In the post-COVID world, it’s common to live far from your employer.

Still, your mortgage lender may ask for a letter of explanation of remote work, which will act as verification that the employer is aware and has approved your remote status.

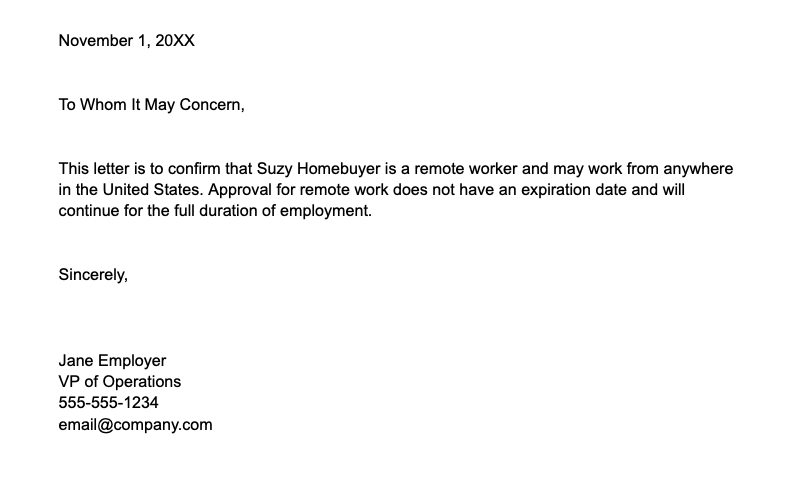

The letter typically can’t come from you, though. It must come from your employer. The below template is a good starting point for your manager or HR department.

Your employer may have its own template that it has to use. If it needs a template, feel free to send this to them.

When complete, you can send the signed letter to your lender. The lender can follow up with your manager if they need to verify the document’s legitimacy.

Request a rate quote to see if you’re getting the best deal. Start here.

Downloadable sample mortgage letter of explanation for remote work

>>Download the Word document here

>>Download the PDF here (requires PDF editor to edit)

Why do lenders need a letter of explanation for remote work?

Fannie Mae, FHA, and all other lending agencies create rules for lenders.

Perhaps the most important guideline of all is to document continuance of the borrower’s income for the next three years.

Imagine if you bought a home 1,000 miles from your employer and you only had permission to work remotely for the next six months. This would pose a real problem when the lender tries to prove three years’ income continuance to Fannie Mae.

Remote work letters are usually triggered when you are buying a house outside reasonable commuting distance from your employer.

So, if you’re buying a house in Dallas, Texas, but your employer is in Seattle, the underwriter may ask for a letter.

This is why a letter is so crucial for the underwriter. It confirms that your remote status is known by your employer and is not a temporary accommodation due to COVID-19.

So, while remote work letters are annoying and sometimes difficult to get, they are a necessary evil, and not your lender’s fault.

Speak to a lender about your homebuying scenario.

What if my employer won’t supply a letter?

Many employers are hesitant to supply any kind of letter regarding stability of employment. It probably has more to do with lawsuit exposure than anything else.

For instance, a lender will probably never certify you’ll remain with the company for three years. It may have to lay you off or let you go for cause. That’s why the above downloadable template doesn’t force the employer to state the length of time you’ll be employed.

Luckily, lenders assume the income will continue unless it finds evidence to the contrary.

Explain to your employer that the letter never leaves the loan file and is for no other purpose.

Another option is to ask the lender to verbally verify your remote status with your direct supervisor. That way, the employer never puts anything in writing.

There also may be public evidence that the company allows permanent remote work. During the pandemic, many companies openly issued permanent remote work policies. Better yet, supply the lender with your HR handbook stating that remote work is an option.

With a little creativity, you can get past this often troublesome requirement.