When rates drop, an FHA Streamline refinance can get you into a new lower-rate loan with no appraisal or income documentation.

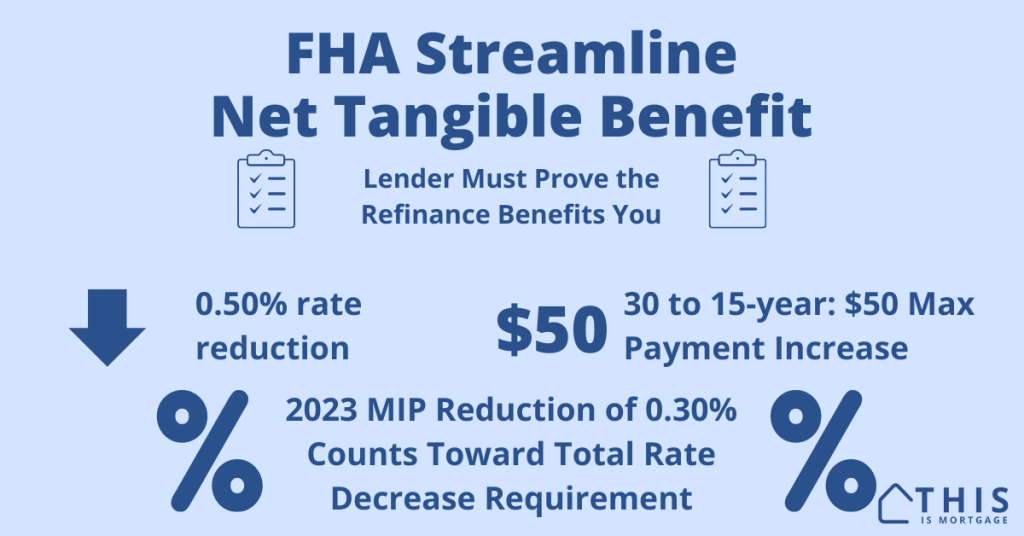

What’s even better is that the program comes with a built-in consumer protection test called the Net Tangible Benefit.

If the loan doesn’t provide value to the applicant, FHA will not approve the loan. This ensures homeowners don’t fall victim to predatory lenders. Still, you might be frustrated that you can’t refinance with an FHA Streamline. If that’s you, here’s what to do.

Check your FHA Streamline eligibility.

Net Tangible Benefit summary table

| Refinancing from | Refinancing to | Requirement |

| 30-year fixed | 30-year fixed | Mortgage rate + MIP rate must drop by 0.50% |

| ARM | 30-year fixed | Mortgage rate + MIP rate can’t rise more than 2% |

| 30-year fixed | 15-year fixed | Mortgage rate + MIP rate must be lower and payment can’t rise by more than $50 |

| ARM | ARM | Mortgage rate + MIP rate must drop by 1% |

| Fixed | ARM | Mortgage rate + MIP rate must drop by 2% |

Passing the Net Tangible Benefit test

Here are ways to pass the test.

Refinancing a 30-year fixed to another 30-year fixed

Lower the mortgage rate by 0.50%

Your mortgage rate needs to drop 0.50% from your current rate.

Example: Current rate of 7.0% drops to 6.5%: Eligible

Lower the mortgage rate and mortgage insurance a total of 0.50%

You can meet eligibility by dropping your mortgage rate and mortgage insurance rate.

FHA mortgage insurance costs dropped from 0.85% to 0.55% per year in February 2023. A new Streamline refinance would give you access to the new mortgage insurance premium.

Anyone who got an FHA loan prior to February 2023 just needs to drop their mortgage rate by 0.20% to be eligible.

Example:

| Current loan | Refinance | |

| Mortgage rate | 7.0% | 6.8% |

| Mortgage insurance rate | 0.85% | 0.55% |

| Total rate + MIP | 7.85% | 7.35% (Eligible) |

See if you pass the Net Tangible Benefit test. Connect with a lender.

