The Section 184 Native American Home Loan is a powerful tool for homeownership. It requires a low down payment, no monthly mortgage insurance, and has no official credit score minimum.

But the most important part: it can be used on or off reservation land.

However, one drawback is that there are only around 140 lenders nationwide that offer the Section 184 Loan. Compare that with thousands that offer FHA loans.

That’s why we created a full list of lenders that offer the program, states they operate in, and a link to their website.

Shortcut: Connect with a Section 184 lender here.

In this article:

- List of Section 184 Loan lenders

- Eligible Section 184 areas

- What to look for in a Section 184 lender

- How to qualify

Full List of Section 184 Loan Lenders

Lenders change programs and states often, so be sure any lender you contact operates in your state.

Note that the below are not affiliate links – they are just there to be helpful. We don’t endorse any lender. Shop around for the lender that suits your needs.

| Section 184 Approved Lenders | Phone | States |

|---|---|---|

| 1st Capital Mortgage LLC | 918-274-1519 | OK |

| Academy Mortgage Corporation | 800-660-8664 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| Alaska USA Federal Credit Union | 800-525-9094 | AK, AZ, CA, WA |

| Alaska USA Mortgage Company | 800-737-3033 | AK, CA, WA |

| All State Homes / Xcellerate Home Loans | 559-475-0583 | CA |

| American Bank of Oklahoma | 918-686-7300 | AR, AZ, OK |

| American Financial Network Inc | 888-636-7573 | CA, FL, ID, NV, OK, TX, UT, WI |

| American Mortgage Bank, LLC | 405-283-8800 | AL, AK, AZ, AR, CA, CO, CT, FL, ID, IL, IN,IA, KS, LA, ME, MA, MI, MN, MS, MO, MT,NE, NV, NM, NY, NC, ND, OK, OR, RI, SC,SD, TX, UT, VA, WA, WI, WY |

| American Pacific Mortgage | 503-550-2662 | All States |

| American United Federal Credit Union | 358-270-8742 | CA, UT |

| AmeriFirst Financial Inc. | 877-276-1974 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| Armstrong Bank | 888-680-2655 | AL, AK, AZ, AR, CA, CO, CT, FL, ID, IL, IN,IA, KS, LA, ME, MA, MI, MN, MS, MO, MT,NE, NV, NM, NY, NC, ND, OK, OR, RI, SC,SD, TX, UT, WA, WI, WY |

| Arvest Bank | 866-952-9523 | AL, AK, AZ, AR, CA, CO, CT, FL, ID, IL, IN,IA, KS, LA, ME, MA, MI, MN, MS, MO, MT,NE, NV, NM, NY, NC, ND, OK, OR, RI, SC,SD, TX, UT, WA, WI, WY |

| Associated Mortgage Corp | 800-725-5262 | OK |

| AVB Bank | 918-251-9611 | OK |

| Axia Financial, LLC | 855-355-2942 | AZ, CA, OK, WA |

| BancFirst | 877-602-2262 | OK |

| Bank of Albuquerque | 866-910-5218 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| Bank of Cherokee County | 918-772-2572 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| Bank of Commerce | 800-324-8003 | OK |

| Bank of England | 888-639-2517 | All States |

| Bank of Oklahoma (BOKF NA) | 800-234-6181 | All States |

| Bay Bank | 920-490-7600 | AL, AK, AZ, AR, CA, CO, CT, FL, ID, IL, IN,IA, KS, LA, ME, MA, MI, MN, MS, MO, MT,NE, NV, NM, NY, NC, ND, OK, OR, RI, SC,SD, TX, UT, WA, WI, WY |

| Bay Equity LLC | 800-BAY-3703 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| BCK Capital Inc. / All Season’s Mortgage | 541-850-9020 | OR |

| Broker Solutions, Inc | 800-450-2010 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| CalCon Mutual Mortgage | 888-488-3807 | All States |

| Caliber Home Loans | 855-808-2124 | AK, AZ, CA, MI, OK, OR, WA |

| Capital Mortgage, LLC | 208-854-7800 | ID, OR |

| Cascade Northern Mortgage | 360-882-0802 | OR, WA |

| Cascade Residential Mortgage | 503 892-0011 | OR, WA |

| Centennial Home Mortgage, LLC | 405-615-0146 | CA, FL, KS, OK |

| Champion Home Loans | 405-716-4565 | OK |

| Cherry Creek Mortgage | 303-320-4040 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| Chickasaw Community Bank | 405-949-7000 | All States |

