The Section 184 Loan Program is one of the best-kept secrets in home buying.

With just a 2.25% down payment, lower upfront mortgage insurance than FHA, no monthly mortgage insurance, and the ability to use it on and off the reservation, these loans are empowering Native American homebuyers every day.

Here’s how to use this powerful loan program.

Connect with a lender to see if you qualify for Section 184.

Section 184 Loan requirements 2024

Here are the main requirements for loan approval.

Tribal membership

To meet Section 184 Loan eligibility requirements, you must be a member of a federally-recognized Tribe. Additionally, the Tribe must be approved with HUD to facilitate Section 184 Loans. Many Tribes are approved, but not all. Check with Tribal leadership if your Tribe is not on the list.

Occupancy

You must plan to live in the home as your primary residence. No second homes or rental properties are allowed.

Type of home

- Single-family residence

- Duplex

- 3-4 unit home

- Manufactured homes on a permanent foundation

Loan purpose

- Buy a newly constructed home or existing home

- Build a home

- Purchase land and build a home

- Buy land and place a manufactured home on it

- Buy and renovate a home

- Renovate your existing home

- Refinance to reduce your rate or take cash out

Related: Section 184 Loan Rates

Credit score

The Section 184 Loan has no minimum credit score requirement, according to guidelines. However, most lenders will have their own minimum. If you are denied, apply with a different Section 184 lender.

Request a call from a lender to check your Section 184 eligibility.

Down payment

Down payment requirements are lower than for most major loan types.

- 2.25% down for loans over $50,000

- 1.25% down for loans under $50,000

For instance, a $200,000 home purchase would require just $4,500 down. You would need just $625 down for a $50,000 home purchase. Keep in mind, though, that you will need enough for Section 184 Loan closing costs, which are usually 2-5% of the home’s price. You can use a down payment assistance program from the Tribe or another government agency to cover down payment and closing costs.

Income

You need to show adequate income to qualify for the Section 184 Loan. The lender will compare your before-tax income with your future total payments including the house payment.

The total of all payments can be up to 43% of your before-tax income. So if you make $7,500 per month, for instance, your future house payment plus car, credit card, and student loan payments could total $3,225 per month. Use the Section 184 Calculator to estimate your future housing payment.

Mortgage insurance

Like most mortgage programs with small down payments, mortgage insurance is required. You will pay an upfront mortgage insurance fee of 1.0% of the loan amount, which can be wrapped into the loan. Monthly mortgage insurance is no longer required for Section 184 loans of July 1, 2023.

Loan limits 2024

Section 184 loan limits are $498,257 for 1-unit properties in most of the U.S. in 2024. Limits are higher for 2, 3, and 4 unit homes: $637,950 for 2 units; $771,125 for 3 units; $958,350 for 4 units. Loan limits are also higher for homes in more expensive locations. For example, a 1-unit home in Alpine County, California can be financed up to $510,400, and a 4-unit home in Saint Lucie County, Florida can receive a loan up to $1,050,500.

Start your home loan pre-approval with a lender.

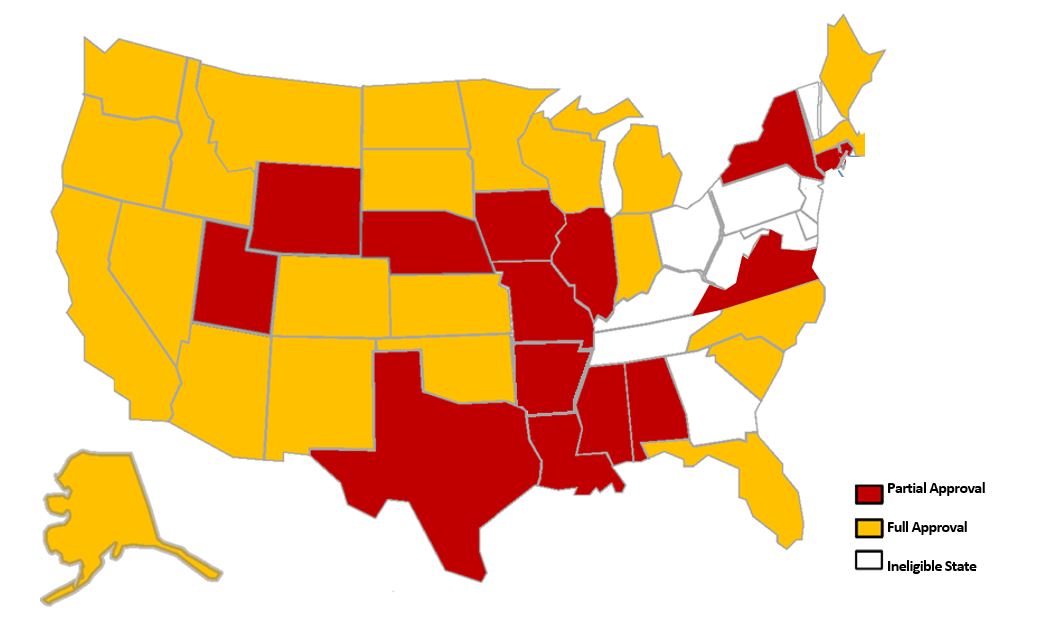

Eligible areas

Not every state and county is approved for Section 184 Loans. Keep in mind that you can use a Section 184 Loan in any approved county or state, not just on the reservation or in the same state as your Tribe is located.

For instance, if you are an official member of the Puyallup Tribe of Indians in Washington State, you can use the program to purchase a home anywhere in Florida. There are 24 states where the entire state is eligible, 14 states where only certain counties are approved, and 11 ineligible states.

Section 184 Loan lender

Not every lender can issue these loans. Only approved Section 184 Loan lenders are approved by HUD to do them.

Trust land approval

You’ll need a lease from the Tribe if you are buying on reservation land. You will work with your Tribe, the BIA, and HUD to create a leasehold estate.

Title Status Report

Loans for homes on reservation land will need a Title Status Report (TSR). Your local BIA office creates this. It is an ownership history of the land and home you are buying.

Section 184 Loan Requirements FAQ

Meet Section 184 Loan requirements for income, employment, down payment, and loan purpose. Then apply with an approved lender. If you’re buying on reservation land, you’ll request a lease from the Tribe and work with BIA for a report on the property’s ownership history.

Most loans require a 2.25% down payment, which is only $4,500 on a $200,000 home purchase.

You can let Tribal Leadership know that you are interested in a Section 184 loan and ask them to complete required steps to gain HUD approval. Requirements for approval can be found here.

Section 184 Loan Requirements Infographic

Section 184 Program: Your key to homeownership

Homeownership has been difficult throughout history for members of Indian Tribes because most lenders won’t issue a loan on a reservation. Plus, income, credit, and down payment requirements can be hard to achieve.

Fortunately, the Section 184 program allows lending on or off a reservation. And, it’s lenient about credit and the buyer’s financial situation.

See if you meet Section 184 Loan requirements by speaking to a lender today.

Connect with a lender to see if you qualify for Section 184.