When people think of home affordability, they consider getting the best purchase price, lower mortgage rates, or home buyer assistance.

All those can go a long way toward affording a larger home and mortgage, but what about solar?

Yes, a solar panel system can help you qualify for more house. Here’s how.

Contact a lender to see if solar can help you buy a home.

Qualify for a larger loan using FHA EEH “Stretch Ratios”

There’s a very obscure feature within the popular FHA loan homebuying program called “EEH stretch ratios.” What does that mean?

What is FHA EEH?

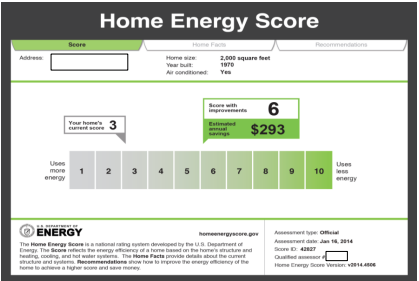

First, let’s find out what EEH means. This is a home efficiency standard recognized by FHA. A home is officially an “Energy Efficient Home” (EEH) when it scores 6 out of 10 on a Home Energy Score Report (more about this report later).

The home can be a “6” or higher before you buy, or you can bring it up to a “6” with upgrades such as solar panels.

What are “stretch ratios”?

FHA mortgages set a limit for your debt-to-income ratio.

For instance, if you spend 43% of gross income on all debt payments plus your future housing payment, your debt-to-income ratio is 43.

The standard FHA maximum ratio is 43. With the FHA EEH Stretch Ratio program, you can have a total debt-to-income ratio of 45.

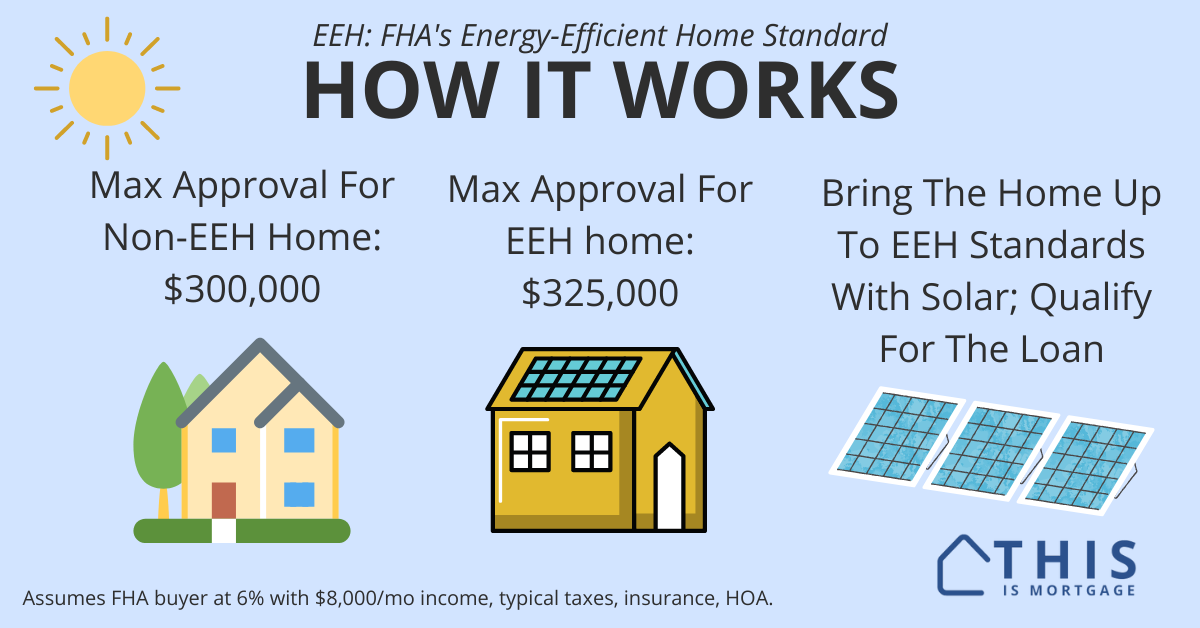

In real dollars, someone with $8,000 per month in gross income can qualify for a home payment that’s $160 more than the amount normally allowed. That might not sound like much, but with a 6% FHA loan, you can qualify for a $25,000 higher purchase price or equivalent upgrades.

Contact a lender to see how much you can afford.

