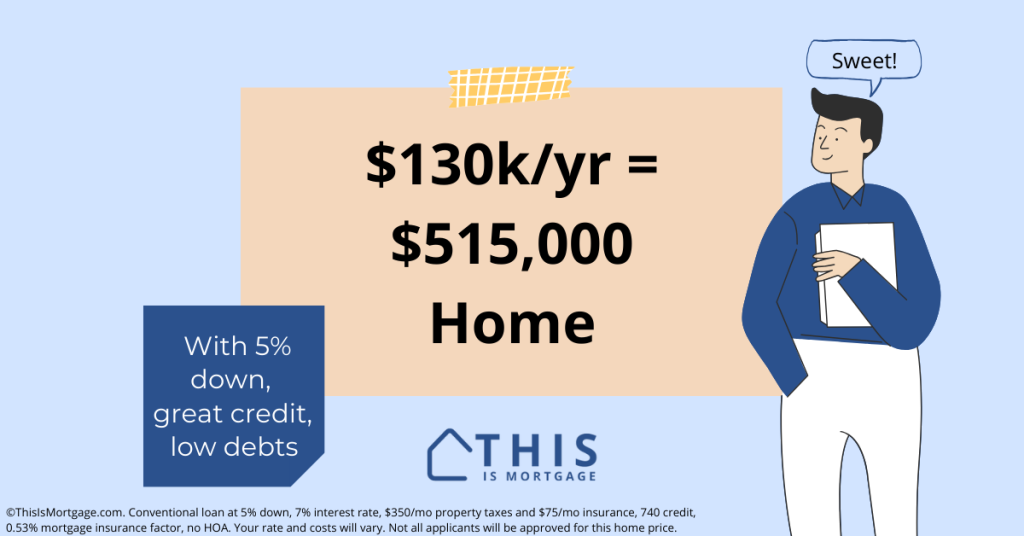

If I Make $130,000 A Year What Mortgage Can I Afford?

You can afford a $515,000 home with a mortgage of $489,250.

This assumes a 5% down conventional loan, low debts, good credit, a 7% rate, and a total debt-to-income ratio of 45%.

Many factors, like property taxes, homeowner’s insurance, HOA dues, credit score, can influence your maximum mortgage. Apply with a lender to find your personalized maximum home price.

Speak to our lending team to see what you can afford with a $130k salary.

Payment breakdown

More goes into your total mortgage payment than the payment itself. Lenders add in every part of your housing payment to determine your maximum home price.

| Part of payment | Amount |

| Principal & interest | $2,525 |

| Monthly mortgage insurance | $216 |

| Taxes | $350 |

| Homeowner’s insurance | $75 |

| HOA dues | $0 |

| Total payment based on these assumptions | $3,896 |

| Maximum payment allowed at 36% housing DTI | $3,900 |

See assumptions for all calculations at the bottom of this article.

Home affordability based on other debt

Your debt level affects your buying power perhaps more than anything else.

With your income, you can have about $975 in monthly debt payments (like student loans and credit card payments) without affecting your maximum mortgage too much. But if you were to add a $750-per-month auto payment, it would reduce your maximum home price by $115,000.

Related: Buying A Car Before A House Could Be a Big Mistake

With an annual salary of $130,000, lenders can approve you for a house payment of up to 36% of your gross income ($3,900). A maximum 45% can go toward debt payments, or $4,875.

| Yearly income | $130,000 |

| Monthly income | $10,833 |

| Max house payment (36%) | $3,900 |

| Max total debt + housing payments (45%) | $4,875 |

In mortgage-speak, that’s a 36% front-end debt-to-income (DTI) ratio and a 45% back-end DTI. This is about the highest DTI lenders will approve for a conventional loan.

Following is what you might qualify for depending on your current debt load.

| Annual Income | Monthly Debt | Max House Payment | Home Price |

|---|---|---|---|

| $130,000 | $0-$975 | $3,900 | $515,000 |

| $130,000 | $1,250 | $3,625 | $475,000 |

| $130,000 | $1,500 | $3,375 | $435,000 |

| $130,000 | $1,750 | $3,125 | $400,000 |

| $130,000 | $2,000 | $2,875 | $360,000 |

Related: Buying a Home With Zero Down Payment

Connect with a lender to see what you can afford.

