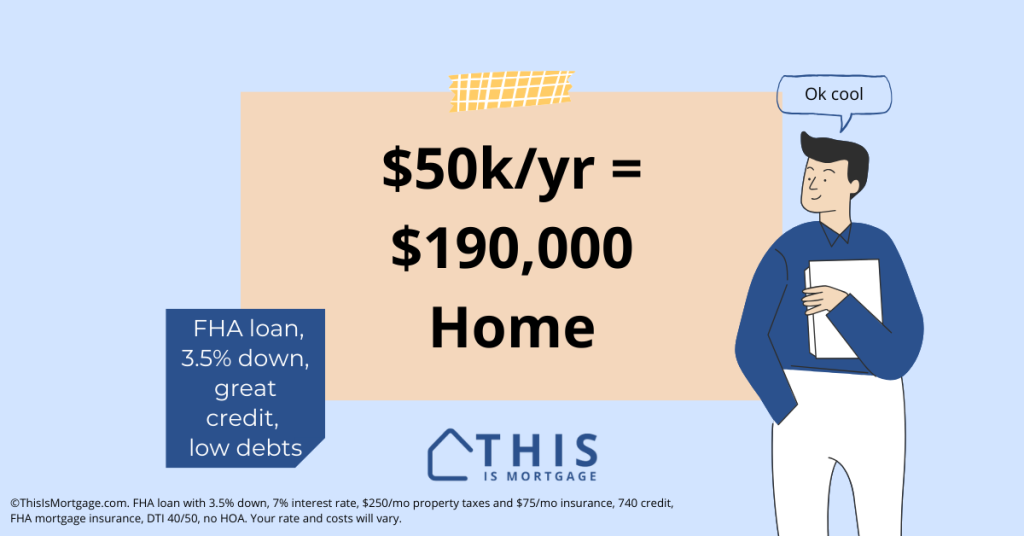

If I Make $50,000 A Year What Mortgage Can I Afford?

You can afford a home price up to $190,000 with a mortgage of $186,559.

This assumes a 3.5% down FHA loan at 7%, a base loan amount of $183,350, financed upfront mortgage insurance premium of 1.75%, low debts, good credit, and a total debt-to-income ratio of 50%.

Remember that many factors affect this number including property taxes, homeowner’s insurance, HOA dues, and more. Apply with a lender to find your personalized maximum home price.

Speak to our lending team to see what you can afford with a $50k salary.

@this_is_mortgage How much home can you buy with $50kyr salary? It’s totally possible. 💪💰🏠 #firsttimehomebuyer #mortgagetips #thisismortgage #mortgagetok #homebuyer #mortgageadvice

♬ 1901 – Instrumental – Phoenix

$50,000 income mortgage payment breakdown

Principal and interest payments aren’t the only costs due each month. Many advertisers leave out other expenses like mortgage insurance and property taxes. But you must factor in all costs that lenders do: property taxes, homeowners insurance, and HOA dues.

| Part of payment | Amount |

| Principal & interest | $1,241 |

| Monthly mortgage insurance | $82 |

| Taxes | $250 |

| Homeowner’s insurance | $75 |

| HOA dues | $0 |

| Total payment based on these assumptions (40% DTI) | $1,667 |

See assumptions for all calculations at the bottom of this article.

Home affordability by monthly debt payments

Your debt level affects your buying power perhaps more than anything else.

For instance, say you have $300 in monthly debt such as student loans and credit card payments. This amount of debt isn’t hurting you much. But adding an additional $400-per-month auto payment would reduce your maximum home price to just $150,000 instead of $190,000.

Lenders can approve you to use up to about half your gross monthly income toward debt payments. That’s $2,083 for an annual salary of $50,000. About 40% of your gross income ($1,667) can be used for the house payment leaving about $400 for other debts.

| Yearly income | $50,000 |

| Monthly income | $4,167 |

| Max house payment (40%) | $1,667 |

| Max housing + total debt payments (50%) | $2,083 |

Terms you might hear are “40% front-end debt-to-income (DTI) ratio” and “50% back-end DTI.” This just means you’re spending 40% of gross income on the house and an additional 10% on other debt payments. Borrowers with good credit can be approved with higher ratios, but to be safe we are using these numbers.

