If you’re buying a home that has peeling paint anywhere on the structure, you may need to get it repaired whether or not you want to waive this requirement. It all depends on when the home was built.

- Peeling paint repair requirement for pre-1978 homes: Can't be waived

- Peeling paint on homes built in 1978 or later

- What can I waive when it comes to peeling paint?

- Lead paint inspection waiver free download

- Alternatives to the seller repairing paint

- FHA peeling paint waiver FAQ

- Don’t be afraid to get a second opinion.

Peeling paint repair requirement for pre-1978 homes: Can’t be waived

Peeling paint must be repaired if the home was built before 1978. You may not waive this requirement.

This is because, before 1978, lead paint was legal and often used on homes. Peeling and chipping paint on a pre-1978 home is a health and safety issue. It could result in lead poisoning of the residents.

FHA will not allow a loan to close if there are any health or safety issues with the property, including possible lead exposure. Again, this repair can not be waived.

Got the best FHA deal? Get a second opinion.

Peeling paint on homes built in 1978 or later

According to FHA guidelines, the FHA loan can close without repairing chipping paint in some cases. The home must have been built in 1978 or later, and the chipping is purely cosmetic.

Repair is only required on a 1978+ home when missing paint “exposes the subsurface to the elements.” In other words, there’s bare siding that might rot due to lack of paint.

What can I waive when it comes to peeling paint?

By now, you’re disappointed that you can’t waive paint repair requirements on a pre-1978 home. That’s understandable. It’s a pain to get the seller to fix a small repair like that. Unfortunately, the repair must be done.

So what exactly can you waive?

On a pre-1978 home, you can waive the 10-day period in which to conduct a lead paint inspection. FHA allows this window of time before you become obligated to purchase the home. In other words, you get a free extra 10 days to inspect lead hazards on the home. At any point during that time, you can back out of the purchase.

Waiving this right, though, can come in handy in a seller’s market.

For example, you sign a purchase agreement for a 1965-built home on June 1. The seller wants to eliminate ways in which you can get out of the contract by June 5. As a condition of purchase, the seller wants you to waive your 10-day window for a lead inspection.

To get the home, you can waive that opportunity. If lead is later discovered, you can’t use it as a reason to withdraw from the purchase.

While it’s risky, it’s within FHA guidelines to waive the right to your lead inspection waiting period. Always consult your agent and other professionals before exercising your waiver.

See if you can get a better deal on your FHA loan. Start here.

Lead paint inspection waiver free download

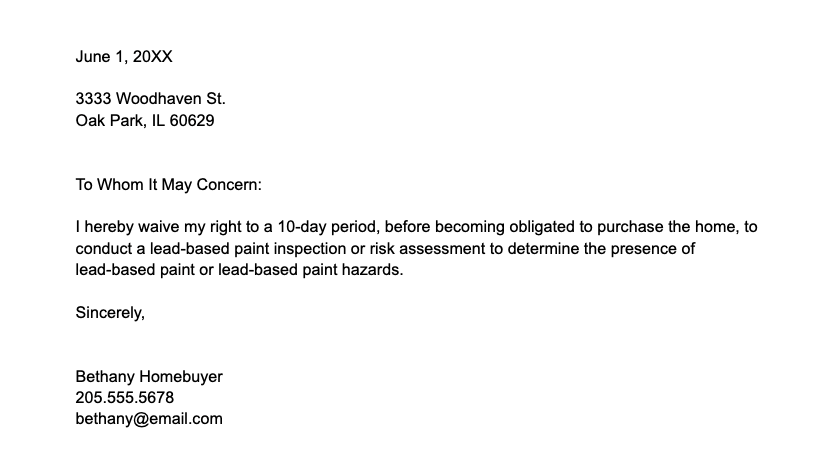

If you would like to waive your 10-day window, the lender may supply their required form. If not, you could use something like the below, which uses wording from the HUD 4000.1 guidelines.

>>Go to the Google Doc template

Sample text:

Property address

To Whom It May Concern:

I hereby waive my right to a 10-day period, before becoming obligated to purchase the home, to conduct a lead-based paint inspection or risk assessment, to determine the presence of lead-based paint or lead-based paint hazards.

Sincerely,

[Your Name]

[Date]

Alternatives to the seller repairing paint

There’s not much you can do to avoid repairing paint on an older home. Luckily, this is a relatively fast and cheap fix. With any luck, the seller will take care of it.

If the seller refuses, you have some options.

FHA repair escrow

FHA allows you to finance up to $5,000 in repairs to be completed after closing. With this option, there’s no risk of doing the repairs yourself before closing just to have the sale fall through.

More: Check out our first-time buyer’s hub here.

FHA 203k

If you’d like to complete larger projects, you can use a Limited FHA 203k loan. Finance cosmetic as well as safety-related repairs into your home purchase loan, up to about $31,000 before contingency costs and other fees. There’s also a Standard 203k loan for which there’s no repair cost limit except for local FHA loan limits.

Find another home

If no options are working, you may have to find another home. The seller should know, though, that a conventional appraiser will probably require the same repair. A safety issue is a no-go for any loan type.

FHA peeling paint waiver FAQ

You can not waive a peeling paint repair that is required by the appraiser. Homes built before 1978 may have lead-based paint, which is a safety hazard. All safety issues must be repaired before an FHA loan can close.

Yes, you can waive your right to a 10-day window in which to perform a lead-based paint safety inspection for an FHA loan. However, you can’t waive peeling or chipping paint repairs required by the appraiser.

Yes, you can make safety-related repairs after closing if you use the FHA repair escrow program. You can resolve hazardous or cosmetic issues after closing with the FHA 203k program.

You can offer to make repairs after closing using the FHA repair escrow or FHA 203k programs, or you can find a different home to buy that was built on or after 1978 or without paint issues.

Don’t be afraid to get a second opinion.

If you’re having trouble with your FHA lender or just want a second opinion, contact me with any questions. I’d love to help. I can connect you with a reputable lender who can get the job done.