I’m going to give you advice that you don’t want to hear. If you’ve already decided that you want to buy a car before buying a house, then don’t read this article.

One of the biggest challenges for many first-time buyers was qualifying for the home they wanted because they had a car payment.

A car payment is about the worst thing you can do to yourself if you want to buy a home.

If your goal is to be in a reliable car, maybe even one that impresses someone, then that should be your goal. Not homeownership.

If you want to achieve the infinitely more important goal, then read on.

Check your homebuying eligibility.

- A car loan is destructive to your home buying power

- Chart: How a car payment affects home buying power

- Prioritize homebuying

- Have high income? Still resist a high car payment

- That’s big talk, but do I do this stuff?

- Other ways to solve for needing a car

- Possible exceptions

- Buying a car before buying a house FAQ

- Sorry, not sorry

A car loan is destructive to your home buying power

First, let me clarify my position.

My main problem is the car payment, not the car itself. You might have cash set aside to pay for a car in cash. This is fine in my book, if you also have enough cash for a small down payment, closing costs, and a 3-6 month emergency fund.

But here’s what a car payment does to your qualifying chances.

For conventional and FHA loans, your total debt payments including the new house are limited to between 43-56% of your gross income.

A car payment eats up a lot of that percentage. Here’s how a car payment diminishes your homebuying power.

| Other debt payments | Car payment | Max home payment* | Max home price* |

| $500 | $0 | $2,300 | $315,000 |

| $500 | $300 | $2,000 | $270,000 |

| $500 | $500 | $1,800 | $240,000 |

| $500 | $750 | $1,550 | $200,000 |

| $500 | $1,000 | $1,300 | $160,000 |

| $500 | $1,250 | $1,050 | $120,000 |

*Assumes $75k annual gross income, an FHA loan at 3.5% down and 6% APR interest rate, 45% back-end ratio, $200/mo property taxes and $50/mo insurance, no HOA. Your rate and costs will vary.

I can’t overstate how destructive a car payment is to your homeownership goals.

Using the assumptions above, each $100 in car payment reduces your home buying power by $15,400.

The average car payment, says the New York Times, is about $700. That payment would diminish homebuying power by nearly $110,000.

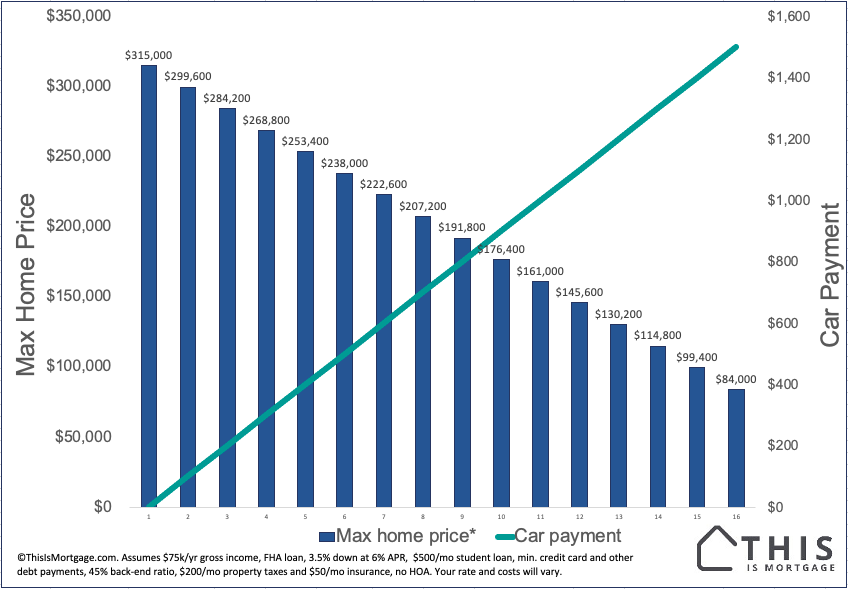

Chart: How a car payment affects home buying power

This chart shows how your homebuying power decreases as your car payment increases.

Prioritize homebuying

When considering financing a new or even used car, do something first. Check prices on the type of home and area you’d like to live in.

Now cut that price by $110,000 and see what’s available. If you’re disappointed, that’s a good indication that you should delay a big car purchase.

The key is to prioritize. The “future you” wants a wealth-building asset that also fires your landlord and locks in housing costs. The “present you” wants a depreciating toy that removes your wealth monthly.

Prioritizing your future is never fun in the moment.

See how much home you can afford.

Have high income? Still resist a high car payment

Now that I’ve railed against financing a car, I’ll add that a lot depends on your income.

For instance, someone with a $150,000 income can absorb a much bigger car payment.

That being said, I don’t think high income is a license to spend as much as you want on a car. At the end of the day, it’s still a depreciating asset that removes wealth.

