The Section 184 Indian Home Loan Guarantee Program is a powerful tool to make homeownership easier for Native Americans.

Because of this program, members of federally-recognized Tribes can purchase a home with very little down payment and no credit score minimum.

But perhaps even more important is the loan’s ability to lend on Tribal trust land, which is not possible with most loan programs.

Here’s your guide to learn more about these fantastic loans.

Connect with a lender to see if you’re eligible for Section 184.

Table of contents

- Section 184 loan calculator

- Flowchart: How Section 184 works

- Who is eligible for Section 184?

- Types of homes and loan purposes

- Credit score

- Down payment

- Income and employment

- Loan limits and eligible areas

- Loans on trust lands

- Section 184 vs FHA

- Construction and rehab loans

- Section 184 lender list

- Section 184 approved Tribes list

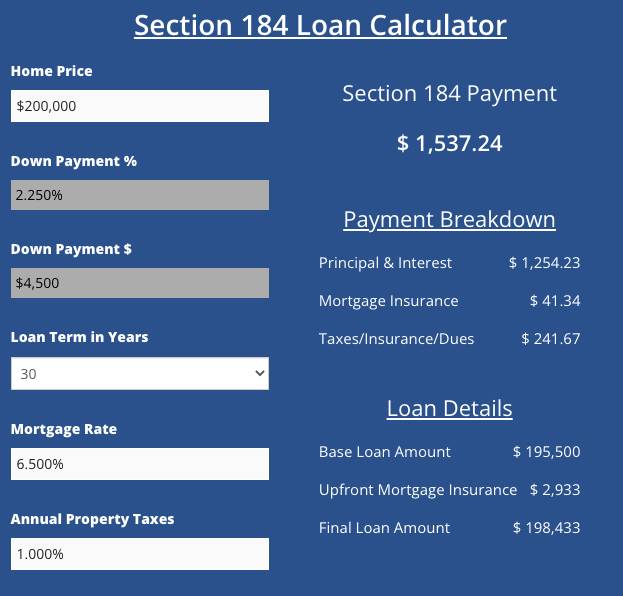

Section 184 Loan Calculator

This Section 184 Loan Calculator will estimate your costs for this loan.

Section 184 Loan Calculator

Section 184 Payment

$

Payment Breakdown

Principal & Interest

$

Mortgage Insurance

$

Taxes/Insurance/Dues

$

Loan Details

Base Loan Amount

$

Upfront Mortgage Insurance

$

Final Loan Amount

$

For informational purposes only. Not a quote or commitment to lend. Speak with a Section 184 lender for a written quote.

Flowchart: Section 184 Loan Process

[↓Click the chart to download a high resolution PDF↓]

Who is eligible for Section 184?

This special loan program is not available to just anyone. Because Native Americans have been traditionally underserved when it comes to housing, the U.S. Department of Housing and Urban Development (HUD) ensures that only registered Tribal members are eligible.

Here are basic Section 184 Loan eligibility requirements. You must be:

- An enrolled member of a federally-recognized Indian Tribe that has been approved for Section 184 loans, or;

- A member of an Alaska Native village

- A Tribally-designated housing entity

- An Indian Housing Authority

In addition, you must:

- Be financing a primary residence (no second homes or rental properties)

- Have adequate income and employment

- Show creditworthiness; no minimum credit score is required, but collections, judgments, and other derogatory credit may not be acceptable

- Be a first-time or repeat buyer or refinancing homeowner

- Have adequate funds or assistance to make a down payment of 2.25% for a loan over $50,000 and 1.25% down on a loan under $50,000

This is just a brief overview, so here’s a deeper look at each requirement.

Request a call from a Section 184 lender.

Tribal membership is required

The most important requirement is that you are a member of a federally-registered Tribe.

Lenders will require proof of membership. You’ll need a clear copy of your enrollment identification card. CDIB cards may be accepted in some cases, if it includes an enrollment number. Blood quantum letters are not accepted.

Only one applicant on the loan needs to be a member.

A lender can’t help you enroll; you must go to your Tribe directly to learn about their requirements for membership. If you are not an official member yet, it’s a good idea to approach your Tribe right away to start the process.

Keep in mind, though, that the Tribe must be approved with HUD to participate in the program. See the bottom of this page for a list of approved Tribes.

What if my Tribe is not approved for Section 184 loans?

Your Tribe can apply for Section 184 approval with HUD. The Tribe must:

- Create a foreclosure and eviction process

- Create a system to enforce these processes

- Permit HUD and private lenders to access Tribal lands

- Certify that lack of enforcement of processes will result in HUD revoking Section 184 approval for the Tribe

- And complete other requirements

For a complete overview of how a Tribe can participate, see HUD’s website.

Types of homes and loan purposes

The Section 184 loan is one of the most flexible lending types available today. It allows you to complete just about any kind of financing for your primary residence.

Types of homes

- Single-family residence (1-unit standard homes)

- Duplex, Triplex, or Four-plex

- Manufactured homes on a permanent foundation

How you can use the loan

- Finance a home on or off the reservation

- Buy a newly constructed home

- Buy an existing home from someone else

- Purchase land and place a manufactured home on it with one loan

- Purchase land and build a home with the same loan

- Renovate your current home

- Refinance or get cash out of your current home

Start your Section 184 mortgage by speaking with a lender.

Credit score requirements

One of the biggest benefits of Section 184 is that it has no minimum credit score. So a lender likely won’t deny your application based on score alone.

That being said, you must prove creditworthiness. The lender needs to make a case that you will faithfully make your payments. That’s simply because all mortgages allow the lender to foreclose if payments aren’t made. It’s the last resort for lenders and they don’t want to do it. And it’s bad for the homeowner, too. However, it’s just the reality of owning a home and getting a mortgage.

So, low scores that were the result of a one-time event like a job loss or medical issue may be approved. But credit profiles that show ongoing late payments and disregard for debt obligations will likely be denied. Other things a lender doesn’t want to see are:

- Open collection accounts

- Tax liens

- Judgments

- Payments made more than 30 days late

- Default on a federal debt (can’t be approved – no exceptions)

Alternative credit is okay if you don’t have enough credit history to generate a traditional score or report. The lender may be able to use items like rent history, utility payments, car insurance, and other recurring bills to prove creditworthiness.