| Churchill Mortgage | 888-562-6200 | AK, AZ, ID, MT, NV, OR, UT, WA |

| Citizens Bank of Ada | 580-332-6100 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| Citywide Mortgage | 405-794-4412 | OK |

| Click n’ Close / 1st Tribal Lending | 866-235-4033 | All States |

| Clift Enterprises, Inc. / Clift Mortgage | 360-683-4848 | WA |

| CMG Financial | 925-983-3000 | All States |

| Cook Inlet Lending Center | 907-793-3058 | AK |

| Cornerstone Home Lending | 877-621-4663 | All States |

| Cross Country Mortgage | 877-351-3400 | AZ, CA, FL, IL, MI, OK, TX |

| DHI Mortgage Company, LTD | 800-315-8434 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| Diversified Lending Group / Cross Timbers Mortgage | 405-233-4321 | OK |

| Eagle Bank | 406-883-2940 | All States |

| Edge Home Finance Corporation | 763-219-8484 | AL, AZ, CA, CO, FL, MA, MI, MO, NC, ND,NM, OK, SC, TX, VA, WA, WI |

| Everett Financial, Inc / Supreme Lending | 877-350-5225 | All States |

| Evergreen Moneysource Mortgage Company | 877-242-2014 | AZ, CA, CO, FL, ID, KS, LA, MN, MT, NV,OR, TX, WA, WY |

| Exchange Bank and Trust Co | 405-742-0202 | All States |

| F&M Bank Mortgage -Yukon Mortgage | 405-348-0300 | All States |

| Fairway Independent Mortgage | 608-837-4800 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| FBC Mortgage LLC | 407-872-3383 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| First American Mortgage Inc | 405-354-0426 | OK |

| First National Bank & Trust Co. | 405-275-8830 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| First National Bank of Alaska | 907-777-4362 | AK |

| First New Mexico Bank of Silver City | 575-388-3121 | All States |

| First Oklahoma Mortgage, LLC | 918-392-2500 | OK |

| First Pryority Bank | 800-462-7032 | OK |

| First United Bank and Trust Co | 800-924-4427 | AL, AK, AZ, AR, CA, CO, CT, FL, ID, IL, IN,IA, KS, LA, ME, MA, MI, MN, MS, MO, MT,NE, NV, NM, NY, NC, ND, OK, OR, RI, SC,SD, TX, UT, WA, WI, WY |

| Firstar Bank | 918-681-7100 | AR, OK |

| FirstTrust Home Loans, Inc. | 870-942-5050 | AL, AK, AZ, AR, CA, CO, CT, FL, ID, IL, IN,IA, KS, LA, ME, MA, MI, MN, MS, MO, MT,NE, NV, NM, NY, NC, ND, OK, OR, RI, SC,SD, TX, UT, WA, WI, WY |

| Flat Branch Mortgage, Inc. | 866-508-4362 | AR, CO, FL, IA, IL, IN, KS, MN, NE, NM, OK,WA |

| Gateway First Bank | 877-764-9319 | All States |

| Geneva Financial, LLC | 888-889-0009 | AL, AK, AZ, AR, CA, CO, CT, FL, ID, IL, IN,IA, KS, LA, ME, MA, MI, MN, MS, MO, MT,NE, NV, NM, NC, OK, OR, RI, SC, SD, TX,UT, VA, WA, WI, WY |

| Grand Savings Bank | 918-786-2203 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| Guaranteed Rate Inc | 866-934-7283 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| Guardian One, LLC | 971-244-2389 | CA, OR, WA |

| Guild Mortgage Company | 800-688-7880 | All States |

| Highlands Residential Mortgage, LTD | 866-912-7511 | AL, AK, AZ, AR, CA, CO, CT, FL, ID, IL, IN,IA, KS, LA, ME, MA, MI, MN, MS, MO, MT,NE, NV, NM, NY, NC, ND, OK, OR, RI, SC,SD, TX, UT, WA, WI, WY |

| Home Mortgage Resource Inc | 918-458-0784 | OK |

| Homestar Financial Corp | 877-538-3393 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| Homestate Mortgage Company LLC | 907-762-5890 | AK |

| Hometown Lenders Inc | 888-628-1414 | AL, AK, AZ, FL, MT, ND, NM, NV, OK, WA |

| Homewise, Inc | 505-955-7044 | CO, MS, NM, TX |

| Hunt Mortgage Services | 405-361-5172 | OK |

| Interlinc Mortgage Services LLC | 800-979-3340 | AL, AR, AZ, CO, FL, IA, IN, KS, LA, MI, MN,MS, NC, NE, NM, OK, SC, TX, VA, WI |