There are better places to put your money. Say you buy a new car for $42,000. The payment on a 5-year term would be $800. Instead, put $800 per month into a car fund for the next year. You would have $9,600 cash for a car. After you purchase your cheaper but okay car, invest $800 per month in an index fund that yields 7% per year for the 4 remaining years. At the end of the five-year total, you have a car that didn’t depreciate much, and $44,000 sitting in investments.

If you bought a new car now, you spend the same amount of money in payments. But in five years you have zero in investments and a car worth $15,000 if you’re lucky.

That’s nearly a $30,000 difference in wealth five years from now, and could go a long way toward a down payment or accomplishing long-term goals.

Start your pre-approval to see how much home you qualify for.

That’s big talk, but do I do this stuff?

I don’t just preach this stuff; I live it too.

A couple years ago my 2003 Ford Explorer needed to be replaced. It was costing me $1,000 per year in repairs, for a car worth $500 (literally). Though I had a good six-figure income, I purchased a used vehicle for $34,000 out-the-door (taxes, fees, registration etc.). I put half down in cash and paid the rest off over six months.

And I only financed the purchase because I had already been a homeowner for 15 years, and the payment was only about 2% of my monthly income.

I could have afforded a car well over $100,000. Think how impressed everyone would have been.

Instead, I prioritized attaining true assets. Over the following couple years, I was able to purchase two investment properties that now throw off more than $500 per month in income.

My overall point is that a car is generally a bad investment and your future self will thank you for making reasonable choices now.

Other ways to solve for needing a car

I want to be realistic and acknowledge that sometimes you just need a car.

Up until my “extravagant” $34k car purchase, I bought cars on Craigslist in cash (selecting a secure location like a bank for the exchange). Or, I wrote a check at a dealership. Some of my previous purchases were:

Craigslist:

- 1999 Subaru Outback: $3,000

- 2003 Ford Explorer: $7,000

- 2005 Nissan Altima: $7,500

Wrote a check for the whole amount at the dealership:

- 2015 Mazda CX-9: $20,000

- 2017 Toyota Sienna $23,000

I started off buying pretty cheap cars. As my income grew, I put money in a designated car savings account each month so that the next time I bought a car, the cash would be sitting there.

These cars were fairly reliable for years. And if they weren’t, I had a car repair savings fund to fix it.

I won’t derail this post to tell you how to buy a car, but I would refer you to Mr. Money Mustache who has some more in-depth (although perhaps more extreme) advice on the topic.

Most of the time it comes down to lowering your expectations and being satisfied with a vehicle that will impress no one – except your future self.

Possible exceptions

About the only exceptions I can think of are:

High-profile sales position: You are physically driving clients around and can’t show up in a Honda Fit. I get that.

Buying a vehicle necessary for the business: For example, you need a huge diesel truck because you own a construction company and tow heavy loads to job sites.

Your income is high versus area home prices: In some areas of the country like the midwest, home prices are a fraction of those on the coasts. And if you have high income as well, a car payment may not affect you. Still, my original point remains: a car is a bad investment. You’d be better buying 3 or 4 rental properties or putting extra income into investments.

In the above cases, the vehicle is “earning its keep.” Just make sure the business is profitable enough to support the vehicle payment. It should be considered a business asset and expenses tracked accordingly.

Buying a car before buying a house FAQ

Typically, you should not take on a large car payment before buying a house. At $75,000 annual income, each $100 in car payment decreases your home purchasing power by $15,400.

Buying a car with cash is better than taking on a payment. You’ll have less cash for a down payment on the house, but you can use low down payment programs and down payment assistance. It’s nearly always better to buy an inexpensive car with cash than an expensive car with a payment.

That depends on your income and savings level. But any car payment will diminish your home purchasing power to some degree. You should only spend as much as you have set aside for that purpose. If you don’t have cash saved, start saving the amount you would have spent on payments. In a year, you could have enough to buy a modest vehicle with cash.

Sorry, not sorry

If you were looking for an article that said it’s okay to take on a large car payment and buy a home too, this isn’t it.

Many people search for opinions on Google and social media that reinforce a previous belief. That’s called confirmation bias. You won’t find that here if your previous belief was that you should buy a car before a house.

My views on this topic are pretty one-sided. Pre-homeowners really have no business buying an expensive car. I can’t tell you how many Teslas, BMWs, and Aston Martins I see in apartment complex parking lots. I truly feel sorry for these people.

It doesn’t matter if you’re buying a house now or in five years. A large car payment will derail your plans or at least limit your options whenever you go to buy a home.

But, if you choose wisely, and you don’t care if people are impressed by your car, you’ll come out way ahead of your friends. In five and ten years, you’ll have the last laugh.