Even if you think you don’t have adequate credit to qualify, you should apply with a lender anyway. Many lenders can offer helpful plans to restore your credit and get you on the path to homeownership.

Down payment requirements

The down payment for a Section 184 loan is very affordable.

- 2.25% on loans over $50k,

- 1.25% on loans under $50k

Compare Section 184 with FHA, which requires 3.5% down payment.

| Loan Amount | Section 184 Down Payment | FHA Down Payment |

| $40,000 | $500 | $1,400 |

| $75,000 | $1,688 | $2,625 |

| $100,000 | $2,250 | $3,500 |

| $200,000 | $4,500 | $7,000 |

| $300,000 | $6,750 | $10,500 |

| $400,000 | $9,000 | $14,000 |

Keep in mind that you’ll also be responsible for Section 184 Loan closing costs, which are typically around 2-5% of the loan amount. Closing costs cover things like the lender’s fees, appraisal, escrow, flood zone search, credit report, and more.

The good news is, though, that you can cover the entire down payment and closing costs from a variety of sources.

- Personal savings

- A gift from family

- Tribal assistance

- Non-tribal down payment assistance program

- Other eligible sources

A user of the popular site Reddit, in a Section 184 loan reviews forum, stated that their Tribe helped them with the down payment if they purchased on reservation land.

The seller, lender, or real estate agent can’t pay your down payment, but they can help pay for closing costs.

With some searching and a little creativity, you could buy a home with little or no money out of your own pocket.

Get a lender quote for your down payment and closing cost total.

Income and employment

You’ll need steady employment history to qualify for any mortgage, including Section 184. That means you’ve been employed in the same line of work for the previous two years.

It’s okay if you’ve changed jobs for a better position or higher pay. But changing jobs for no apparent benefit could indicate you have a hard time holding a job.

If you’re self-employed, you’ll need two years of filed tax returns showing your income.

Debt-to-income ratio

The lender will look at how your income compares with total monthly debt payments.

This means adding up your future mortgage payment, property taxes (if any), and homeowner’s insurance. Then they will add other debt obligations like monthly payments for credit cards, auto loans, and any other debt. Utilities and other non-debt payments are not included.

The lender will verify that all payments are no more than 41% of your pre-tax income. This is called your debt-to-income or DTI ratio. You can have a maximum 43% DTI with two compensating factors such as no increase in your housing payment, good credit, additional income not used to qualify, a large down payment, or savings after closing.

Example DTI

| Monthly Income | House payment plus all debt payments for 41% DTI | House payment plus all debt payments for 43% DTI |

| $2,000 | $820 | $860 |

| $3,000 | $1,230 | $1,290 |

| $4,000 | $1,640 | $1,720 |

| $6,000 | $2,460 | $2,580 |

| $8,000 | $3,280 | $3,440 |

The less you pay for other debts like auto loans, the more house you’ll be able to qualify for while staying under the 41% or 43% maximum DTI.

Mortgage insurance (MI)

Section 184 loans require upfront mortgage insurance (MI). Monthly mortgage insurance was removed on July 1, 2023.

- Upfront: 1.0% of the loan amount (can be rolled into the loan)

- Monthly: 0% (removed July 1, 2023)

Example upfront mortgage insurance amounts

| Loan Amount | Upfront Mortgage Insurance |

| $50,000 | $750 |

| $100,000 | $1,500 |

| $150,000 | $2,250 |

| $200,000 | $3,000 |

| $300,000 | $4,500 |

| $400,000 | $6,000 |

Section 184 loan limits

How much home can you buy with a Section 184? This loan comes with limits, but they are not very restrictive.

Most areas offer a loan limit of $498,257 for a 1-unit home in 2024.

But this amount increases in many high-cost areas of the country, all the way up to $1,149,825.

Limits also increase for 2-, 3-, and 4-unit homes. In fact, you can get a loan of over $2.2 million on a 4-unit home in some areas of California.

Here are standard limits for standard areas and the highest-cost areas. Most areas will use the base limits, and others will be between the base and high-cost limits. A few areas will be at the max high-cost limit. Check your county’s local loan limits here.

| Units | Base Limit | Max High-Cost Limit |

| 1 | $498,257 | $1,149,825 |

| 2 | $637,950 | $1,472,250 |

| 3 | $771,125 | $1,779,525 |

| 4 | $958,350 | $2,211,600 |

Mortgage rates

Section 184 loan rates are comparable to FHA, VA, and USDA rates. Rates change daily with the broader mortgage market. Plus, personal factors like credit score can affect your rate.

Contact an approved Section 184 lender to get a personalized rate quote.

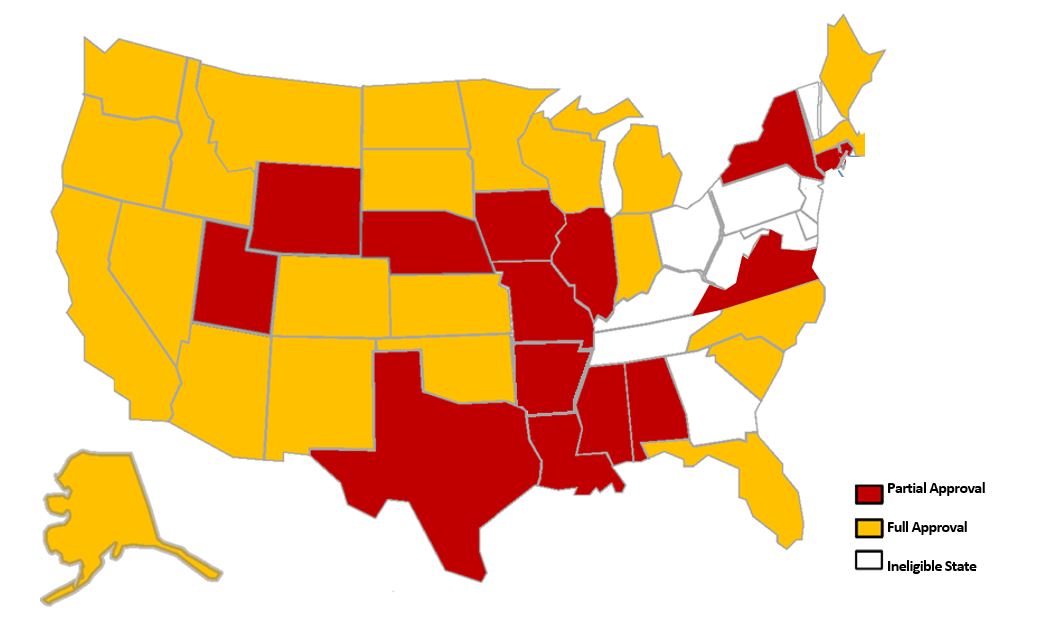

Eligible Areas for Section 184

Eligible Tribe members may purchase a regular home outside of reservation lands, even if it is not in the same state as the Tribe. But, the home still has to be in an approved state or county.