| Key Mortgage Group, Inc | 505-334-2510 | CO, NM |

| Lake Superior Community Development Corp. | 906-524-5445 | MI |

| LeaderOne Financial Corporation | 800-270-3416 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| Legacy Mortgage LLC | 888-296-4747 | AZ, CO, NM, TX |

| Legend Lending Corporation | 888-820-2572 | AZ, MI |

| Lend Smart Mortgage LLC | 866-772-2503 | AL, AZ, CA, CO, FL, IA, ID, MI, MN, MT, NC,ND, NE, NM, OR, SC, SD, TX, UT, VA, WA,WI, WY |

| Lighthouse Financial Enterprises, Inc | 888-689-3042 | ID, OR, WA |

| LoanDepot | 888-337-6888 | All States |

| LRG Lending, Inc. | 916-758-8000 | CA |

| Lumbee Guaranty Bank | 910-521-9707 | NC |

| McClain County National Bank | 405-447-7283 | OK |

| MLD Mortgage Inc / The Money Store | 888-777-4706 | AL, AZ, AR, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MI, MN, MO, MT, NE, NV, NM,NY, NC, ND, OK, OR, RI, SC, TX, UT, VA,WA, WI, WY |

| Mortgage Brokers of Alaska Corp | 907-343-8898 | AK |

| NACDC Financial Services | 406-338-2099 | MT |

| Nations Reliable Lending, LLC | 713-275-1300 | All States |

| Nationwide Loans, Inc. | 800-540-3909 | CA |

| Native Partnership for Housing, Inc. | 505-722-0551 | AZ, NM |

| Neighborhood Mortgage | 877-385-8044 | AZ, WA |

| NEXA Mortgage, LLC | 833-391-3911 | AL, AK, AZ, AR, CA, CO, CT, FL, ID, IL, IN,IA, KS, LA, ME, MI, MN, MS, MO, MT, NE,NV, NM, NC, ND, OK, OR, RI, SC, SD, TX,UT, WA, WI, WY |

| NOVA Financial | 520-425-8514 | AZ, CA, CO, FL, IL, IN, NM, NV, OR, TX, UT,WA |

| Nuvision Federal Credit Union | 907-257-1601 | All States |

| On Q Financial | 866-667-3279 | AZ, CA, CO, FL, ID, MO, NC, ND, NV, OR,SC, TX, WA |

| Open Mortgage LLC | 888-602-6626 | All States |

| Pacific Residential Mortgage, LLC | 503-699-5626 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| Powerhouse Mortgage & Realty / Your DarlingLender | 619-504-9983 | CA |

| Premier Mortgage Advisors | 505-830-9685 | CO, NM, TX |

| Premier Mortgage Resources LLC | 866-733-3700 | CA, ID, OR, WA |

| Price Mortgage Group, Inc | 405-413-5427 | AR, CA, CO, OK, TX, VA |

| Primary Residential Mortgage Inc. | 800-255-2792 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| PrimeLending | 800-317-7463 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| Princeton Mortgage Corporation | 800-635-0977 | AK, AZ, AR, CA, CO, FL, ID, IL, IN, IA, KS,LA, ME, MA, MI, MN, MS, NE, NM, NC, OK,OR, RI, SC, TX, VA, WI |

| Raven Mortgage LLC | 833-997-2836 | AK, WA |

| RCB Bank | 855-226-5722 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| Resident Lending Group Inc | 503-589-1999 | OR |

| Residential Mortgage, LLC | 907-222-8800 | AK, OR, WA |

| RoundPoint Mortgage | 877-426-8805 | All States |

| Spirit Bank | 800-352-1171 | All States |

| Spurr Mortgage, Corp | 405-348-9919 | OK |

| Stride Bank, NA | 405-900-5433 | All States |

| Summit Funding Inc | 855-234-7561 | AL, AZ, AR, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NC, ND, OK, OR, SC, SD, TX, UT,WA, WI, WY |

| Sunflower Bank / Guardian Mortgage | 800-331-4799 | AL, AZ, AR, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, MA, MI, MN, MS, MO, MT, NE, NV,NM, NC, OK, OR, RI, SC, SD, TX, UT, VAWA, WI, WY |

| Sun West Mortgage Corp | 800-453-7884 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| The Central Trust Bank | 573-634-5600 | All States |

| The Turnkey Foundation / Arbor Financial | 866-639-6554 | AZ, CA, CO, FL, ID, IL, MI, MO, NV, OR, TX,UT, WA |