Adding solar equipment costs into the FHA loan

We just said that you can qualify for a bigger loan or energy-efficient upgrades when your future home meets EEH standards.

A bonus, though, is that you can bring the home up to EEH standards, and finance those upgrades into the FHA loan.

Yes, FHA allows you to finance the cost of a solar panel system at the same time as the home purchase. You do this by using another feature called the Solar and Wind Technologies policy.

Under this policy, you can use the FHA loan to finance the cost of a photovoltaic system that provides energy to the residence.

The maximum amount you can roll into the FHA loan is the actual cost of the system plus installation, or 20% of the home’s value, whichever is lower.

Speak to a lender about energy efficient mortgage options.

For instance, you find a $300,000 home that you like, but it does not have solar panels. Solar plus installation would cost $25,000. FHA allows you to roll that cost into the loan as long as you buy the solar panel system (not lease it).

This is allowed whether or not you need the Stretch Ratio provision. Anyone who qualifies can wrap solar into the FHA loan using the Solar and Wind Technologies guideline.

However, you can also combine this Solar and Wind policy with the Stretch Ratio rules if you can not qualify for the loan with the home and solar combined.

In short, the Stretch Ratios rule lets you qualify for more home and more upgrades if those upgrades bring the home up to EEH standards.

Afford more by finding an EEH home

Keep in mind that the Stretch Ratios rule can help you buy a more expensive home, not just finance solar installation.

Any EEH-rated home qualifies you to have higher debt-to-income ratios with FHA.

For example, you are at the 43% debt-to-income limit. But you find an EEH home that is above your approved price range.

Someone making $10,000 per month can “stretch” their FHA monthly payment by about $200. This gives them about $35,000 in additional buying power assuming an FHA loan at 6%.

You have the choice of using that extra buying power to add solar panels or simply buy a bigger home.

Getting a Home Energy Score Report with a score of 6 or higher

You can qualify for a bigger FHA loan if the home scores (or will score after upgrades) 6 or higher on an official Home Energy Score Report.

This report must come from a qualified Home Energy Score Assessor. You can find an approved assessor at Energy.gov.

First, schedule your inspection. The assessor will determine the home’s current score, then outline upgrades necessary to bring it up to a score of 6.

Energy.gov’s Home Energy Score needed for an FHA EEH mortgage. Source: HUD.

With FHA, you can finance many types of energy-efficient upgrades, such as insulation, Energy Star-rated HVAC, and yes, solar. Most items can be included in the FHA loan using a combination of the Solar and Wind Technologies Policy, Weatherization Policy, and Energy Efficient Mortgage (EEM) Program.

With the report in-hand, the lender can qualify you for the Stretch Ratios and get you into an efficient home, with upgrades financed at a lower monthly cost than many other financing methods.

Connect with a lender to see if solar can help you buy a home.

Completing the solar panel installation

Most likely, the home seller will not let you add solar to the home before the sale closes. This is perfectly okay.

FHA allows the lender to hold back loan funds to pay for the solar installation after closing. Then, you have 120 days to install the system.

The whole process would look like this:

- Get pre-approved for the home price plus approximate solar cost

- Find a home and make an offer

- Get a Home Energy Score Report

- Determine upgrades needed, including solar, to raise the Energy Score to 6

- Get a contractor bid for solar plus other upgrades

- Submit the Home Energy Score Report and bids to your lender

- The lender will finalize the loan

- Close the loan

- The lender holds backfunds for solar and installation

- Complete the solar installation within 120 days

The loan is essentially like any other, except there’s the one additional step of completing the project after closing.

The big benefit is that you don’t have to find a home with solar panels already installed. Find the home you love, and add solar panels using the FHA loan.

Solar panels: Making the home more affordable long-term

You might be thinking that FHA has debt-to-income maximums in place for a reason. Why, then, do they let you qualify at higher ones?

According to FHA, it’s because they know your monthly costs of homeownership will be lower with solar panels and other energy-efficient features.

Sure, your payment is, for example, $160 per month higher. But if your energy bill is $300 per month lower, the home is more affordable overall.

And those energy savings last long after the mortgage is refinanced to a lower payment or paid off completely. The energy savings are yours as long as you own the home.

When you think of home affordability, think beyond purchase price and interest rate. Think energy, and it will open up new opportunities in your goal of homeownership.