Maximum home price by down payment

Your down payment dramatically affects affordability.

For one, your loan balance drops with a higher down payment, resulting in a lower payment. Additionally, you pay less mortgage insurance or none at all when you put more down.

| Annual Income | Down Payment | Monthly Payment | Home Price |

|---|---|---|---|

| $130,000 | 5% | $3,900 | $515,000 |

| $130,000 | 10% | $3,900 | $550,000 |

| $130,000 | 20% | $3,900 | $650,000 |

Check your minimum down payment. Start here.

Maximum home price by interest rate

Interest rate is another significant determiner of your maximum home price. In the below example, your buying power increases $170,000 if rates drop from 7% to 5%.

| Annual Income | Interest Rate | Monthly Payment | Home Price |

|---|---|---|---|

| $130,000 | 8% | $3,900 | $470,000 |

| $130,000 | 7% | $3,900 | $515,000 |

| $130,000 | 6% | $3,900 | $570,000 |

| $130,000 | 5% | $3,900 | $630,000 |

Maximum home price by desired debt-to-income level

Many financial gurus say your housing payment should be 25% or less of your gross income. It’s just not realistic in most markets. Pushing your housing costs from 25% to 36% (the maximum for conventional loans) increases your buying power by $175,000.

Still, you might choose to buy a more affordable home if you’re not comfortable with the maximum payment a lender will qualify you for.

| Annual Income | DTI | Payment | Home Price |

|---|---|---|---|

| $130,000 | 25% | $2,700 | $340,000 |

| $130,000 | 36% | $3,900 | $515,000 |

Ways to increase your buying power

If you’re struggling to find a home that you can qualify for, there are ways to increase your maximum purchase price.

Consider an adjustable-rate mortgage (ARM): As seen above, reducing your rate from 7% to 6% can increase your buying power by $55,000 at your income level. An ARM rate eventually adjusts but starts off fixed for at least 3-5 years. That’s a lot of time to refinance or increase your income to afford a potentially higher payment later.

Buy down your rate: Consider buying down your rate with points, especially if you can get closing cost credit from the seller or builder.

Avoid HOAs: Homeowner association dues can be hundreds of dollars per month. Dues add to your DTI which limits your buying power.

Make a bigger down payment or get gift funds. The lower your mortgage balance, the lower your payment will be. Try to find a down payment assistance program or get a gift from family to reduce your loan amount.

Use an FHA loan. FHA loan limits are $472,030 in most areas, which may be too low for your needs. Still, these loans allow up to a 56% DTI for strong borrowers.

Pay off debt: Paying off a $750 car payment can increase your buying power by $110,000.

Request a call from a lender to see what you can afford with a $130k salary.

FAQ

You can afford a $515,000 home with a $489,250 mortgage (5% down). Your exact maximum depends on your debts, interest rate, property taxes, homeowner’s insurance, HOA dues, loan program, and payment comfort level.

Reducing your debt payments by $750 per month can increase your maximum home price by about $110,000 assuming an income of $130,000 per year. Paying off debt will help you qualify for a better home.

You don’t need a high credit score, but it will help you qualify for more. Conventional mortgage insurance is less expensive for those with credit scores above 720.

You can afford a lot of house with a $130k salary

Could you be happy in a $515,000 home? If you have a good salary and credit, you might be surprised that you may qualify for this much. Get started on your pre-approval so you’re ready when you find the right home.

Speak to a lending professional to see if you are eligible to buy a home.

Assumptions for all calculations:

*Note that a 3.5%-down FHA loan above $472,030 is not available in most areas. Calculations assume a conventional loan with 5% down, 7% interest rate, $350/mo property taxes and $75/mo insurance, 740 credit, 0.53% MI factor for 5% down and 0.38% MI factor for 10% down. No PMI on 20% down. Some applicants will not qualify for 36/45 ratios. Your maximum might be lower. Your rate and costs will vary as well.