| Tongass Federal Credit Union | 907-225-9063 | AK |

| Triad Bank, NA | 918-254-1444 | All States |

| TTCU- The Credit Union | 918-749-8828 | All States |

| United Bank | 251-446-6000 | AL, AR, FL, LA, NC |

| United Fidelity Funding Corp. | 866-760-0600 | AR, MO, OK |

| Universal Lending Corp | 800-758-4063 | AZ, CO, IA, MT, NM, WY |

| US Mortgage Corporation | 631-580-2600 | All States |

| Valley Bank of Ronan, Corporation | 406-676-2000 | MT |

| VanDyk Mortgage Corporation | 616-940-3000 | All States |

| V.I.P. Mortgage, INC | 480-966-0919 | AL, AZ, AR, CA, CO, FL, ID, IL, IN, IA, KS,LA, MA, MI, MN, MT, NE, NV, NM, NC, OK,OR, SC, SD, TX, UT, WA, WI, WY |

| Vision Bank | 580-332-5132 | All States |

| Vision Mortgage, INC | 530-672-0106 | AK, CA, ID |

| Waterstone Mortgage Corporation | 800-354-1149 | AL, AZ, AR, CA, CO, ID, IL, IN, IA, ME, MA,MI, MN, NV, NM, ND, OR, RI, WA, WY |

| Woodlands National Bank | 888-532-4142 | IA, MN, ND, SD, WI |

| Xpert Home Lending | 833-449-7378 | AL, AR, AZ, CA, CO, FL, ID, IL, KS, MI, NC,NM, OR, SC, TX, VA, WA, WI |

| ZFG Mortgage LLC | 918-459-6530 | OK |

Connect with a lender to check your Section 184 eligibility.

I can’t find a lender in my state

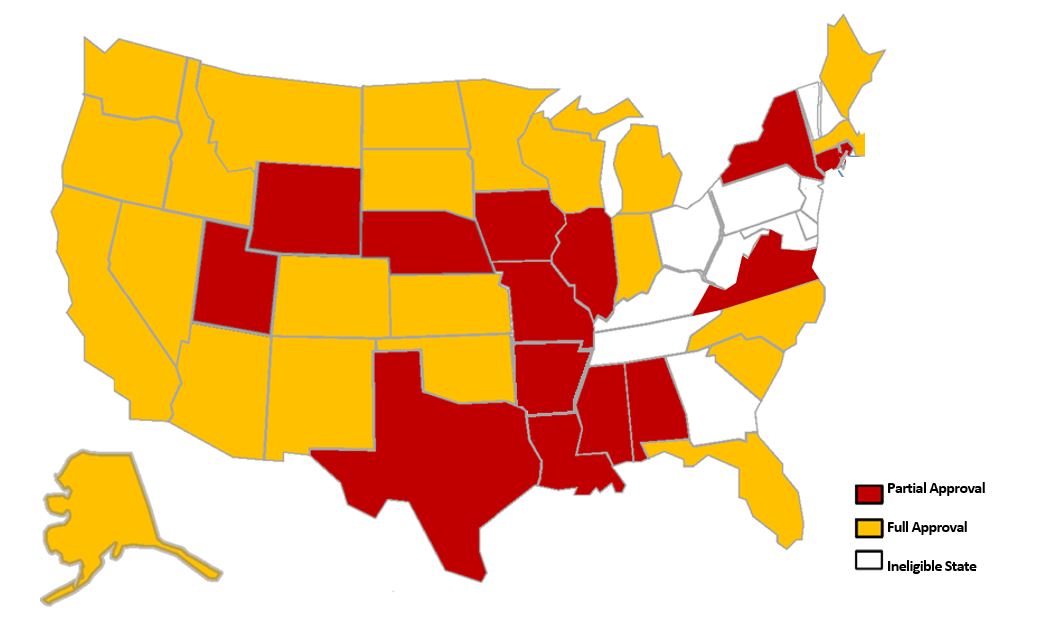

Note that not every state and county in the U.S. is approved for Section 184 Loans. If you don’t see a lender in your state, it may be because your state is not eligible.

