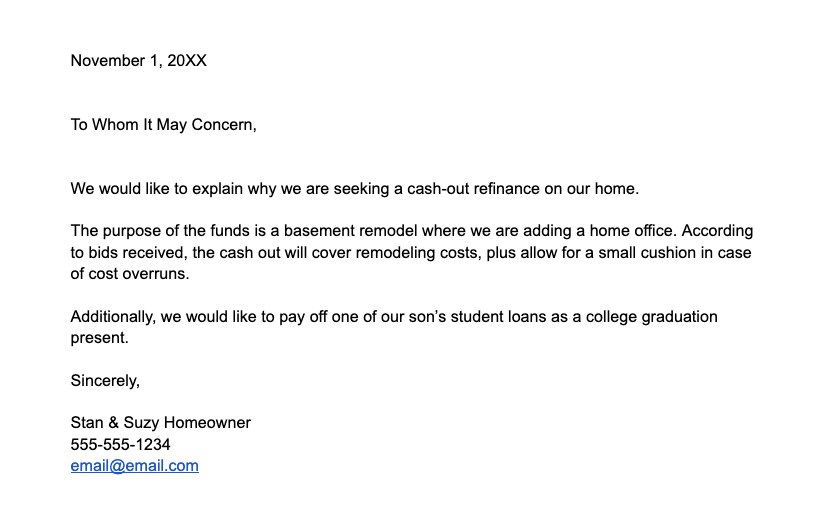

Free downloadable letter of explanation for cash-out refinance example

Sometimes, the lender’s underwriter will request a letter of explanation (LOE or LOX) for why you are seeking a cash-out refinance and what the funds are for.

Connect with a lender to check today’s refinance rates.

Here is a template to use.

>>Download the Word document here

>>Download the PDF here (requires PDF editor to edit)

Sample letter of explanation for cash-out refinance

Acceptable reasons for a cash-out refinance

According to Fannie Mae, you can use funds from a cash-out refinance for any purpose. So there are literally no limitations (within the law) for what you can do with the money.

However, the lender still has the discretion to deny a loan if it’s not comfortable with it as a whole package. A lender probably won’t deny you for simply “wasting money” on a big vacation. Still, the underwriter may want to strengthen the file with a good LOE.

See today’s cash-out refinance rates. Connect with a lender.

“Good” reasons for a cash-out, according to lenders:

- Consolidate a 1st and 2nd mortgage

- Remodel the home

- Consolidate high-interest debt

- Lower overall monthly debt payments

- Pay off student loans

- Anything that puts you in a better financial situation

“Not so good” reasons to take cash-out

- Extravagant vacation

- Paying off credit cards that you will obviously run up again

- New boat or another depreciating asset

- Any purpose that does not improve your financial situation in the long run

“Bad” reasons to take cash-out

- Illegal activity

- Risky investing, especially crypto

Reasons that will raise additional questions

- A down payment for a second home or investment property

- Starting a business

The last two reasons raise questions because they could raise your debt level or put your income at risk. Talk to your loan officer about what you should or shouldn’t disclose.

Why do underwriters ask for a letter of explanation for a cash-out refinance?

As shown above, not all reasons for cash are created equal.

Some put you into a better financial position or make the collateral (the house) more marketable. Thumbs up.

However, certain reasons are just a waste of money in the eyes of the lender, or worse, could put you in financial trouble.

Some cash-out reasons raise more questions. If you’re taking cash out to go into more debt, such as buying a second home, the lender will need to know the terms of the new loan. Plans to start a business could derail the approval because your W2 income that is used to qualify could dry up after closing.

Get advice from your loan officer about how the underwriter might view your reason for cash out if asked.

Should I submit a cash-out LOE when not asked for one?

No. Never volunteer more information than is required. Don’t hide anything, but you also don’t want to raise questions about your loan file if they can be avoided.

Good luck with your cash-out refinance!

Get a rate quote or second opinion about your cash-out refinance.