While the Section 184 loan is widely available, it’s not available everywhere.

States where every county is approved

| Alaska | Maine | North Dakota |

| Arizona | Massachusetts | Oklahoma |

| California | Michigan | Oregon |

| Colorado | Minnesota | South Carolina |

| Florida | Montana | South Dakota |

| Idaho | Nevada | Utah |

| Indiana | New Mexico | Washington |

| Kansas | North Carolina | Wisconsin |

States with partial approval

| State | Approved Counties and Cities |

| Alabama | BALDWIN, ELMORE, ESCAMBIA, MOBILE, MONROE, MONTGOMERY, WASHINGTON |

| Arkansas | BENTON, CRAWFORD, HOWARD, LITTLE RIVER, LOGAN, MONTGOMERY, POLK, SCOTT, SEBASTIAN, SERVIER, WASHINGTON, YELL |

| Connecticut | FAIRFIELD, LITCHFIELD, NEW LONDON |

| Iowa | BLACK HAWK, LINN, MARSHALL, MONONA, POLK, POTTAWATTAMIE, POWESHIEK, TAMA, WOODBURY |

| Illinois | COOK, DUPAGE, KANE, LAKE |

| Louisiana | ALLEN, AVOYELLES, CONCORDIA, EVANGELINE, GRANT, IBERIA, IBERVILLE, JEFFERSON DAVIS, LA SALLE, RAPIDES, SAINT MARY, WASHINGTON |

| Missouri | BARRY, JASPER, LAWRENCE, MCDONALD, NEWTON, |

| Mississippi | ATTALA, JACKSON, JASPER, JONES, KEMPER, LEAKE, NESHOBA, NEWTON, SCOTT, WINSTON |

| Nebraska | BOYD, BURT, CUMING, DIXON, DOUGLAS, HALL, HOLT, KNOW, LANCASTER, MADISON, PLATTE, RICHARDSON, SARPY, SHERIDAN, STANTON, THURSTON, WAYNE |

| New York | ALL EXCEPT: BRONX, KINGS, NEW YORK, QUEENS, RICHMOND |

| Rhode Island | WASHINGTON |

| Texas | EL PASO, HUDSPETH |

| Virginia | AMHERST, CAROLINE, CHARLES CITY, CITY OF CHESAPEAKE, CITY OF HAMPTON, CITY OF NEWPORT NEWS, CITY OF NORFOLK, CITY OF PORTSMOUTH, CITY OF RICHMOND, CITY OF SUFFOLK, CITY OF VIRGINIA BEACH, ESSEX, HANOVER, HENRICO, ISLE OF WIGHT, JAMES CITY, KING AND QUEEN, KING GEORGE, KING WILLIAM, LANCASTER, NEW KENT, RICHMOND, ROCKBRIDGE, SPOTSYLVANIA, STAFFORD |

| Wyoming | FREMONT, HOT SPRINGS |

Ineligible States

| Delaware | New Hampshire | Tennessee |

| Georgia | New Jersey | Vermont |

| Kentucky | Ohio | West Virginia |

| Maryland | Pennsylvania |

What if the home is on trust lands (leased land)?

Are you buying a house on or off of a reservation? It makes a big difference in the process. If you plan to buy outside of Tribal trust land, you can skip this section.

With Section 184 loans, you have the option to buy off-reservation. But many would like to buy on-reservation, meaning it would be leased land.

Before you get a loan on-reservation, you need a lease from the Tribe for that parcel.

Additionally, the Tribe needs HUD approval to use the loan on their lands. A list of approved Tribes can be found here.

Assuming it has this approval, the Tribe assigns a lease to you so that you can get the loan.

Each Tribe has its own process to issue leases. It’s important to talk to your Tribe about their requirements. Until the lease is in your hand, the lender can’t move forward with the loan process. So it’s a good idea to begin the process right away.

Start your Section 184 loan with a reputable lender.

How do mortgages on trust land work?

As mentioned, lending on Tribal land has historically been difficult for lenders.

Section 184 loans provided a way for private lenders to lend on trust land. Without the program, lenders wouldn’t lend on the reservation because they could not foreclose on the property if they had to. But because HUD will pay back the lender 100% of the loan amount in the case of default, lenders are now willing to make loans on Tribal land.

If the land is held in a trust for a Tribe, it can’t be included in the mortgage. Instead, the lease itself is what is mortgaged.

The buyer creates a leasehold estate with the help of BIA and HUD. Then, the lender can open a mortgage securing the leasehold. The lease must last the length of the mortgage plus an additional 10 years. The lease can be foreclosed on and resold in the case of loan default, though the land itself stays in the Tribal trust.

Land in an individual trust (rather than a trust held by the Tribe) does not need the extra step of setting up a leasehold. Yet, it still must receive approval from the Bureau of Indian Affairs.

In the case of an unpaid loan, the lender must offer to transfer the loan back to the Tribe or Tribe member. If that’s not possible and the home is foreclosed on, the lender must sell the lease or land, plus the home, back to a member of the Tribe, the Tribe itself, or the Indian Housing Authority.

In this way, the Tribe is protected against losing land to someone outside the Tribe.

There are two ways Tribal land can be held:

Allotment: The Tribe doesn’t own the land and the owner has control over the property, subject to BIA approval.

Assignment: The Tribe has control over the land. The Tribe can assign a lease to an individual member. If the lease is at least 10 years longer than the mortgage, the member can get a Section 184 Loan for the property.

