.

One Redditor described it as borrowing from their older self, which is a helpful way to look at it.

Pros:

- No IRS penalties or taxes assuming the loan is paid back within five years

- Interest goes to you, not a lender

- Does not affect your credit score

- Lenders do not count payments toward your debt-to-income ratio

Cons:

- You miss out on growth of funds until they are paid back

- Loan may come due if you are laid off, fired, or your employer changes retirement administrators

- Must pay income taxes plus a 10% penalty if not repaid

- Could result in back taxes owed if you are laid off and can’t pay the penalties

Perhaps the biggest gotcha is that you may have to pay back the loan quickly if you lose your job. If you can’t pay it immediately, it could result in a hefty tax bill just when you can least afford it.

Before taking a 401k loan, talk to a representative with the investment firm. Think twice about taking a loan if the plan doesn’t give you time to pay back the loan upon job termination.

401k withdrawal

A 401k withdrawal is less risky but more expensive.

You don’t have to pay it back, but you will pay income taxes on the withdrawn funds. Most retirement accounts are funded with pre-tax dollars so you must pay taxes upon withdrawal.

You can avoid the extra 10% IRS penalty by providing the home purchase contract. According to IRS rules, 401k withdrawals can pay for “costs directly related to the purchase of an employee’s principal residence.”

Pros:

- You don’t have to pay funds back even if you lose your job

- No additional 10% penalty if funds are used toward a primary home

Cons:

- Taxed as ordinary income

- Miss out on growth of removed funds

What about ROTH IRA withdrawals?

A ROTH IRA is made up of after-tax dollars. In exchange, the funds grow tax-free until retirement.

Taking a ROTH IRA withdrawal is a bit easier than taking money from a traditional 401k. Here are rules of thumb:

- You can remove contributions at any time with no penalty

- You may have to pay taxes on earnings

- You can withdraw up to $10,000 in earnings tax-free for a first home purchase

For example, you contributed $50,000 into a ROTH IRA. The account value is now $70,000 because it’s gone up in value by $20,000. You could remove $50,000 tax-free, plus another $10,000 of the earned income, also tax-free. You would pay tax on the remaining $10,000 if removed.

Start the home buying process.

How much can I borrow from a 401k?

The IRS states you can get a loan of up to 50% of the 401k value or $50,000, whichever is less. Your plan administrator may have different rules.

Take out as little as possible to reduce the risk of high taxes if you can’t repay the loan.

How much should I borrow to put down on a house?

There are plenty of loan programs for first-time buyers that allow just 3-5% down. Though you’ll pay higher PMI rates, it could be worth putting a minimum amount down to acquire the house. This makes payback more manageable in the case that you’re laid off.

How a 401k loan affects your mortgage application (DTI, reserves)

Lenders do not count 401k loan payments against your debt-to-income ratio nor is it considered a debt. This is true for conventional, FHA, VA, and USDA loans.

However, the lender will reduce your assets on the application. This will affect reserves, lowering chances of approval.

For example, you have $25,000 in your 401k. You borrow $10,000. The lender now uses $15,000 as the asset value. If you need $20,000 in reserves because your credit is low, for instance, a 401k loan could jeopardize your approved status.

401k Loan FAQ

Each plan is different, but it typically takes just a few minutes to apply for a 401k loan or withdrawal on the plan administrator’s website. You may need to supply documents such as a purchase agreement to prove eligibility.

You simply make payments to your employer’s retirement administrator, which deposits funds and interest back into your account. You have five years to pay back the loan but can repay it faster.

Interest rates are typically the current prime rate plus 1% to 2%. Currently, the prime rate is 8.5% so a 401k loan rate could be 9.5% to 10.5%. This seems high, but prime rate is expected to fall in 2024 along with Federal Reserve rate cuts, bringing 401k loan rates down with them. And, remember that interest paid is to yourself, not to a bank.

Employer plan administrators determine whether you can have more than one loan out at a time. IRS rules state you can take a 401k loan every 12 months but your plan administrator may impose stricter rules.

Yes, and this is a great use case. A 401k loan is a good “bridge loan” to fund a down payment before selling your current residence. When you sell, simply pay back the 401k loan in full. You barely lose any momentum in your retirement savings or growth.

Is a 401k loan for you?

As shown above, it can be a very good idea to borrow from your 401k to lock in housing costs and start building equity.

Check your own numbers, but many people will come out way ahead in the long run by buying a home as soon as they can.