Buying your first home is hard enough, but imagine purchasing a home with low income, and being the first in your family to do it.

This is where the $25,000 Downpayment Toward Equity Act hopes to help.

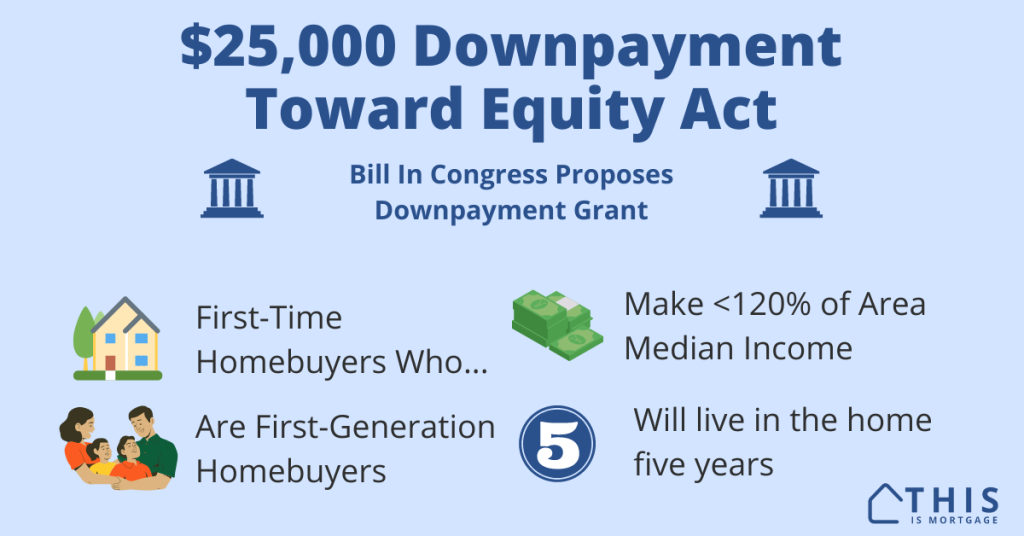

It is a bill introduced in Congress that seeks to assist first-time, first-generation homebuyers to break into the housing market and gain wealth through home appreciation.

This downpayment grant is not yet available; it’s still under review by the nation’s lawmakers. But, if the bill’s sponsors have their way, many historically disadvantaged homebuyers could soon be living in their own homes.

See if you qualify to buy before the assistance is available. Start here.

- Downpayment Toward Equity Act explained

- Proposed requirements

- How this first-generation down payment assistance can help homebuyers

- Is the Downpayment Toward Equity Act a grant, loan, or tax credit?

- When will the Downpayment Toward Equity Act become law?

- How some could get even more than $25,000

- Downpayment Toward Equity grant example

- Downpayment Toward Equity grant alternatives

- FAQ

- Check your homebuying readiness

Downpayment Toward Equity Act explained

The Act proposes a $20,000 downpayment grant to be used toward the purchase of a home, with another $5,000 available to economically or socially disadvantaged buyers.

It is meant to give historically underserved and underrepresented groups a fair shot at owning a home.

The grant could be used for:

- The downpayment on a home

- Closing costs

- Buying down the interest rate

For instance, a homebuyer is purchasing a $325,000 house with 5% down. The downpayment would be $16,250. At closing, the entire down payment would be covered, and nearly $9,000 would be left over for closing costs and to buy down the interest rate, making ongoing monthly payments more affordable.

Proposed requirements

If signed into law as-is, eligible homebuyers would need to meet the following requirements.

Income: You would need to make 120% of their area’s median income or less, based on the home’s location or your current address. That limit could rise to 180% in high-cost areas.

First-time buyer: You have not owned a home in the last three years, or you are a displaced homemaker or single parent who owned a home with your ex-spouse.

First-generation homebuyer: Your parents or household do not have ownership in a home or you were placed in foster care at any time.

Use standard financing: You use a Fannie Mae or Freddie Mac conventional loan, FHA, VA, USDA, or Section 184 Native American home loan.

Will live in the home 5 years: After five years, the grant is forgiven. Except for emergency situations, those who leave earlier need to pay back a portion of the grant based on the number of years of residence.

Take homeownership counseling: Buyers must pass a HUD-approved homeownership counseling course.

Economic disadvantage: To receive $25,000 instead of $20,000 you must identify as part of a socially or economically disadvantaged group. Anyone who is already eligible for the program should qualify for $25,000 since “economic disadvantage” is defined as making 120% or less of area median income, a requirement to be eligible in the first place.

Approved home type: Eligible grant recipients must buy a single-family home, duplex, triplex, or fourplex that is classified as residential property.

Check your homebuying readiness and eligibility for other grants. Start here.

How this first-generation down payment assistance can help homebuyers

Family history has a bigger effect than most people realize.

Those whose parents were not homeowners may not have a built-in framework from which to launch their own homeownership journey.

The data backs up that statement. Children of homeowners are three times more likely to own a home themselves, says a Trulia study. In other words, if your parents weren’t homeowners, you are only about one-third as likely to buy a home.

This bill seeks to create generational wealth by kickstarting a new group of first-generation buyers.

Another goal of the Act is to narrow the homeownership gap between minority homeownership and that of the white population. Only 44% of Black Americans own their homes, while nearly 73% of white Americans do. This 29-point gap is worthy of narrowing (or eliminating altogether, frankly). Native American and Hispanic homeownership rates are lower as well. The bill would be a significant step in encouraging homeownership for those who may have been historically locked out.