Following is what you might qualify for depending on your current debt load.

| Annual Income | Monthly Debt | Max House Payment | Max Home Price |

|---|---|---|---|

| $50,000 | $0-$400 | $1,667 | $190,000 |

| $50,000 | $500 | $1,583 | $180,000 |

| $50,000 | $700 | $1,383 | $150,000 |

| $50,000 | $1,000 | $1,083 | $105,000 |

Related: Buying a Home With Zero Down Payment

Connect with a lender to see what you can afford.

Maximum home price by down payment

Your down payment dramatically affects affordability.

For one, your loan balance drops with a higher down payment, resulting in a lower payment. Additionally, you pay less mortgage insurance when you put more down.

| Annual Income | Down Payment | Monthly Payment | Home Price |

|---|---|---|---|

| $50,000 | 3.5% | $1,667 | $190,000 |

| $50,000 | 5% | $1,667 | $195,000 |

| $50,000 | 10% | $1,667 | $205,000 |

| $50,000 | 20% | $1,667 | $250,000 |

No down payment? Many programs let you buy a home without one. Start here.

Maximum home price by interest rate

Interest rate is another significant determiner of your maximum home price. If rates drop, it’s a great time to enter your home search.

| Annual Income | Interest Rate | Monthly Payment | Home Price |

|---|---|---|---|

| $50,000 | 8% | $1,667 | $175,000 |

| $50,000 | 7% | $1,667 | $190,000 |

| $50,000 | 6% | $1,667 | $210,000 |

| $50,000 | 5% | $1,667 | $230,000 |

Maximum home price by desired debt-to-income level

While many financial gurus suggest you have a debt-to-income of 25% or less, it’s unrealistic in most markets. Pushing your front-end (housing) DTI from 25% to 40% increases your buying power by over $135,000 at an income of $50,000.

| Annual Income | DTI | Max Payment | Home Price |

|---|---|---|---|

| $50,000 | 25% | $1,040 | $110,000 |

| $50,000 | 40% | $1,667 | $335,000 |

Ways to increase your buying power

Here are ways to qualify for more home.

Adjustable-rate mortgage (ARM): As seen above, reducing your rate from 7% to 6% can increase your buying power by $30,000 at your income level. An ARM gives you a fixed rate for a few years, hopefully enough time to refinance or increase your income to afford a potentially higher payment later.

Avoid HOAs. Adding HOA dues to your housing payment could cut your buying power by $50,000 or more.

Put more down or get gift funds. The lower your mortgage balance, the lower your payment will be. Try to find down payment assistance (DPA) programs or get a gift from family to reduce your loan amount.

Use FHA. These loans are lenient on debt-to-income ratios. Conventional loans allow a DTI up to 45% including all debts and total housing payment (50% in select cases). FHA’s max is 56.9% for well-qualified buyers.

Pay off debt: Paying off a $500 car payment can increase your buying power by $75,000.

Request a call from a lender to see what you can afford with a $50k salary.

FAQ

You may be able to afford a $190,000 home with an FHA loan of $186,559 and a monthly payment of $1,667 which is 40% of your gross income. Your maximum mortgage depends on your debts, interest rate, property taxes, homeowner’s insurance, HOA dues, loan program, and payment comfort level.

Reducing your debt payments by $500 per month can increase your maximum home price by about $75,000 if you make $50k per year. Paying off debt will help you qualify for a better home that will suit your needs longer.

You don’t need a high credit score. An FHA lon requires just a 580 score and allows for high debt-to-income ratios. However, a higher credit score will help you qualify for a larger loan and better terms.

$50,000 income isn’t too low to buy a house.

You may have been told that you can’t afford a home on $50,000 per year. But if you use creative financing for homeownership and are committed to becoming a homeowner, you can very likely make it happen.

Speak to a lending professional to see if you are eligible to buy a home.

All calculations assume a 3.5% down FHA loan at 7%, $250/mo property taxes and $75/mo insurance, FHA monthly mortgage insurance, 1.75% upfront FHA MIP, 740 credit score, no HOA, $400 or less in monthly debt payments. Your rate and costs will vary.