How to apply with BIA for a mortgage on leased land

The BIA requires you to get approval for a mortgage on trust land, whether you own it or someone else does.

Leasehold mortgage approval

To get approval to buy land owned by the Tribe or another Indian Landowner, submit the following items by mail.

- BIA lease number or copy of approved lease

- Deed of trust (produced by the lender)

- Mortgage note (produced by the lender)

- Landowner consent to lease. The lease must last at least 10 years longer than the mortgage term (for instance, a 40-year lease for a 30-year mortgage. Most leases are 50 years.)

- Survey map and legal description and/or lot number

See full requirements at BIA.gov.

Trust land mortgage approval

You’ll also need BIA approval to get a mortgage on Tribal land owned by you. Send by mail:

- Commitment letter detailing loan terms

- Loan purpose (new purchase, construction, refinance)

- Form 1003 loan application (the lender can print a copy after applying)

- Legal description or survey

- BIA disclosure statement explaining the process if the trust or land will be transferred if foreclosed

- Deed of trust (produced by the lender)

- Mortgage note (produced by the lender)

- Proof of employment

Other items may be required as applicable

- If a refinance, proof the previous mortgage has been paid off and closed

- Authorization to share information with the BIA

- Proof of right-of-way to cross non-owned land for parcels with no direct access from a public street or driveway

- Statement that you are not delinquent on a federal debt

- Certified Title Status Report (TSR)

See mailing address and more details at BIA.gov.

This sounds like a complex list of items, and it is. However, your lender will assist (or completely take care of) gathering the necessary information and getting BIA approval for you. The above is just so you know what to expect your lender to ask for.

What is a Title Status Report (TSR)?

The lender will require a Title Status Report, or TSR, for parcels within trust land. This report shows ownership history. It is created by the Bureau of Indian Affairs.

The TSR shows that the seller has the right to sell the home or land to you. If you’re refinancing, it shows that you have the right to get a new loan on the home.

A TSR may take some time for the BIA to put together, from a few weeks to a few months. Prepare by starting your application earlier than you think you need to.

You can request a TSR at your local BIA office. A list of regional offices can be found here. From the Regional Office page, you can find and select your local office.

Section 184 vs FHA

What are advantages of the Section 184 Loan vs FHA? For some, FHA may be the better choice. A checkmark means it may be the better program for each feature.

| Loan Feature | Section 184 | FHA |

| Down payment | 1.25-2.25% ✔ | 3.5% |

| Upfront mortgage insurance | 1.0% ✔ | 1.75% |

| Monthly mortgage insurance | None ✔ | 0.55% annually |

| Can be used on-reservation | Yes ✔ | No |

| Credit score | No minimum ✔ | 580 for 3.5% down |

| Available in all states | No | Yes ✔ |

| Tribe membership required | Yes | No ✔ |

| Availability | About 140 lenders | Thousands of lenders ✔ |

| Tribe approval from HUD required | Yes | No ✔ |

If you’re just getting a regular loan outside the reservation, and you qualify, FHA could be faster and easier. But, if you need any of the special features offered by Section 184, that’s your better option.

Section 184 construction or rehab

You can use a Section 184 loan to construct or rehabilitate a home on your land or leased land. Check with your lender to make sure they offer the construction option.

This loan lets you:

- Build a new home

- Buy and place a manufactured home on land

- Buy and rehab a home with one loan

- Rehab or make improvements to your current home

- Add accessibility features to your home

Building a home with this loan could be a good option. It allows you to buy the land and pay for construction costs with a single loan. You can build a home that perfectly suits your needs instead of finding an existing home. You must be ready to build when you buy the land.

You can also use a single loan to buy and fix up a property. There are often great values when shopping for fixer-uppers. With this loan, you can finance repair costs. The loan is based on the future estimated value after repairs are complete.

No matter which type of construction loan you choose, you’ll have to find an experienced and reputable builder. Ask your lender for referrals. Also, ask the builder for references from past customers. You want a builder that will complete the project on time and on budget, since delays will end up costing you more and add to your loan amount.

Request a call to check your Section 184 eligibility.

Optional homeownership counseling

While homeownership counseling is not required for the program, lenders strongly advise it.

These resources can help you plan for life as a homeowner. They prepare you to budget, save for unexpected expenses, and more.

Check for HUD-approved housing counseling agencies here.

Section 184 FAQs

No, there is no income limit for the program. You can make a large income and still be eligible.

For most areas of the country, you can get a Section 184 Loan up to $420,680 for a 1-unit home. But limits are higher for high-cost areas and for 2-4 unit homes. However, your income level and financial situation could mean you will be approved for a lower loan amount.

No. You must use the funds to both buy the land and build the home. The home must be ready to be built for the loan to be approved.

Closing can take longer than for an FHA or conventional loan, especially if the home is on leased land. You must secure a lease for the property, which involves working with the Tribe. Getting approval from the Tribe can take a few weeks to a few months. Once the Tribe issues permission to lend on trust land, it can take 30-45 days to process the rest of the loan.

Section 184 down payment can come from Tribal assistance, a family gift, a down payment assistance program, or personal savings.

You can only receive a Section 184 loan if you are an enrolled member of a federally-recognized Tribe that is also approved for Section 184 loans. Your Tribe can apply with HUD by forming housing processes and procedures and meeting other HUD requirements.

The Section 184 Loan can be used as a first-time homebuyer program. It requires just a 2.25% down payment which can be paid for with down payment assistance. Those who have owned a home before can also use it.

Contact a Section 184 lender to get started.

Resources

Section 184 Lender List

There are around 140 Section 184 Loan lenders nationwide that offer Section 184 loans.

This means you shouldn’t have any problem finding a lender and shopping around for the best rate and terms.

Each lender must be approved by HUD to offer these loans. And, they must complete at least one Section 184 loan every six months to keep their approval.

