The short answer is that you should get a USDA loan over FHA if you are eligible.

There are a few reasons:

- Zero down payment

- Similar or lower mortgage rates

- Lower mortgage insurance costs

However, USDA is not as widely available as FHA. Below is more information on how to know if you’re eligible.

Check your eligibility to use FHA or USDA.

- FHA vs USDA comparison

- USDA loans are only available in certain locations. FHA is available everywhere

- USDA comes with strict income limits. FHA has none

- USDA loan DTIs are harder to meet. FHA has lenient DTI maximums

- 3 USDA advantages

- Should you choose USDA or FHA?

- FHA or USDA? Two great options for first-time buyers

FHA vs USDA comparison

| Loan feature | FHA | USDA |

| Min. down payment | 3.50% | 0% |

| Geographic restrictions | None | Rural areas as defined by USDA |

| Income limits | None | $110k-200k/yr |

| DTI | 56% | 41% |

| Min. credit score | 580 | 580-620 |

| Upfront mortgage insurance | 1.75% | 1% |

| Monthly mortgage insurance | $46/mo per $100k | $29/mo per $100k |

| Loan limits | $498,257 | About $340,000 |

| Roll closing costs into loan? | No | When value > purchase price |

| Cancelable mortgage insurance? | No | No |

| Eligible properties | 1-4 unit homes | 1-unit |

| Eligible mortgage types | 15, 30-year fixed and ARMs | 30-year fixed only |

| Occupancy | Owner-occupied only | Owner-occupied only |

USDA loans are only available in certain locations. FHA is available everywhere

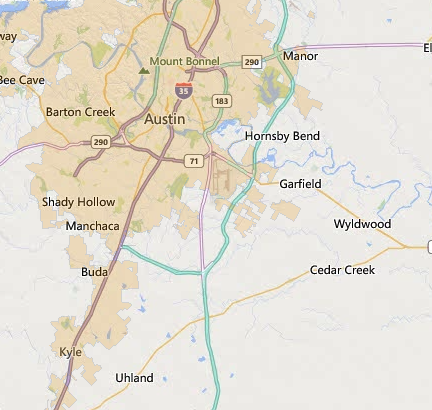

The home must be located in a “rural” area as defined by USDA.

Some locations are surprisingly close to major metro areas, though. If not, this can be a limiting factor. You may have to commute long distances if you work in a major city.

Here’s a snapshot of USDA-eligible areas around Austin, Texas as an example. USDA maintains a map of the entire U.S. so you can search your city. All unshaded areas are eligible.

If you are already planning to live in a rural area, USDA is a great option. But FHA has no geographic limitations.

See if a property is in a USDA-eligible area on USDA’s website.

See if you qualify for USDA. Start here.

USDA comes with strict income limits. FHA has none

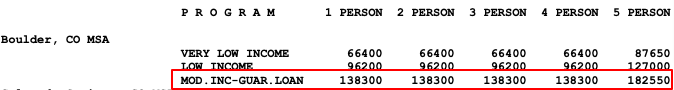

You must make about $110,000 per year to be eligible for USDA in most areas of the country. However, some high-cost areas allow incomes over $200,000.

This loan program counts all household income toward this total, even if the person isn’t on the loan. So even if your girlfriend moves in with you before you buy, it could jeopardize your approval.

Plus, it’s hard to qualify for much home when mortgage rates are high. The maximum eligible purchase price at today’s rates is about $340,000 in an average-income area.

USDA loan DTIs are harder to meet. FHA has lenient DTI maximums

FHA is the king of high debt-to-income (DTI) ratios.

With a strong profile, you can use up to 56.9% of your before-tax income toward the house payment plus all debt payments. This is another way of saying 56.9% DTI.

USDA has a hard stop at 29% for the house payment and 41% for total payments.

This means if you could qualify for a $400,000 home using FHA, you could only qualify for about $340,000 with USDA.

In a time when mortgage rates are high and personal debts are rising, USDA’s DTI limits disqualify a lot of buyers.

Start here to see if your income qualifies you for USDA.

3 USDA advantages

While USDA imposes hard-to-meet criteria, those who fit inside the box enjoy many benefits.

1. No down payment

While FHA requires 3.5% down, USDA has no down payment requirement.

This saves the buyer $10,500 in upfront cash on a $300,000 home.

Since down payment is one of the largest barriers to homeownership, buyers who don’t have enough funds for FHA should see if they are eligible for USDA.

Start your zero-down USDA loan.

2. Lower mortgage insurance

FHA mortgage insurance is often cheaper than conventional PMI. But not as cheap as USDA’s mortgage insurance.

| FHA | USDA | |

| Upfront mortgage insurance | 1.75% | 1.0% |

| Monthly mortgage insurance | 0.55% | 0.35% |

On a $300,000 loan, USDA mortgage insurance is $2,250 less upfront and $50 per month cheaper than FHA’s.

3. Low rates

You might think that USDA’s no-down-payment requirements would require high rates. But USDA rates are comparable with FHA’s.

Check your personalized USDA and FHA rates.

Should you choose USDA or FHA?

It’s worth checking your eligibility for a USDA loan first. Use FHA only when you’re sure you’re not eligible for USDA.

I have no savings: USDA requires no down payment. FHA requires 3.5% down. With USDA, you can finance closing costs if the appraised value comes in higher than the purchase price.

I’m not in a rural area: Use USDA’s website to explore USDA-eligible areas around your city. Surprisingly, eligible areas can be found 10-20 minutes outside of many downtown cores.

I might be over the income limit: Income limits are generally around $110,000 per year but over $200,000 in some areas. Check your local income limit on USDA’s map under your family size and the designation: “MOD.INC-GUAR.LOAN”.

USDA offers income deductions for eligibility purposes, such as for dependents, childcare expenses, and medical expenses.

I’m worried the seller won’t accept my offer: Both FHA and USDA pose a problem when making an offer in a competitive market. If sellers won’t accept your officer, check your eligibility for a low-down-payment conventional loan.

Related: FHA vs Conventional: 12 Buyer Profiles Examined

I have less-than-perfect credit: Both FHA and USDA are lenient about credit scores, but FHA is more so. Most lenders require a 580-600 credit score for both programs. But you will receive an approval more easily with FHA.

I have high debts: Those with high debt payments should choose FHA. With USDA, you can spend 41% of your income on the house payment plus any debt payments, but with FHA that DTI limit is 56.9%.

I’m a first-time buyer: You can be a first-time buyer for both FHA and USDA, but repeat buyers are eligible for both programs as well.

FHA or USDA? Two great options for first-time buyers

You can feel good about choosing either program. USDA comes with advantages over FHA, but FHA works for a larger segment of buyers.

If you have questions about which program is right for you, get help from a knowledgeable lender.

Connect with a reputable lender to get your FHA vs USDA analysis.