New Mexico is home to more than 200,000 Native Americans, which is why the state is one of the most popular for Section 184 loans.

Section 184 is another name for the Native American Home Loan program, which is opening up opportunities for many people to become homeowners.

It offers a low down payment, no minimum credit score, and easier terms than FHA. Plus, you can buy on or off reservation land. Here’s what to know about this powerful homebuyer program.

Find a lender to check your eligibility.

In this article:

- Benefits of a New Mexico Section 184 Loan

- Eligible areas in New Mexico

- New Mexico Section 184 loan limits

- New Mexico Section 184 calculator

- Who qualifies?

- Approved Native American Tribes in New Mexico

- Section 184 approved lenders

- Section 184 FAQ

- Start your Section 184 loan

- Infographic

Benefits of a Section 184 Loan in New Mexico

In New Mexico (and all states), Section 184 Loans come with huge benefits:

- 2.25% down payment

- Down payment assistance accepted

- You can pay for closing costs with gift funds or assistance

- No monthly mortgage insurance

- No credit score minimum

- Competitive interest rates

- Finance a home on or off reservations and Pueblos

- Purchase, build, renovate, or refinance a home

- Easier qualification criteria than FHA or conventional

The Section 184 Loan is a flexible financing option only available to Native Americans. If you are an enrolled member of a federally-recognized Tribe, it’s worth considering this loan program before looking into other financing options.

See if you can be approved for Section 184 by speaking with a lender.

Where in New Mexico are Section 184 loans available?

The entire state of New Mexico is geographically eligible for the Native American Home Loan.

This includes reservation land and Pueblos. This is an important difference between these loans and conventional, FHA, or VA loans. No other major loan type will let you finance a home on tribal trust land.

It does require some extra work, and the Tribe or Pueblo itself must be approved by HUD, the agency that oversees the program. But those who qualify can purchase or build a home, or set a manufactured home on a foundation, even if the land is off-limits for regular home loans.

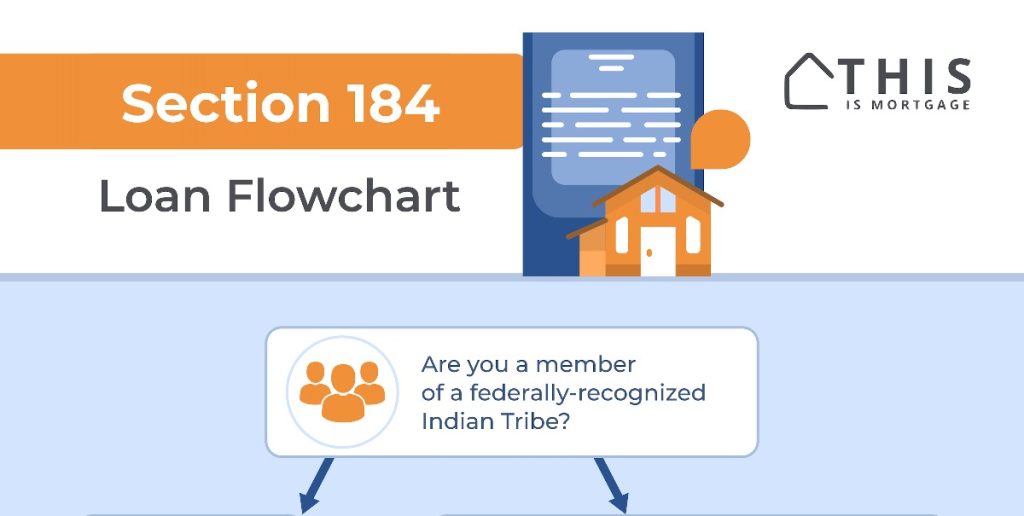

Who qualifies for a Native American Home Loan in New Mexico?

Here are the requirements to meet Section 184 loan eligibility.

Tribal membership: You’ll need valid ID from a federally-recognized Tribe. Your Tribe also must be approved by HUD to participate in the program.

Primary residence: You must live in the home you will buy.

Property type: 1-4 unit home or manufactured home on a permanent foundation

Loan purpose: You can buy, build, renovate, or refinance a home. You can also purchase and place a manufactured home on a permanent foundation.

Credit: Section 184 has no credit score minimum, but you must have reasonable credit history with no current judgments or other serious derogatory items.

Income: You will prove two years of employment history.

Debt-to-income ratio: Your “DTI” can be up to 41%. This means that your future housing payment plus all debt payments can be up to 41% of your gross income. HUD allows DTIs up to 43% when the file is otherwise strong.

Tribal lease: If buying on reservation land, you must obtain a lease from the Tribe or Pueblo. You’ll also need a Title Status Report from your local BIA office.