Below is a list of approved Section 184 lenders as of January 2023. Be sure to check for more recent lists on HUD’s website.

| Section 184 Approved Lenders | Phone | States |

|---|---|---|

| 1st Capital Mortgage LLC | 918-274-1519 | OK |

| Academy Mortgage Corporation | 800-660-8664 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| Alaska USA Federal Credit Union | 800-525-9094 | AK, AZ, CA, WA |

| Alaska USA Mortgage Company | 800-737-3033 | AK, CA, WA |

| All State Homes / Xcellerate Home Loans | 559-475-0583 | CA |

| American Bank of Oklahoma | 918-686-7300 | AR, AZ, OK |

| American Financial Network Inc | 888-636-7573 | CA, FL, ID, NV, OK, TX, UT, WI |

| American Mortgage Bank, LLC | 405-283-8800 | AL, AK, AZ, AR, CA, CO, CT, FL, ID, IL, IN,IA, KS, LA, ME, MA, MI, MN, MS, MO, MT,NE, NV, NM, NY, NC, ND, OK, OR, RI, SC,SD, TX, UT, VA, WA, WI, WY |

| American Pacific Mortgage | 503-550-2662 | All States |

| American United Federal Credit Union | 358-270-8742 | CA, UT |

| AmeriFirst Financial Inc. | 877-276-1974 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| Armstrong Bank | 888-680-2655 | AL, AK, AZ, AR, CA, CO, CT, FL, ID, IL, IN,IA, KS, LA, ME, MA, MI, MN, MS, MO, MT,NE, NV, NM, NY, NC, ND, OK, OR, RI, SC,SD, TX, UT, WA, WI, WY |

| Arvest Bank | 866-952-9523 | AL, AK, AZ, AR, CA, CO, CT, FL, ID, IL, IN,IA, KS, LA, ME, MA, MI, MN, MS, MO, MT,NE, NV, NM, NY, NC, ND, OK, OR, RI, SC,SD, TX, UT, WA, WI, WY |

| Associated Mortgage Corp | 800-725-5262 | OK |

| AVB Bank | 918-251-9611 | OK |

| Axia Financial, LLC | 855-355-2942 | AZ, CA, OK, WA |

| BancFirst | 877-602-2262 | OK |

| Bank of Albuquerque | 866-910-5218 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| Bank of Cherokee County | 918-772-2572 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| Bank of Commerce | 800-324-8003 | OK |

| Bank of England | 888-639-2517 | All States |

| Bank of Oklahoma (BOKF NA) | 800-234-6181 | All States |

| Bay Bank | 920-490-7600 | AL, AK, AZ, AR, CA, CO, CT, FL, ID, IL, IN,IA, KS, LA, ME, MA, MI, MN, MS, MO, MT,NE, NV, NM, NY, NC, ND, OK, OR, RI, SC,SD, TX, UT, WA, WI, WY |

| Bay Equity LLC | 800-BAY-3703 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| BCK Capital Inc. / All Season’s Mortgage | 541-850-9020 | OR |

| Broker Solutions, Inc | 800-450-2010 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| CalCon Mutual Mortgage | 888-488-3807 | All States |

| Caliber Home Loans | 855-808-2124 | AK, AZ, CA, MI, OK, OR, WA |

| Capital Mortgage, LLC | 208-854-7800 | ID, OR |

| Cascade Northern Mortgage | 360-882-0802 | OR, WA |

| Cascade Residential Mortgage | 503 892-0011 | OR, WA |

| Centennial Home Mortgage, LLC | 405-615-0146 | CA, FL, KS, OK |

| Champion Home Loans | 405-716-4565 | OK |

| Cherry Creek Mortgage | 303-320-4040 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| Chickasaw Community Bank | 405-949-7000 | All States |

| Churchill Mortgage | 888-562-6200 | AK, AZ, ID, MT, NV, OR, UT, WA |

| Citizens Bank of Ada | 580-332-6100 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| Citywide Mortgage | 405-794-4412 | OK |

| Click n’ Close / 1st Tribal Lending | 866-235-4033 | All States |

| Clift Enterprises, Inc. / Clift Mortgage | 360-683-4848 | WA |

| CMG Financial | 925-983-3000 | All States |

| Cook Inlet Lending Center | 907-793-3058 | AK |

| Cornerstone Home Lending | 877-621-4663 | All States |

| Cross Country Mortgage | 877-351-3400 | AZ, CA, FL, IL, MI, OK, TX |

| DHI Mortgage Company, LTD | 800-315-8434 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| Diversified Lending Group / Cross Timbers Mortgage | 405-233-4321 | OK |

| Eagle Bank | 406-883-2940 | All States |

| Edge Home Finance Corporation | 763-219-8484 | AL, AZ, CA, CO, FL, MA, MI, MO, NC, ND,NM, OK, SC, TX, VA, WA, WI |

| Everett Financial, Inc / Supreme Lending | 877-350-5225 | All States |

| Evergreen Moneysource Mortgage Company | 877-242-2014 | AZ, CA, CO, FL, ID, KS, LA, MN, MT, NV,OR, TX, WA, WY |

| Exchange Bank and Trust Co | 405-742-0202 | All States |

| F&M Bank Mortgage -Yukon Mortgage | 405-348-0300 | All States |

| Fairway Independent Mortgage | 608-837-4800 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| FBC Mortgage LLC | 407-872-3383 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| First American Mortgage Inc | 405-354-0426 | OK |

| First National Bank & Trust Co. | 405-275-8830 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| First National Bank of Alaska | 907-777-4362 | AK |

| First New Mexico Bank of Silver City | 575-388-3121 | All States |

| First Oklahoma Mortgage, LLC | 918-392-2500 | OK |

| First Pryority Bank | 800-462-7032 | OK |

| First United Bank and Trust Co | 800-924-4427 | AL, AK, AZ, AR, CA, CO, CT, FL, ID, IL, IN,IA, KS, LA, ME, MA, MI, MN, MS, MO, MT,NE, NV, NM, NY, NC, ND, OK, OR, RI, SC,SD, TX, UT, WA, WI, WY |

| Firstar Bank | 918-681-7100 | AR, OK |

| FirstTrust Home Loans, Inc. | 870-942-5050 | AL, AK, AZ, AR, CA, CO, CT, FL, ID, IL, IN,IA, KS, LA, ME, MA, MI, MN, MS, MO, MT,NE, NV, NM, NY, NC, ND, OK, OR, RI, SC,SD, TX, UT, WA, WI, WY |