Is the Downpayment Toward Equity Act a grant, loan, or tax credit?

Homebuyers are wary of “free money,” as they should be. Is there a catch when receiving the funds?

The money is not a loan or a lien placed on the house. You would not be going into debt by accepting funds.

Fund would come in the form of a grant, i.e. a direct payment to the closing agent on your behalf at time of loan closing. The grant would reduce or eliminate any of your own funds due at closing. Because you would know that you qualify for the grant before you apply, the lender would structure the loan to use all available funds to your advantage.

This is better than a loan or tax credit. Many downpayment assistance programs come in the form of a loan that must be paid back when you sell or refinance.

Tax credits don’t help those without upfront funds. You must cover your own down payment and hope to be reimbursed via a tax credit the next time you file tax returns.

That being said, there is a repayment requirement if you vacate the home prior to the five-year mark. You must return

- 100% of the grant money if you leave the home within 1 year

- 80% if you leave before 2 years

- 60% if you leave before 3 years

- 40% if you leave before 4 years

- 20% if you leave before 5 years

- $0 repayment if you leave after 5 years

The bill provides an exception if you experience a hardship, such as military deployment, death of a borrower, or other approved reason.

When will the Downpayment Toward Equity Act become law?

As with any new legislation, this bill could take time to pass. It might not become law at all, and if it does, it could undergo significant revisions.

It was introduced into the U.S. House of Representatives (the first stage) in July 2021. It would have to be passed by the House via a vote, then sent to the Senate. The Senate would review, make changes, then take a vote. If passed, the bill would be sent to President Biden to sign into law.

More recently, the bill was then ordered to be amended in June 2022. There has been no additional movement in 2023.

- The bill was created and sponsored – DONE

- Studied by a Committee – DONE

- Introduced to the House – DONE

- Amendments requested – DONE

- House Vote – Incomplete

- Passed by House – Incomplete

- Reviewed and Passed by Senate – Incomplete

- Signed into Law by the President – Incomplete

We will keep this article updated with developments.

How some could get even more than $25,000

There are two ways some buyers could get even more than $25,000 for homebuying.

First, the bill allows the grant to be larger in high-cost areas where home prices are higher. There is no maximum given for this provision, so it would be up to the final version of the bill or local housing authority to determine the maximum.

Second, buyers could combine these grant funds with other down payment assistance. For instance, if you received $25,000 from the Downpayment Toward Equity grant, and another $10,000 grant from a local non-profit or state housing agency, you would have $35,000 to spend on your down payment, closing costs, and rate buydowns.

Downpayment Toward Equity grant example

| Downpymnt Toward Equity Assistance | No Assistance | |

| Home price | $350,000 | $350,000 |

| FHA down payment | $12,250 | $12,250 |

| Closing costs* | $7,500 | $7,500 |

| Buy down rate 1%* | $6,000 | none |

| Total upfront costs | $25,750 | $19,750 |

| Grant | $25,000 | $0 |

| Personal cash required | $750 | $19,750 |

| Interest rate* | 5.5% | 6.5% |

| Monthly payment* | $2,500 | $2,715 |

*Estimated for example purposes. Not real costs or quotes. Est payment includes typical taxes, insurance, HOA.

The grant recipient comes out ahead in two ways. First, their upfront cash requirement is reduced by $19,000. Second, they were able to buy down their mortgage rate with extra funds, saving them over $200 per month.

Downpayment Toward Equity grant alternatives

Though the grant is not available yet, there are plenty of alternatives.

Grants and down payment assistance exist in every state in the U.S. Many are available within certain cities or counties; others you can get statewide. Each program has its own requirements, so check with your state housing finance agency.

However, there are some programs that are available nearly nationwide.

Empowered DPA Program: This offers 3.5% down payment assistance to first-time buyers, first responders, teachers, and other groups. It is available in almost every state in the country. Find out more about Empowered DPA.

Good Neighbor Next Door: Buy a home at half price with just $100 down if you’re a police officer, teacher, firefighter, or EMT.

National Homebuyers Fund: Up to 5% down payment assistance for eligible buyers.

Chenoa Fund: This is a 3.5-5% down payment assistance program. However, the assistance comes in the form of a repayable or forgivable loan, but the buyer must make a certain number of on-time payments to have the loan forgiven.

Check your eligibility for these and other downpayment assistance programs.

FAQ

No, all funds must be used for the down payment, closing costs, or rate buy-downs at the time of closing. You will work with your lender to make sure that any extra funds are used in the transaction for rate buydowns and prepaid items like taxes and insurance.

Yes. Even if you qualify under the disadvantaged group guideline, you still must be within income limits.

Use this Fannie Mae tool. Look up your address or the neighborhood where you would buy. Multiply the Area Median Income by 1.2.

The bill has not been signed into law, so it is not yet available and there is no application process determined. We will keep this article up-to-date with developments.

The current version of the bill does not allow past homebuyers to be reimbursed. So if you purchase a home now, you can’t apply grant fund later if the program becomes available.

Check your homebuying readiness

While you wait for the Downpayment Toward Equity Act to be approved, it’s a good idea to see how ready you are to buy a home even without it.

Many people are surprised that they can buy a home now with an existing downpayment assistance program or using a low down payment loan.

See if you are ready to buy a home using other assistance. Start here.