Refinance an adjustable-rate mortgage (ARM) to fixed Rate

In most cases, converting an ARM to a fixed mortgage is considered a benefit to the borrower. However, your mortgage rate can’t rise more than 2.0%.

Example: Current ARM is 6%; refinance to a 7% fixed-rate mortgage: Eligible.

Refinancing a 30-year fixed into a 15-year fixed

It’s very difficult to refinance into a shorter loan term with an FHA streamline:

- The payment can’t rise more than $50 per month going from a 30-year fixed to 15-year

- The mortgage rate plus mortgage insurance rate must decrease any amount

- If refinancing an ARM to 15-year fixed, the rate can’t rise by more than 2%.

Most 15-year mortgage payments are hundreds of dollars more than their 30-year equivalents.

However, if your loan amount is now much lower than the original loan, it’s possible to keep the increase below $50.

Example:

| Current 30-year fixed | 15-year refinance | |

| Mortgage rate | 6.0% | 4.0% |

| Mortgage insurance rate | 0.85% | 0.55% |

| Loan amount | $250,000 | $210,000 |

| Principal, interest, MIP | $1,610 | $1,650 |

This scenario would be eligible since the payment increased by only $40, less than the $50 threshold.

Refinancing an ARM to another ARM

Your mortgage rate plus mortgage insurance rate must drop 1%.

Example: Current ARM 6%; You get a new ARM at 5%. Eligible.

Refinancing a fixed rate to an ARM

Your mortgage rate plus mortgage insurance rate must drop 2%.

Example: Current fixed rate at 7%. New ARM must be 5% or lower.

Related: Check Your FHA MIP Refund When Using a Streamline Refinance

What if you can’t pass the Net Tangible Benefit test?

You may have a situation where you need to refinance, but the benefit to you “doesn’t count” as an FHA net tangible benefit. You have alternatives.

Negotiate your rate

Some lenders will give you a below-market rate to get your business. For instance, your current FHA loan rate is 6.75%. You’re quoted a 6.375% FHA streamline rate. Negotiate to get the rate down to 6.25%, meeting the 0.50% rate reduction requirement.

Get a no-obligation FHA Streamline refinance quote.

Pay points

Another way to lower your rate to meet requirements is to pay points. For example, achieving an additional 0.25% rate reduction might cost 1% of the loan (one point). Check with your lender how much you would need to pay in points to get a new loan that is 0.50% lower than your current rate.

Make sure you’re factoring in the MIP reduction

As mentioned, FHA mortgage insurance decreased 0.30% in February 2023, from 0.85% to 0.55%. Anyone who got an FHA loan prior to this date gets an automatic 0.30% of the required 0.50% reduction. You only have to lower your mortgage rate by 0.20%.

Use a standard FHA refinance

You don’t have to use an FHA Streamline loan. You can select a standard FHA refinance. This will require an appraisal and income documentation, but you don’t have to meet Net Tangible Benefit rules.

Use an FHA cash-out loan

An FHA cash-out refinance lets you take cash at closing. It does not require the benefit test. However, you need 25-30% equity in the home. The maximum new loan must have 20% equity remaining (80% LTV).

Read more about the FHA cash-out refinance.

Get a conventional refinance

You can refinance out of an FHA loan into conventional. This is also a great strategy if you want to get rid of FHA mortgage insurance, which is required as long as you have the FHA loan.

Wait for lower rates

Rates are projected to drop in 2024 and could also drop after that. If you wait long enough, chances are you’ll be able to meet FHA Streamline Net Tangible Benefit requirements. As soon as rates drop far enough, lock in, just in case rates rise.

See if you meet Net Tangible Benefit rules

It’s impossible to know whether you’ll meet the Net Tangible Benefit guidelines until you have a written rate quote. A 0.125% difference in rate could help you qualify.

Get your FHA Streamline Refinance rate quote and Net Tangible Benefit check by connecting with a lender now.