| Flat Branch Mortgage, Inc. | 866-508-4362 | AR, CO, FL, IA, IL, IN, KS, MN, NE, NM, OK,WA |

| Gateway First Bank | 877-764-9319 | All States |

| Geneva Financial, LLC | 888-889-0009 | AL, AK, AZ, AR, CA, CO, CT, FL, ID, IL, IN,IA, KS, LA, ME, MA, MI, MN, MS, MO, MT,NE, NV, NM, NC, OK, OR, RI, SC, SD, TX,UT, VA, WA, WI, WY |

| Grand Savings Bank | 918-786-2203 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| Guaranteed Rate Inc | 866-934-7283 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| Guardian One, LLC | 971-244-2389 | CA, OR, WA |

| Guild Mortgage Company | 800-688-7880 | All States |

| Highlands Residential Mortgage, LTD | 866-912-7511 | AL, AK, AZ, AR, CA, CO, CT, FL, ID, IL, IN,IA, KS, LA, ME, MA, MI, MN, MS, MO, MT,NE, NV, NM, NY, NC, ND, OK, OR, RI, SC,SD, TX, UT, WA, WI, WY |

| Home Mortgage Resource Inc | 918-458-0784 | OK |

| Homestar Financial Corp | 877-538-3393 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| Homestate Mortgage Company LLC | 907-762-5890 | AK |

| Hometown Lenders Inc | 888-628-1414 | AL, AK, AZ, FL, MT, ND, NM, NV, OK, WA |

| Homewise, Inc | 505-955-7044 | CO, MS, NM, TX |

| Hunt Mortgage Services | 405-361-5172 | OK |

| Interlinc Mortgage Services LLC | 800-979-3340 | AL, AR, AZ, CO, FL, IA, IN, KS, LA, MI, MN,MS, NC, NE, NM, OK, SC, TX, VA, WI |

| Key Mortgage Group, Inc | 505-334-2510 | CO, NM |

| Lake Superior Community Development Corp. | 906-524-5445 | MI |

| LeaderOne Financial Corporation | 800-270-3416 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| Legacy Mortgage LLC | 888-296-4747 | AZ, CO, NM, TX |

| Legend Lending Corporation | 888-820-2572 | AZ, MI |

| Lend Smart Mortgage LLC | 866-772-2503 | AL, AZ, CA, CO, FL, IA, ID, MI, MN, MT, NC,ND, NE, NM, OR, SC, SD, TX, UT, VA, WA,WI, WY |

| Lighthouse Financial Enterprises, Inc | 888-689-3042 | ID, OR, WA |

| LoanDepot | 888-337-6888 | All States |

| LRG Lending, Inc. | 916-758-8000 | CA |

| Lumbee Guaranty Bank | 910-521-9707 | NC |

| McClain County National Bank | 405-447-7283 | OK |

| MLD Mortgage Inc / The Money Store | 888-777-4706 | AL, AZ, AR, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MI, MN, MO, MT, NE, NV, NM,NY, NC, ND, OK, OR, RI, SC, TX, UT, VA,WA, WI, WY |

| Mortgage Brokers of Alaska Corp | 907-343-8898 | AK |

| NACDC Financial Services | 406-338-2099 | MT |

| Nations Reliable Lending, LLC | 713-275-1300 | All States |

| Nationwide Loans, Inc. | 800-540-3909 | CA |

| Native Partnership for Housing, Inc. | 505-722-0551 | AZ, NM |

| Neighborhood Mortgage | 877-385-8044 | AZ, WA |

| NEXA Mortgage, LLC | 833-391-3911 | AL, AK, AZ, AR, CA, CO, CT, FL, ID, IL, IN,IA, KS, LA, ME, MI, MN, MS, MO, MT, NE,NV, NM, NC, ND, OK, OR, RI, SC, SD, TX,UT, WA, WI, WY |

| NOVA Financial | 520-425-8514 | AZ, CA, CO, FL, IL, IN, NM, NV, OR, TX, UT,WA |

| Nuvision Federal Credit Union | 907-257-1601 | All States |

| On Q Financial | 866-667-3279 | AZ, CA, CO, FL, ID, MO, NC, ND, NV, OR,SC, TX, WA |

| Open Mortgage LLC | 888-602-6626 | All States |

| Pacific Residential Mortgage, LLC | 503-699-5626 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| Powerhouse Mortgage & Realty / Your DarlingLender | 619-504-9983 | CA |

| Premier Mortgage Advisors | 505-830-9685 | CO, NM, TX |

| Premier Mortgage Resources LLC | 866-733-3700 | CA, ID, OR, WA |

| Price Mortgage Group, Inc | 405-413-5427 | AR, CA, CO, OK, TX, VA |

| Primary Residential Mortgage Inc. | 800-255-2792 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| PrimeLending | 800-317-7463 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| Princeton Mortgage Corporation | 800-635-0977 | AK, AZ, AR, CA, CO, FL, ID, IL, IN, IA, KS,LA, ME, MA, MI, MN, MS, NE, NM, NC, OK,OR, RI, SC, TX, VA, WI |

| Raven Mortgage LLC | 833-997-2836 | AK, WA |

| RCB Bank | 855-226-5722 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| Resident Lending Group Inc | 503-589-1999 | OR |

| Residential Mortgage, LLC | 907-222-8800 | AK, OR, WA |

| RoundPoint Mortgage | 877-426-8805 | All States |

| Spirit Bank | 800-352-1171 | All States |

| Spurr Mortgage, Corp | 405-348-9919 | OK |

| Stride Bank, NA | 405-900-5433 | All States |

| Summit Funding Inc | 855-234-7561 | AL, AZ, AR, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NC, ND, OK, OR, SC, SD, TX, UT,WA, WI, WY |

| Sunflower Bank / Guardian Mortgage | 800-331-4799 | AL, AZ, AR, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, MA, MI, MN, MS, MO, MT, NE, NV,NM, NC, OK, OR, RI, SC, SD, TX, UT, VAWA, WI, WY |

| Sun West Mortgage Corp | 800-453-7884 | AL, AK, AZ, CA, CO, CT, FL, ID, IL, IN, IA,KS, LA, ME, MA, MI, MN, MS, MO, MT, NE,NV, NM, NY, NC, ND, OK, OR, RI, SC, SD,TX, UT, WA, WI, WY |