States where every county is approved

| Alaska | Maine | North Dakota |

| Arizona | Massachusetts | Oklahoma |

| California | Michigan | Oregon |

| Colorado | Minnesota | South Carolina |

| Florida | Montana | South Dakota |

| Idaho | Nevada | Utah |

| Indiana | New Mexico | Washington |

| Kansas | North Carolina | Wisconsin |

States with partial approval

| State | Approved Counties and Cities |

| Alabama | BALDWIN, ELMORE, ESCAMBIA, MOBILE, MONROE, MONTGOMERY, WASHINGTON |

| Arkansas | BENTON, CRAWFORD,HOWARD, LITTLE RIVER, LOGAN, MONTGOMERY, POLK, SCOTT, SEBASTIAN, SERVIER, WASHINGTON, YELL |

| Connecticut | FAIRFIELD, LITCHFIELD, NEW LONDON |

| Iowa | BLACK HAWK, LINN, MARSHALL, MONONA, POLK, POTTAWATTAMIE, POWESHIEK, TAMA, WOODBURY |

| Illinois | COOK, DUPAGE, KANE, LAKE |

| Louisiana | ALLEN, AVOYELLES, CONCORDIA, EVANGELINE, GRANT, IBERIA, IBERVILLE, JEFFERSON DAVIS, LA SALLE, RAPIDES, SAINT MARY, WASHINGTON |

| Missouri | BARRY, JASPER, LAWRENCE, MCDONALD, NEWTON, |

| Mississippi | ATTALA, JACKSON, JASPER, JONES, KEMPER, LEAKE, NESHOBA, NEWTON, SCOTT, WINSTON |

| Nebraska | BOYD, BURT, CUMING, DIXON, DOUGLAS, HALL, HOLT, KNOW, LANCASTER, MADISON, PLATTE, RICHARDSON, SARPY, SHERIDAN, STANTON, THURSTON, WAYNE |

| New York | ALL EXCEPT: BRONX, KINGS, NEW YORK, QUEENS, RICHMOND |

| Rhode Island | WASHINGTON |

| Texas | EL PASO, HUDSPETH |

| Virginia | AMHERST, CAROLINE, CHARLES CITY, CITY OF CHESAPEAKE, CITY OF HAMPTON, CITY OF NEWPORT NEWS, CITY OF NORFOLK, CITY OF PORTSMOUTH, CITY OF RICHMOND, CITY OF SUFFOLK, CITY OF VIRGINIA BEACH, ESSEX, HANOVER, HENRICO, ISLE OF WIGHT, JAMES CITY, KING AND QUEEN, KING GEORGE, KING WILLIAM, LANCASTER, NEW KENT, RICHMOND, ROCKBRIDGE, SPOTSYLVANIA, STAFFORD |

| Wyoming | FREMONT, HOT SPRINGS |

Ineligible States

| Delaware | New Hampshire | Tennessee |

| Georgia | New Jersey | Vermont |

| Kentucky | Ohio | West Virginia |

| Maryland | Pennsylvania |

What to look for in a Section 184 lender

These loans can be complex and difficult to close. First and foremost, find a lending company that does these loans regularly.

But finding a good company is not enough.

You also need an experienced loan officer. The best lending company in the world can’t make up for an inexperienced loan officer.

Ask your loan officer how many Section 184 loans he or she has done in the past three months. If less than three in three months, you might want to find someone else.

These loans consist of many moving parts. You need someone who can coordinate all parties to get your loan closed.

Related: Section 184 Loan Calculator

How do you qualify for a Section 184 Loan?

While these loans are easier to qualify for than most mortgages, you must still meet Section 184 Loan requirements. You must:

- Be a member of a federally-recognized Indian Tribe

- The Tribe must be approved by HUD to facilitate Section 184 Loans

- Obtain a lease from the Tribe and Title Status Report from BIA if buying on reservation land

- Have a credit score of around 580-620+

- Make a 2.25% down payment

- Pay Section 184 loan closing costs

- Have a 43% debt-to-income ratio

- Have adequate income and employment history

- Intend to live in the house you’re buying

- Buy in an eligible area

- Meet other lender requirements

Section 184 Loan Lenders – FAQ

Many lenders don’t offer Section 184 Loans because they take a lot of specialized knowledge to complete. The lender also needs HUD approval to offer them. Fortunately, there are approved lenders in every eligible state, so buyers have options when searching for the best rate and terms.

You must be an enrolled member of a Tribe that is HUD-approved for Section 184 Loans. If your Tribe is not on the list, ask Tribal Leadership to start the approval process with HUD. The process can be found here.

You have to be an enrolled member of a Tribe that is approved for the program. You must buy in a state or county that is approved for the loan as well. If those qualifications are met, then you work with a lender to see if your income, credit, assets, and employment are adequate to qualify for the loan.

Many Section 184 Loan Lenders to choose from

Though this loan is not offered by every lender, there is still probably a good selection of lenders in your state.

Shop around for the best lender for you. And, remember that some lenders are more flexible than others. If you’re denied at one company, find another one.

You could be closer to owning a home than you think.

Connect with a lender to check your Section 184 eligibility.

Source: HUD