Section 184 loan limits New Mexico

Standard Section 184 loan limits across most of New Mexico are as follows:

- 1-unit: $498,257

- 2-unit: $637,950

- 3-unit: $771,125

- 4-unit: $958,350

A few counties within the state allow you to get a larger loan due to higher home prices. Counties with extended limits are:

| County | 1-Unit | 2-Unit | 3-Unit | 4-Unit |

| TAOS | $498,257 | $637,950 | $771,125 | $958,350 |

| SANTA FE | $541,650 | $693,400 | $838,150 | $1,041,650 |

| Los Alamos | $625,600 | $800,900 | $968,100 | $1,203,100 |

These limits give you plenty of room to buy the home you want, even if it’s higher than the New Mexico average.

However, you may not qualify for the loan limit amount. Your income and debts will determine your personal limit.

Check with a Section 184 lender to determine your personal loan limit.

New Mexico Section 184 calculator

Our Section 184 calculator tells you your estimated down payment, upfront mortgage insurance, and other factors specific to this program. Be wary of the online mortgage calculators that aren’t specifically for Section 184.

>>See the New Mexico Section 184 Calculator

Approved Native American Tribes in New Mexico

To be eligible for the program, your Tribe or Pueblo must be approved by HUD. A good place to check is our Approved Tribes list. Always be sure to check the housing section of your Tribe’s website and HUD for current information.

Below is a list of HUD-approved tribes in New Mexico as of December 2022, the most recent information available.

- Jicarilla Apache Nation

- Mescalero Apache Tribe

- Navajo Nation

- Ohkay Owingeh Pueblo

- Pueblo of Acoma

- Pueblo of Cochiti

- Pueblo of Isleta

- Pueblo of Jemez

- Pueblo of Laguna

- Pueblo of Nambe

- Pueblo of Pojoaque

- Pueblo of San Felipe

- Pueblo of San Ildefonso

- Pueblo of Sandia

- Pueblo of Santa Ana

- Pueblo of Santa Clara

- Pueblo of Taos

- Pueblo of Tesuque

- Pueblo of Zia

- Zuni Pueblo

New Mexico Native American Home Loan lenders

Not every lender offers these loans, but there are around 50 Section 184 lenders in New Mexico. This gives you plenty of options when shopping around.

Below is a list of approved Section 184 lenders in New Mexico as of January 2023, according to HUD.

- Academy Mortgage Corporation

- American Mortgage Bank, LLC

- AmeriFirst Financial Inc.

- Armstrong Bank

- Arvest Bank

- Bank of Albuquerque

- Bank of Cherokee County

- Bay Bank

- Bay Equity LLC

- Broker Solutions, Inc

- Cherry Creek Mortgage

- Citizens Bank of Ada

- DHI Mortgage Company, LTD

- Edge Home Finance Corporation

- Fairway Independent Mortgage

- FBC Mortgage LLC

- First National Bank & Trust Co.

- First United Bank and Trust Co

- FirstTrust Home Loans, Inc.

- Flat Branch Mortgage, Inc.

- Geneva Financial, LLC

- Grand Savings Bank

- Guaranteed Rate Inc

- Highlands Residential Mortgage, LTD

- Homestar Financial Corp

- Hometown Lenders Inc

- Homewise, Inc

- Interlinc Mortgage Services LLC

- Key Mortgage Group, Inc

- LeaderOne Financial Corporation

- Legacy Mortgage LLC

- Lend Smart Mortgage LLC

- MLD Mortgage Inc / The Money Store

- Native Partnership for Housing, Inc.

- NEXA Mortgage, LLC

- NOVA Financial

- Pacific Residential Mortgage, LLC

- Premier Mortgage Advisors

- Primary Residential Mortgage Inc.

- PrimeLending

- Princeton Mortgage Corporation

- RCB Bank

- Summit Funding Inc

- Sunflower Bank / Guardian Mortgage

- Sun West Mortgage Corp

- Universal Lending Corp

- V.I.P. Mortgage, INC

- Waterstone Mortgage Corporation

- Xpert Home Lending

See if you’re eligible. Find a lender here.

FAQ

Though the U.S. Department of Housing and Urban Development (HUD) oversees the program, you apply with private lenders and mortgage companies. Your chosen lender and loan officer will walk you through the process.

There can be a little more paperwork than with FHA or conventional loans, such as supplying your Tribal enrollment ID. However, qualifying can be easier than with other loan programs, with a lower down payment requirement and no credit score minimums.

Yes. These loans are different than any other major loan program. You can buy on Tribal trust land.

How to apply

Even if you’re not sure whether you can qualify, it’s worth applying for this loan.

Contact a Section 184 lender and say you’re an enrolled member of a Native American Tribe and you’d like to see if you qualify for this loan type.

Members of Tribes and Pueblos of New Mexico have an advantage over other homebuyers, so they should use this loan to accomplish their homeownership goals.

Connect with a lender to see if you qualify for Section 184.