| The Central Trust Bank | 573-634-5600 | All States |

| The Turnkey Foundation / Arbor Financial | 866-639-6554 | AZ, CA, CO, FL, ID, IL, MI, MO, NV, OR, TX,UT, WA |

| Tongass Federal Credit Union | 907-225-9063 | AK |

| Triad Bank, NA | 918-254-1444 | All States |

| TTCU- The Credit Union | 918-749-8828 | All States |

| United Bank | 251-446-6000 | AL, AR, FL, LA, NC |

| United Fidelity Funding Corp. | 866-760-0600 | AR, MO, OK |

| Universal Lending Corp | 800-758-4063 | AZ, CO, IA, MT, NM, WY |

| US Mortgage Corporation | 631-580-2600 | All States |

| Valley Bank of Ronan, Corporation | 406-676-2000 | MT |

| VanDyk Mortgage Corporation | 616-940-3000 | All States |

| V.I.P. Mortgage, INC | 480-966-0919 | AL, AZ, AR, CA, CO, FL, ID, IL, IN, IA, KS,LA, MA, MI, MN, MT, NE, NV, NM, NC, OK,OR, SC, SD, TX, UT, WA, WI, WY |

| Vision Bank | 580-332-5132 | All States |

| Vision Mortgage, INC | 530-672-0106 | AK, CA, ID |

| Waterstone Mortgage Corporation | 800-354-1149 | AL, AZ, AR, CA, CO, ID, IL, IN, IA, ME, MA,MI, MN, NV, NM, ND, OR, RI, WA, WY |

| Woodlands National Bank | 888-532-4142 | IA, MN, ND, SD, WI |

| Xpert Home Lending | 833-449-7378 | AL, AR, AZ, CA, CO, FL, ID, IL, KS, MI, NC,NM, OR, SC, TX, VA, WA, WI |

| ZFG Mortgage LLC | 918-459-6530 | OK |

Section 184 approved Tribes list

This is a list of Tribes that are approved for Section 184 loans. This list is as of 12/19/22, the most recent list available from HUD. Be sure to check on HUD’s website directly for the most current list.

Absentee Shawnee Tribe of Indians of Oklahoma

Alabama-Quassarte Tribal Town

Apache Tribe of Oklahoma

Assiniboine and Sioux Tribes of the Fort Peck Reservation

Bad River Band of Lake Superior Tribe of Chippewa Indians

Barona Group of Capitan Grande Band of Mission Indians aka Barona Band of Mission Indians

Bay Mills Indian Community

Bear River Band of the Rohnerville Rancheria

Berry Creek Rancheria of Maidu Indians of California

Big Lagoon Rancheria

Big Sandy Rancheria of Western Mono Indians of California

Bishop Paiute Tribe

Blackfeet Tribe

Blue Lake Rancheria

Bois Forte Band of Chippewa

Burns Paiute Tribe

Cabazon Band of Mission Indians

Cahuilla Band of Indians

Catawba Indian Nation aka Catawba Tribe of South Carolina

Chemehuevi Indian Tribe

Cherokee Nation

Cheyenne River Sioux Tribe

Chickasaw Nation

Chippewa Cree Indians of the Rocky Boy’s Reservation

Chitimacha Tribe of Louisiana

Choctaw Nation of Oklahoma

Citizen Potawatomi Nation

Cocopah Tribe of Arizona

Coeur d’Alene Tribe

Coharie Tribe

Cold Springs Rancheria of Mono Indians of California

Colorado River Indian Tribes

Comanche Nation

Confederated Tribes of Siletz

Confederated Tribes of Warm Springs

Confederated Tribes of the Chehalis

Confederated Tribes of the Colville

Confederated Tribes of the Coos, Lower Umpqua and Siuslaw Indians

Confederated Tribes of the Umatilla

Coquille Indian Tribe

Cowlitz Indian Tribe

Crow Creek Sioux Tribe

Crow Tribe of Montana

Delaware Nation

Dry Creek Rancheria Band of Pomo Indians

Duckwater Shoshone Tribe

Eastern Band of Cherokee Indians

Eastern Shawnee Tribe of Oklahoma

Eastern Shoshone Tribe of the Wind River Reservation

Ely Shoshone Tribe of Nevada

Flandreau Santee Sioux Tribe of South Dakota

Fond du Lac Band of Lake Superior Chippewa aka Fond du Lac Band of Minnesota Chippewa

Forest County Potawatomi Community

Fort Belknap Indian Commuity aka Gros Ventre and Assiniboine Tribes of Fort Belknap

Fort McDowell Yavapai Tribe

Fort Mojave Indian Tribe of Arizona, California and Nevada

Gila River Indian Community

Grand Portage Band of Minnesota Chippewa

Grand Ronde Confederated Tribes

Grand Traverse Band of Ottawa and Chippewa Indians

Guidiville Rancheria of California

Haliwa Saponi Indian Tribe

Ho-Chunk Nation of Wisconsin

Hoh Indian Tribe

Hoopa Valley Tribe

Hopi Tribe of Arizona

Hopland Band of Pomo Indians

Hualapai Indian Tribe

Iowa Tribe of Oklahoma

Isleta del Sur Pueblo aka Tigua Pueblo

Jicarilla Apache Nation

Kaibab Band of Paiute Indians

Kalispel Indian Community

Kashia Band of Pomo Indians of the Stewarts Point Rancheria

Kaw Nation

Kewa Pueblo formerly known as Pueblo of Santa Domingo

Keweenaw Bay Indian Community

Kialegee Tribal Town

Kickapoo Tribe of Indians of the Kickapoo Reservation in Kansas

Kiowa Indian Tribe of Oklahoma

Klamath Tribes

Kootenai Tribe of Idaho

La Jolla Band of Luiseno Indians

Lac Courte Oreilles Band of Lake Superior Chippewa Indians of Wisconsin

Lac du Flambeaux Band of Lake Superior Chippewa Indians

Leech Lake Band of Ojibwe aka Leech Lake Band of Minnesota Chippewa

Little River Band of Ottowa Indians

Little Traverse Bay Bands of Odowa Indians

Lower Brule Sioux Tribe

Lower Elwha Tribal Community

Lower Sioux Indian Community in the State of Minnesota

Lumbee Tribe of North Carolina

Lummi Tribe

Makah Tribe

Manchester Band of Pomo Indians of the Manchester Rancheria

Manzanita Band of Diegueno Mission Indians aka Manzanita Band of Kumeyaay Nation

Mashantucket Pequot Indian Tribe

Match-e-be-nash-she-wish Band of Pottawatomi Indians of Michigan

Menominee Indian Tribe of Wisconsin

Mescalero Apache Tribe

Metlakatla Indian Community

Miami Tribe of Oklahoma

Mille Lacs Band of the Minnesota Chippewa Tribe

Mississippee Band of Choctaw Indians

Mooretown Rancheria of Maidu Indians of California

Morongo Band of Mission Indians

MOWA Band of Choctaw Indians

Muckleshoot Indian Tribe

Muscogee (Creek) Nation

Narragansett Indian Tribe

Navajo Nation

Nez Perce Tribe

Nisqually Indian Tribe

Nooksack Indian Tribe

Northern Arapaho aka Arapaho Tribe of the Wind River Reservation

Northern Cheyenne Tribe

Northwestern Band of Shoshoni Indians

Oglala Sioux Tribe

Ohkay Owingeh formerly known as Pueblo of San Juan

Omaha Tribe of Nebraska

Oneida Nation

Osage Nation

Oteo-Missouria Tribe of Indians

Paiute-Shoshone Tribe of the Fallon Reservation and Colony

Pala Band of Mission Indians

Pauma Bank of Luiseno Mission Indians

Pascua Yaqui Tribe of Arizona

Passamaquoddy Tribe of Indian Township

Passamaquoddy Tribe of Pleasant Point

Pawnee Nation of Oklahoma

Penobscot Nation

Peoria Tribe of Indians of Oklahoma

Poarch Band of Creeks aka Poarch Band of Creek Indians

Pokagaon Band of Pottawatomi Indians

Ponca Tribe of Indians of Oklahoma

Ponca Tribe of Nebraska aka Northern Ponca

Port Gamble S’Klallam Tribe

Prairie Band Potawatomi Nation

Pueblo of Acoma

Pueblo of Cochiti

Pueblo of Isleta

Pueblo of Jemez

Pueblo of Laguna

Pueblo of Nambe

Pueblo of Pojoaque

Pueblo of San Felipe

Pueblo of San Ildefonso

Pueblo of Sandia

Pueblo of Santa Ana

Pueblo of Santa Clara

Pueblo of Taos*

Pueblo of Zia

Pueblo of Tesuque

Puyallup Tribe

Pyramid Lake Paiute Tribe

Quapaw Nation

Quinault Indian Nation

Red Cliff Band of Lake Superior Chippewa Indians of Wisconsin

Redwood Valley or Little River Band of Pomo Indians of the Redwood Valley Rancheria

Rincon Band of Luiseno Mission Indians

Robinson Rancheria

Rosebud Sioux

Saboba Band of Luiseno Indians

Sac & Fox Nation of Oklahoma

Sac & Fox Nation Tribe of Mississippi in Iowa

Sac and Fox Nation

Sac and Fox Nation of Missouri in Kansas and Nebraska

Saginaw Chippewa Indian Tribe of Michigan

Saint Regis Mohawk Tribe

Salish and Kootenai Tribe

Salt River Pima-Maricopa Indian Community

Samish Indian Nation

San Carlos Apache Tribe

Santa Rosa Band of Cahuilla Indians

Santa Ynez Band of Chumash Mission Indians

Santa Ysabel Band of Diegueno Mission Indians

Santee Sioux Nation, Nebraska

Sault Ste. Marie Tribe of Chippewa Indians

Seminole Nation of Oklahoma

Seminole Tribe of Florida

Seneca-Cayuga Nation

Seneca Nation of Indians

Sherwood Valley Rancheria

Shingle Springs Band of Miwok Indians

Shoalwater Bay Indian Tribe

Shoshone Bannock

Sisseton-Wahpeton Oyate formerly Sisseton-Wahpeton Sioux Tribe

Skokomish Indian Tribe

Snoqualmie Indian Tribe

Soboba Band of Luiseno Indians

Sokaogan Chippewa Community

Southern Ute Indian Tribe

Spirit Lake Tribe

Spokane Tribe

Squaxin Island Tribe

St. Croix Chippewa Indians of Wisconsin

Standing Rock Sioux Tribe

Stillaguamish Tribe

Stockbridge-Munsee Community aka Mohican Nation Stockbridge-Munsee Band

Suquamish Indian Tribe

Susanville Indian Rancheria

Swinomish Indian Tribal Community

Te-Moak Tribe of Western Shoshone Indians of Nevada

The Lac Vieux Desert Band of Lake Superior Chippewa Indians of Michigan

Three Afiliated Tribes of the Fort Berthold Reservation aka Mandan, Hidatsa and Arikara Nation

Tohono O’odham Nation

Tolowa Dee-ni’ Nation formerly Smith River Rancheria

Torres Martinez Desert Cahuilla Indians

Tulalip Tribes of Washington

Tule River Indian Tribe of California

Tunica Buloxi Indian Tribe

Tuolumne Band of Me-Wak Indians of the Tuolumne Rancheria

Turtle Mountain Band of Chippewa Indians of North Dakota

United Auburn Indian Community

Upper Skagit Indian Tribe

Ute Indian Tribe of the Uintah & Ouray Res

Waccamaw Siouan Tribe

Walker River Paiute Tribe

Wampanoag Tribe of Gayhead (Aquinnah)

Washoe Tribes of Nevada and California

White Earth Band of Minnesota Chippewa Tribe

White Mountain Apache Tribe

Winnebago Tribe of Nebraska

Witchita and Affiliated Tribes

Yakama Nation

Yankton Sioux Tribe of South Dakota

Yarrington Paiute Tribe

Yavapai -Prescott Indian Tribe

Yavapai-Apache Nation

Yurok Tribe

Zuni Tribe aka Zuni Pueblo

Section 184 Native American Home Loan Calculator Image: